Şirket özeti

| Tradition İnceleme Özeti | |

| Kuruluş | 2004 |

| Kayıtlı Ülke/Bölge | Avustralya |

| Düzenleme | SFC |

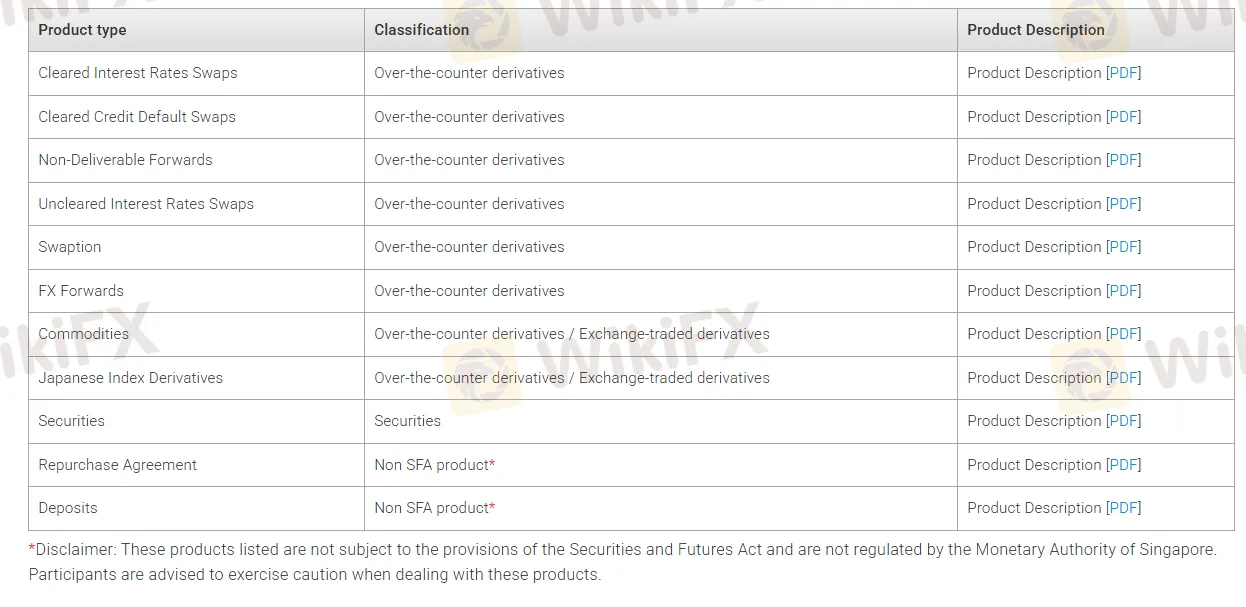

| Piyasa Enstrümanları | Döviz vadeli işlemleri, emtialar, Japon endeks türevleri, menkul kıymetler, swaption, teslim edilmeyen vadeli işlemler, vb. |

| İşlem Platformu | TRADe sistemi |

| Müşteri Desteği | Tel: +61 2 9135 4931; +61 2 9135 4936; +61 2 9135 4933 |

| E-posta: market.data.sales@traditionasia.com; trading.operations@traditionasia.com | |

Adres:

| |

| Diğer ofisler için iletişim bilgileri: https://www.traditionasia.com/contactUS | |

Tradition Bilgileri

Tradition, dünyanın en büyük aracı kurumlarından biri olan Compagnie Financière Tradition'nın aracı kurum bölümüdür ve döviz vadeli işlemleri, emtialar, Japon endeks türevleri, menkul kıymetler, swaption vb. gibi tezgah üstü finansal ve emtia ürünlerinin en büyük aracı kurumlarından biridir. Şu anda aracı kurum, Çin, Hong Kong, Japonya, Singapur vb. dahil olmak üzere 28'den fazla ülkede faaliyet göstermektedir.

İyi olan şey, şirketin SFC tarafından düzenlendiği ve bu da finansal faaliyetlerinin bu otoriteler tarafından sıkı bir şekilde izlendiği anlamına gelir, bu da belirli bir müşteri koruma seviyesini garanti etmektedir.

Artıları ve Eksileri

| Artıları | Eksileri |

| SFC düzenlemesi | İşlem koşullarında sınırlı şeffaflık |

| Küresel varlık | |

| Çeşitli işlem ürünleri |

Tradition Güvenilir mi?

Tradition şu anda Hong Kong Menkul Kıymetler ve Vadeli İşlemler Komisyonu (SFC) tarafından lisans numarası T2023364 ile iyi bir şekilde düzenlenmektedir.

| Düzenlenen Ülke | Düzenleyici | Mevcut Durum | Düzenlenen Kuruluş | Lisans Türü | Lisans No. |

| SFC | Düzenlenmiş | T.F.S. Türevler HK Limited | Vadeli işlemlerle uğraşma | ASE218 |

| Alım Satım Araçları | Desteklenen |

| FX vadeli işlemleri | ✔ |

| Emtialar | ✔ |

| Japon endeks türevleri | ✔ |

| Menkul kıymetler | ✔ |

| Swaption | ✔ |

| Teslim edilmeyen vadeli işlemler | ✔ |

| Endeksler | ❌ |

| Hisse Senetleri | ❌ |

| Kripto Paralar | ❌ |

| Bono | ❌ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |

Alım Satım Platformu

Tradition'nin TRADe platformu, TFS Türevler HK Ltd tarafından işletilen, kredi temerrüt takasları (CDS) ve tahvillerin alım satımı için tasarlanmış düzenlenmiş bir emir giriş sistemidir. Gerçek zamanlı uyarılar aracılığıyla emir dağıtımını ve yürütme bildirimlerini kolaylaştırır. Platform ayrıca sabit fiyat eşleştirme oturumlarını veya açık artırmaları destekler, katılımcıların yayınlanmış fiyat seviyelerinde alım veya satım emirleri göndermelerine olanak tanır.