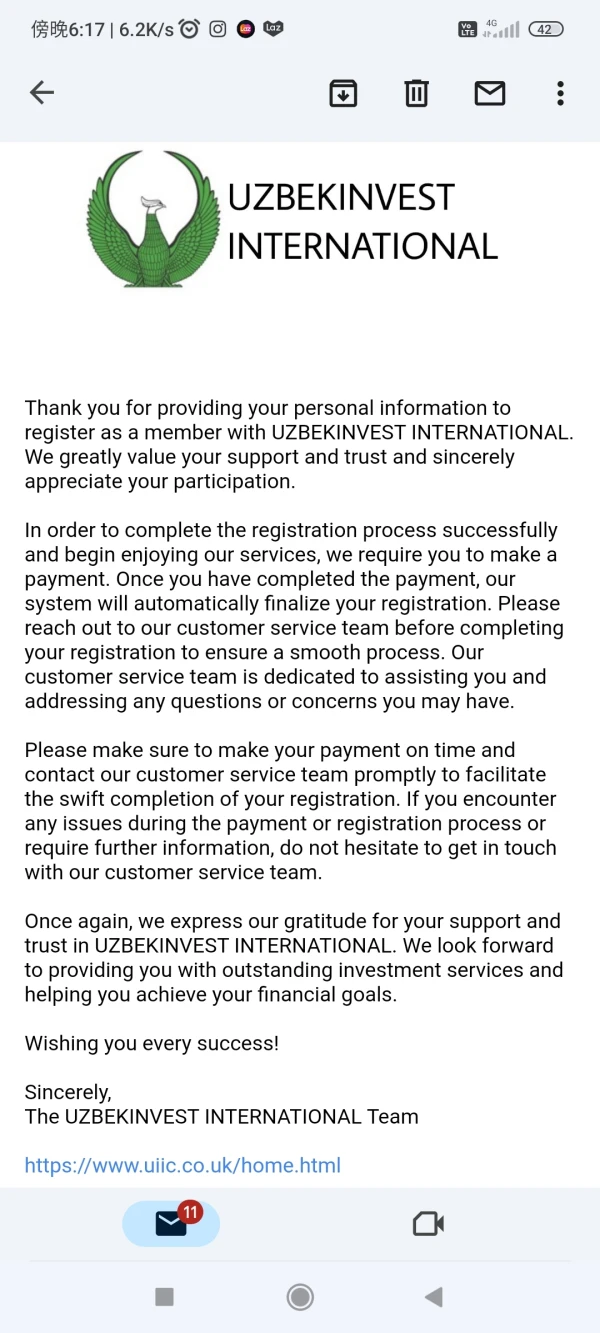

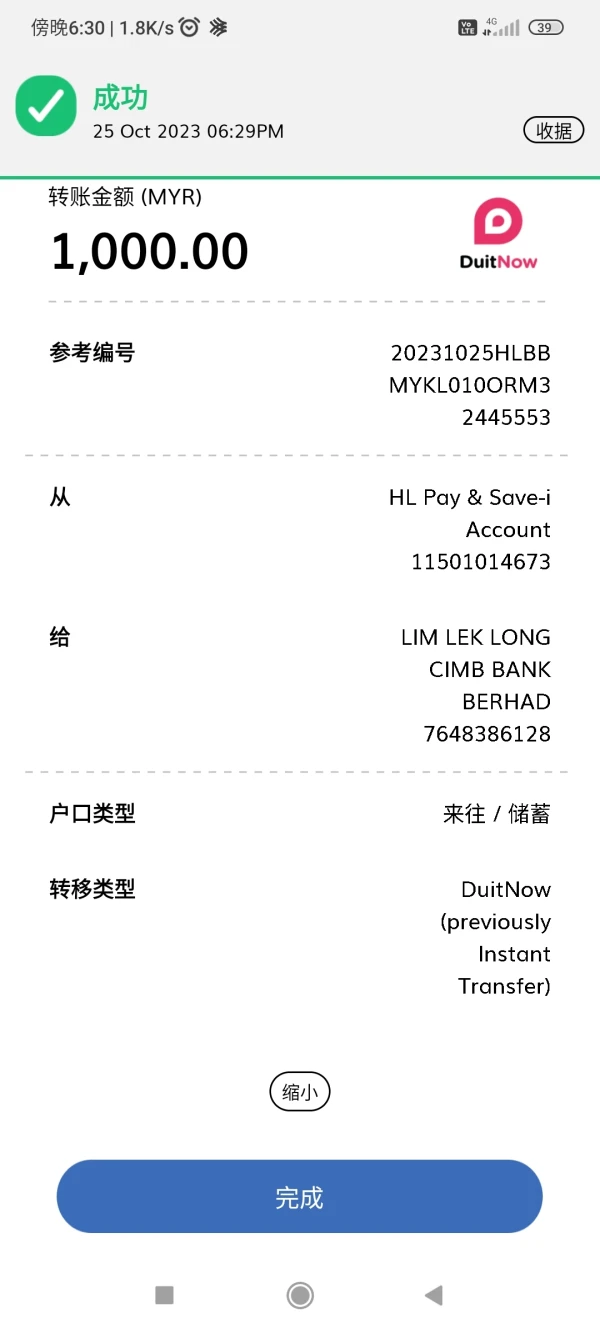

Profil perusahaan

| UIIC Ringkasan Ulasan | |

| Dibentuk | 1994 |

| Negara/Daerah Terdaftar | Britania Raya |

| Regulasi | FCA |

| Layanan | Asuransi risiko politik |

| Dukungan Pelanggan | Formulir kontak |

| Tel: +44 20 7954 8397 | |

| Alamat: The AIG Building, 58 Fenchurch Street, London, EC3M 4AB, Britania Raya | |

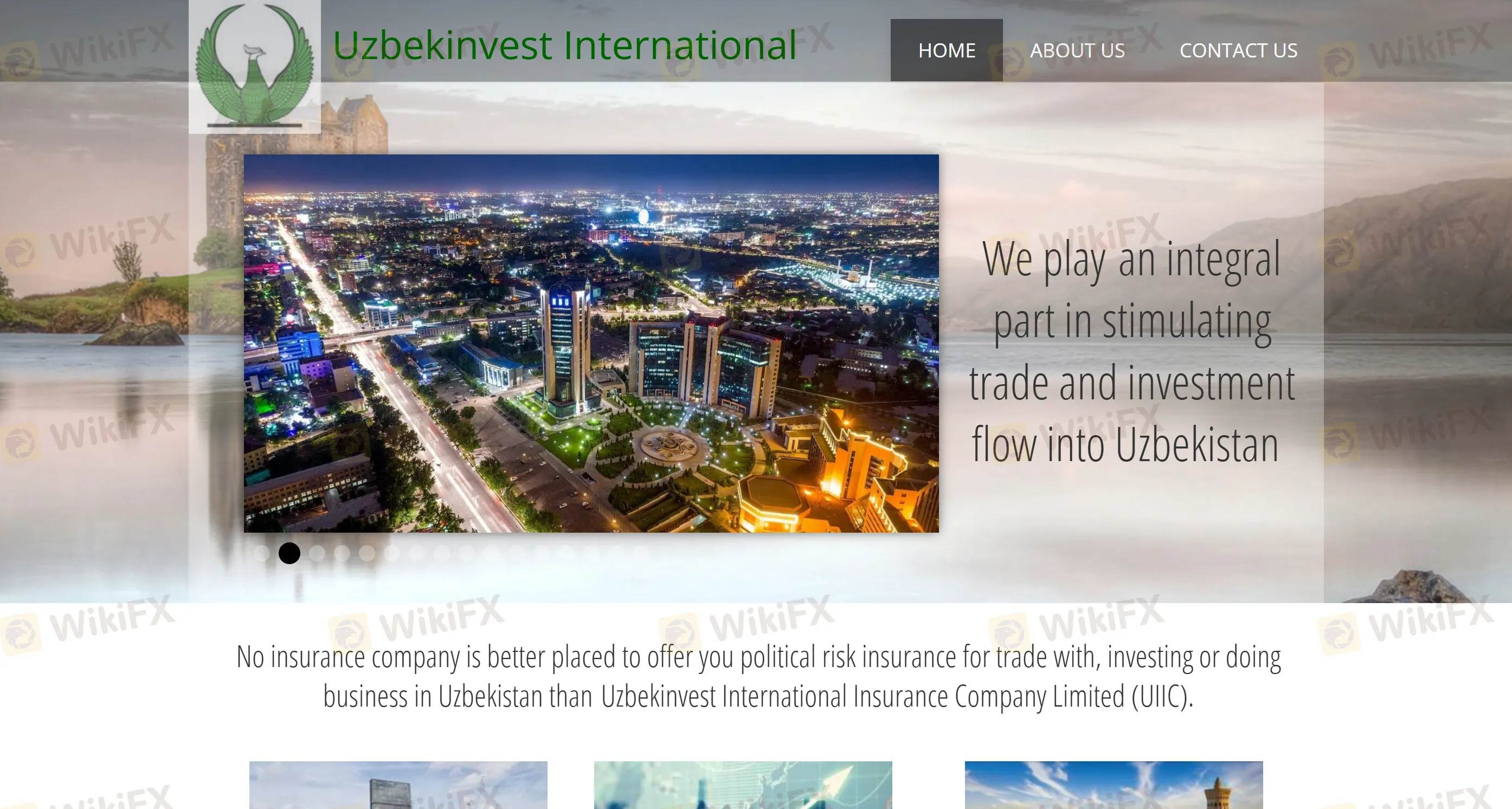

Informasi UIIC

Perusahaan Asuransi Internasional Uzbekinvest, dengan nama singkat UIIC, adalah perusahaan asuransi Inggris yang menawarkan asuransi risiko politik kepada perusahaan dengan paparan lintas batas, termasuk investor baru, lembaga keuangan, eksportir, dan kontraktor proyek.

Perusahaan saat ini diatur dengan baik oleh FCA, yang menunjukkan tingkat kredibilitas dan perlindungan pelanggan tertentu.

Pro dan Kontra

| Pro | Kontra |

| Diatur oleh FCA | / |

| Pengalaman industri bertahun-tahun |

Apakah UIIC Legal?

Ya. Saat ini UIIC sedang diatur dengan baik oleh Otoritas Jasa Keuangan (FCA).

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | No. Lisensi |

| FCA | Diatur | Uzbekinvest International Insurance Company Ltd | Pembuat Pasar (MM) | 202923 |

Layanan

UIIC menyediakan asuransi risiko politik khusus untuk melindungi investor asing dan pedagang yang beroperasi di atau dengan Uzbekistan.

Cakupan mereka meliputi perlindungan terhadap risiko seperti penyitaan, ekspropriasi, nasionalisasi, penolakan kontrak, panggilan jaminan yang salah, dan ketidakpembayaran di bawah surat kredit.