Buod ng kumpanya

| ACLEDA BankBuod ng Pagsusuri | |

| Itinatag | 2005 |

| Nakarehistrong Bansa/Rehiyon | Cambodia |

| Regulasyon | Walang regulasyon |

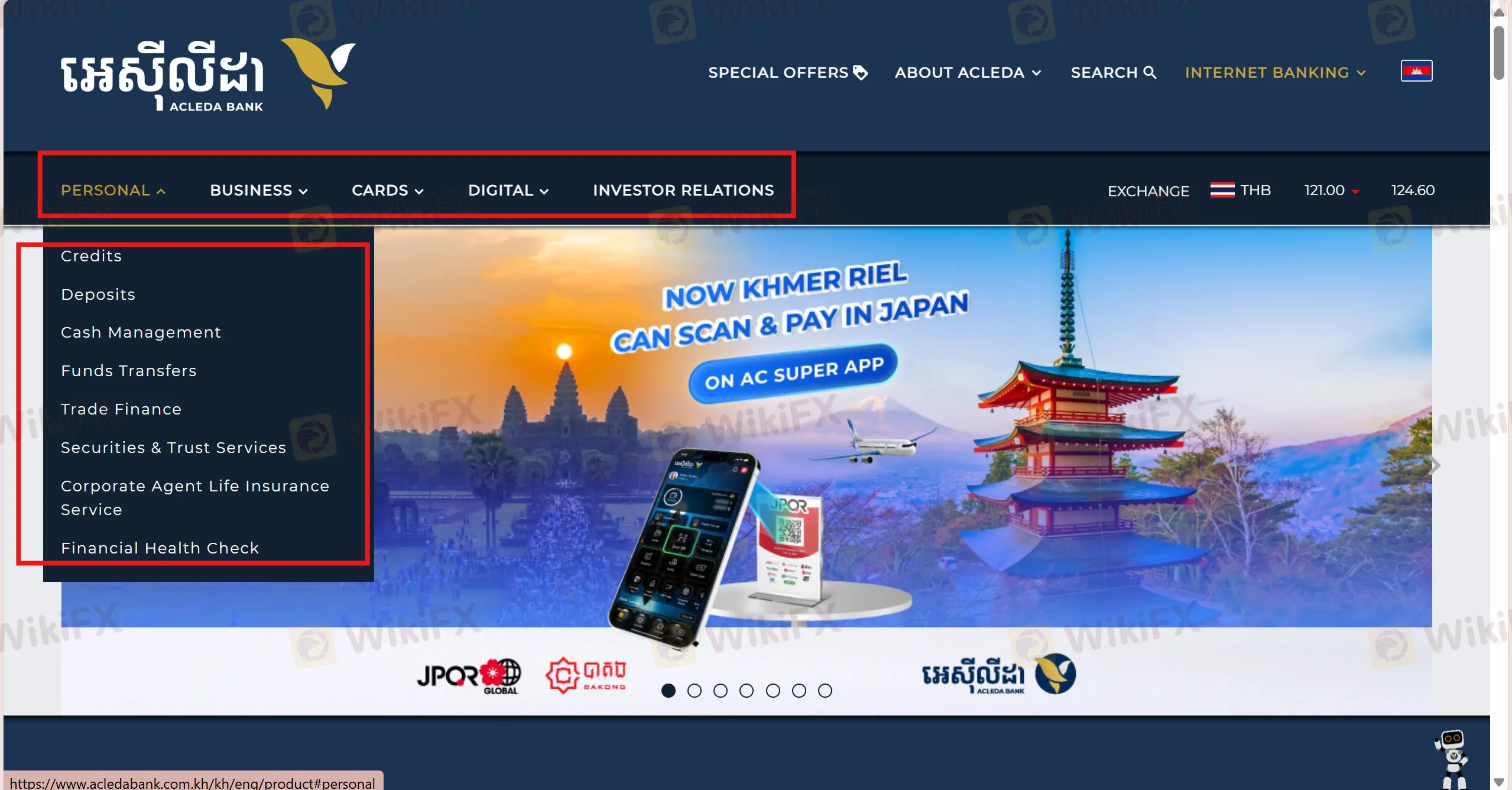

| Mga Produkto at Serbisyo | Credits, deposits, cash management, fund transfer, trade finance, securities and trust services, corporate agent life insurance service, financial health check |

| Demo Account | / |

| Levaheng | / |

| Spread | / |

| Plataforma ng Pagtitinda | AC SUPER APP, ACLEDA INTERNET BANKING |

| Minimum na Deposito | / |

| Suporta sa Kustomer | Telepono: 023 994 444, 015 999 233 |

| Email: acledabank@acledabank.com.kh | |

| Fax: 023 430 555 | |

| Social Media: Facebook, Telegram, Messenger, TikTok, YouTube, LinkedIn, Line, WeChat, WhatsApp, X | |

| Address: Building N° 61, Preah Monivong Blvd., Sangkat Srah Chak, Khan Doun Penh, Phnom Penh, Cambodia. | |

Impormasyon ng ACLEDA Bank

ACLEDA Bank, na itinatag noong 2005, ay isang bangko na naka-rehistro sa Cambodia. Nagbibigay ito ng iba't ibang mga serbisyong bangko tulad ng credits, deposits, cash management, fund transfer, trade finance, securities and trust services, corporate agent life insurance service, at financial health check. Ngunit walang lisensya.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Malawak na hanay ng mga serbisyong bangko | Walang regulasyon |

| Maraming pagpipilian sa suporta sa kustomer |

Tunay ba ang ACLEDA Bank?

Ang ACLEDA Bank ay walang lisensya, kaya't ang mga customer nito ay dapat maging mas maingat kapag nagsasagawa ng negosyo sa bangkong ito.

Mga Produkto at Serbisyo

Tulad ng karamihan ng mga bangko, ACLEDA Bank ay nag-aalok ng maraming serbisyong bangko, na sumasaklaw sa mga kredito, deposito, pamamahala ng pera, paglilipat ng pondo, pondo ng kalakalan, serbisyo sa sekuriti at tiwala, serbisyong pang-seguro sa buhay ng korporasyon, pagsusuri ng kalusugan sa pinansyal.

| Mga Produkto at Serbisyo | Supported |

| Kredito | ✔ |

| Deposito | ✔ |

| Pamamahala ng Pera | ✔ |

| Paglilipat ng Pondo | ✔ |

| Pondo ng Kalakalan | ✔ |

| Serbisyo sa Sekuriti at Tiwala | ✔ |

| Serbisyong pang-Seguro sa Buhay ng Korporasyon | ✔ |

| Pagsusuri ng Kalusugan sa Pinansyal | ✔ |

Plataforma ng Kalakalan

Ang mga plataporma ng kalakalan ng ACLEDA Bank ay ACLEDA Super App at ACLEDA INTERNET BANKING, na sumusuporta sa mga mangangalakal sa PC, Mac, iPhone at Android.

| Plataforma ng Kalakalan | Supported | Available Devices | Suitable for |

| ACLEDA Super App | ✔ | Mobile | / |

| ACLEDA INTERNET BANKING | ✔ | PC, tablet | / |