회사 소개

| 신만굉원증권은리뷰 요약 | |

| 설립 연도 | 2015 |

| 등록 국가/지역 | 중국 |

| 규제 | SFC 선물 계약 거래 라이선스 (규제), SFC 증권 거래 라이선스 (초과) |

| 시장 상품 | 주식, 선물 |

| 거래 플랫폼 | e-service |

| 고객 지원 | 문의 양식 |

| 전화: (852) 2509-8395 | |

| 이메일: ir@swhyhk.com | |

신만굉원증권은정보

신만굉원증권은(H.K.) Limited은 홍콩을 기반으로 하는 금융 서비스 제공업체로 중국 증권 회사인 신만굉원증권은Group Co., Ltd.의 자회사입니다. 이 회사는 주식 및 선물 거래, 자산 관리, 기업 금융 및 기관 증권을 포함한 다양한 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 선물 계약 거래 라이선스로 규제됨 | 증권 거래 라이선스 초과 |

| 다양한 연락 채널 | 한정된 거래 가능 제품 |

| 투명한 수수료 구조 |

신만굉원증권은합법인가요?

신만굉원증권은은 홍콩 증권 선물 위원회 (SFC)에 의해 규제되며, 선물 계약 거래 라이선스 (No AAF420)를 보유하고 있습니다. 한편, 증권 거래 라이선스 (No AAC927)는 초과되었으며, 이는 증권과 관련된 활동이 위험을 수반할 수 있다는 것을 의미합니다.

| 규제 기관 | 규제 상태 | 규제 엔티티 | 라이선스 유형 | 라이선스 번호 | |

| 홍콩 증권 선물 위원회 (SFC) | 규제됨 | 신만굉원증권은Futures (H.K.) Limited | 선물 계약 거래 | AAF420 |

| 홍콩 증권 선물 위원회 (SFC) | 초과됨 | 신만굉원증권은Securities (H.K.) Limited | 증권 거래 | AAC927 |

신만굉원증권은에서 무엇을 거래할 수 있나요?

거래자들은 이 플랫폼에서 주식 및 선물을 거래할 수 있습니다.

