회사 소개

| ACLEDA Bank리뷰 요약 | |

| 설립 연도 | 2005 |

| 등록 국가/지역 | 캄보디아 |

| 규제 | 규제 없음 |

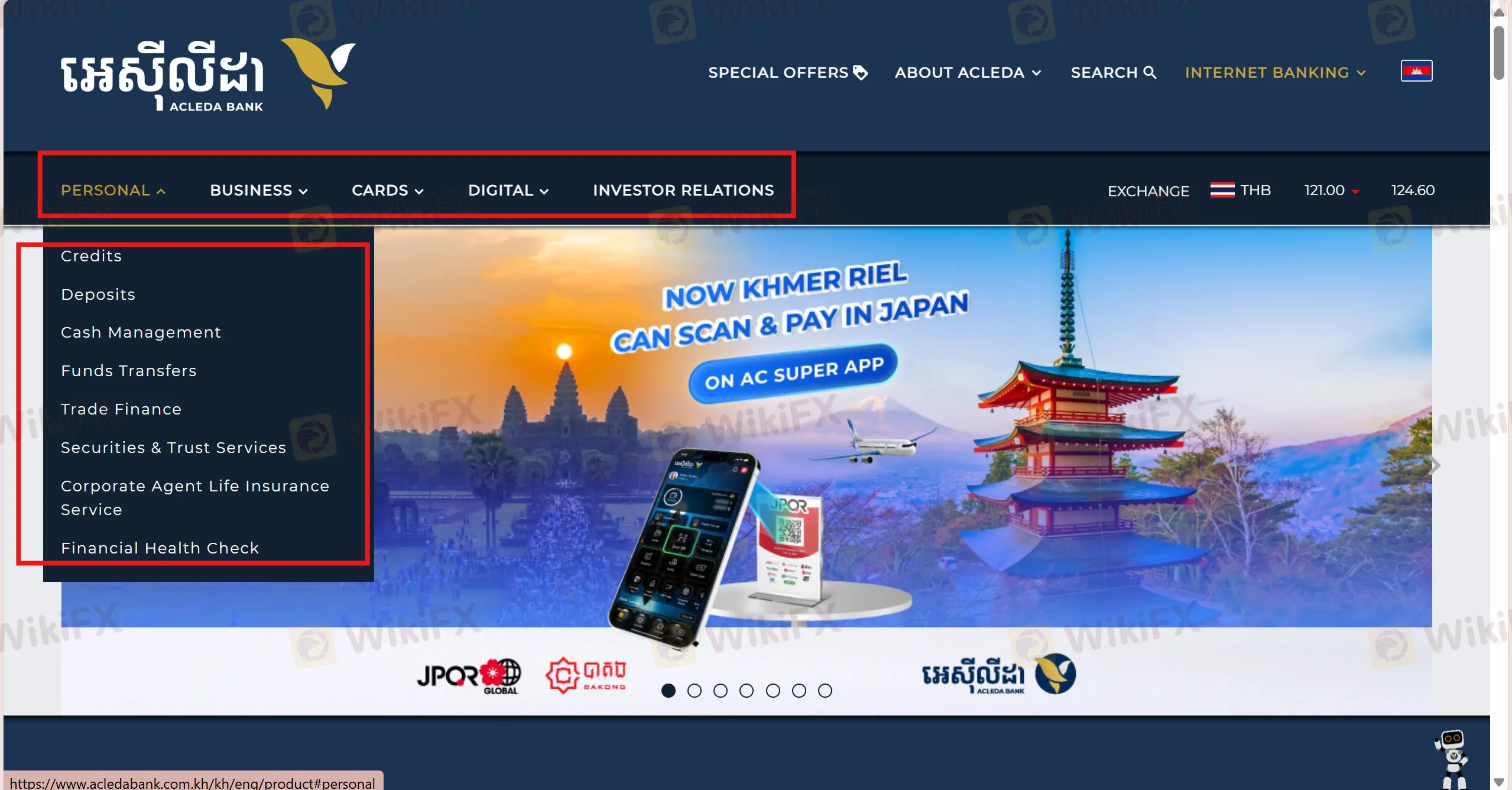

| 상품 및 서비스 | 신용, 예금, 현금 관리, 자금 이체, 무역 금융, 증권 및 신탁 서비스, 기업 에이전트 생명 보험 서비스, 금융 건강 점검 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | AC SUPER APP, ACLEDA INTERNET BANKING |

| 최소 입금 | / |

| 고객 지원 | 전화: 023 994 444, 015 999 233 |

| 이메일: acledabank@acledabank.com.kh | |

| 팩스: 023 430 555 | |

| 소셜 미디어: Facebook, Telegram, Messenger, TikTok, YouTube, LinkedIn, Line, WeChat, WhatsApp, X | |

| 주소: Building N° 61, Preah Monivong Blvd., Sangkat Srah Chak, Khan Doun Penh, Phnom Penh, Cambodia. | |

ACLEDA Bank 정보

ACLEDA Bank은 2005년에 설립된 캄보디아에 등록된 은행입니다. 신용, 예금, 현금 관리, 자금 이체, 무역 금융, 증권 및 신탁 서비스, 기업 에이전트 생명 보험 서비스 및 금융 건강 점검과 같은 다양한 은행 서비스를 제공합니다. 그러나 라이센스가 없습니다.

장단점

| 장점 | 단점 |

| 다양한 은행 서비스 | 규제 없음 |

| 다양한 고객 지원 옵션 |

ACLEDA Bank 합법적인가요?

ACLEDA Bank은 라이센스가 없으므로 이 은행에서 거래하는 고객들은 더욱 주의해야 합니다.

상품 및 서비스

대부분의 은행들과 마찬가지로, ACLEDA Bank은 다양한 은행 서비스를 제공하며, 신용, 예금, 현금 관리, 자금 이체, 무역 금융, 증권 및 신탁 서비스, 기업 에이전트 생명 보험 서비스, 재무 건강 진단을 포함합니다.

| 제품 및 서비스 | 지원 |

| 신용 | ✔ |

| 예금 | ✔ |

| 현금 관리 | ✔ |

| 자금 이체 | ✔ |

| 무역 금융 | ✔ |

| 증권 및 신탁 서비스 | ✔ |

| 기업 에이전트 생명 보험 서비스 | ✔ |

| 재무 건강 진단 | ✔ |

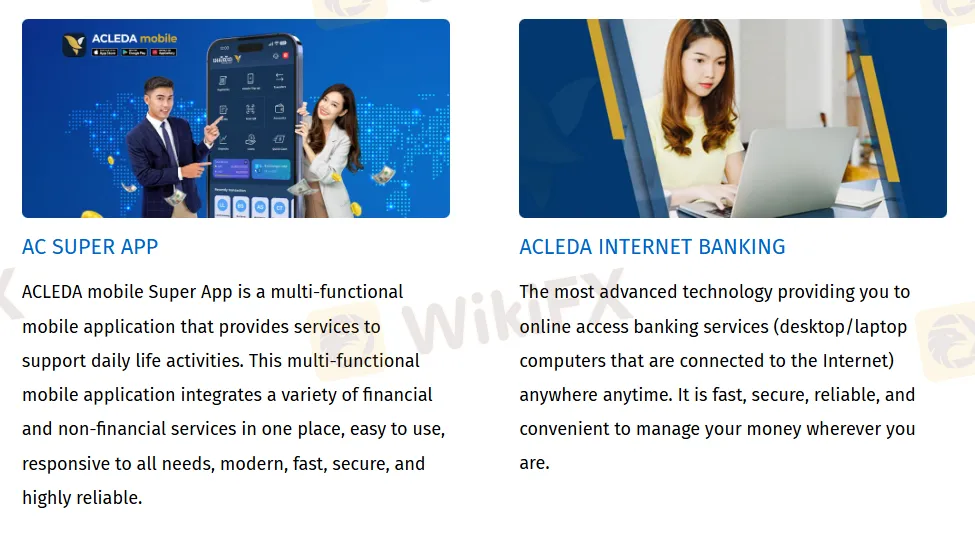

거래 플랫폼

ACLEDA Bank의 거래 플랫폼은 ACLEDA Super App 및 ACLEDA INTERNET BANKING으로, PC, Mac, iPhone 및 Android에서 트레이더를 지원합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합한 대상 |

| ACLEDA Super App | ✔ | 모바일 | / |

| ACLEDA INTERNET BANKING | ✔ | PC, 태블릿 | / |