Profil perusahaan

Informasi & Regulasi Umum

ADCB, nama dagang dari ADCB Securities , diduga sebagai perusahaan keuangan yang terdaftar di uni emirat arab dan diatur oleh sca (otoritas sekuritas dan komoditas), adx (bursa sekuritas abu dhabi) dan dfm (pasar keuangan dubai). broker mengklaim untuk menyediakan pelanggan individu dan institusi dengan berbagai pilihan produk dan layanan pada platform perdagangan berbasis web dan seluler.

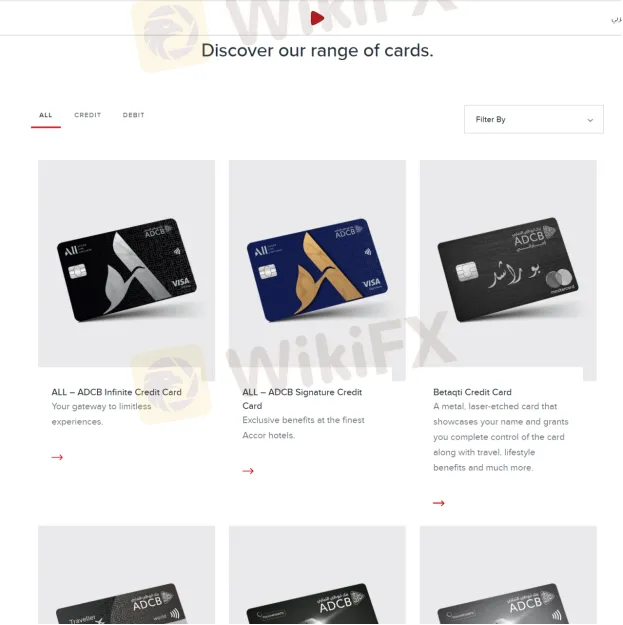

Produk

ADCBmengiklankan bahwa ia menawarkan berbagai macam produk, termasuk kartu kredit/debit, pinjaman dan manajemen kekayaan seperti investasi, asuransi, manajemen aset, layanan broker, dan pasar modal.

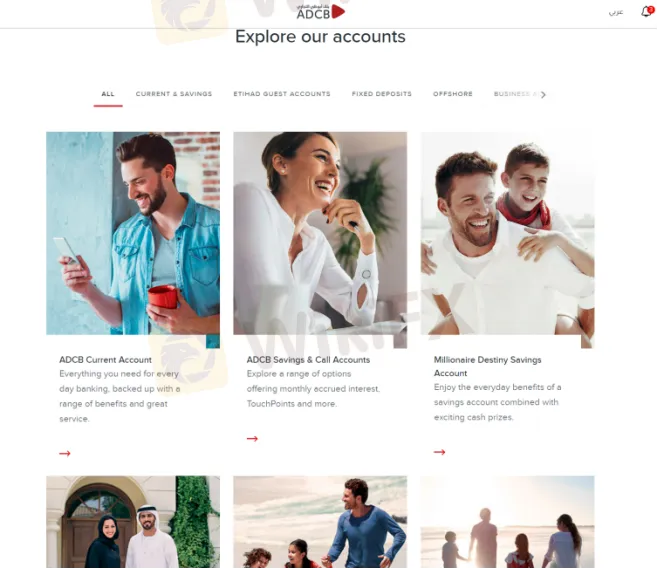

Jenis Akun

secara umum, ada dua akun broker berbeda yang ditawarkan oleh ADCB , yaitu rekening perantara perorangan dan rekening perantara institusional. khususnya, rekening giro & tabungan, rekening tamu etihad, rekening deposito tetap, dan lainnya semuanya tersedia.

Platform Perdagangan Tersedia

platform yang tersedia untuk diperdagangkan di ADCB adalah platform perdagangan berbasis web dan ADCB Securities aplikasi. broker mengatakan bahwa aplikasi seluler memungkinkan pedagang untuk berdagang saat bepergian dan memeriksa harga saham terbaru, serta mengelola portofolio mereka. itu dapat diunduh di apple app store atau google play store.

Bonus

ADCBmengklaim di berandanya bahwa ketika pedagang mendaftar untuk kartu kredit visa touchpoints, mereka dapat memperoleh hingga 250.000 touchpoints. namun, tidak dapat dipastikan apakah bonus ini dapat ditarik tanpa syarat apa pun.

Dukungan Pelanggan

ADCBdukungan pelanggan dapat dihubungi dari Senin hingga Jumat, pukul 08:00 hingga 15:00 melalui telepon: di uae 600 50 3325, di luar uae +97126211608 atau kirim pesan online untuk menghubungi kami. alamat perusahaan: jalan sheikh zayed bin sultan, di sebelah perusahaan distribusi adnoc - abu dhabi.