회사 소개

| Shikoku 리뷰 요약 | |

| 설립 연도 | 2002 |

| 등록 국가/지역 | 일본 |

| 규제 | FSA (일본) 규제 |

| 시장 상품 | 투자 신탁, 주식, 채권, 외환, 상품 |

| 데모 계정 | / |

| EUR/USD 스프레드 | 10 - 75 센 |

| 거래 플랫폼 | 웹 트레이더 |

| 고객 지원 | 전화: 089-921-5200 |

| 주소: 에히메 현 마쓰야마 시 산반초 5-10-1 | |

Shikoku 정보

Shikoku은 2002년에 설립된 FSA에 의해 규제되는 일본의 브로커입니다. 투자 신탁, 주식, 채권, 외환 및 상품과 같은 다양한 시장 상품을 제공합니다.

장단점

| 장점 | 단점 |

| FSA 규제 | 연락 채널 제한 |

| 다양한 거래 자산 | MT4 및 MT5 cTrader 지원 없음 |

| 운영 시간이 길다 | 데모 계정 미제공 |

| 다양한 수수료 부과 |

Shikoku 합법인가요?

Shikoku은 FSA(Financial Services Agency)에 의해 규제되며, Shikoku의 라이센스 번호는 四国財務局長(金商)第21号입니다.

| 규제 상태 | 규제 기관 | 라이센스 기관 | 라이센스 유형 | 라이센스 번호 |

| 규제됨 | 금융 서비스 기관 (FSA) | Shikoku | 소매 외환 라이센스 | 四国財務局長(金商)第21号 |

WikiFX 현장 조사

WikiFX 현장 조사팀은 Shikoku의 주소가 일본임을 확인하였으며, 현장에서 그들의 사무실을 발견했습니다. 이는 회사가 실제 사무실을 운영한다는 것을 의미합니다.

Shikoku에서 무엇을 거래할 수 있나요?

