회사 소개

일반 정보 및 규정

ADCB, 상품명 ADCB Securities , 아랍 에미레이트에 등록되어 있고 sca(증권 및 상품 관리국), adx(아부다비 증권 거래소) 및 dfm(두바이 금융 시장)의 규제를 받는 금융 회사라고 합니다. 브로커는 개인 및 기관 고객 모두에게 웹 기반 및 모바일 거래 플랫폼에서 다양한 제품 및 서비스를 제공한다고 주장합니다.

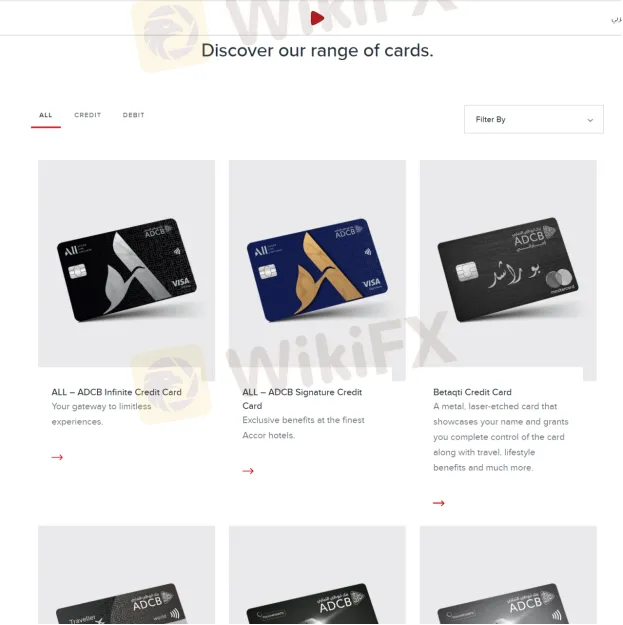

제품

ADCB신용/직불 카드, 대출 및 투자, 보험, 자산 관리, 중개 서비스 및 자본 시장과 같은 자산 관리를 포함한 다양한 상품을 제공한다고 광고합니다.

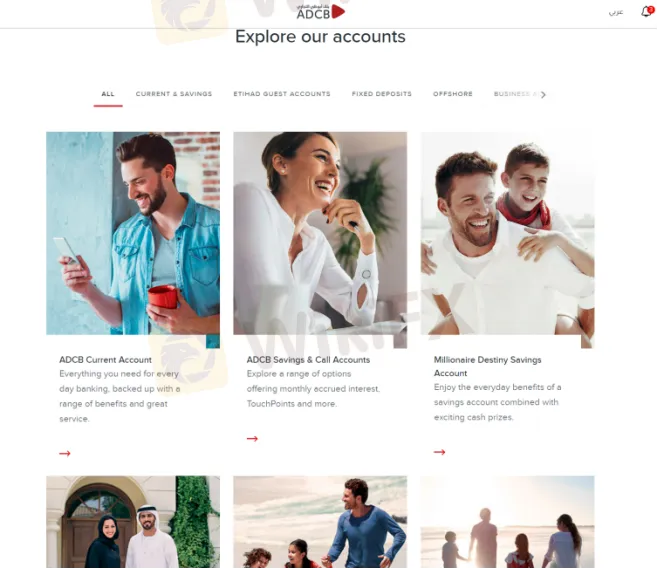

계정 유형

일반적으로 주로 두 가지 다른 중개 계정이 제공됩니다. ADCB , 즉 개인 중개 계좌와 기관 중개 계좌. 특히 당좌예금계좌, 에티하드 게스트계좌, 정기예금계좌 등을 모두 이용하실 수 있습니다.

사용 가능한 거래 플랫폼

거래 가능한 플랫폼 ADCB 웹 기반 거래 플랫폼이며 ADCB Securities 앱. 브로커는 모바일 앱을 통해 트레이더가 이동 중에도 거래하고 최신 주가를 확인하고 포트폴리오를 관리할 수 있다고 말합니다. 애플 앱스토어나 구글 플레이스토어에서 다운받을 수 있다.

보너스

ADCB트레이더가 터치포인트 비자 신용 카드에 가입하면 최대 250,000개의 터치포인트를 얻을 수 있다고 홈페이지에서 주장합니다. 그러나 이러한 보너스가 조건 없이 철회될 수 있는지 여부는 확신할 수 없습니다.

고객 지원

ADCBs 고객 지원팀은 월요일부터 금요일까지 오전 8시부터 오후 3시까지 전화로 연락할 수 있습니다. uae 600 50 3325, 외부 uae +97126211608 또는 온라인 메시지를 보내 연락하십시오. 회사 주소: 셰이크 자예드 빈 술탄 거리, adnoc 유통 회사 옆 - 아부다비.