Profil perusahaan

| Shenwan Hongyuan Ringkasan Ulasan | |

| Didirikan | 2015 |

| Negara/Daerah Terdaftar | China |

| Regulasi | Lisensi Bertransaksi Kontrak Berjangka SFC (diatur), Lisensi Bertransaksi Efek SFC (Melebihi) |

| Instrumen Pasar | Ekuitas, Berjangka |

| Platform Perdagangan | e-service |

| Dukungan Pelanggan | Formulir Kontak |

| Tel: (852) 2509-8395 | |

| Email: ir@swhyhk.com | |

Informasi Shenwan Hongyuan

Shenwan Hongyuan (H.K.) Limited adalah penyedia layanan keuangan yang berbasis di Hong Kong dan merupakan anak perusahaan dari Shenwan Hongyuan Group Co., Ltd., sebuah perusahaan sekuritas Tiongkok. Perusahaan ini menawarkan berbagai layanan, termasuk perdagangan ekuitas dan berjangka, manajemen aset, keuangan korporat, dan sekuritas institusional.

Pro dan Kontra

| Pro | Kontra |

| Diatur dengan lisensi bertransaksi kontrak berjangka | Lisensi bertransaksi efek melebihi |

| Beragam saluran kontak | Produk yang dapat diperdagangkan terbatas |

| Struktur biaya transparan |

Apakah Shenwan Hongyuan Legit?

Shenwan Hongyuan di atur oleh Komisi Sekuritas dan Berjangka Hong Kong (SFC), memegang Lisensi Bertransaksi Kontrak Berjangka (No AAF420). Sementara itu, Lisensi Bertransaksi Efeknya (No AAC927) telah melebihi, yang berarti aktivitas yang terkait dengan efek mungkin melibatkan risiko.

| Diatur oleh | Otoritas yang Diatur | Status Regulasi | Entitas yang Diatur | Tipe Lisensi | Nomor Lisensi |

| Komisi Sekuritas dan Berjangka Hong Kong (SFC) | Diatur | Shenwan Hongyuan Futures (H.K.) Limited | Bertransaksi kontrak berjangka | AAF420 |

| Komisi Sekuritas dan Berjangka Hong Kong (SFC) | Melebihi | Shenwan Hongyuan Securities (H.K.) Limited | Bertransaksi efek | AAC927 |

Apa yang Bisa Saya Perdagangkan di Shenwan Hongyuan?

Para pedagang dapat melakukan perdagangan ekuitas dan futures di platform ini.

