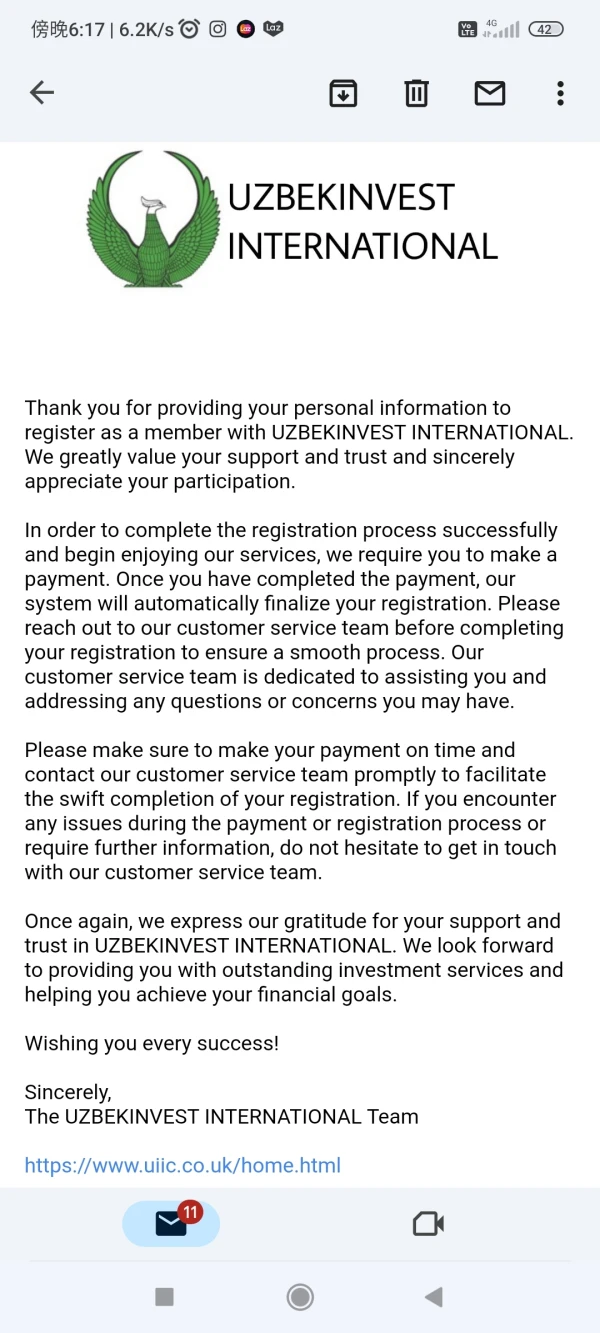

Company Summary

| UIIC Review Summary | |

| Founded | 1994 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Services | Political risk insurance |

| Customer Support | Contact form |

| Tel: +44 20 7954 8397 | |

| Address: The AIG Building, 58 Fenchurch Street, London, EC3M 4AB, United Kingdom | |

UIIC Information

Uzbekinvest International Insurance Company, with the short name UIIC, is a UK insurance company who offers political risk insurance to companies with cross-border exposure, including first-time investors, financial institutions, exporters, and project contractors.

The company is currently well-regulated by FCA,which indicates a certain level of credibility andcustomer protection.

Pros and Cons

| Pros | Cons |

| FCA regulated | / |

| Many years' industry experice |

Is UIIC Legit?

Yes. UIIC is currently being well regulated byFinancial Conduct Authority (FCA).

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| FCA | Regulated | Uzbekinvest International Insurance Company Ltd | Market Maker (MM) | 202923 |

Services

UIIC provides specialized political risk insurance to protect foreign investors and traders operating in or with Uzbekistan.

Their coverage includes protection against risks such as confiscation, expropriation, nationalisation, contract repudiation, wrongful calling of guarantees, and non-payment under letters of credit.