회사 소개

| ATG 리뷰 요약 | |

| 설립 연도 | 2009 |

| 등록 국가/지역 | 홍콩 |

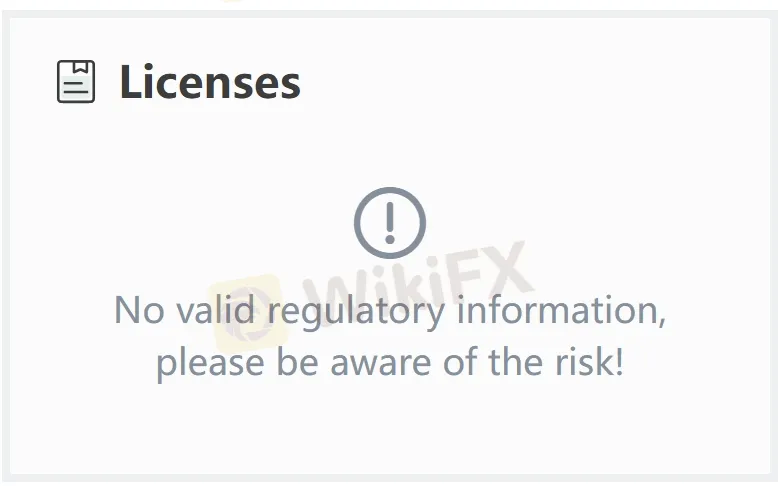

| 규제 | 규제 없음 |

| 시장 상품 | 선물, 주식 |

| 고객 지원 | 전화: +(31) 205 782 180 |

| 이메일: emailus@algorithmictradinggroup.com | |

| 암스테르담 사무실: Beursplein 5, 1012 JW 암스테르담, 네덜란드 | |

| 홍콩 사무실: Unit 2, 13/F, 자바로드 108 상업 센터 108 자바로드, 홍콩 | |

ATG 정보

알고리즘 트레이딩 그룹 (ATG) 리미티드는 암스테르담과 홍콩에 사무실을 두고 있는 전자 프로프리어터리 트레이딩 기업입니다. 2009년 홍콩에서 설립된 이 회사는 유럽, 아시아 및 미국 전역의 선물 및 주식 시장에서 거래를 하며, 주로 주간 5일 동안 거의 24시간 운영합니다.

그러나 ATG의 웹사이트는 배경 및 사업 범위에 대한 투명성이 제한적인 단순한 구조를 가지고 있습니다. 더 나쁜 점은, 이 회사가 공식 당국에 의해 규제되지 않고 있어서 신뢰성과 신뢰성이 부족하다는 점에 주의를 기울여야 합니다.

장단점

| 장점 | 단점 |

| 없음 | 규제 없음 |

| 배경 및 사업 범위에 대한 투명성이 제한적 |

ATG이 신뢰할 만한가요?

중개 플랫폼의 안전성을 측정하는 가장 중요한 요소는 공식적으로 규제되었는지 여부입니다. ATG은 규제되지 않은 중개업체이므로 사용자 자금 및 거래 활동의 안전이 효과적으로 보호되지 않습니다. 투자자는 ATG을 신중히 선택해야 합니다.

ATG에서 무엇을 거래할 수 있나요?

비정보적인 웹사이트에서 몇 마디만 배울 수 있지만, 이 회사는 유럽, 아시아 및 미국 전역의 주요 선물 및 주식 시장에서 주로 활동하며, 주간 5일 동안 거의 24시간 운영합니다.