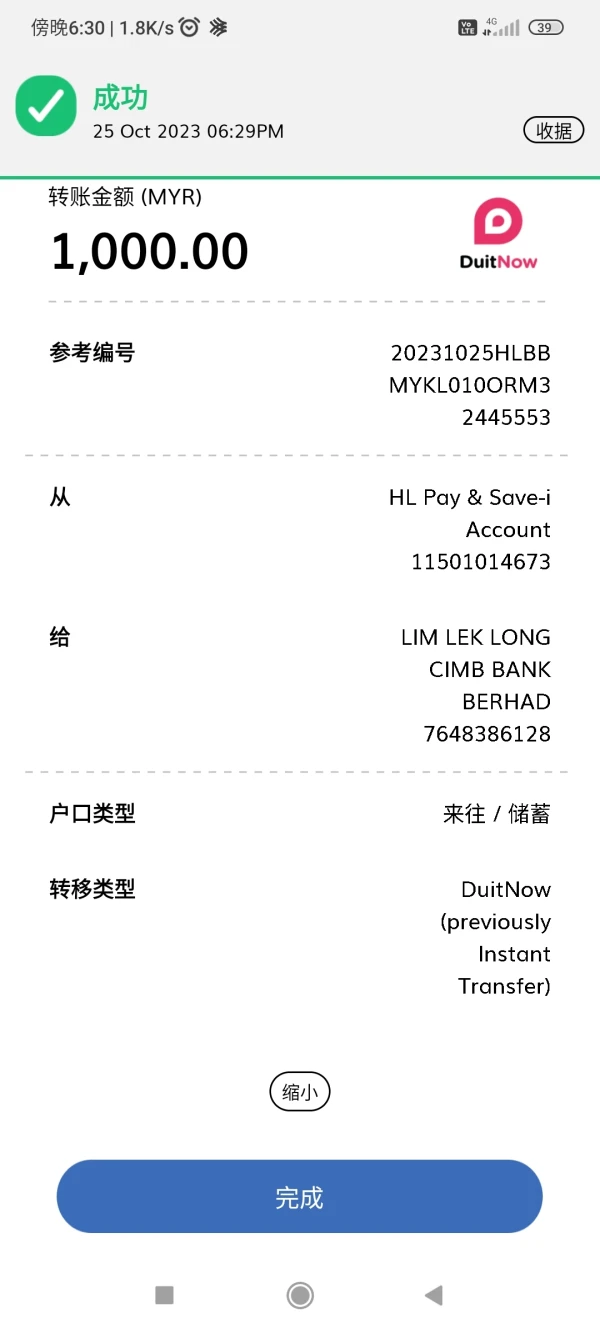

Giới thiệu doanh nghiệp

| UIIC Tóm tắt Đánh giá | |

| Thành lập | 1994 |

| Quốc gia/Vùng đăng ký | Vương quốc Anh |

| Quy định | FCA |

| Dịch vụ | Bảo hiểm rủi ro chính trị |

| Hỗ trợ Khách hàng | Mẫu liên hệ |

| Điện thoại: +44 20 7954 8397 | |

| Địa chỉ: Tòa nhà AIG, 58 Fenchurch Street, Luân Đôn, EC3M 4AB, Vương quốc Anh | |

Thông tin về UIIC

Công ty Bảo hiểm Quốc tế Uzbekinvest, với tên viết tắt UIIC, là một công ty bảo hiểm của Vương quốc Anh cung cấp bảo hiểm rủi ro chính trị cho các công ty có tiếp xúc với biên giới, bao gồm các nhà đầu tư lần đầu, các tổ chức tài chính, người xuất khẩu và các nhà thầu dự án.

Hiện tại, công ty đang được quản lý tốt bởi FCA, điều này cho thấy một mức độ đáng tin cậy và bảo vệ khách hàng.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Được quy định bởi FCA | / |

| Nhiều năm kinh nghiệm trong ngành |

UIIC Có Uy tín không?

Có. UIIC hiện đang được quản lý tốt bởi Ủy ban Hành vi Tài chính (FCA).

| Quốc gia được quy định | Cơ quan quản lý | Tình trạng hiện tại | Thực thể được quản lý | Loại Giấy phép | Số Giấy phép |

| FCA | Được quy định | Công ty Bảo hiểm Quốc tế Uzbekinvest Ltd | Người tạo lập thị trường (MM) | 202923 |

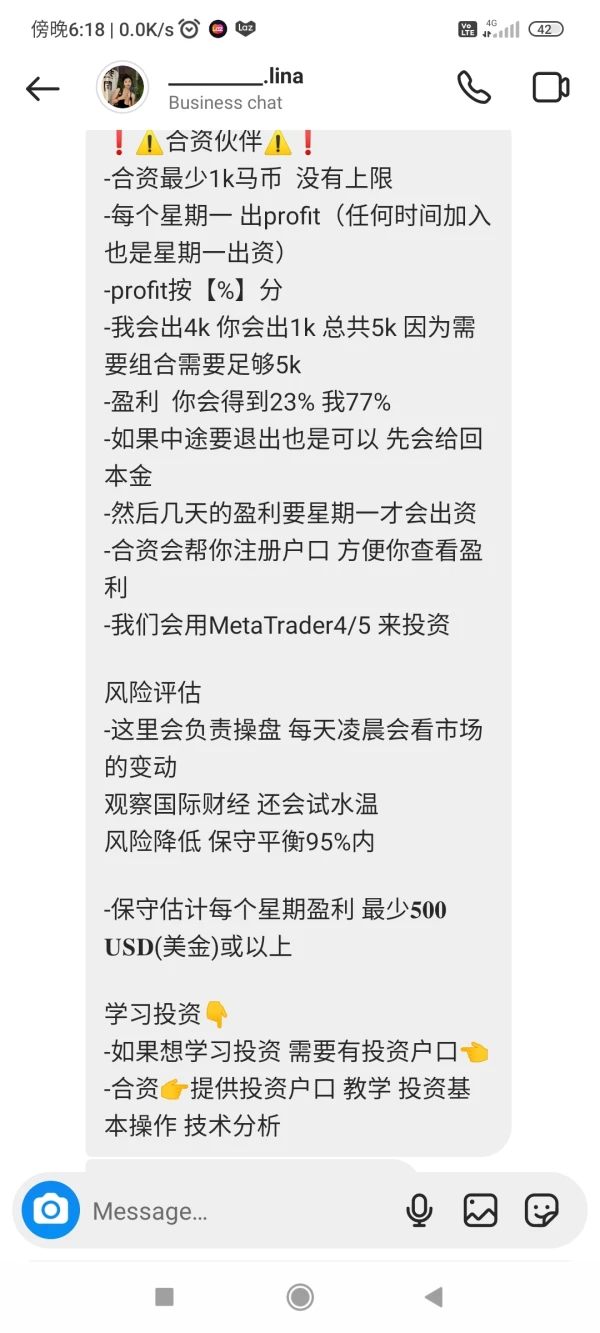

Dịch vụ

UIIC cung cấp bảo hiểm rủi ro chính trị chuyên biệt để bảo vệ nhà đầu tư nước ngoài và nhà giao dịch hoạt động tại hoặc với Uzbekistan.

Phạm vi bảo hiểm của họ bao gồm bảo vệ chống lại các rủi ro như tịch thu, thu hồi, quốc gia hóa, từ chối hợp đồng, gọi sai bảo đảm, và không thanh toán theo thư tín dụng.