Perfil de la compañía

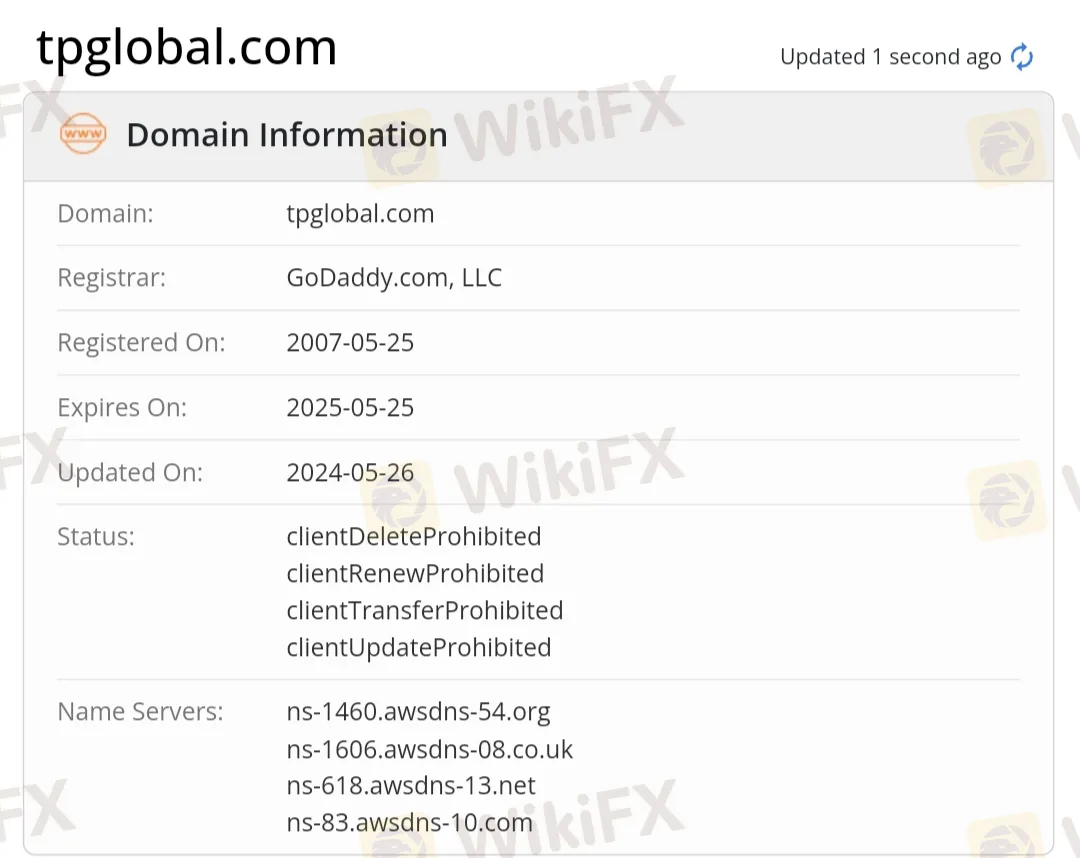

Nota: El sitio web oficial de TP Global - https://tpglobal.com/ no está accesible, por lo que la información relevante está incompleta. Haremos todo lo posible para recopilar información al respecto.

| TP GlobalResumen de la reseña | |

| Fundado | 2007 |

| País/Región registrado | Bulgaria |

| Regulación | Sin regulación |

| Servicios | Seguro de carga, seguro de almacenamiento empresarial, seguro de responsabilidad civil para transitarios y agentes de aduanas, y bonos de importación temporales o definitivos |

| Soporte al cliente | Formulario de contacto |

| Tel: +52 81 8363 3960 | |

| Email: conecta@tpglobal.com | |

| Dirección de la empresa: Pedro Ramirez Vazquez 200-8 Piso 10 Colonia Valle Oriente, San Pedro Garza García, NL, México, CP 66269 | |

TP Global es una empresa de corretaje de seguros fundada en 2007 y registrada en Bulgaria. Ofrece servicios de seguros, especialmente en las industrias de logística y transporte.

Pros y contras

| Pros | Contras |

| Múltiples canales de contacto | Sitio web no accesible |

| Sin regulación |

¿Es TP Global legítimo?

No, TP Global actualmente no tiene regulaciones válidas. ¡Tenga en cuenta el riesgo!

Programas de seguros

Petróleo y Gas

TP Global ofrece un programa para la industria del transporte de petróleo y gas que incluye ahorros de costos por litro y cobertura personalizada según las necesidades del cliente, ya sea para el propio producto del cliente, el producto de un cliente o un proyecto, en un viaje único, anual o por proyecto.

Carga general

TP Global también ofrece un programa de seguro de carga general. Dirigido a múltiples partes interesadas como transportistas, operadores logísticos y agentes de aduanas, el programa permite a los socios asegurar selectivamente su carga, asegurando que no haya cláusulas ocultas.