| Aset Perdagangan | Tersedia |

| ekuitas | ✔ |

| futures | ✔ |

| forex | ❌ |

| komoditas | ❌ |

| indeks | ❌ |

| saham | ❌ |

| cryptocurrency | ❌ |

| obligasi | ❌ |

| opsi | ❌ |

| dana | ❌ |

| ETF | ❌ |

Biaya

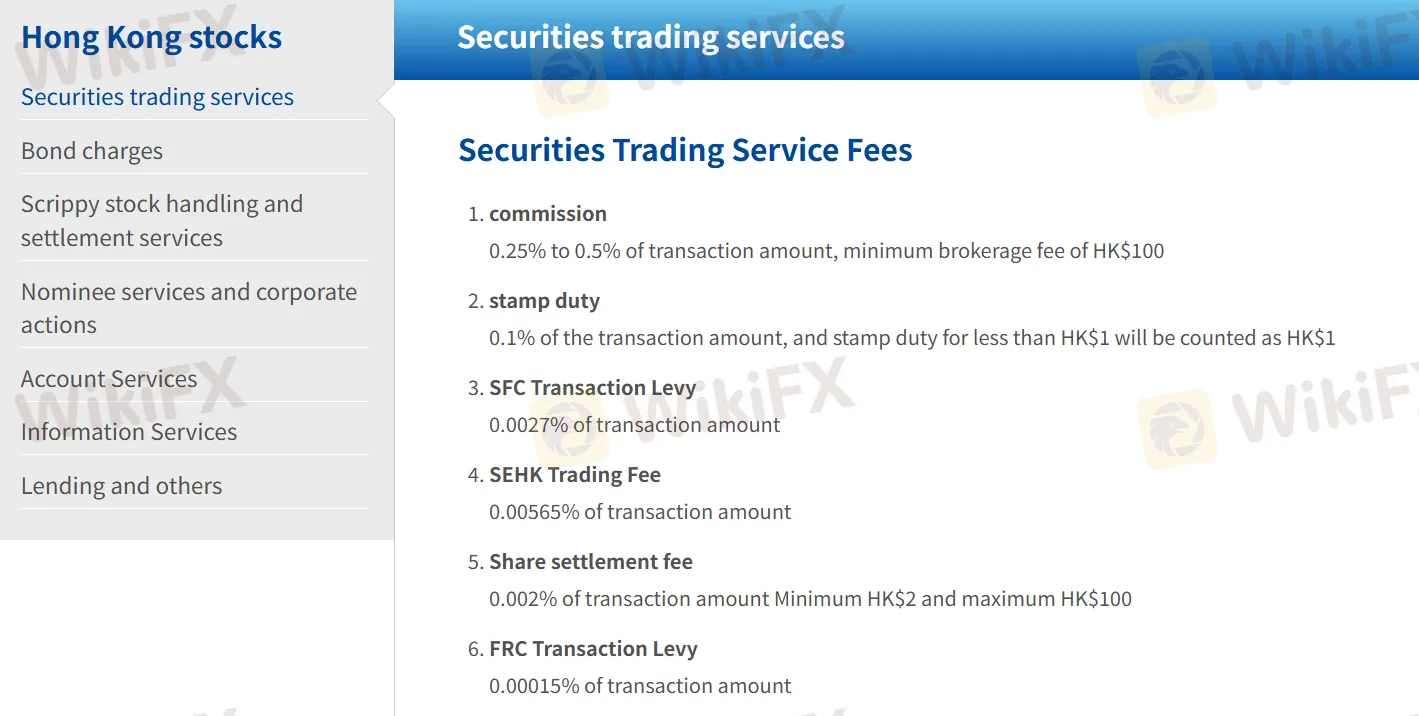

Shenwan Hongyuan memberikan gambaran jelas tentang struktur biaya di situs webnya.

Berbagai biaya layanan perdagangan sekuritas, termasuk metode perhitungan dan jumlah minimum atau maksimum yang berlaku, disajikan di bawah ini.

Untuk informasi lebih lanjut tentang biaya dan tarif di platform ini, silakan kunjungi https://www.swhyhk.com/tc/wealth-management_hong-kong-equities/#trading-methods

| Layanan Perdagangan Sekuritas | Biaya |

| Komisi | 0,25% hingga 0,5% dari jumlah transaksi, biaya pialang minimum sebesar HK$100 |

| Pajak Cap | 0,1% dari jumlah transaksi; pajak cap untuk kurang dari HK$1 akan dihitung sebagai HK$1 |

| Levy Transaksi SFC | 0,0027% dari jumlah transaksi |

| Biaya Perdagangan SEHK | 0,00565% dari jumlah transaksi |

| Biaya Penyelesaian Saham | 0,002% dari jumlah transaksi, Minimum HK$2 dan maksimum HK$100 |

