Buod ng kumpanya

| FlexTradePangkalahatang Pagsusuri | |

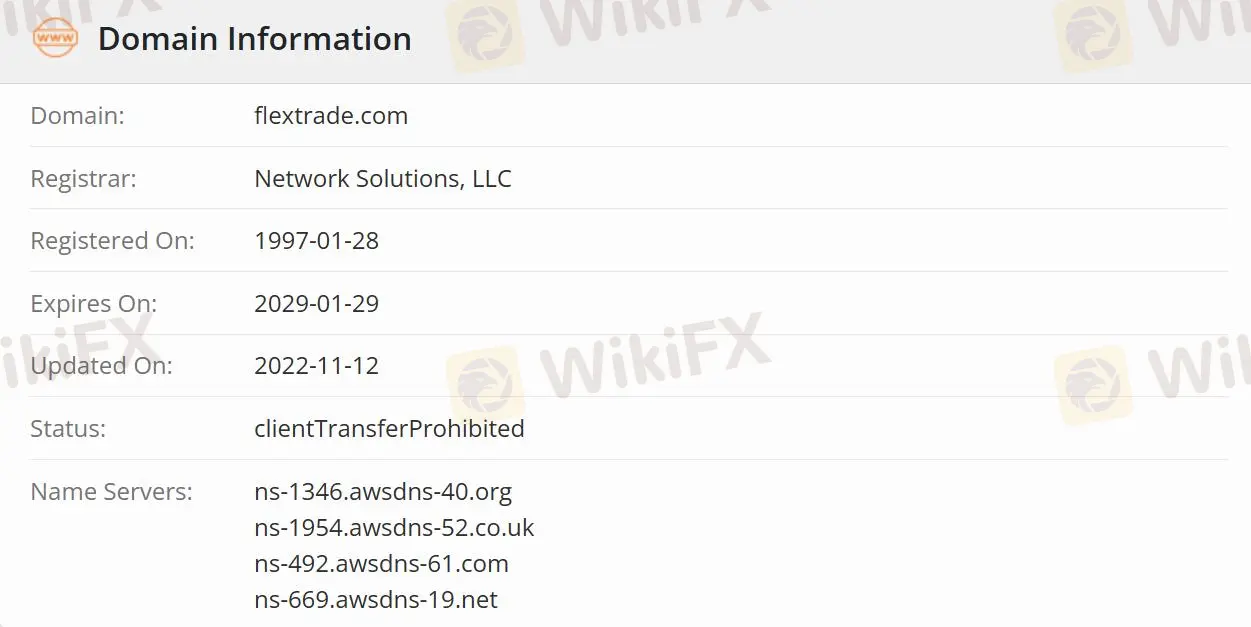

| Itinatag | 1997-01-28 |

| Rehistradong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | Hindi Regulado |

| Mga Serbisyo | Asset Managers/Hedge Funds//High-Touch/Trading/Market Making/Low-Touch Trading/Program Trading/Derivatives Trading/Outsourced Trading/and Retail Trading |

| Suporta sa Customer | Telepono ng Opisina: +1 516 627 8993/+1 516 304 3655/+44 20 3757 9310/+33 1 59 03 15 77/+65 6965 2100/+91 20 6724 5023/+852 3579 2200/+61 2 8103 4043 |

| Email ng Pagbebenta: sales@flextrade.com | |

FlexTrade Impormasyon

Nakarehistro sa Estados Unidos, ang FlexTrade Systems ay nagbibigay ng iba't ibang serbisyo sa teknolohiya ng kalakalan sa industriya ng kalakalan, kabilang ang isang multi-asset execution at order management system para sa mga equity, fixed income, foreign exchange, futures, at options. Naglilingkod ito sa mga pinahahalagahang kliyente sa 45 na bansa.

Totoo ba ang FlexTrade?

Ang FlexTrade ay hindi regulado, kaya't mas hindi ligtas kumpara sa mga reguladong broker.

Ano ang mga produkto at solusyon na mayroon ang FlexTrade?

Nagbibigay ang FlexTrade ng mga serbisyo para sa mga Asset Managers, Hedge Funds, at Sovereign Wealth/Pension Funds para sa mga mamimili, habang nagbibigay naman ito ng mga serbisyo para sa High-Touch Trading/Market Making, Low-Touch Trading, Program Trading, Derivatives Trading, Outsourced Trading, at Retail Trading para sa mga nagbebenta.

Ang mga produkto sa kalakalan na maaaring piliin ng mga customer ay ang FIexTRADER EMS, FIexONE OEM, Financial Financing, FlexFX, Flex Options, Flex Futures at FlexOMS.