مقدمة عن الشركة

| Tradition ملخص المراجعة | |

| تأسست | 2004 |

| البلد/المنطقة المسجلة | أستراليا |

| التنظيم | SFC |

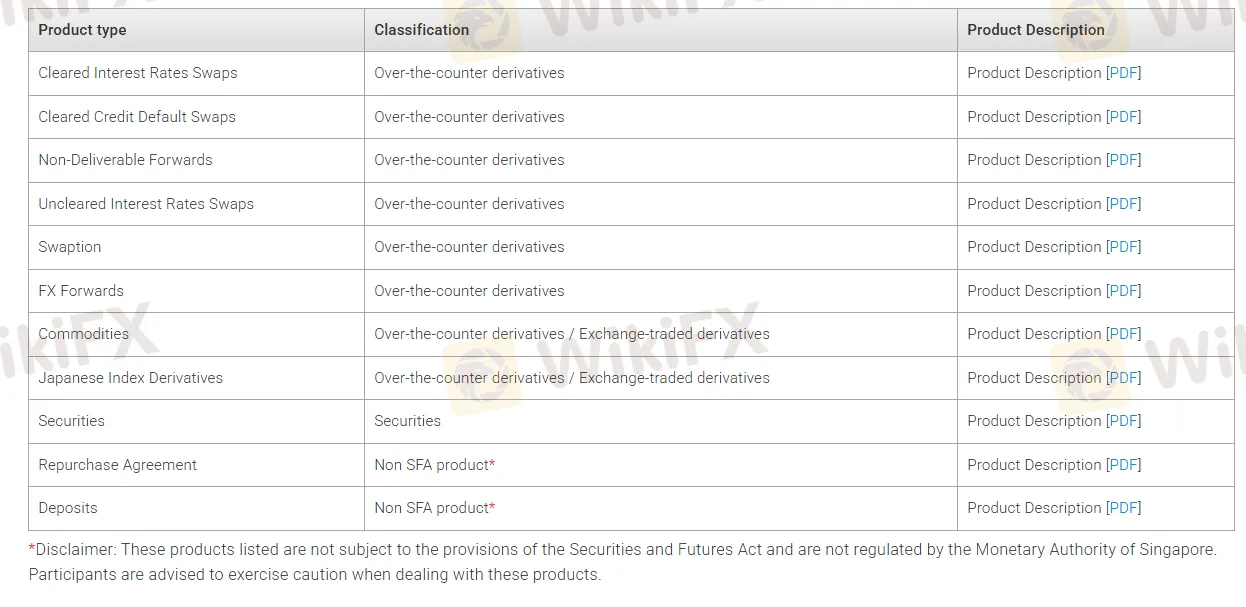

| أدوات السوق | عقود الصرف الأجنبي، السلع، مشتقات مؤشر الين الياباني، الأوراق المالية، سوابشن، عقود الصرف الأجنبي غير القابلة للتسليم، وما إلى ذلك. |

| منصة التداول | نظام TRADe |

| دعم العملاء | هاتف: +61 2 9135 4931؛ +61 2 9135 4936؛ +61 2 9135 4933 |

| البريد الإلكتروني: market.data.sales@traditionasia.com؛ trading.operations@traditionasia.com | |

العنوان:

| |

| معلومات الاتصال للمكاتب الأخرى: https://www.traditionasia.com/contactUS | |

معلومات Tradition

Tradition هو قسم التوسيط بين الوسطاء لـ Compagnie Financière Tradition، واحدة من أكبر وسطاء العالم للمنتجات المالية والسلعية خارج البورصة مثل عقود الصرف الأجنبي، السلع، مشتقات مؤشر الين الياباني، الأوراق المالية، سوابشن، وما إلى ذلك. الآن يعمل الوسيط في أكثر من 28 دولة بما في ذلك الصين، هونغ كونغ، اليابان، سنغافورة، وما إلى ذلك.

الجيد في الأمر هو أن الشركة تخضع لل تنظيم SFC، مما يعني أن نشاطاتها المالية تُراقب بدقة من قبل هذه السلطات، مما يضمن إلى حد ما مستوى معينًا من حماية العملاء.

المزايا والعيوب

| المزايا | العيوب |

| تنظيم SFC | شفافية محدودة في شروط التداول |

| وجود عالمي | |

| منتجات تداول متنوعة |

هل Tradition شرعي؟

Tradition يتم تنظيمه حاليًا بشكل جيد من قبل هيئة الأوراق المالية والعقود الآجلة في هونغ كونغ (SFC) برقم ترخيص T2023364.

| البلد المنظم | الجهة التنظيمية | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| SFC | منظم | T.F.S. Derivatives HK Limited | تداول في عقود الآجلة | ASE218 |

| أدوات التداول | مدعوم |

| عقود الصرف الأجنبي الآجلة | ✔ |

| السلع | ✔ |

| مشتقات مؤشر الين الياباني | ✔ |

| الأوراق المالية | ✔ |

| سوابشن | ✔ |

| عقود الآجلة غير القابلة للتسليم | ✔ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

منصة التداول

منصة التداول TRADe التابعة لـ Tradition، التي تديرها TFS Derivatives HK Ltd، هي نظام إدخال أوامر منظم مصمم لتداول عقود الاستبدال الائتماني (CDS) والسندات. تسهل توزيع الطلبات وإشعارات تنفيذ الطلبات من خلال تنبيهات فورية. تدعم المنصة أيضًا جلسات تطابق الأسعار الثابتة، أو المزادات، مما يتيح للمشاركين تقديم طلبات شراء أو بيع بمستويات الأسعار المنشورة.