기본 정보

인도

인도

점수

인도

|

5-10년

|

인도

|

5-10년

| http://www.fortunewmc.com/

공식 사이트

평점 지수

영향력

D

영향력 지수 NO.1

인도 2.45

인도 2.45 라이선스

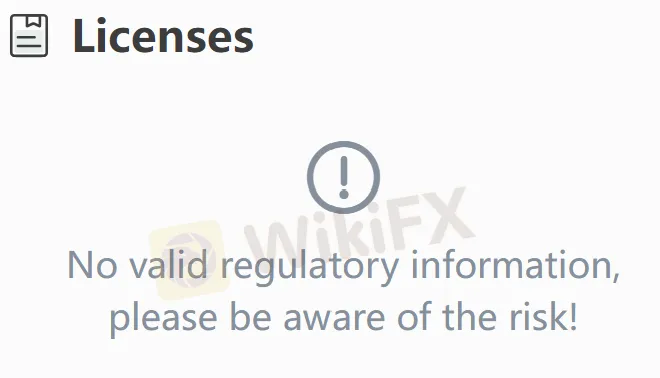

라이선스효력 있는 규제 정보가 없습니다. 위험에 유의해 주세요!

인도

인도 fortunewmc.com

fortunewmc.com 인도

인도

| 포춘 웰스 리뷰 요약 | |

| 설립 연도 | 2006 |

| 등록 국가/지역 | 인도 |

| 규제 | 규제 없음 |

| 시장 상품 | 주식, 파생상품 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | NSE Mobile App, NOW (NSE의 온라인 거래 플랫폼) |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: +91-422-4334333 | |

| 이메일: pms@fortunewmc.com, info@fortunewmc.com | |

| 소셜 미디어: Facebook, Instagram, Twitter | |

포춘 웰스는 NSE Mobile App 및 NOW (NSE의 온라인 거래 플랫폼) 거래 플랫폼에서 주식 및 파생상품 거래를 제공하는 규제되지 않은 브로커입니다.

| 장점 | 단점 |

| 운영 시간이 길다 | 규제 없음 |

| 다양한 연락 수단 | 데모 계정 없음 |

| 한정된 결제 수단 종류 |

아니요. 포춘 웰스는 현재 유효한 규제가 없습니다. 리스크를 인식해주시기 바랍니다!

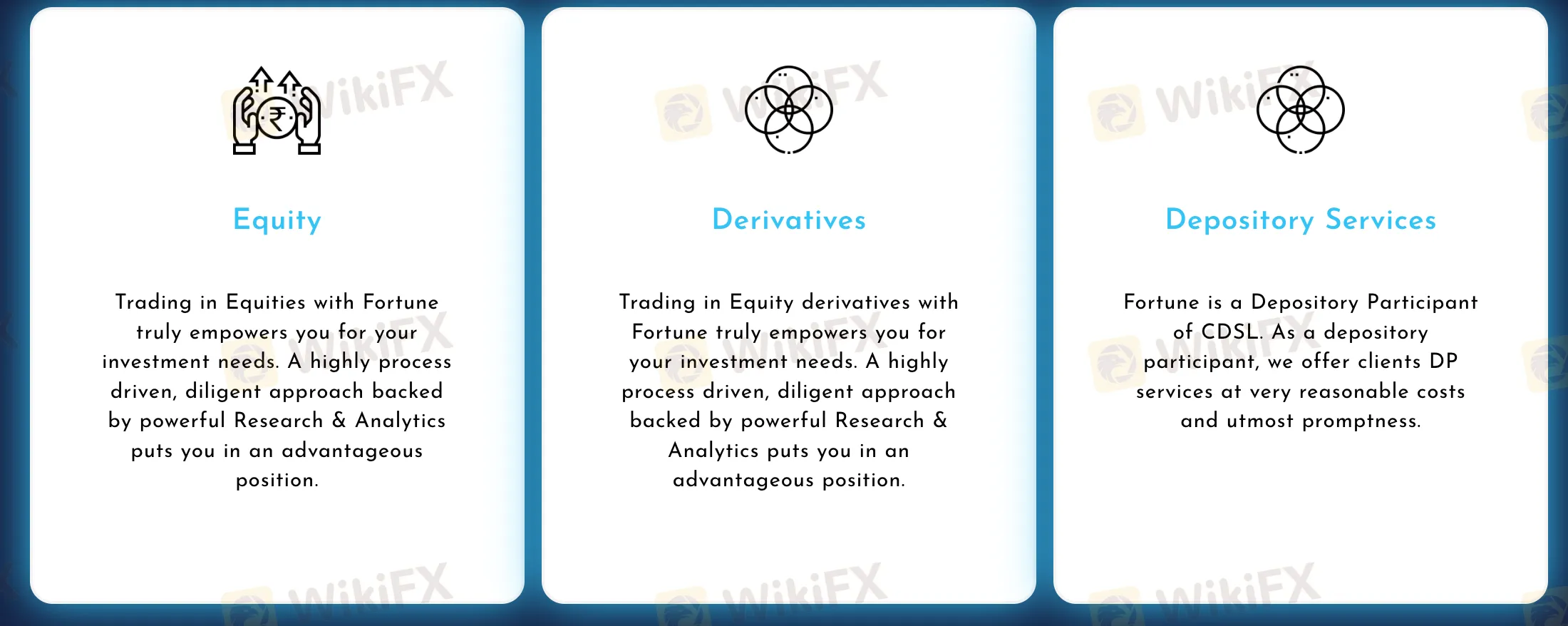

포춘 웰스는 주식 및 파생상품 거래를 제공합니다.

| 거래 상품 | 지원 |

| 주식 | ✔ |

| 파생상품 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

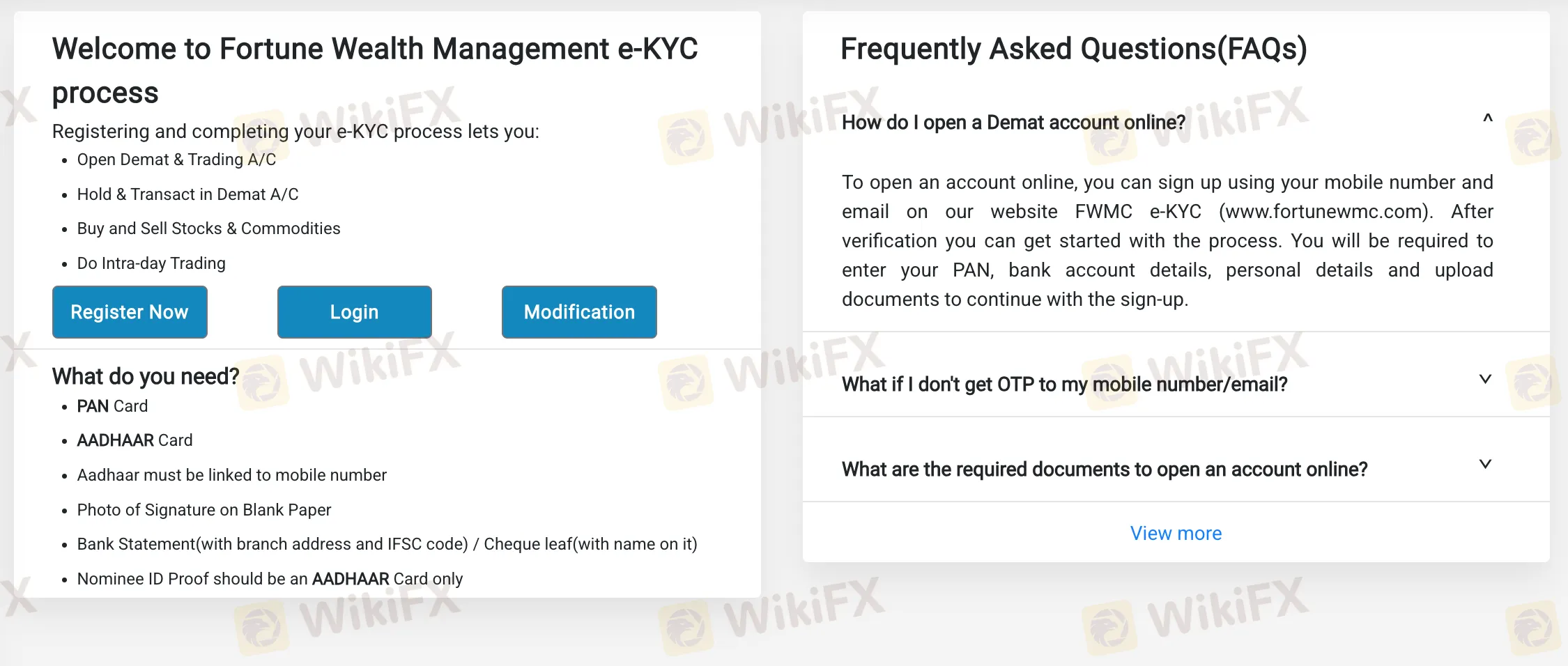

브로커는 Demat 계좌를 제공합니다. 그러나 계좌에 대한 세부 정보는 제공하지 않습니다.

거래 시 현금 시장 세그먼트에서 거래하기 위해 거래 금액의 20%를 선금으로 지불해야 합니다.

브로커와 거래 계좌를 개설할 때 Rs 116의 일회성 수수료가 있습니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| NSE 모바일 앱 | ✔ | 모바일 |

| NOW (NSE 온라인 거래 플랫폼) | ✔ | 웹 |

브로커는 은행 송금을 통한 결제를 수락합니다. 최소 입금 또는 출금 금액이 정의되어 있지 않으며 수수료나 요금이 명시되어 있지 않습니다.

Based on my thorough evaluation of Fortune Wealth, I could only find bank wire as an available method for deposits and withdrawals. The broker does not mention any support for alternative funding options like credit cards, PayPal, Skrill, or cryptocurrencies. For me, this is a significant limitation, especially when compared to other brokers I’ve worked with that provide a broader, more convenient range of payment methods. Relying solely on bank transfers can slow down the funding process, limit flexibility, and create additional hurdles for clients who might prefer faster or more modern transaction options. Another important consideration—from both a risk management and client trust perspective—is that Fortune does not specify minimum amounts or outline any associated transaction fees for deposits and withdrawals. This lack of transparency makes it difficult for me to assess the full cost and accessibility of moving funds in and out of their platform. In my experience, reputable brokers are clear about their payment channels, timelines, and charges because such details are essential for financial planning and operational confidence. Given Fortune Wealth’s unregulated status and these payment constraints, I remain cautious and conservative about recommending them. I prioritize safety and operational clarity in my trading decisions, and the absence of multiple, industry-standard funding options is a clear drawback for me.

In my experience with multiple brokers, one of the first things I look for is a clear fee structure, especially regarding commissions per lot on ECN or raw spread accounts. With Fortune Wealth, this has proven challenging. Based on my review of their available information, Fortune Wealth does not offer ECN or raw spread accounts typically found in the forex industry. Their primary focus appears to be on equities and derivatives trading via platforms like the NSE Mobile App and NOW. For me, the lack of offering in standard forex account types, such as ECN, is a significant limitation. Moreover, Fortune Wealth is upfront about charging a one-time account opening fee of Rs 116, but I could not find any straightforward details about trading commissions per lot. Instead, they require clients to pay a 20% upfront margin of the transaction value for cash market trades, which is different from a per-lot commission structure and is more in line with Indian equity brokers. For someone used to forex trading, this approach feels less transparent. What raises additional concern for me is the lack of regulatory oversight—there’s no valid license, which means there’s limited external accountability if questions about fees or execution arise. In short, I did not find any information about standard commission charges per lot for ECN or raw spread accounts, because Fortune Wealth doesn’t appear to provide those account types. This absence of clarity and limited range of trading instruments makes me very cautious about engaging with this broker.

As someone who relies heavily on testing a broker’s platform and order execution before ever putting real funds at risk, I took a close look at Fortune’s offering in this regard. From my examination, Fortune does not provide any kind of demo account option—the feature simply isn’t available. For me, that’s a significant drawback, as I consider demo accounts essential for anyone aiming to familiarize themselves with the trading environment and conditions, or to safely test new strategies. I found no indication of an expiry period or limitations—because the absence of demo accounts makes the question of expiry moot. All live trading appears to require a one-time account opening fee, along with an upfront margin commitment when trading equities. That suggests a level of financial commitment from day one, and there’s no way to trial the service risk-free. Given that Fortune is also unregulated, and that their business scope raises a number of red flags according to objective risk indicators, I personally would urge extreme caution. In my own trading practice, the inability to conduct risk-free testing and the lack of regulatory oversight are deal-breakers. Because of these factors, I would not use Fortune for my trading needs.

After carefully studying Fortune's available information and considering my own criteria as a trader, I find their fee structure somewhat opaque and quite restrictive. The most explicit cost disclosed is a one-time account opening fee of Rs 116, which is comparatively minor. Much more significant, however, is the requirement for a 20% upfront margin on cash market trades, which could impact capital allocation and leverage decisions for some traders. This margin is not a cost in and of itself, but it does mean tying up a substantial portion of funds to initiate trades, and it's vital to consider this when assessing position sizing and risk. As for commissions and spreads specifically, Fortune does not provide detailed disclosures on these—at least from the context I have reviewed. Unlike global brokers that clearly outline per-trade commissions, spread ranges, or tiered fee structures, Fortune appears to lack transparency here. In my experience, unclear or undisclosed commission and spread details are a cause for concern, particularly because these directly affect trading costs and ultimately net profitability. Additionally, since Fortune operates without regulatory oversight, there is no credible third-party assurance regarding the fairness or consistency of their fee practices. When dealing with any broker—especially one without explicit, published data on commissions and spreads—I proceed with heightened caution, fully recognizing that costs could vary or be higher than anticipated. For my own trading, this lack of detail would be a material drawback, making it difficult to conduct rigorous cost analysis or compare Fortune’s offerings competitively.

입력해 주세요....