Resumo da empresa

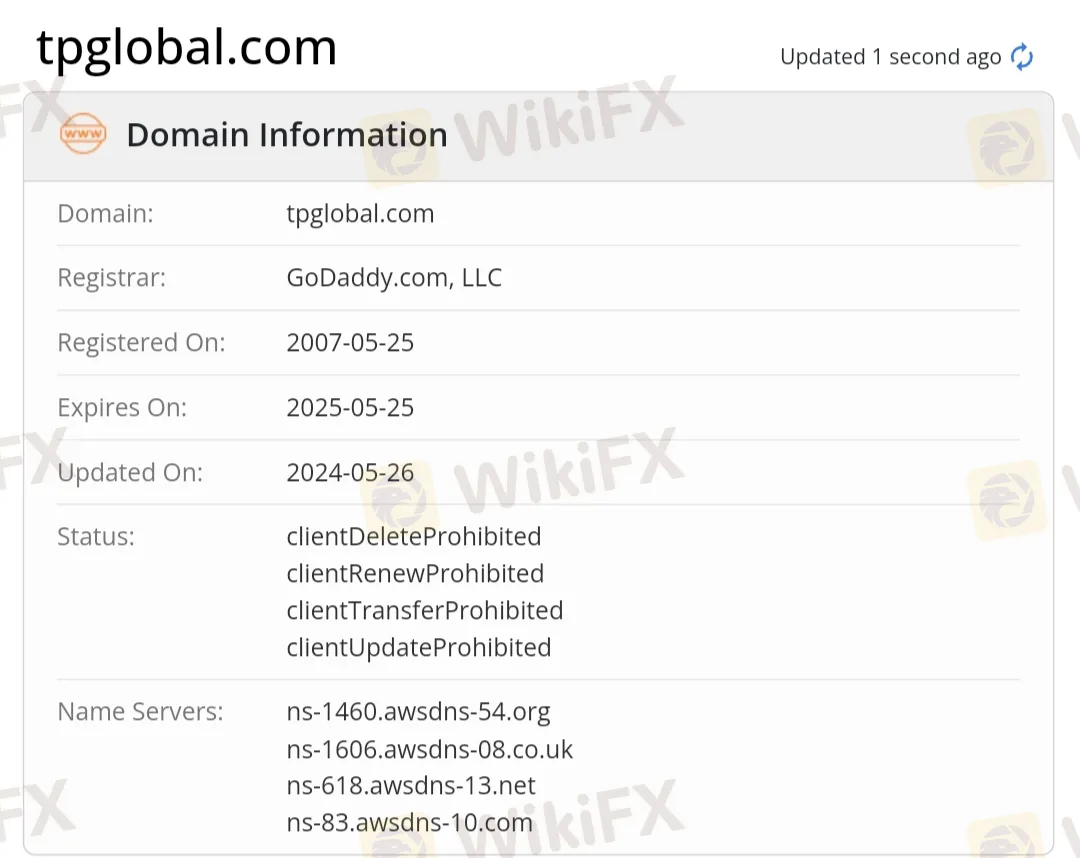

Nota: O site oficial de TP Global - https://tpglobal.com/ está inacessível, portanto, as informações relevantes estão incompletas. Faremos o possível para coletar algumas informações sobre isso.

| TP GlobalResumo da Revisão | |

| Fundado | 2007 |

| País/Região Registrado | Bulgária |

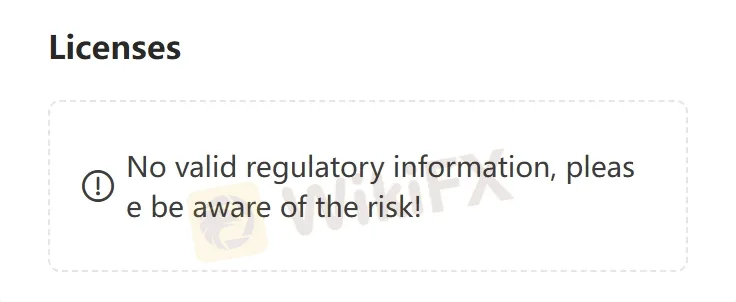

| Regulação | Sem regulação |

| Serviços | Seguro de carga, seguro de armazenamento de negócios, seguro de responsabilidade para agentes de carga e despachantes aduaneiros e garantias de importação temporárias ou definitivas |

| Suporte ao Cliente | Formulário de contato |

| Tel: +52 81 8363 3960 | |

| Email: conecta@tpglobal.com | |

| Endereço da empresa: Pedro Ramirez Vazquez 200-8 Piso 10 Colonia Valle Oriente, San Pedro Garza García, NL, México, CP 66269 | |

TP Global é uma empresa de corretagem de seguros fundada em 2007 e registrada na Bulgária. Ela oferece serviços de seguro, especialmente nas indústrias de logística e transporte.

Prós e Contras

| Prós | Contras |

| Múltiplos canais de contato | Site inacessível |

| Sem regulação |

TP Global é Legítimo?

Não, TP Global atualmente não possui regulamentação válida. Esteja ciente do risco!

Programas de Seguro

Petróleo e Gás

TP Global oferece um programa para a indústria de transporte de petróleo e gás que inclui economia de custos por litro e cobertura personalizada às necessidades do cliente, seja para o próprio produto do cliente, produto de um cliente ou projeto, em uma única viagem, anual ou por projeto.

Carga Geral

TP Global também oferece um programa de seguro de carga geral. Segmentando múltiplos interessados, como transportadores, operadores logísticos e agentes aduaneiros, o programa permite que os parceiros segurem seletivamente sua carga, garantindo que não haja cláusulas ocultas.