| Levy Transaksi FRC | 0,00015% dari jumlah transaksi |

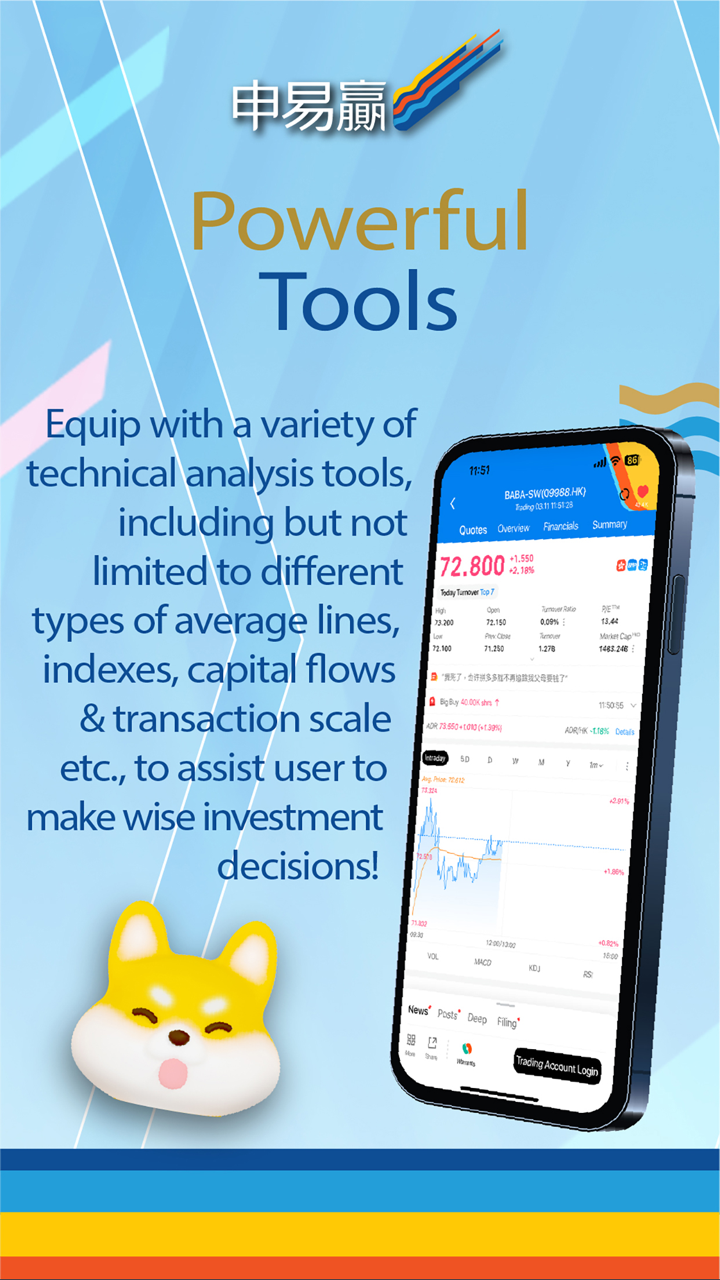

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia |

| layanan e | ✔ | Desktop, Mobile, Web |

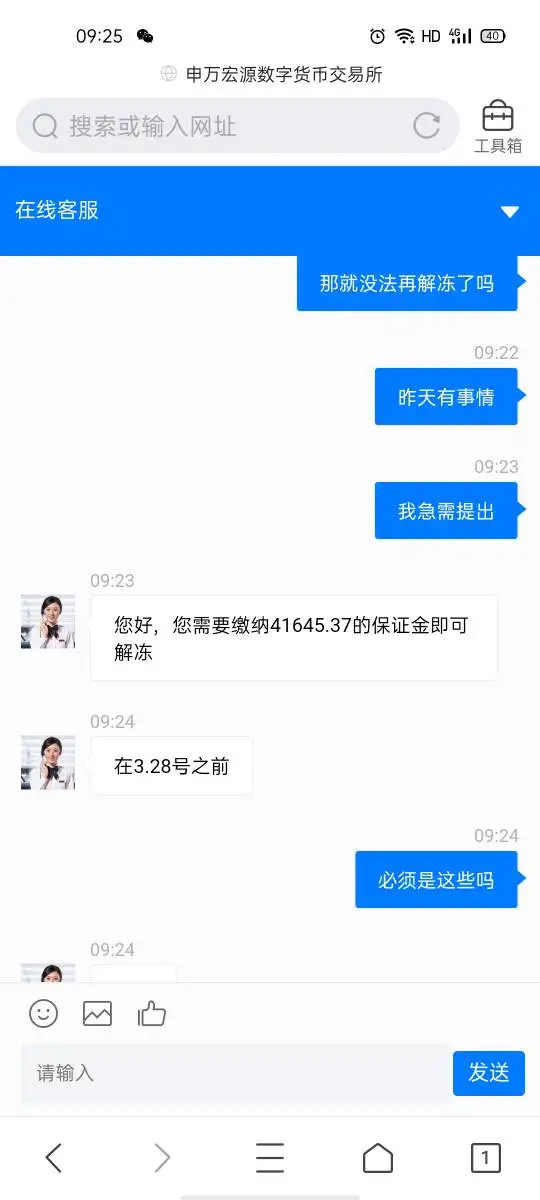

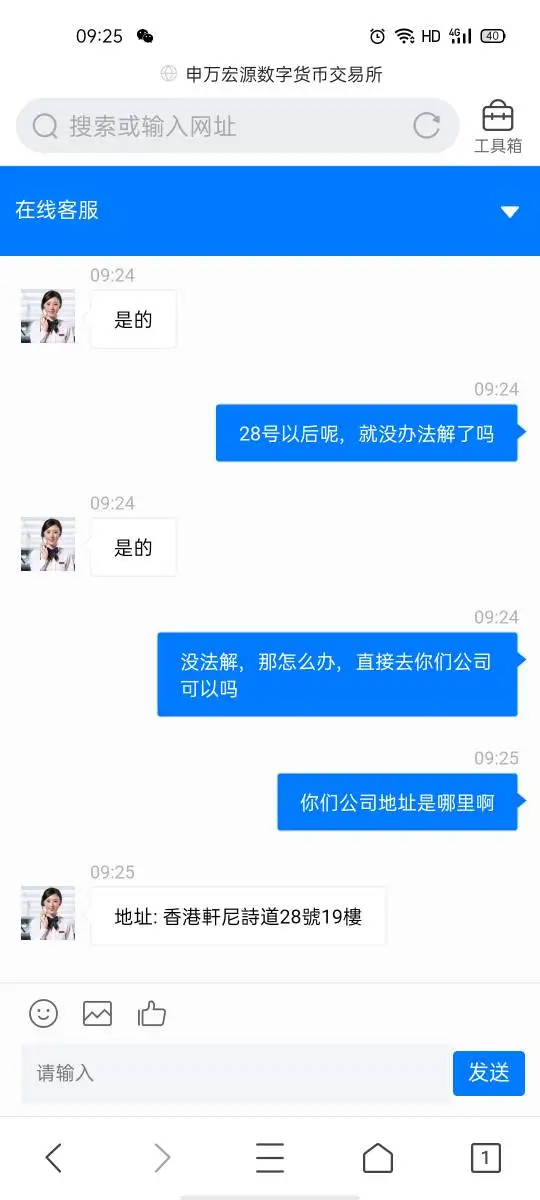

Deposit dan Penarikan

Prosedur Deposit

- Metode yang Diterima: Transfer bank, cek, pesanan kasir, dan deposit melalui cabang-cabang atau pusat-pusat ekspres yang ditunjuk.

- Detail Akun: Deposit harus dibuat atas nama “Shenwan Hongyuan Securities (HK) Ltd”.

- Konfirmasi: Klien harus mengirim surel atau faks slip bank ke funddeposit@swhyhk.com atau faks ke (852)-35258455.

Prosedur Penarikan Sama untuk ekuitas dan futures.

- Lengkapi dan faks formulir penarikan ke (852)-35258455.

- Instruksi yang diterima sebelum pukul 12:00 PM diproses pada hari yang sama.

- Untuk transfer telegraf, biaya layanan berlaku.

Catatan: Nama penyetor harus sesuai dengan nama akun klien. Setoran pihak ketiga dan setoran tunai tidak diterima. Setoran harus mematuhi peraturan lokal.