Unternehmensprofil

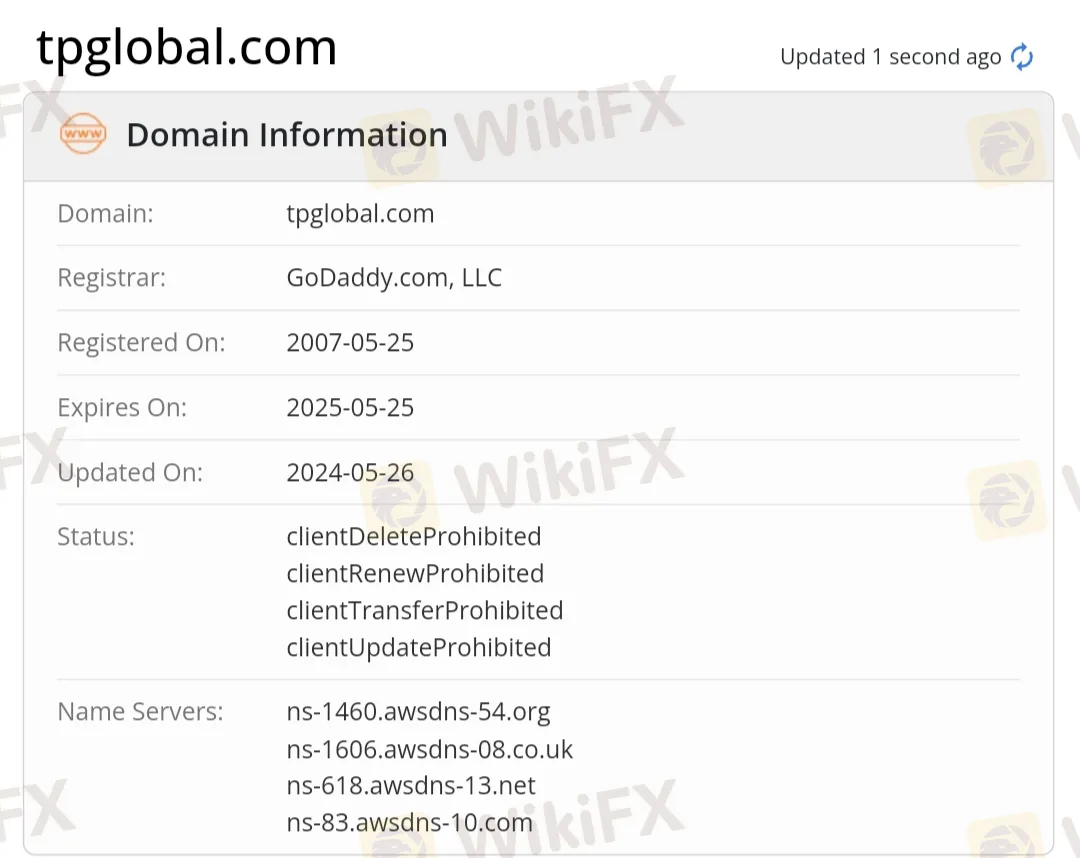

Hinweis: Die offizielle Website von TP Global - https://tpglobal.com/ ist nicht erreichbar, daher sind die relevanten Informationen unvollständig. Wir werden unser Bestes tun, um einige Informationen darüber zu sammeln.

| TP GlobalÜberprüfungszusammenfassung | |

| Gegründet | 2007 |

| Registriertes Land/Region | Bulgarien |

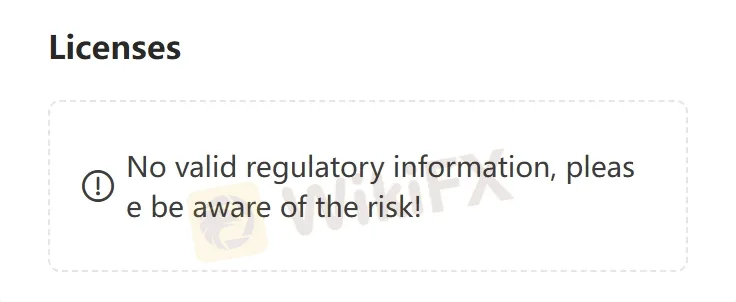

| Regulierung | Keine Regulierung |

| Dienstleistungen | Frachtversicherung, Geschäftslagerversicherung, Haftpflichtversicherung für Spediteure und Zollagenten sowie vorübergehende oder endgültige Einfuhrbürgschaften |

| Kundensupport | Kontaktformular |

| Tel: +52 81 8363 3960 | |

| E-Mail: conecta@tpglobal.com | |

| Firmenadresse: Pedro Ramirez Vazquez 200-8 Piso 10 Colonia Valle Oriente, San Pedro Garza García, NL, México, CP 66269 | |

TP Global ist ein Versicherungsmaklerunternehmen, das 2007 gegründet wurde und in Bulgarien registriert ist. Es bietet Versicherungsdienstleistungen an, insbesondere in den Bereichen Logistik und Transport.

Vor- und Nachteile

| Vorteile | Nachteile |

| Mehrere Kontaktmöglichkeiten | Nicht erreichbare Website |

| Keine Regulierung |

Ist TP Global seriös?

Nein, TP Global hat derzeit keine gültigen Regulierungen. Bitte beachten Sie das Risiko!

Versicherungsprogramme

Öl und Gas

TP Global bietet ein Programm für die Öl- und Gas-Transportindustrie an, das Kosteneinsparungen auf Literbasis und eine an die Bedürfnisse des Kunden angepasste Deckung umfasst, egal ob es sich um das eigene Produkt des Kunden, ein Produkt des Kunden oder ein Projekt handelt, auf Einzelreise-, Jahres- oder Projektbasis.

Allgemeine Fracht

TP Global bietet auch ein Programm für die Versicherung von allgemeiner Fracht an. Das Programm richtet sich an verschiedene Interessengruppen wie Transportunternehmen, Logistikbetreiber und Zollagenten und ermöglicht es Partnern, ihre Fracht selektiv zu versichern und versteckte Klauseln zu vermeiden.