| 거래 상품 | 지원 |

| 투자 신탁 | ✔ |

| 주식 | ✔ |

| 채권 | ✔ |

| 외환 | ✔ |

| 상품 | ✔ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

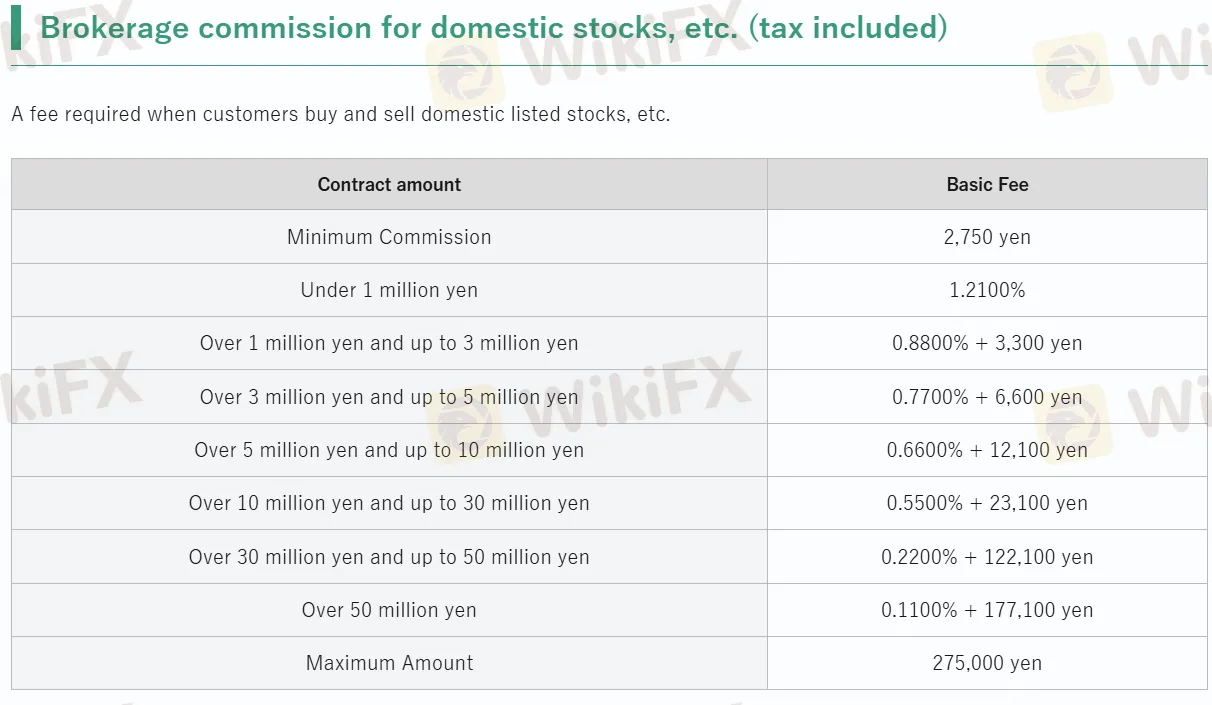

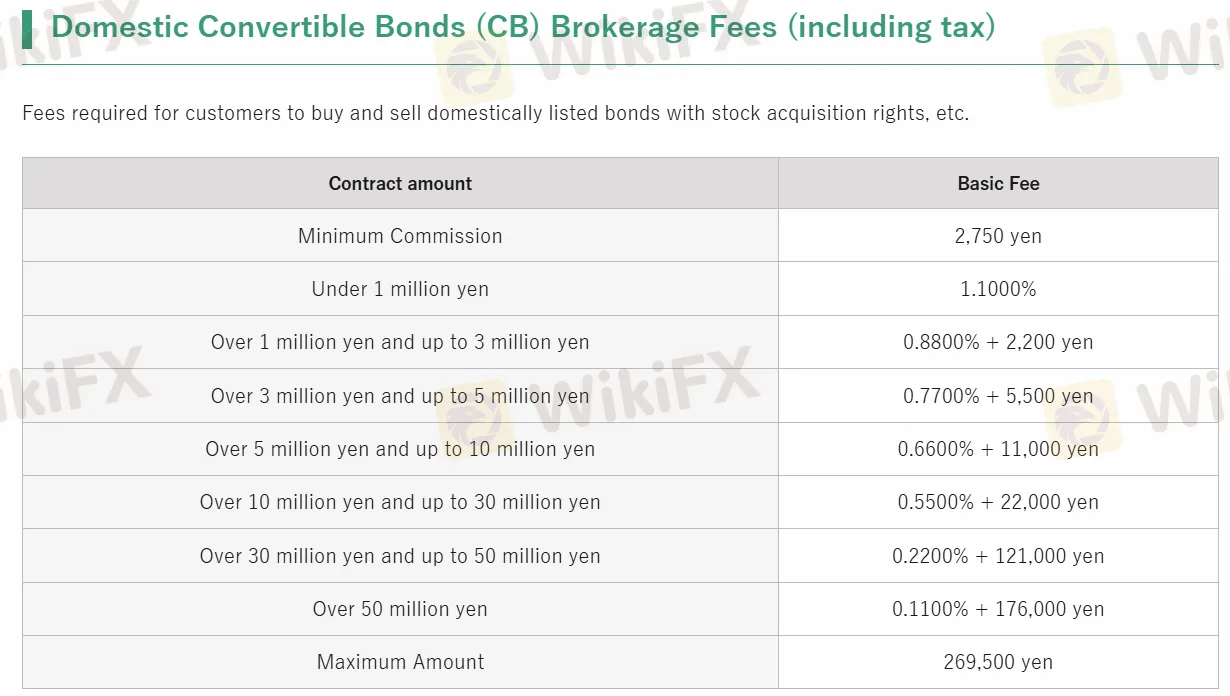

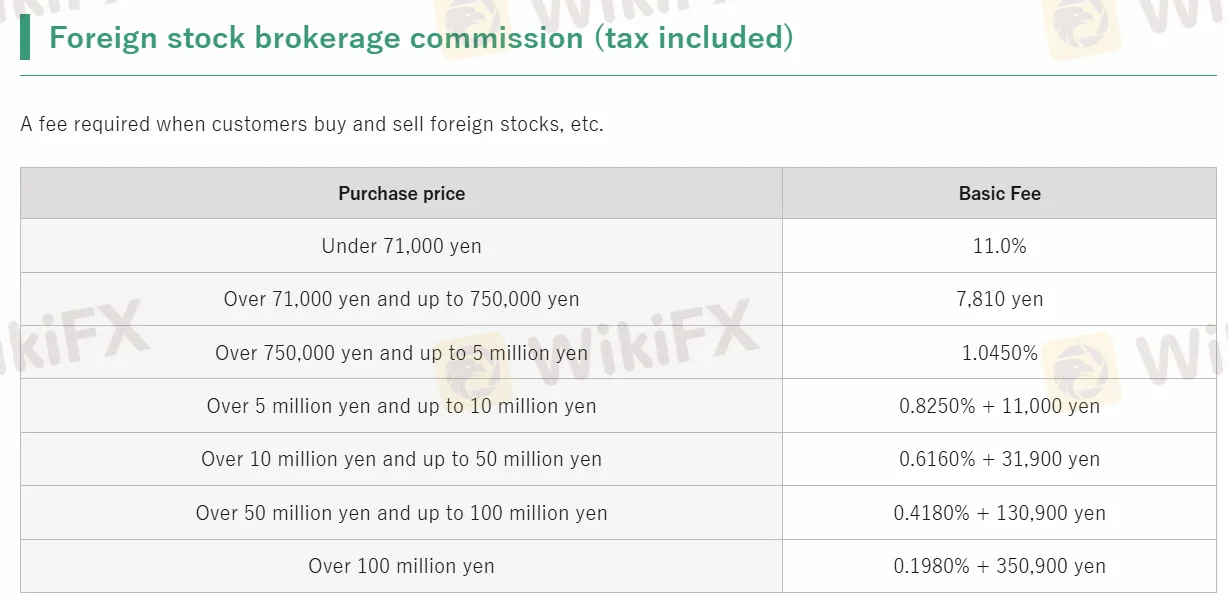

Shikoku 수수료

| 서비스 유형 | 기본 수수료 |

| 국내 주식 중개 | JPY 2,750 - 275,000 |

| 국내 변환채권 거래 중개 | JPY 2,750 - 269,500 |

| 해외 주식 중개 | 0.1980% - 11% |

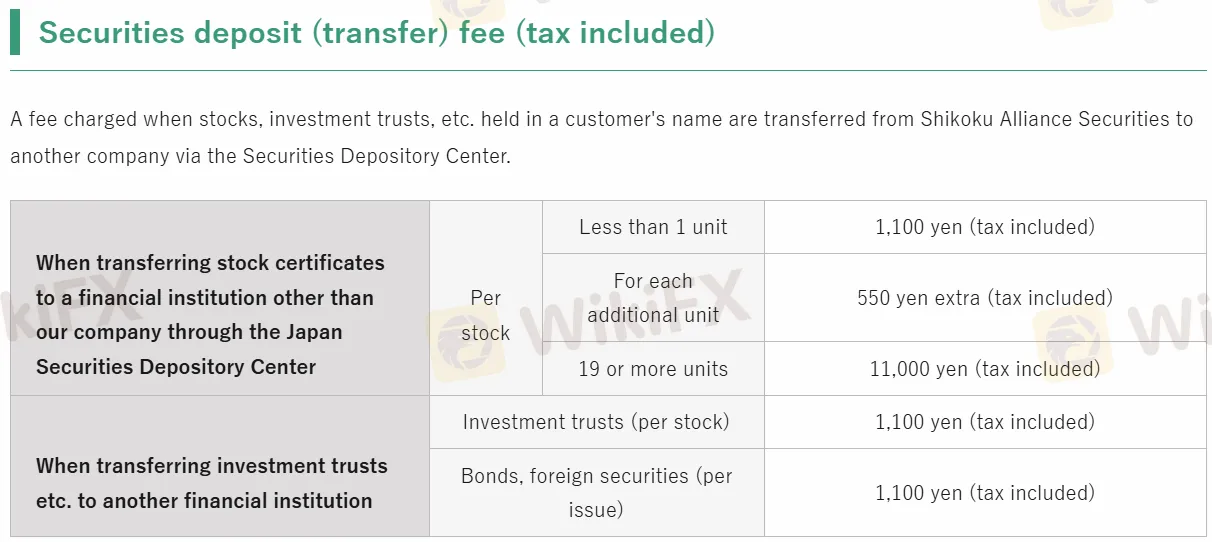

| 증권 예탁 | JPY 550 - 11,000 |

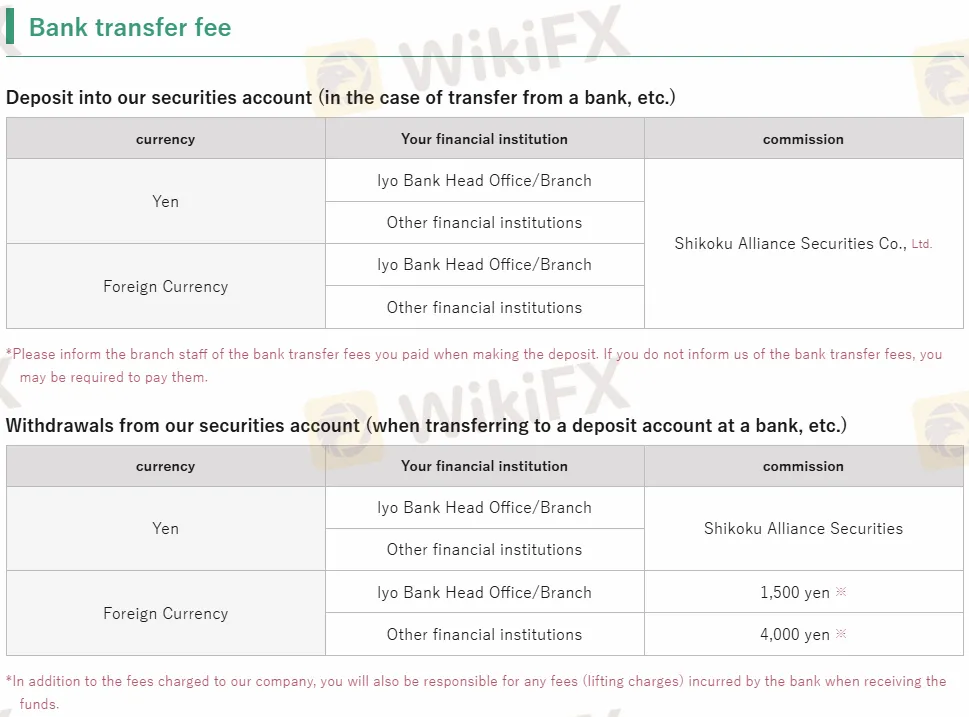

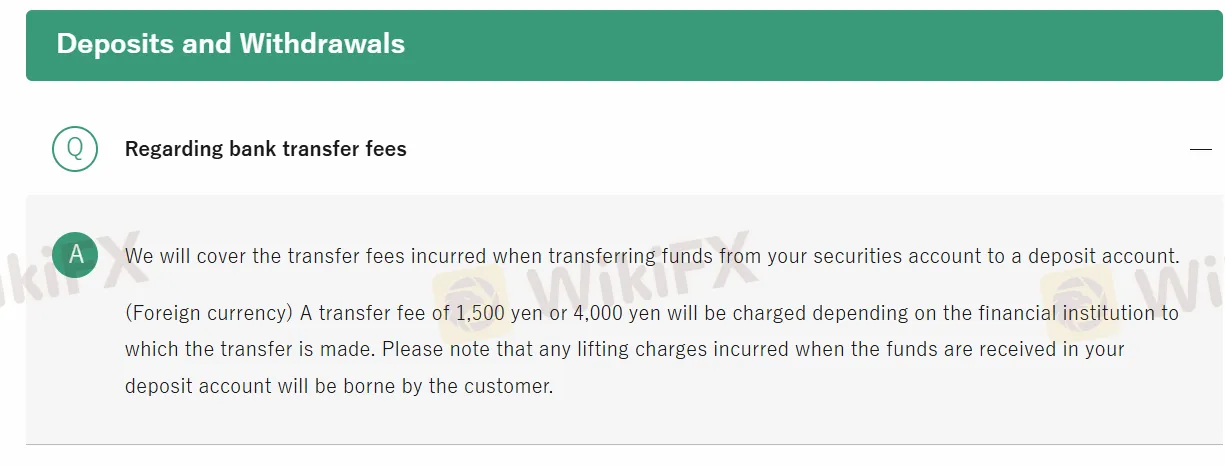

| 은행 송금 수수료 | JPY 0 - 4,000 |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| 웹 트레이더 | ✔ | 웹 | / |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |

