Giới thiệu doanh nghiệp

| Banca Akros Tóm tắt Đánh giá | |

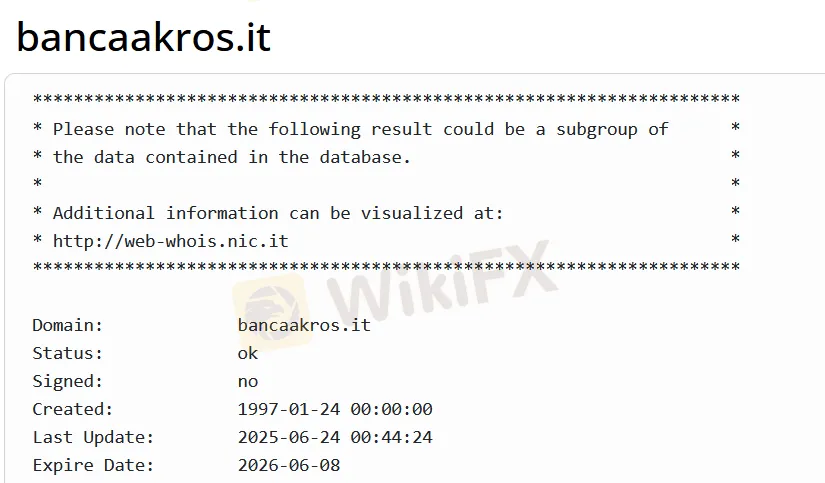

| Thành lập | 1997 |

| Quốc gia/ Khu vực Đăng ký | Ý |

| Quy định | Không có quy định |

| Sản phẩm | Thu nhập cố định, Cổ phiếu, Ngoại hối, Hàng hóa |

| Tài khoản Demo | / |

| Đòn bẩy | / |

| Chênh lệch | / |

| Nền tảng Giao dịch | / |

| Yêu cầu Tiền gửi Tối thiểu | / |

| Hỗ trợ Khách hàng | Điện thoại: +39 02.43444.1 |

| Địa chỉ: Viale Eginardo, n. 29 20149 Milan – Ý | |

Thông tin về Banca Akros

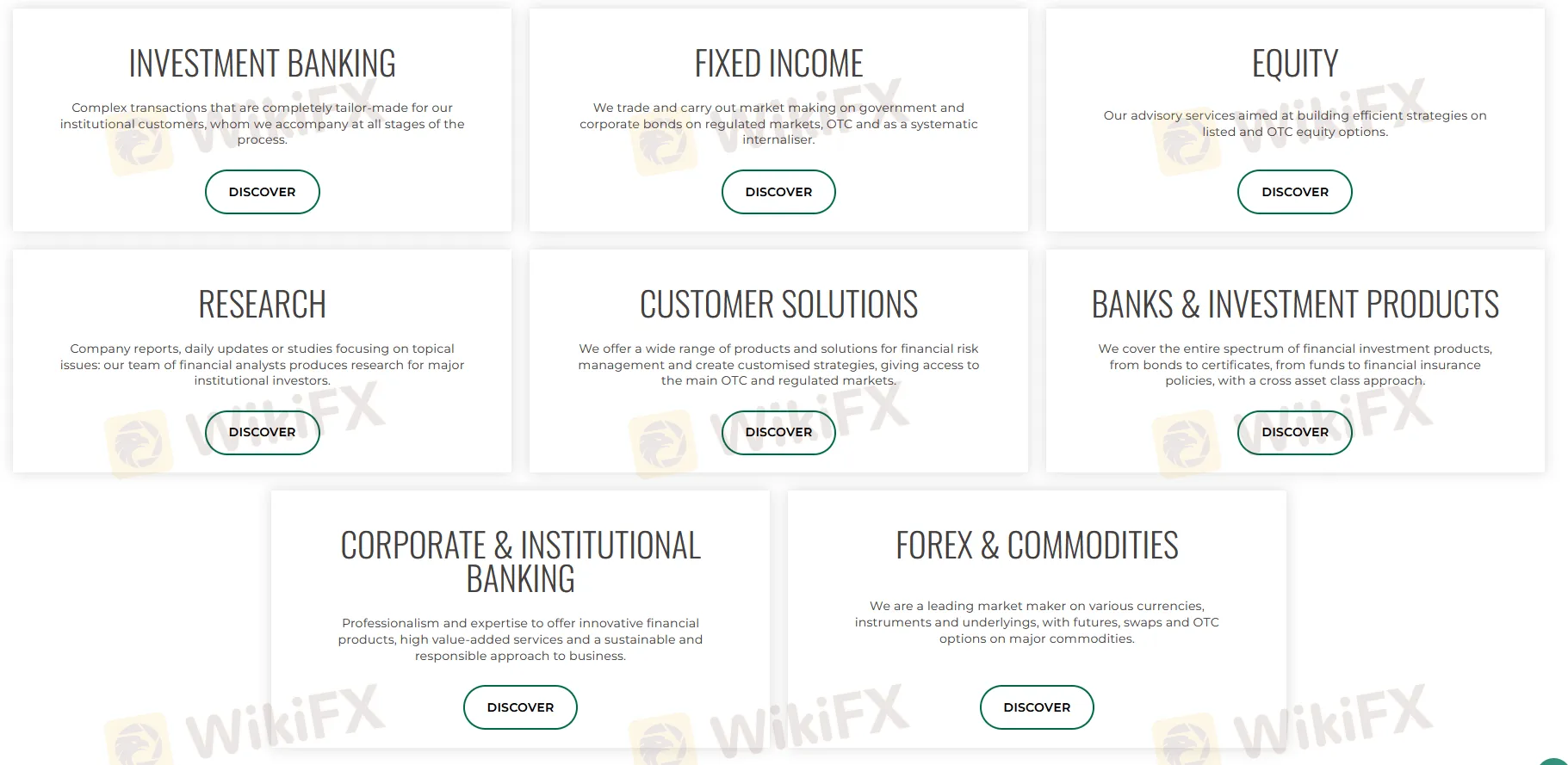

Banca Akros là một công ty dịch vụ tài chính Ý được thành lập vào năm 1997. Các lĩnh vực kinh doanh chính của họ bao gồm Thu nhập cố định, Ngân hàng Đầu tư, Cổ phiếu, Nghiên cứu, Giải pháp cho khách hàng, Ngoại hối, Hàng hóa, Ngân hàng & Sản phẩm Đầu tư và Ngân hàng Doanh nghiệp & Tổ chức. Tuy nhiên, hiện tại Banca Akros không có quy định.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Lịch sử hoạt động dài hạn tại Ý | Không có quy định |

| Đa dạng về mặt kinh doanh | Cấu trúc phí không rõ ràng |

| Không có thông tin về gửi và rút tiền |

Banca Akros Có Uy tín không?

Không. Hiện tại Banca Akros không có quy định . Vui lòng chú ý đến rủi ro!

Sản phẩm

| Sản phẩm | Hỗ trợ |

| Thu nhập cố định | ✔ |

| Cổ phiếu | ✔ |

| Ngoại hối | ✔ |

| Hàng hóa | ✔ |

| Chỉ số | ❌ |

| Tiền điện tử | ❌ |

| Trái phiếu | ❌ |

| Tùy chọn | ❌ |

| ETFs | ❌ |