| 거래 자산 | 가능 |

| 주식 | ✔ |

| 선물 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| 펀드 | ❌ |

| ETFs | ❌ |

수수료

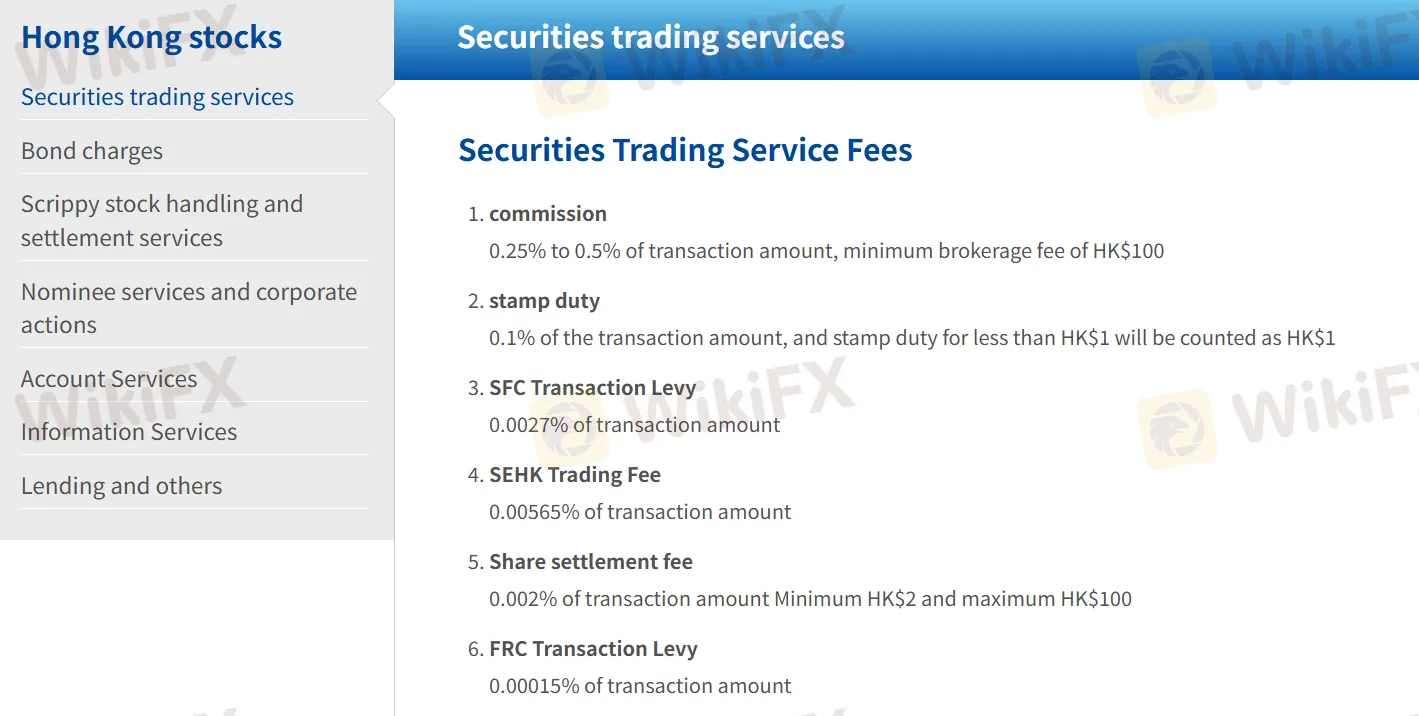

신만굉원증권은 웹 사이트에서 수수료 구조에 대한 명확한 개요를 제공합니다.

최소 또는 최대 금액 및 계산 방법을 포함한 다양한 증권 거래 서비스 수수료가 아래에 제시되어 있습니다.

이 플랫폼의 수수료 및 요금에 대한 자세한 정보는 https://www.swhyhk.com/tc/wealth-management_hong-kong-equities/#trading-methods를 방문하십시오.

| 증권 거래 서비스 | 요금 |

| 수수료 | 거래 금액의 0.25%에서 0.5%, 최소 중개 수수료 HK$100 |

| 스탬프 세금 | 거래 금액의 0.1%; HK$1 미만의 스탬프 세금은 HK$1로 계산됩니다 |

| SFC 거래 수수료 | 거래 금액의 0.0027% |

| SEHK 거래 수수료 | 거래 금액의 0.00565% |

| 주식 결제 수수료 | 거래 금액의 0.002%, 최소 HK$2 및 최대 HK$100 |

| FRC 거래 수수료 | 거래 금액의 0.00015% |

거래 플랫폼

| 거래 플랫폼 | 지원됨 | 사용 가능한 장치 |

| 전자 서비스 | ✔ | 데스크톱, 모바일, 웹 |

입출금

입금 절차

- 수락된 방법: 은행 송금, 수표, 현금 주문 및 지정된 지점 또는 익스프레스 센터를 통한 입금

- 계좌 세부 정보: 입금은 “신만굉원증권은Securities (HK) Ltd”로 이체되어야 합니다.

- 확인: 고객은 은행 송금 영수증을 funddeposit@swhyhk.com으로 이메일 또는 팩스로 보내거나 (852)-35258455로 팩스를 보내야 합니다.

출금 절차는 주식 및 선물 모두 동일합니다.

- 출금 양식을 작성하고 (852)-35258455로 팩스를 보냅니다.

- 오후 12:00 이전에 받은 지시 사항은 동일한 날 처리됩니다.

- 전신 이체의 경우 서비스 수수료가 부과됩니다.

노트: 예금자의 이름은 고객의 계정 이름과 일치해야 합니다. 제3자 예금 및 현금 예금은 허용되지 않습니다. 예금은 현지 규정을 준수해야 합니다.