Şirket özeti

Genel Bilgiler ve Yönetmelik

ADCB, ticari adı ADCB Securities , iddiaya göre birleşik arap emirliklerinde kayıtlı ve sca (menkul kıymetler ve emtia kurumu), adx (abu dhabi menkul kıymetler borsası) ve dfm (dubai finans piyasası) tarafından düzenlenen bir finans firmasıdır. komisyoncu, hem bireysel hem de kurumsal müşterilere web tabanlı ve mobil ticaret platformlarında geniş bir ürün ve hizmet yelpazesi sunmayı iddia ediyor.

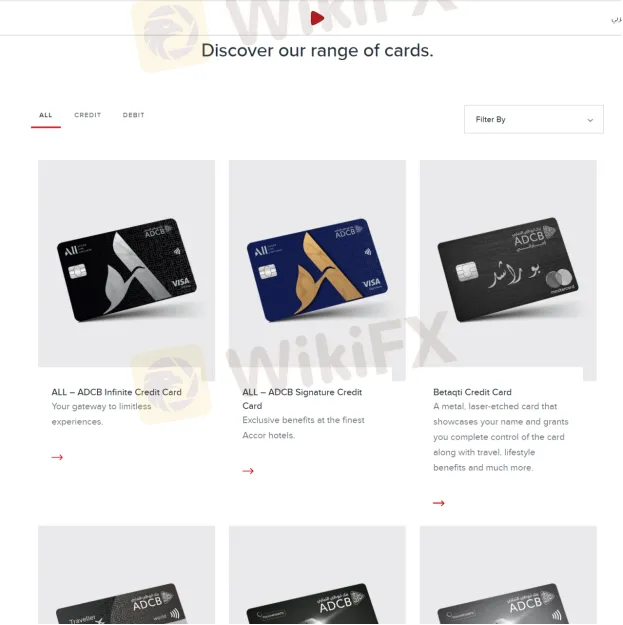

Ürünler

ADCByatırım, sigorta, varlık yönetimi, aracılık hizmetleri ve sermaye piyasaları gibi kredi/banka kartları, krediler ve servet yönetimi dahil olmak üzere çok çeşitli ürünler sunduğunun reklamını yapmaktadır.

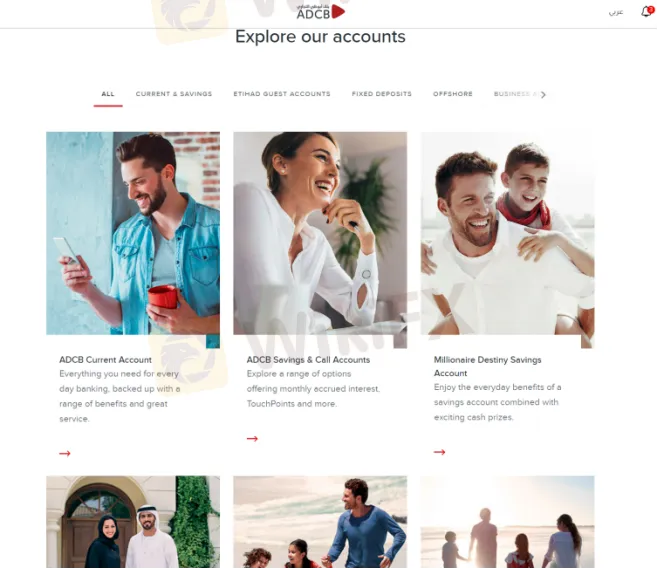

Hesap Türleri

Genel olarak, tarafından sunulan başlıca iki farklı aracılık hesabı vardır. ADCB , yani bireysel aracılık hesabı ve kurumsal aracılık hesabı. özellikle cari & tasarruf hesabı, etihad misafir hesapları, vadeli mevduat hesabı ve daha fazlası mevcuttur.

Ticaret Platformu Mevcut

ticaret için kullanılabilir platformlar ADCB web tabanlı ticaret platformudur ve ADCB Securities uygulama. komisyoncu, mobil uygulamanın tüccarların hareket halindeyken ticaret yapmasına ve en son hisse senedi fiyatlarını kontrol etmesine ve portföylerini yönetmesine izin verebileceğini söylüyor. apple app store veya google play store'dan indirilebilir.

ikramiyeler

ADCBana sayfasında tacirlerin bir temas noktası vize kredi kartına kaydolduklarında 250.000 temas noktası kazanabileceklerini iddia ediyor. ancak, bu bonusların herhangi bir koşul olmaksızın çekilip çekilemeyeceğinden emin olamaz.

Müşteri desteği

ADCBnin müşteri desteğine pazartesiden cumaya 08:00 - 15:00 saatleri arasında telefonla ulaşılabilir: Birleşik Arap Emirlikleri içinde 600 50 3325, dışında +97126211608 veya iletişime geçmek için çevrimiçi mesaj gönderin. şirket adresi: sheikh zayed bin sultan street, adnoc dağıtım şirketinin yanında - abu dhabi.