公司简介

| FlexTrade评论摘要 | |

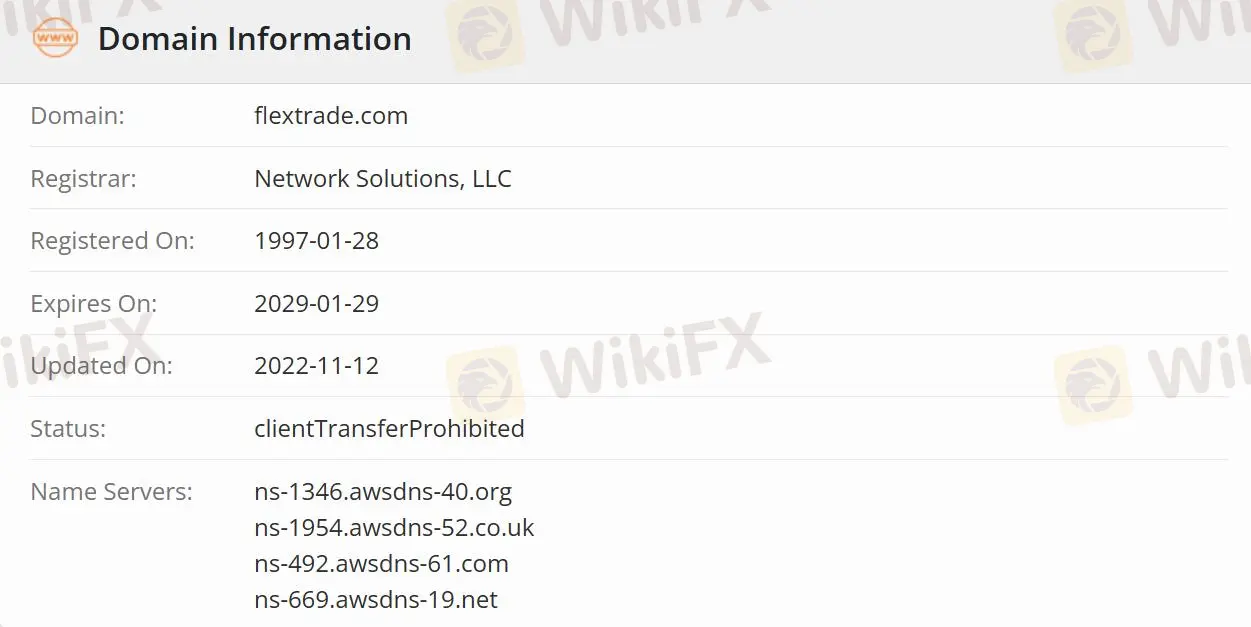

| 成立日期 | 1997-01-28 |

| 注册国家/地区 | 美国 |

| 监管 | 未受监管 |

| 服务 | 资产管理公司/对冲基金/高触碰交易/交易/市场做市/低触碰交易/程序化交易/衍生品交易/外包交易/零售交易 |

| 客户支持 | 办公电话:+1 516 627 8993/+1 516 304 3655/+44 20 3757 9310/+33 1 59 03 15 77/+65 6965 2100/+91 20 6724 5023/+852 3579 2200/+61 2 8103 4043 |

| 销售邮箱:sales@flextrade.com | |

FlexTrade 信息

FlexTrade Systems在美国注册,为交易行业提供各种交易技术服务,包括股票、固定收益、外汇交易所、期货和期权的多资产执行和订单管理系统。它为来自45个国家的重要客户提供服务。

FlexTrade 是否合法?

FlexTrade 没有受到监管,相比受监管的经纪商来说,安全性较低。

FlexTrade 有哪些产品和解决方案?

FlexTrade 为买方提供资产管理公司、对冲基金和主权财富/养老基金服务,为卖方提供高触碰交易/市场做市、低触碰交易、程序化交易、衍生品交易、外包交易和零售交易服务。

客户可以选择的交易产品包括FIexTRADER EMS、FIexONE OEM、金融融资、FlexFX、Flex Options、Flex Futures和FlexOMS。