입출금

| 최소 금액 | 은행 송금 수수료 | 처리 시간 | |

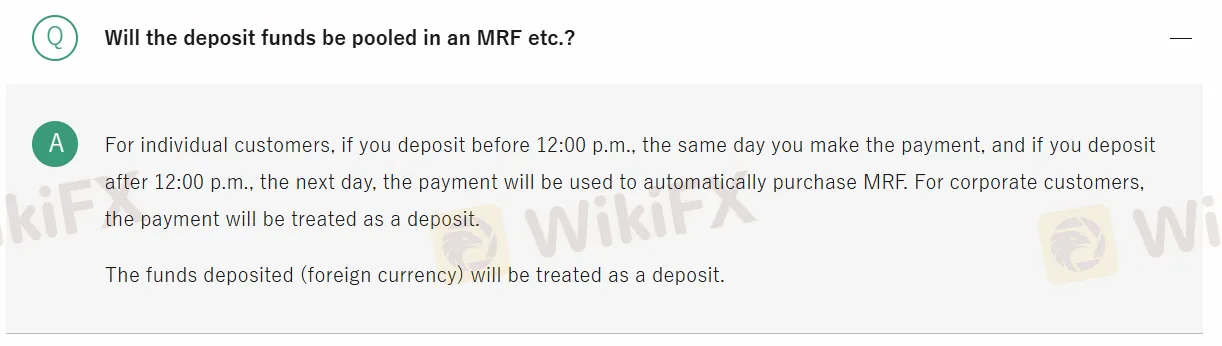

| 입금 | / | JPY 0 - 4,000 | 24시간 미만 |

| 출금 | / | / |

within

콜롬비아

지금까지 시코쿠는 적격 기업이라고 생각하고 필요하신 분들은 선택하시면 될 것 같아요! 다양한 거래 조건이 합리적이며 가장 중요한 것은 불법 회사가 아니며 돈을 속이지 않을 것입니다.

좋은 평가

文章

홍콩

나는 Shikoku에서 신뢰를 투자하는 데 익숙합니다. 내 경험은 훌륭합니다! 새로운 중개인이 많이 등장하지만 어쨌든 나는 경험이 풍부한 중개인을 선택하는 것을 선호합니다.

좋은 평가

FX1015868943

홍콩

누군가는 시코쿠가 다양한 주식 거래에 투자하기에 좋은 플랫폼이라고 말했습니다. 수수료가 얼마인지 알려주실 분 계신가요? 문의를 보냈는데 아무도 답을 안해주시네요...

중간 평가

FX1022619685

홍콩

웹사이트 디자인은 내가 선호하는 디자인이 아니며, 집중하고 싶은 것을 찾기가 어렵습니다. 아무도 이것을 찾지 못했습니까? 일본 투자자들에게 더 적합할 수 있습니다. 나를 위해, 나는 나를 편안하게 해줄 중개인을 찾을 것입니다…

중간 평가