Şirket özeti

| Banca Akros İnceleme Özeti | |

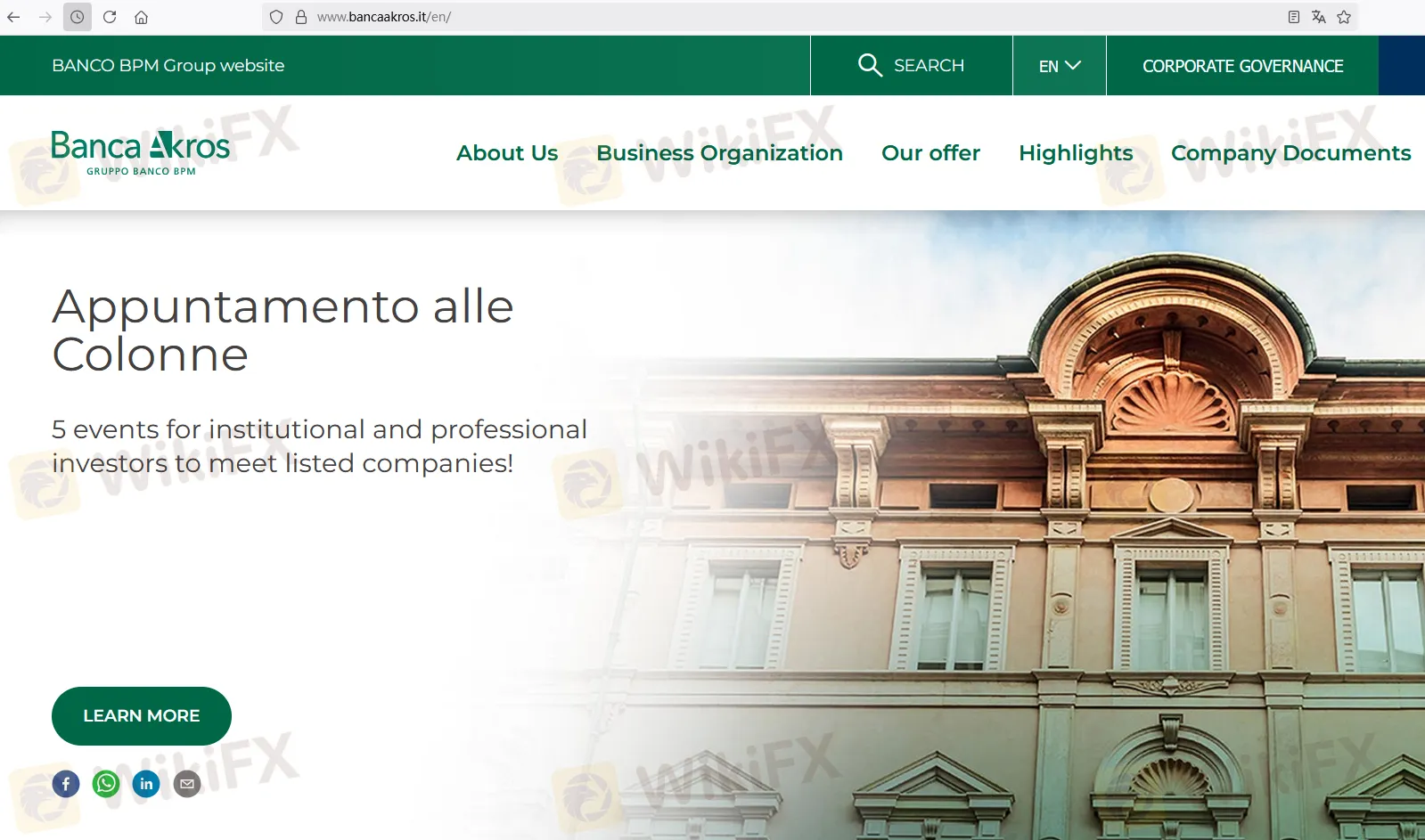

| Kuruluş Yılı | 1997 |

| Kayıtlı Ülke/Bölge | İtalya |

| Düzenleme | Düzenleme yok |

| Ürünler | Sabit Gelir, Hisse Senetleri, Forex, Emtialar |

| Deneme Hesabı | / |

| Kaldıraç | / |

| Spread | / |

| İşlem Platformu | / |

| Minimum Yatırım | / |

| Müşteri Desteği | Telefon: +39 02.43444.1 |

| Adres: Viale Eginardo, n. 29 20149 Milano – İtalya | |

Banca Akros Bilgileri

Banca Akros, 1997 yılında kurulan İtalyan bir finansal hizmetler firmasıdır. Ana iş alanları Sabit Gelir, Yatırım Bankacılığı, Hisse Senetleri, Araştırma, Müşteri çözümleri, Forex, Emtialar, Bankalar & Yatırım Ürünleri ve Kurumsal & Kurumsal Bankacılık alanlarını kapsar. Bununla birlikte, Banca Akros şu anda herhangi bir düzenlemeye sahip değildir.

Artıları ve Eksileri

| Artılar | Eksiler |

| İtalya'da uzun işletme geçmişi | Düzenleme yok |

| Çeşitli iş alanları | Belirsiz ücret yapısı |

| Yatırım ve çekim bilgileri yok |

Banca Akros Güvenilir mi?

Hayır. Banca Akros şu anda herhangi bir düzenlemeye sahip değildir . Lütfen riskin farkında olun!

Ürünler

| Ürünler | Desteklenen |

| Sabit Gelir | ✔ |

| Hisse Senetleri | ✔ |

| Forex | ✔ |

| Emtialar | ✔ |

| Endeksler | ❌ |

| Kripto Paralar | ❌ |

| Bono | ❌ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |