Unternehmensprofil

| Banca Akros Überprüfungszusammenfassung | |

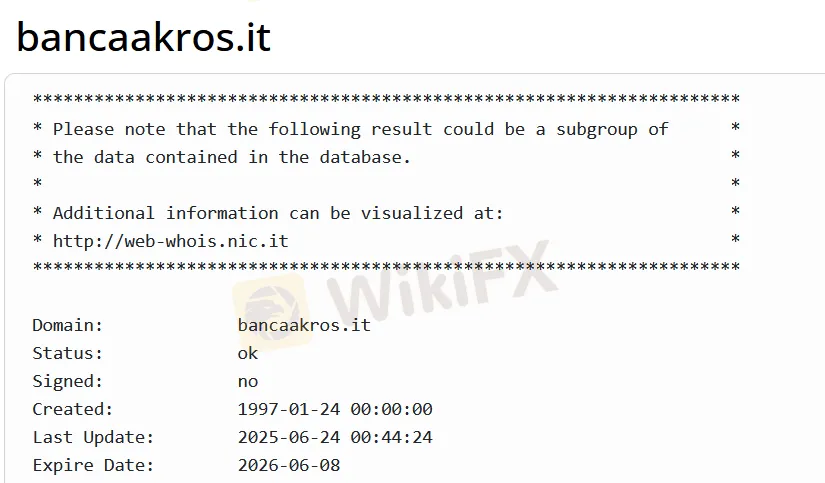

| Gegründet | 1997 |

| Registriertes Land/Region | Italien |

| Regulierung | Keine Regulierung |

| Produkte | Festverzinsliche Wertpapiere, Aktien, Devisen, Rohstoffe |

| Demokonto | / |

| Hebel | / |

| Spread | / |

| Handelsplattform | / |

| Mindesteinzahlung | / |

| Kundensupport | Telefon: +39 02.43444.1 |

| Adresse: Viale Eginardo, Nr. 29, 20149 Mailand – Italien | |

Banca Akros Informationen

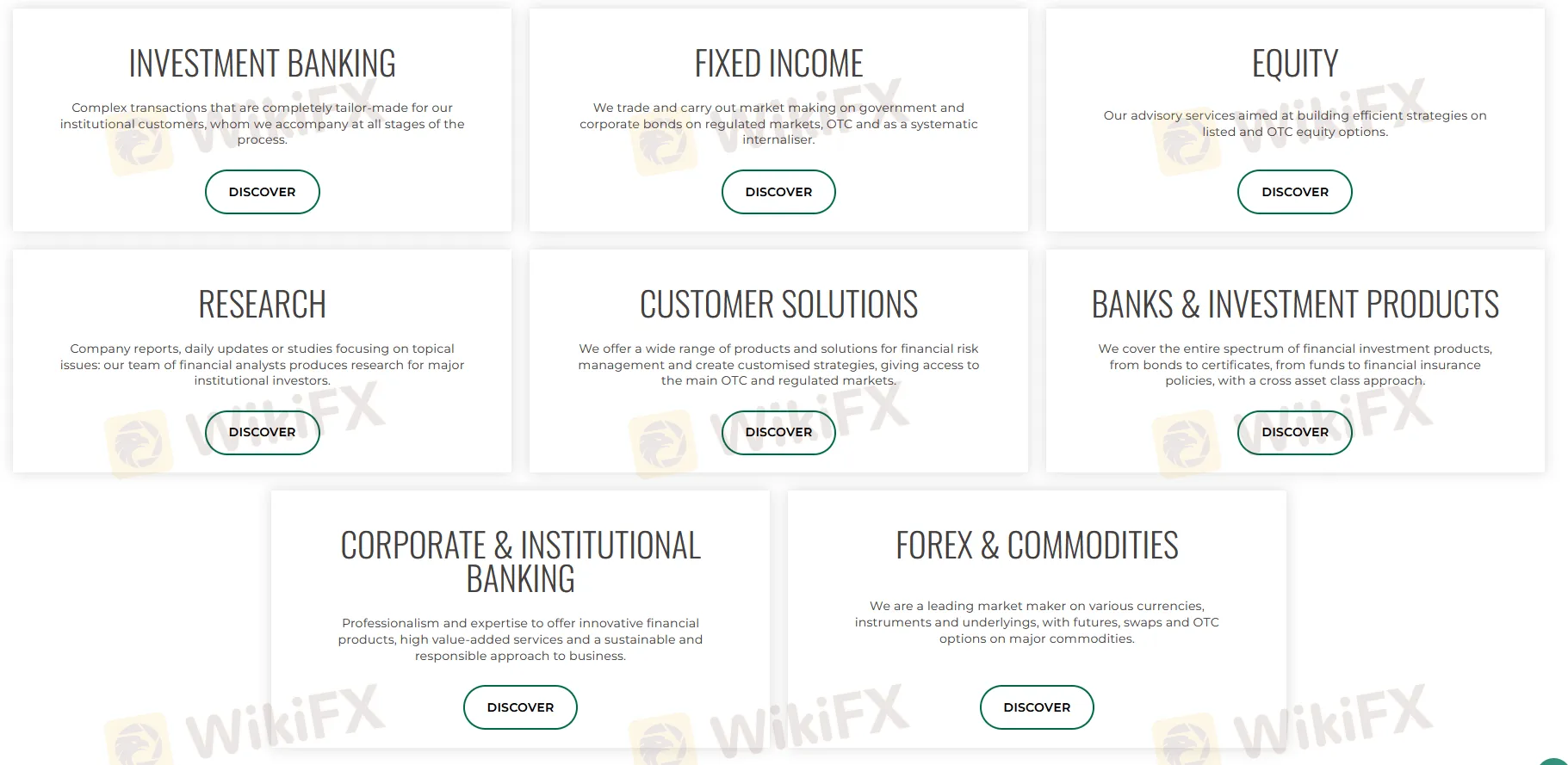

Banca Akros ist ein italienisches Finanzdienstleistungsunternehmen, das 1997 gegründet wurde. Seine Hauptgeschäftsbereiche umfassen Festverzinsliche Wertpapiere, Investmentbanking, Aktien, Forschung, Kundensolutions, Devisen, Rohstoffe, Banken & Investmentprodukte sowie Corporate & Institutional Banking. Allerdings hat Banca Akros derzeit keine Regulierungen.

Vor- und Nachteile

| Vorteile | Nachteile |

| Langjährige Betriebshistorie in Italien | Keine Regulierung |

| Vielfältiges Geschäft | Unklare Gebührenstruktur |

| Keine Informationen zu Einzahlungen und Auszahlungen |

Ist Banca Akros legitim?

Nein. Banca Akros hat derzeit keine Regulierungen. Bitte beachten Sie das Risiko!

Produkte

| Produkte | Unterstützt |

| Festverzinsliche Wertpapiere | ✔ |

| Aktien | ✔ |

| Devisen | ✔ |

| Rohstoffe | ✔ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |