Şirket özeti

| United Securities Co. İnceleme Özeti | |

| Kuruluş | 1996 |

| Kayıtlı Ülke/Bölge | Filistin |

| Düzenleme | Düzenleme yok |

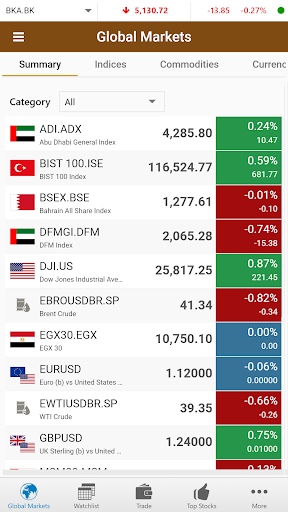

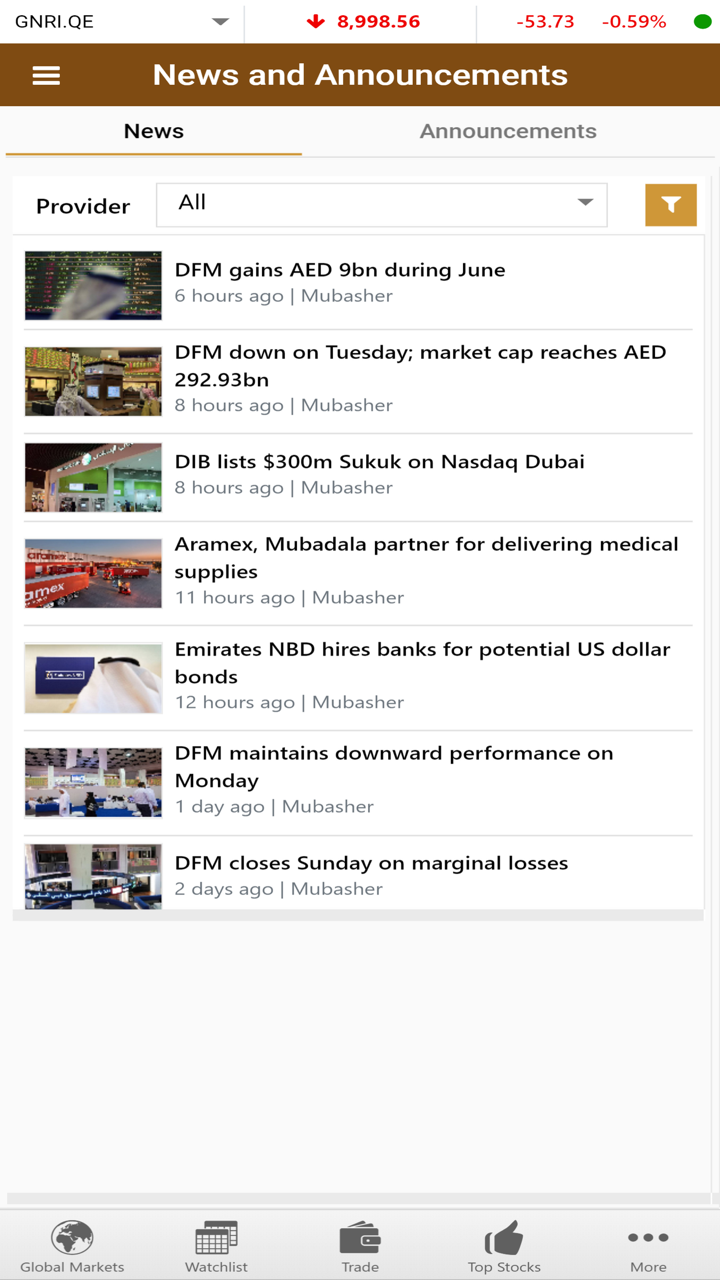

| Hizmetler | Özel ticaret, Başkaları adına ticaret, İhraç yönetimi, Portföy yönetimi, Saklayıcı hizmetler, Yabancı piyasalarda ticaret, Ticaret Uygulamaları, E-Ticaret |

| Demo Hesabı | ❌ |

| Kaldıraç | 1:300'e kadar |

| Spread | 0 pip'ten başlayarak |

| İşlem Platformu | United Securities Co., MT5 |

| Minimum Yatırım | $100 |

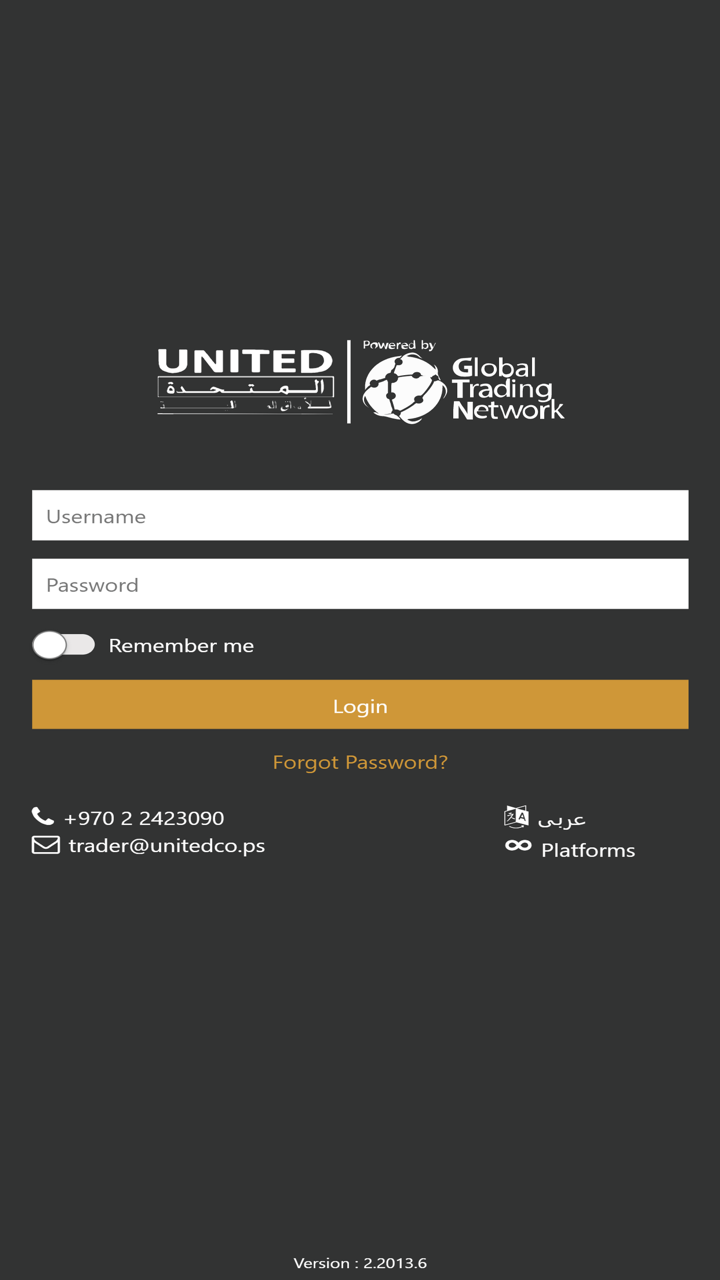

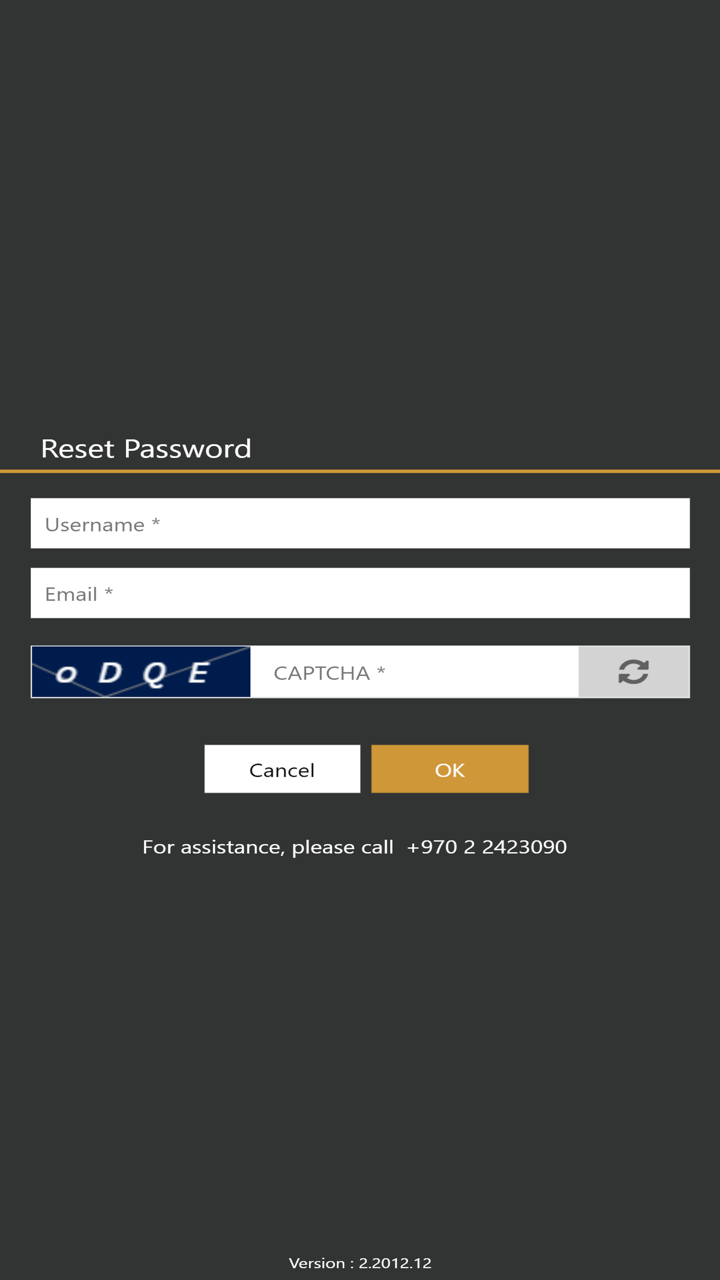

| Müşteri Desteği | Canlı sohbet, İletişim formu |

| Tel: 02-2423090 | |

| E-posta: info@unitedco.ps | |

| Adres: Rawabi Şehri Q Merkezi, Ofis Binası, birinci kat | |

| Sosyal medya: Facebook, Whatsapp, Instagram, LinkedIn | |

United Securities Co. Bilgileri

United Securities Co., 1996 yılında Filistin'de kurulmuş olan öncü aracı kurum ve finansal hizmetlerin düzenlenmemiş bir sağlayıcısıdır. Özel ticaret, Başkaları adına ticaret, İhraç yönetimi, Portföy yönetimi, Saklayıcı hizmetler, Yabancı piyasalarda ticaret, Ticaret Uygulamaları ve E-Ticaret hizmetleri sunmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| Uzun işlem süresi | Düzenleme eksikliği |

| Çeşitli iletişim kanalları | Demo hesapları yok |

| Çeşitli ticaret ürünleri | MT4 platformu yok |

| MT5 platformu | Komisyon ücretleri alınır |

| Sınırlı hesap seçenekleri |

United Securities Co. Güvenilir mi?

No. United Securities Co. şu anda geçerli düzenlemelere sahip değil. Lütfen riskin farkında olun!

United Securities Co. Hizmetleri

| Hizmetler | Desteklenen |

| Özel ticaret | ✔ |

| Başkaları adına ticaret | ✔ |

| İhraç yönetimi | ✔ |

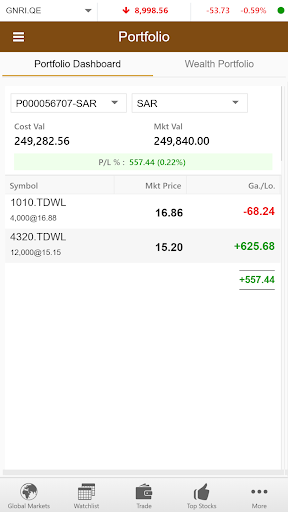

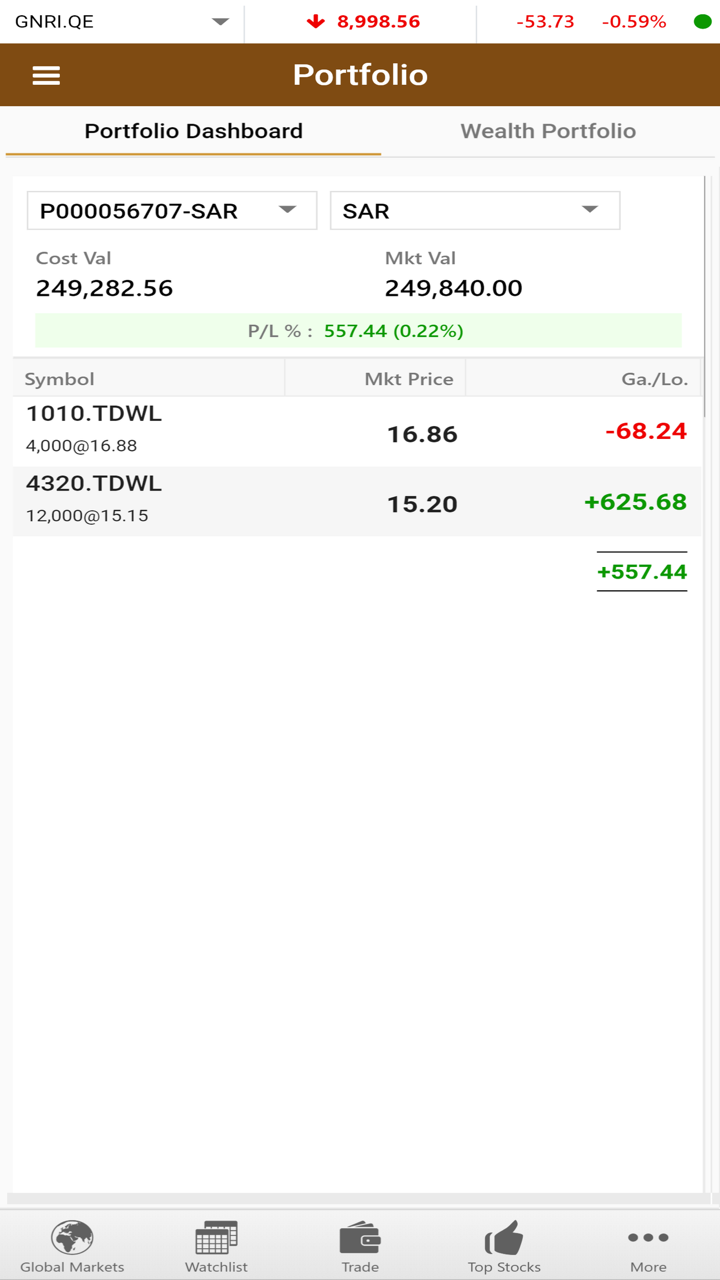

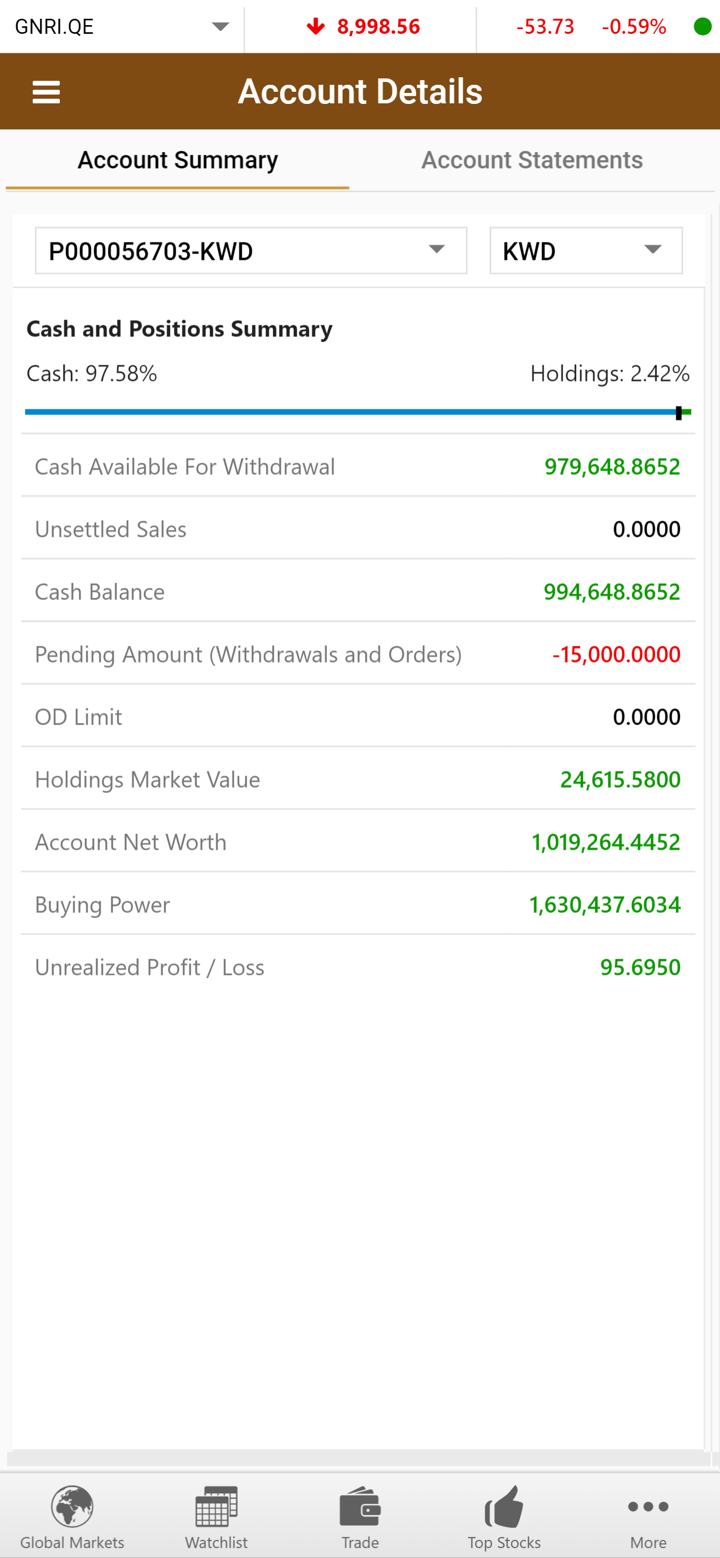

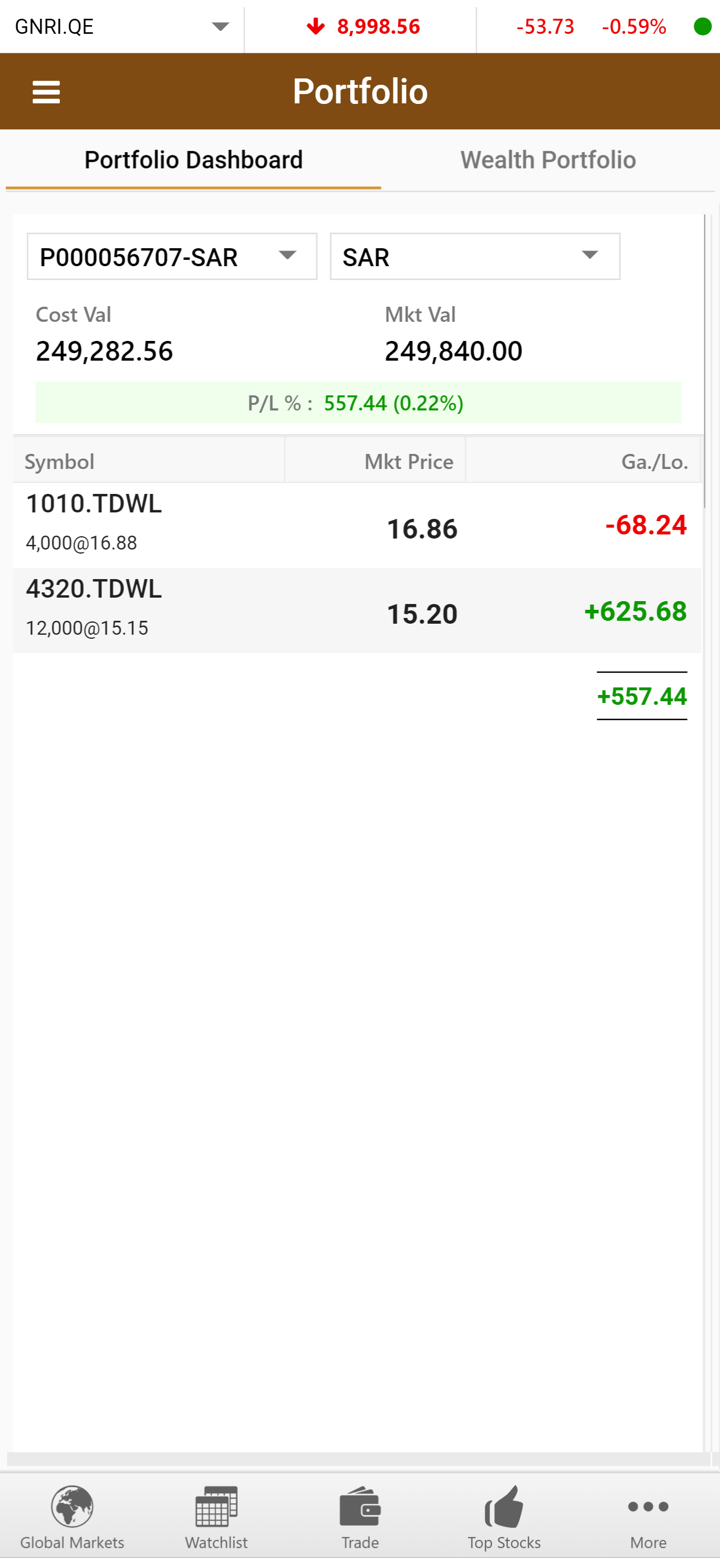

| Portföy yönetimi | ✔ |

| Saklayıcı hizmetler | ✔ |

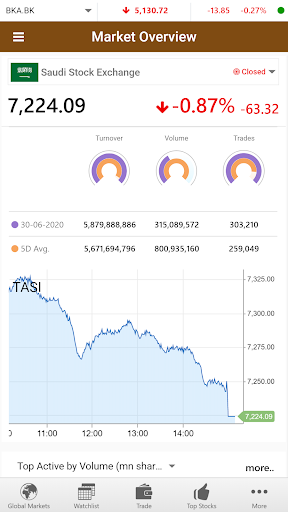

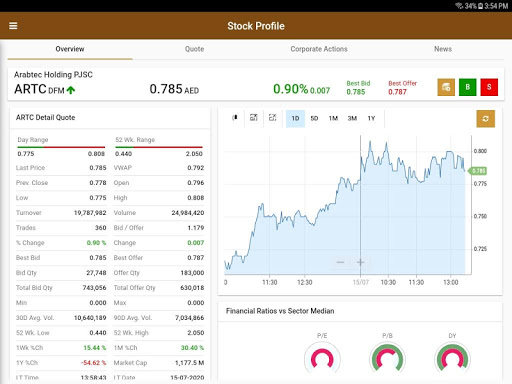

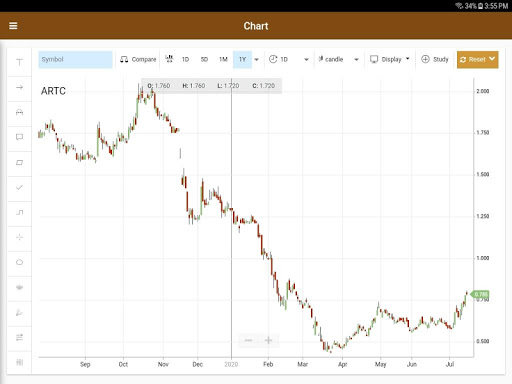

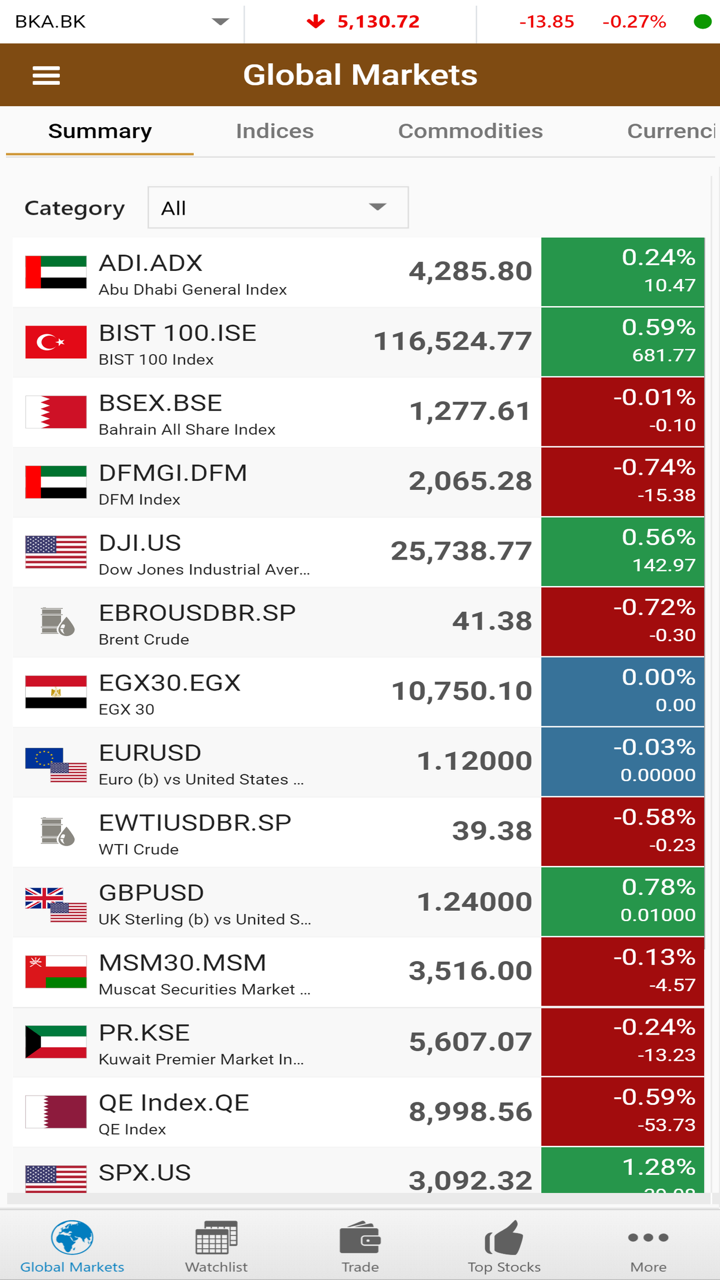

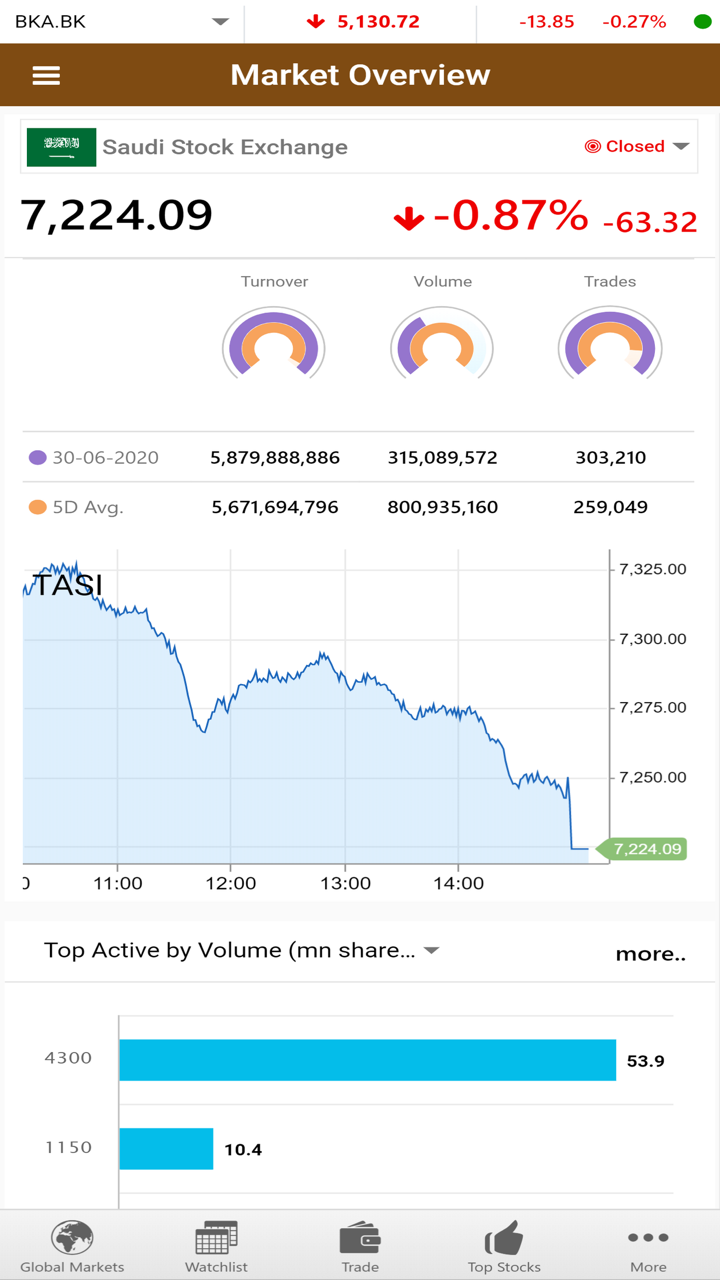

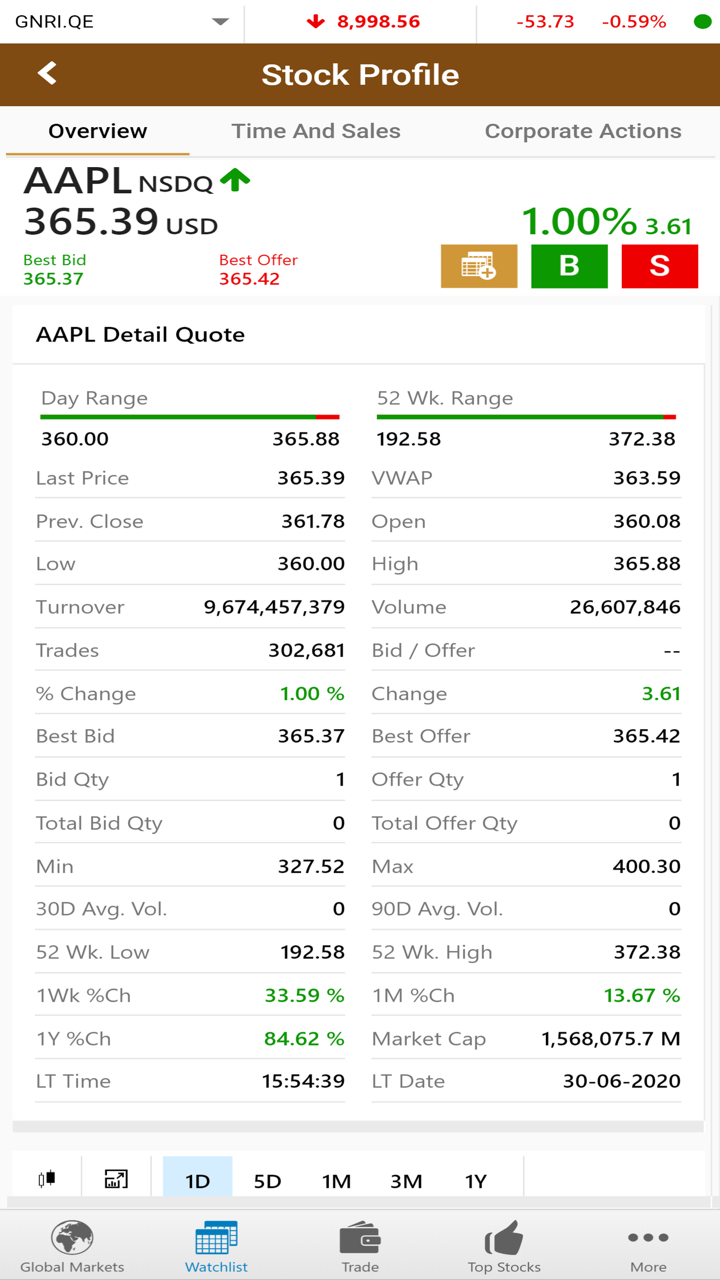

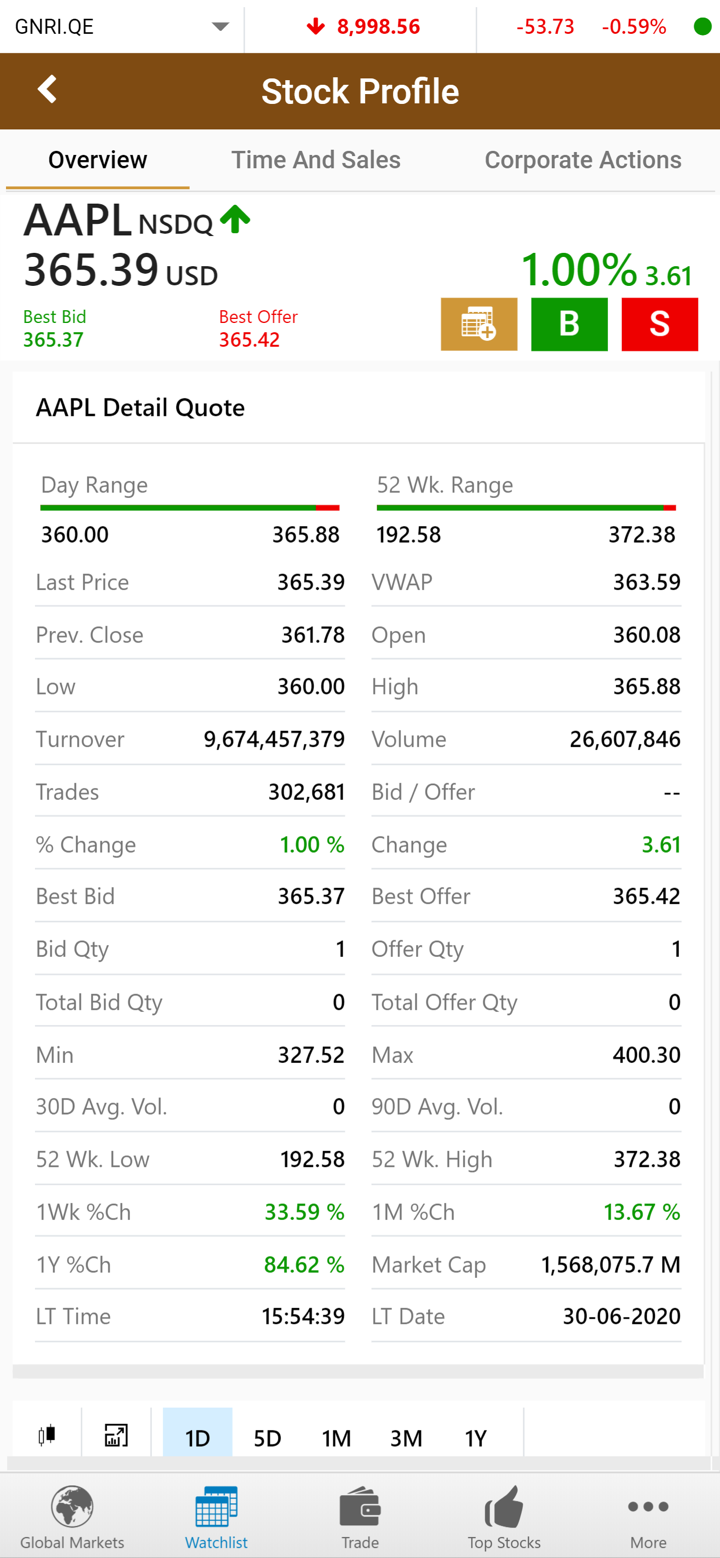

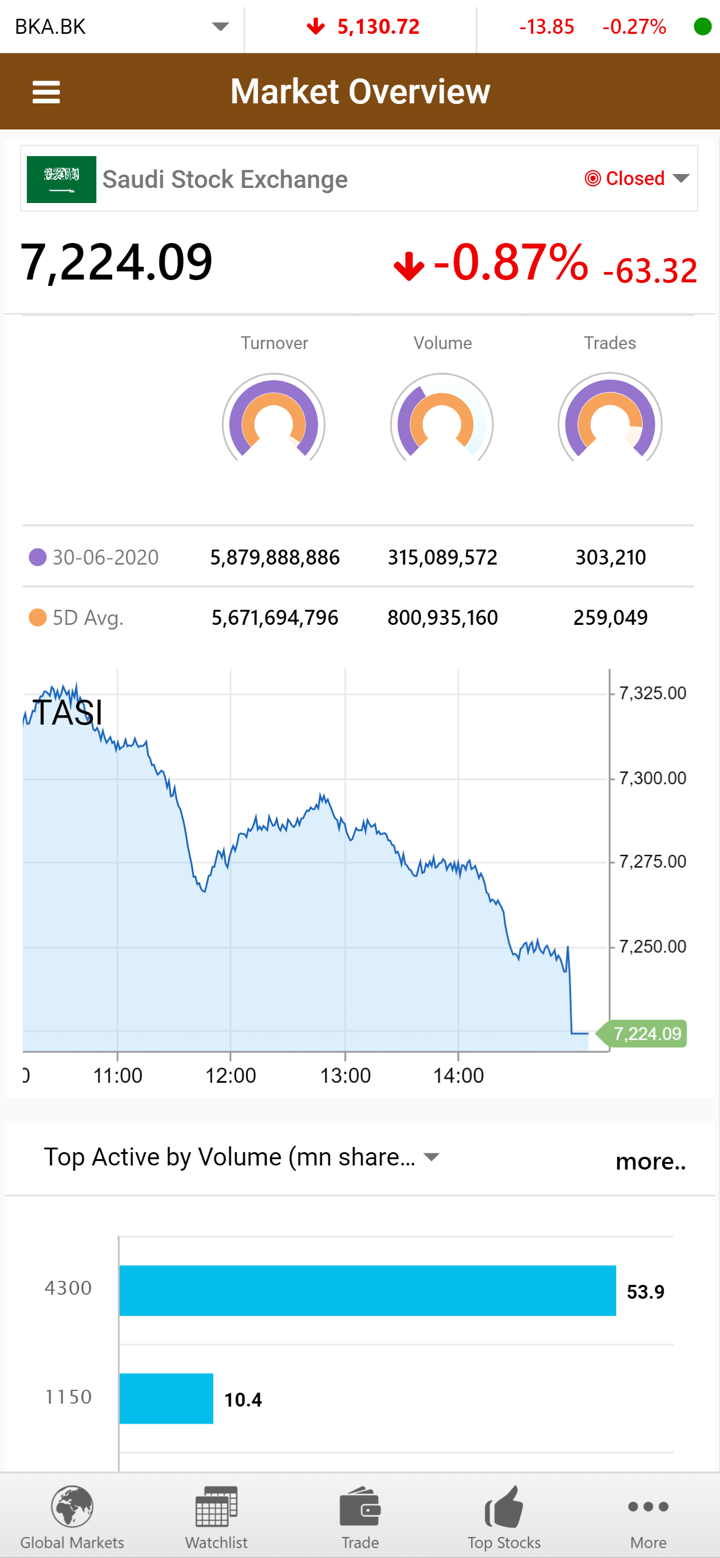

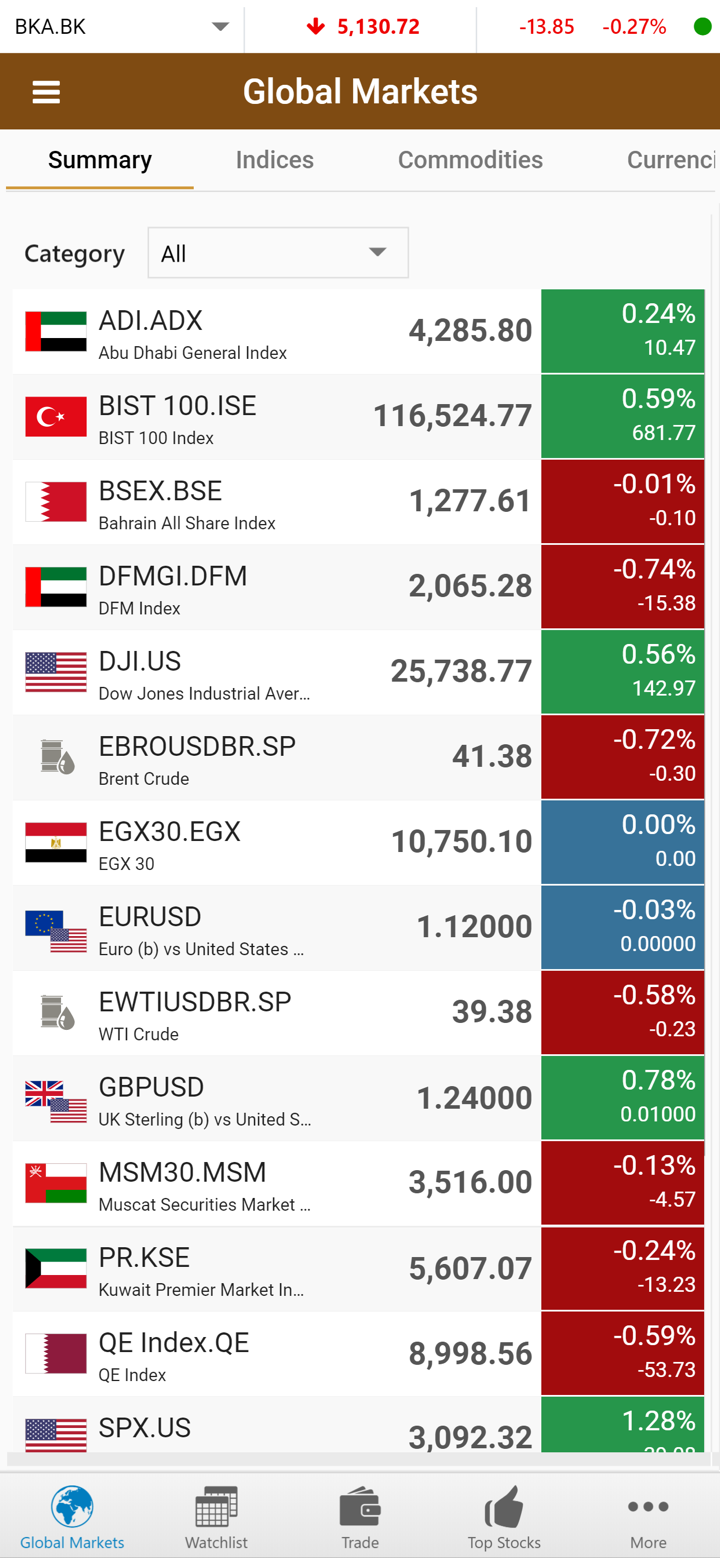

| Yabancı piyasalarda ticaret | ✔ |

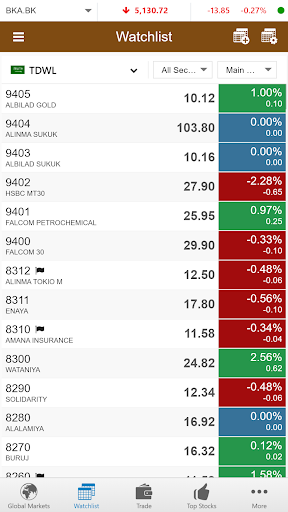

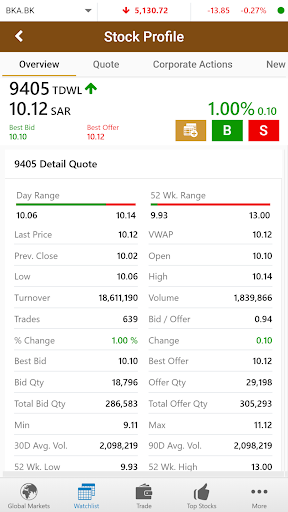

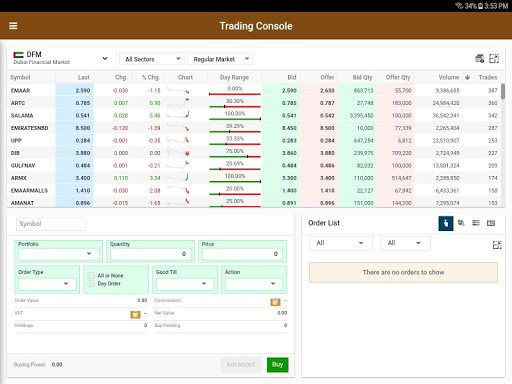

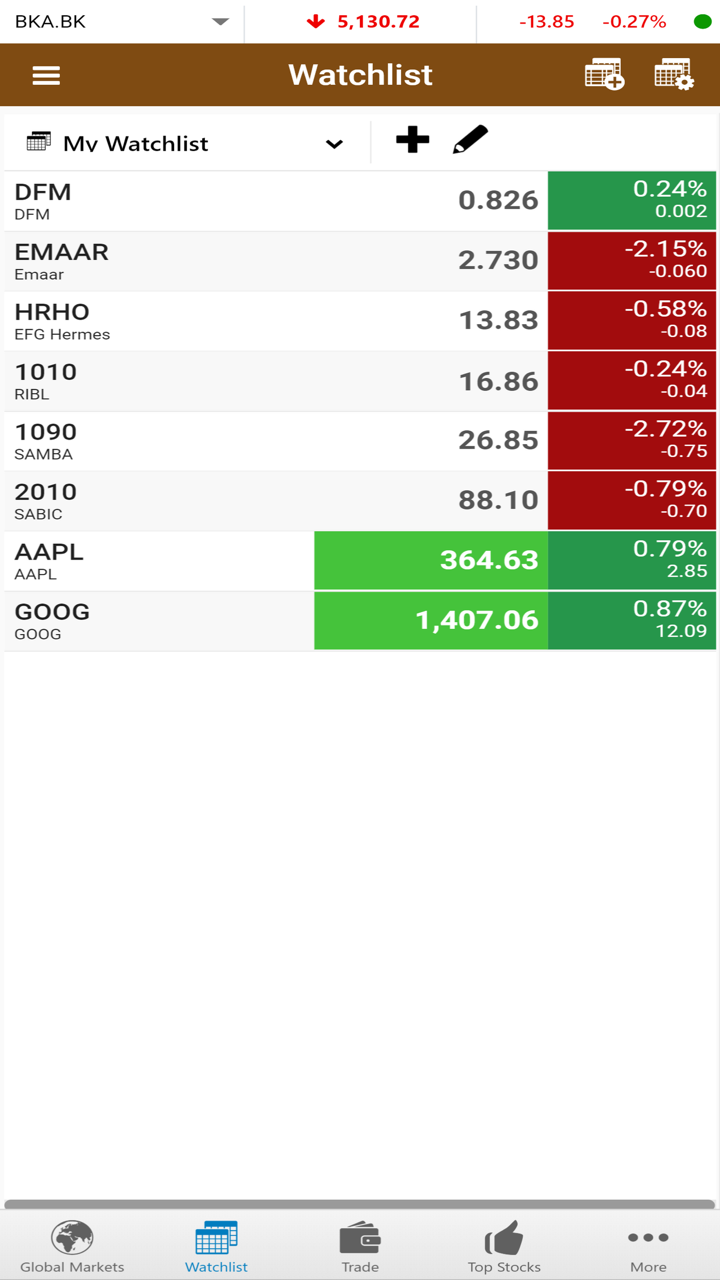

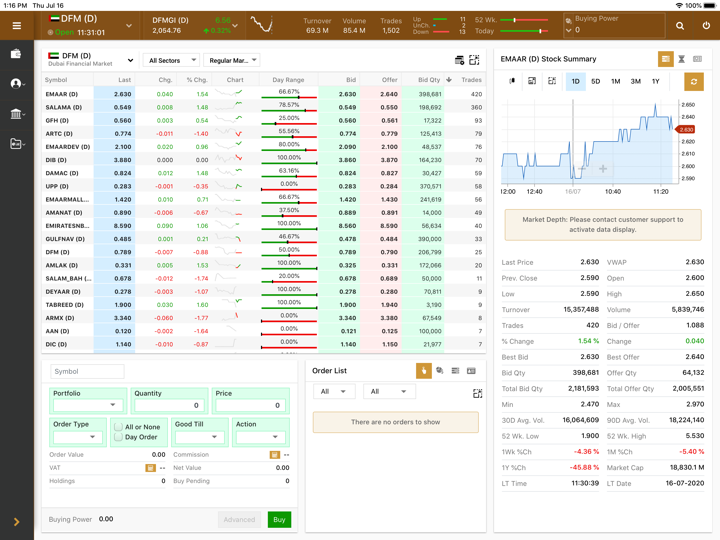

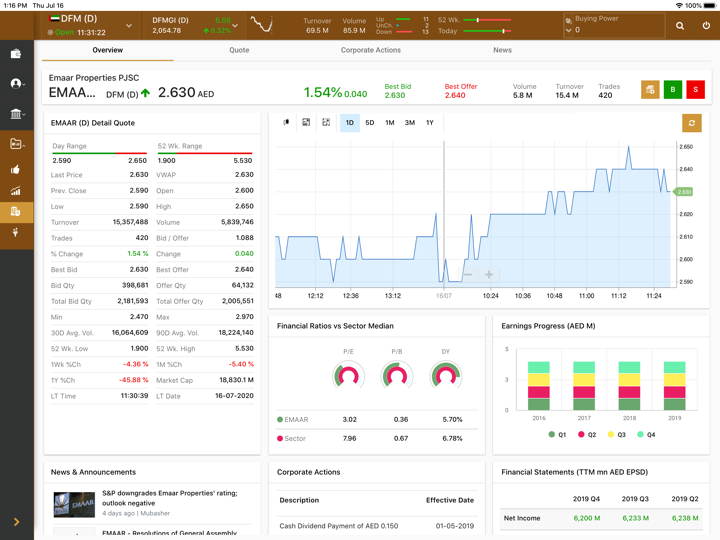

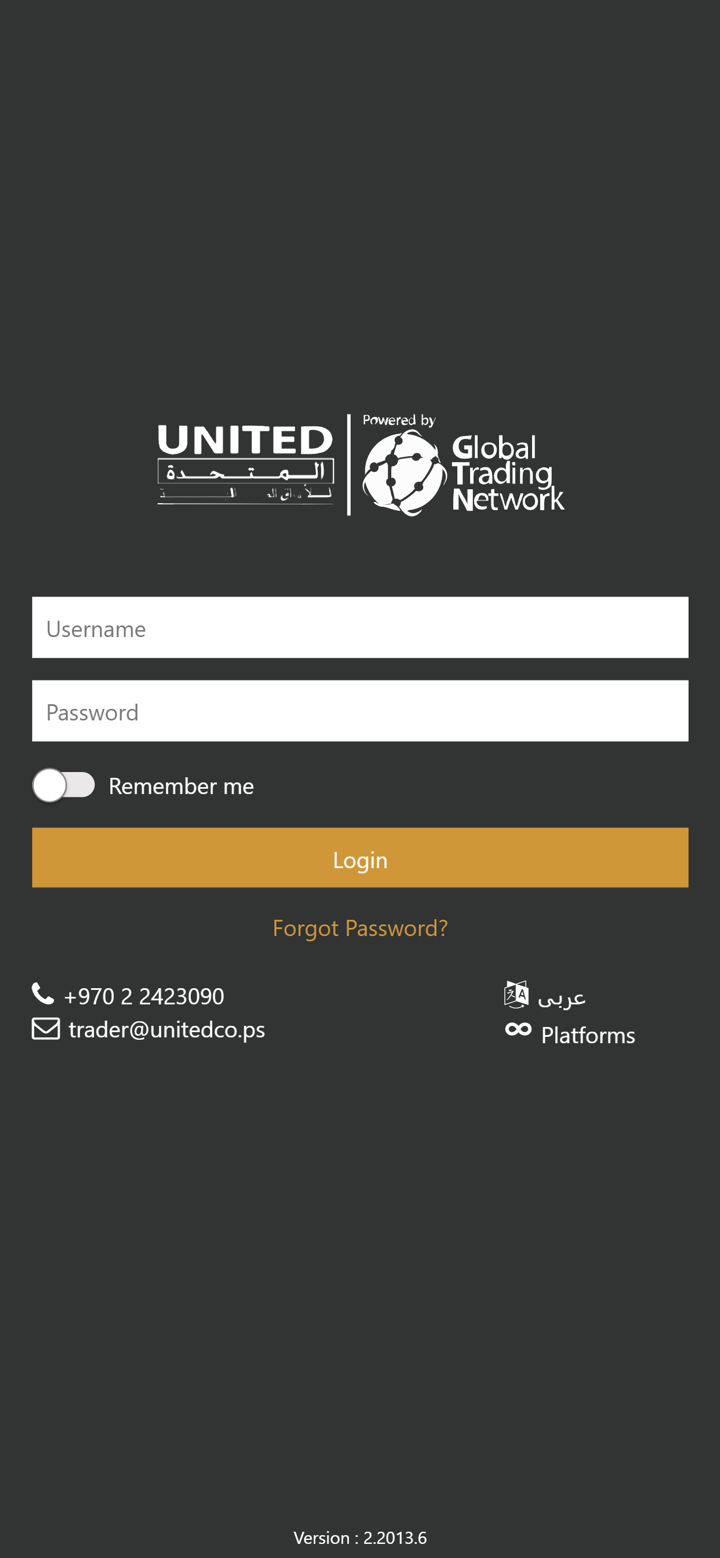

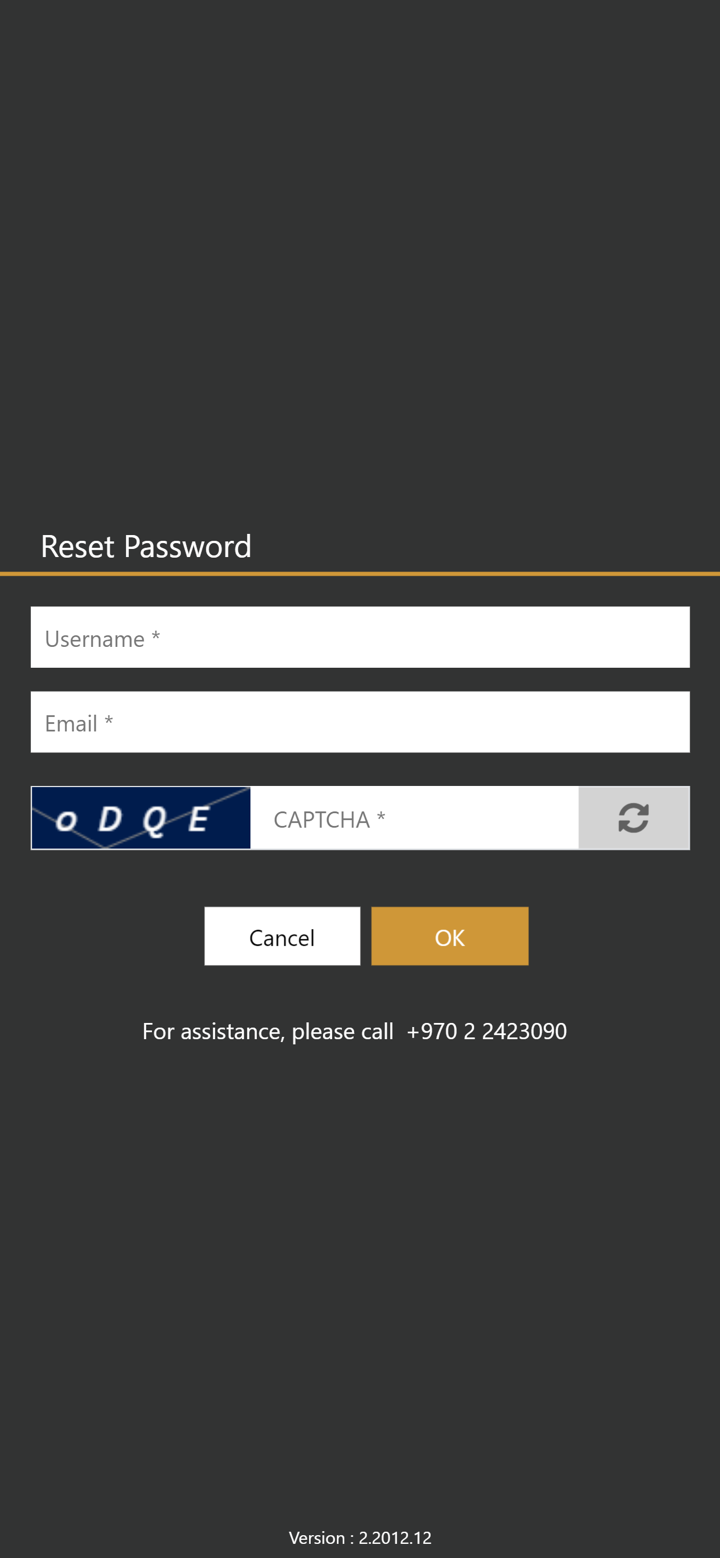

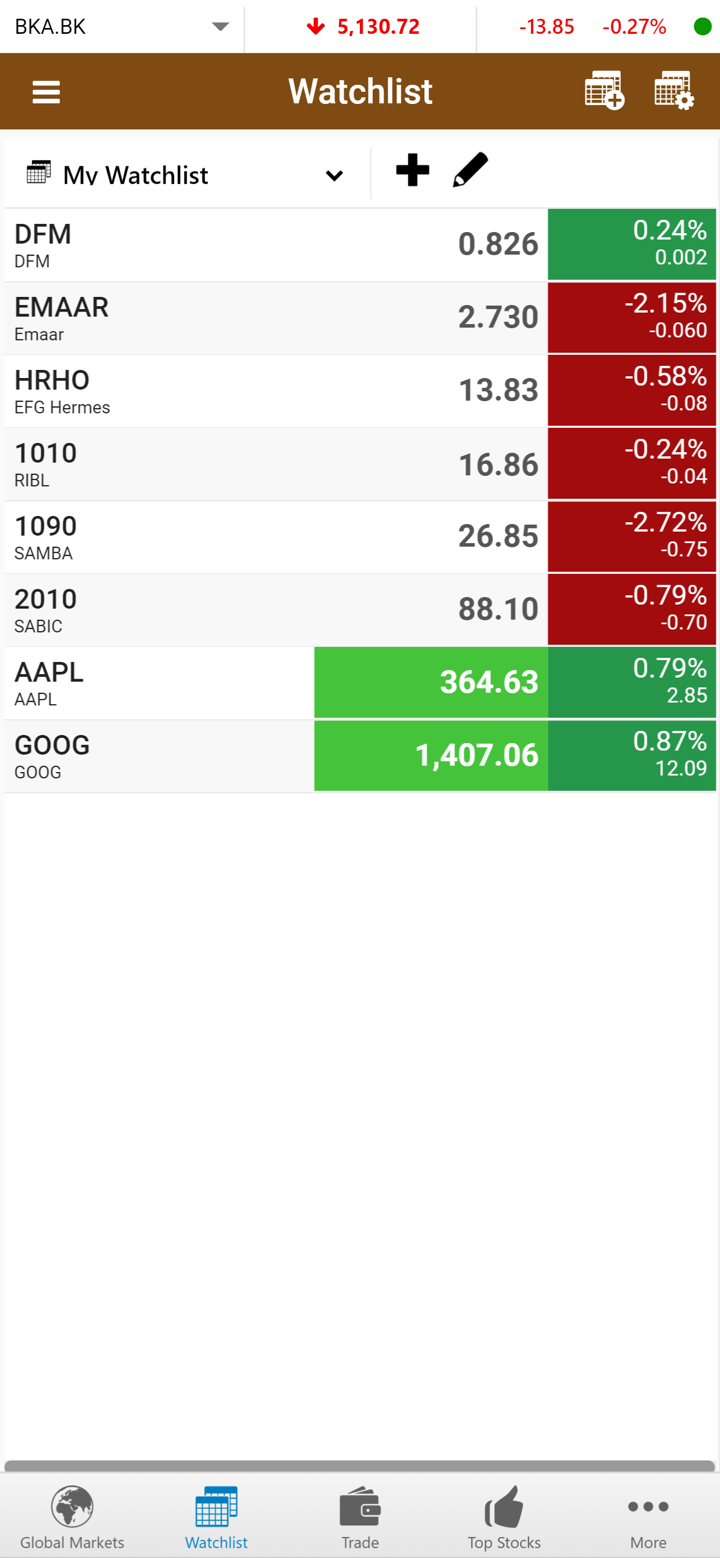

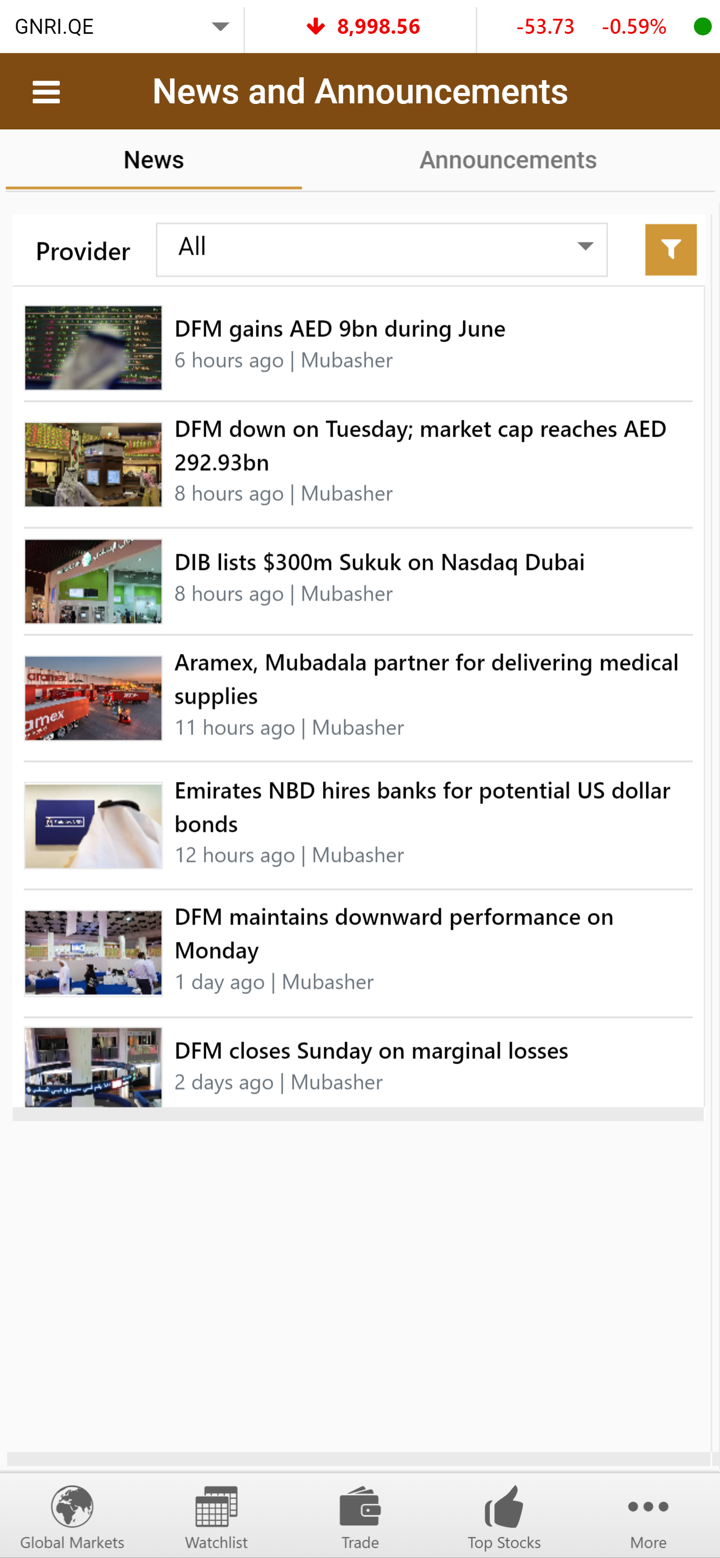

| Ticaret Uygulamaları | ✔ |

| E-Ticaret | ✔ |

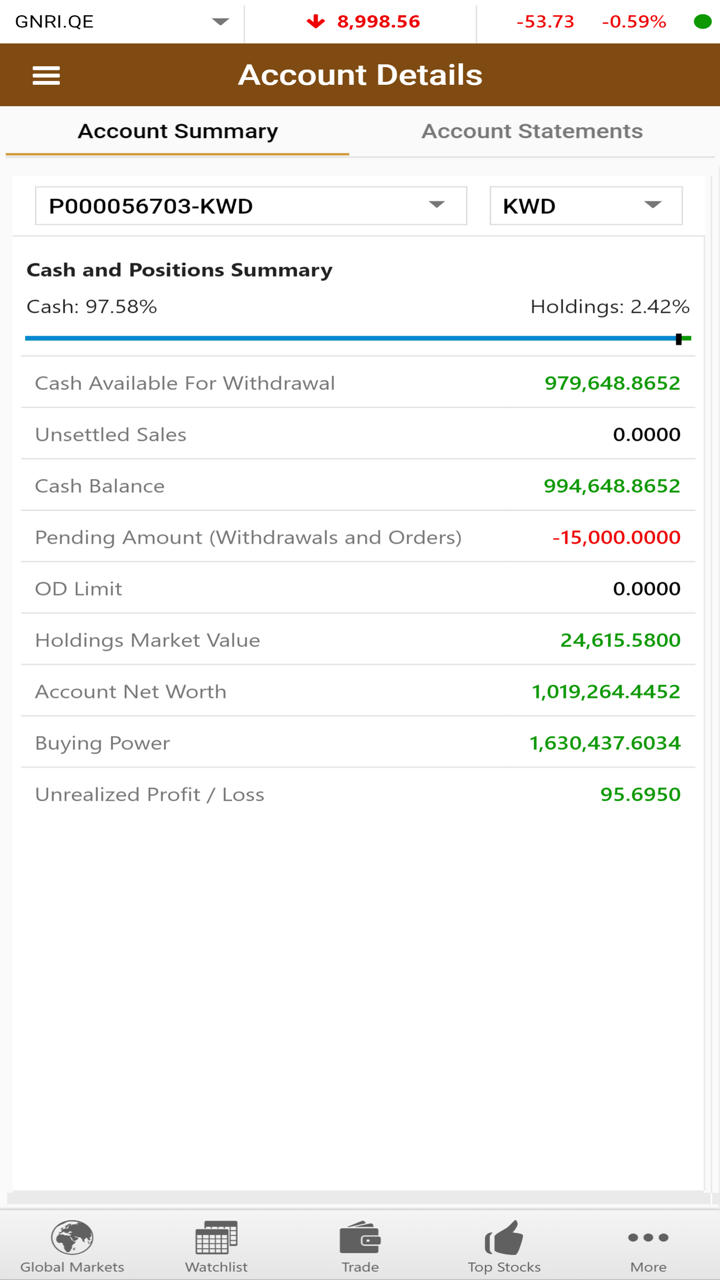

Hesap Türü ve Ücretler

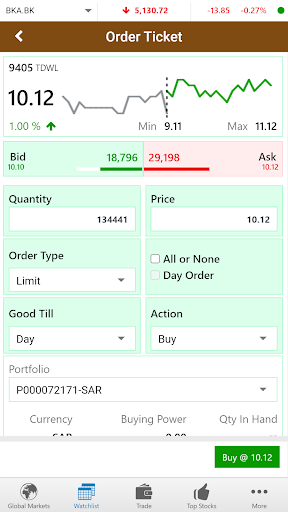

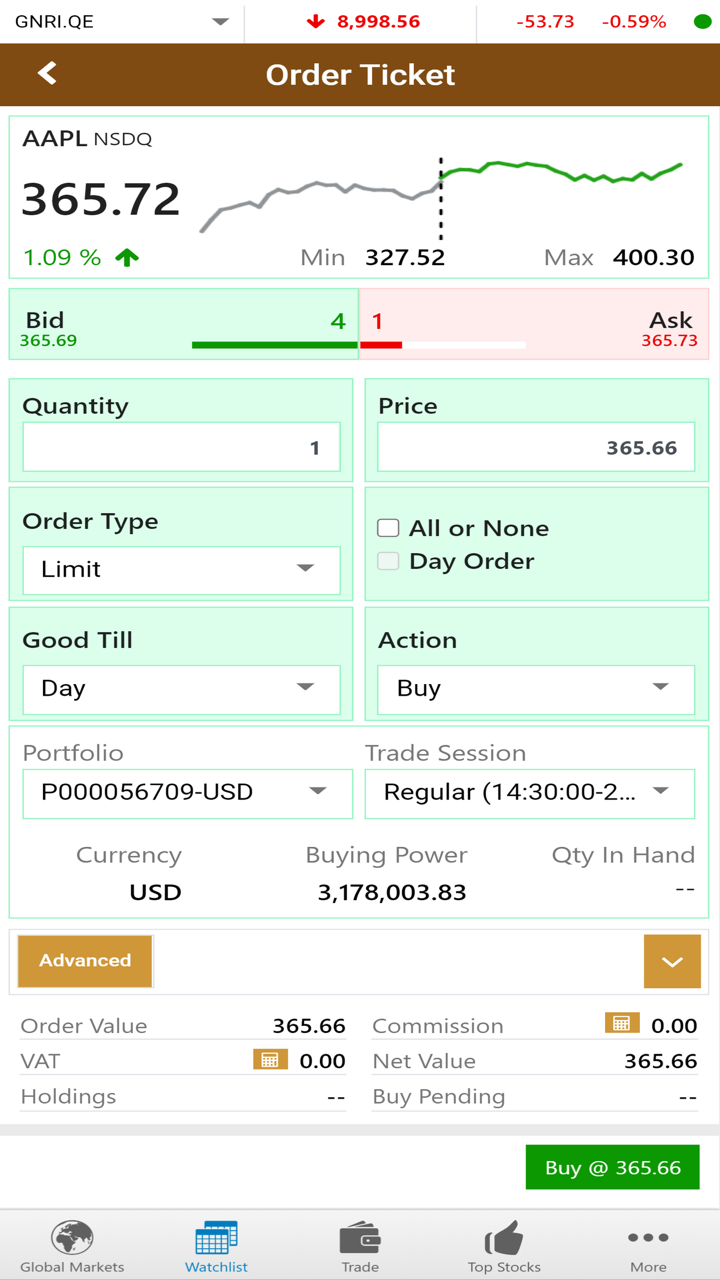

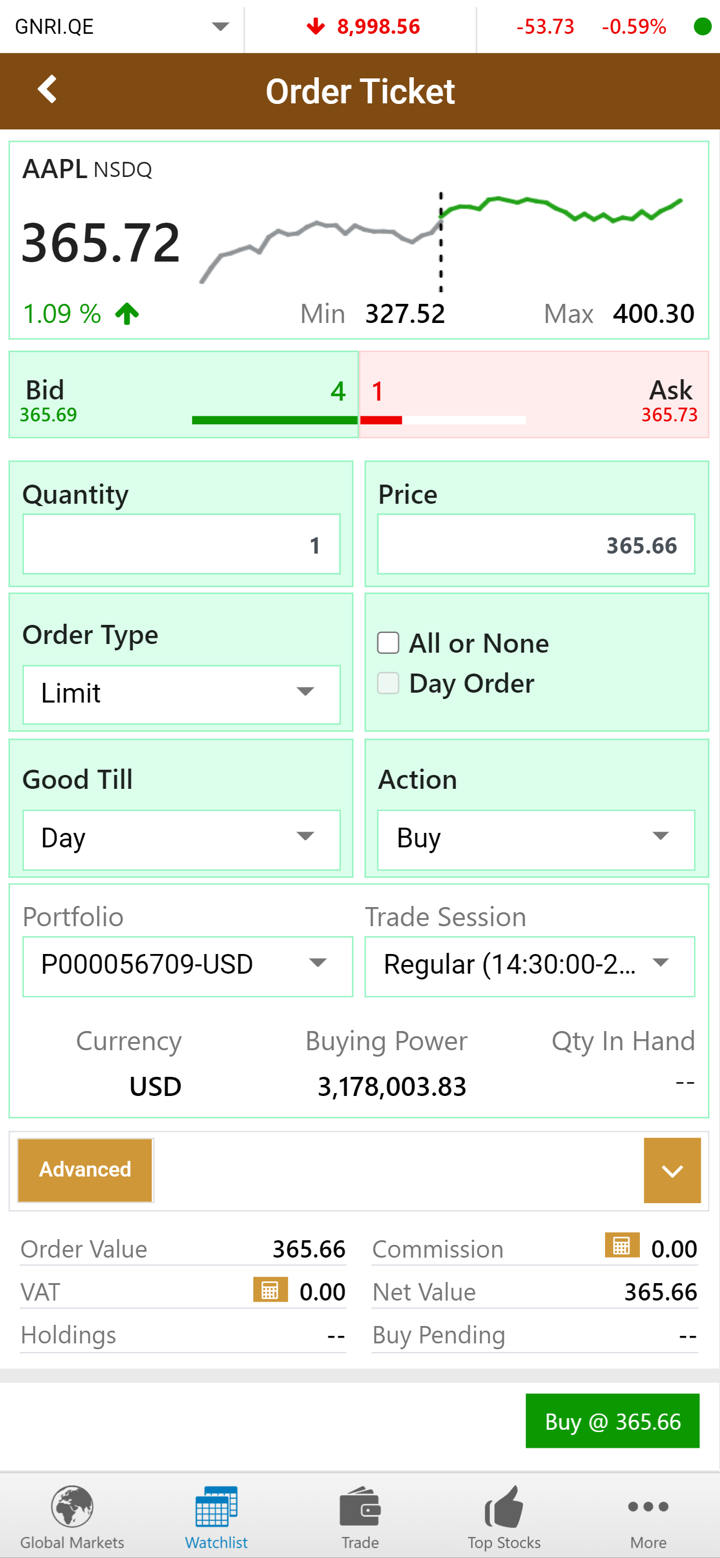

| Hesap Türü | Minimum Yatırım | Maksimum Kaldıraç | Spread | Komisyon |

| Profesyonel | $1,000 | 1:300 | 0 pips | $4/taraf |

| Standart | $100 | 1:300 | 1 pip | ❌ |

İşlem Platformu

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar | Uygun |

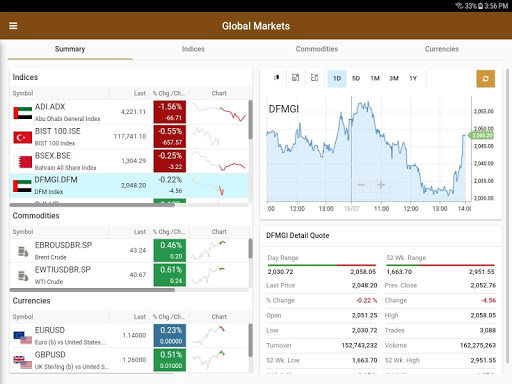

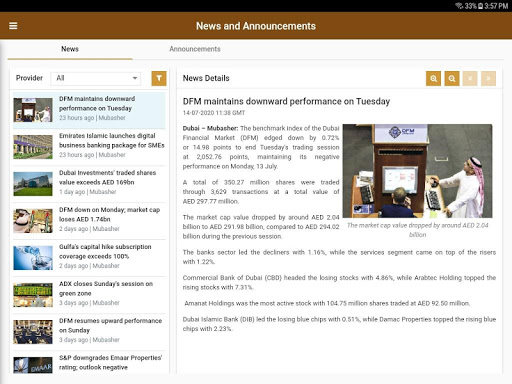

| United Securities Co. uygulaması | ✔ | Mobil, masaüstü, dizüstü bilgisayar | / |

| MT5 | ✔ | Mobil, masaüstü, web | Deneyimli tüccarlar |

| MT4 | ❌ | / | Yeni başlayanlar |

Para Yatırma ve Çekme

United Securities Co., VISA, mastercard ve bankatransferi ile yapılan ödemeleri kabul eder.