Resumo da empresa

| Resumo da Revisão da Fortune Wealth | |

| Fundada | 2006 |

| País/Região Registrada | Índia |

| Regulação | Sem regulação |

| Instrumentos de Mercado | Ações, derivativos |

| Conta Demonstrativa | ❌ |

| Plataforma de Negociação | Aplicativo Móvel NSE, NOW (plataforma de negociação online da NSE) |

| Depósito Mínimo | / |

| Suporte ao Cliente | Formulário de Contato |

| Tel: +91-422-4334333 | |

| Email: pms@fortunewmc.com, info@fortunewmc.com | |

| Redes Sociais: Facebook, Instagram, Twitter | |

Informações da Fortune Wealth

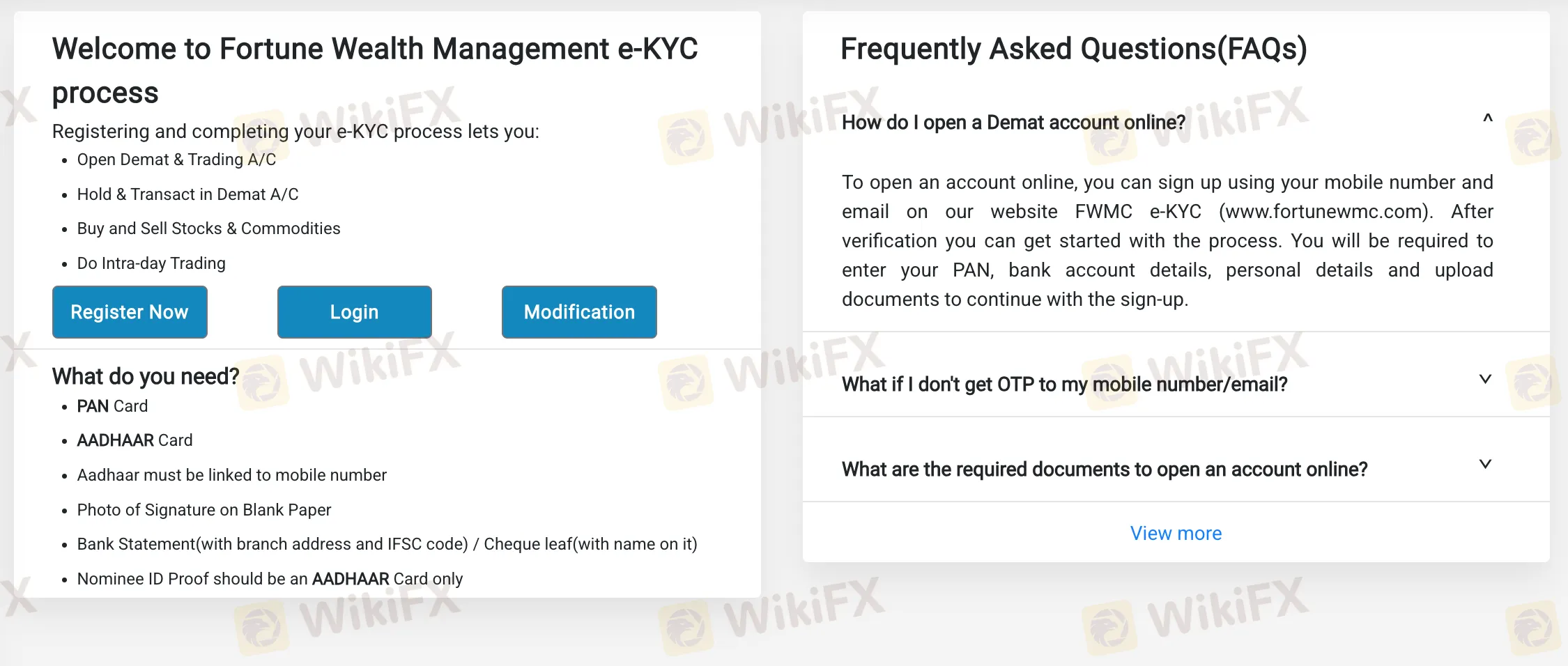

A Fortune Wealth é uma corretora não regulamentada que oferece negociação de ações e derivativos na plataforma de negociação do Aplicativo Móvel NSE e NOW (plataforma de negociação online da NSE).

Prós e Contras

| Prós | Contras |

| Tempo de operação longo | Sem regulação |

| Vários canais de contato | Sem contas de demonstração |

| Tipos limitados de opções de pagamento |

A Fortune Wealth é Legítima?

Não. A Fortune Wealth não possui regulações válidas atualmente. Esteja ciente do risco!

O Que Posso Negociar na Fortune Wealth?

Fortune Wealth oferece negociação em ações e derivativos.

| Instrumentos de Negociação | Suportado |

| Ações | ✔ |

| Derivativos | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

Tipo de Conta

A corretora oferece contas Demat. No entanto, não fornece detalhes sobre as contas.

Taxas da Fortune Wealth

Os clientes devem pagar uma margem inicial de 20% do valor da transação para negociar no segmento de mercado à vista.

Ao abrir uma conta de negociação com a corretora, há uma taxa única de R$ 116.

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis |

| Aplicativo Móvel NSE | ✔ | Móvel |

| NOW (plataforma de negociação online da NSE) | ✔ | Web |

Depósito e Saque

A corretora aceita pagamentos feitos via transferência bancária. Não há valor mínimo de depósito ou saque definido e não há taxas especificadas.