Perfil de la compañía

| Resumen de la Revisión de Fortune Wealth | |

| Establecido | 2006 |

| País/Región Registrada | India |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Acciones, derivados |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Aplicación Móvil NSE, NOW (plataforma de trading en línea de NSE) |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de Contacto |

| Tel: +91-422-4334333 | |

| Email: pms@fortunewmc.com, info@fortunewmc.com | |

| Redes Sociales: Facebook, Instagram, Twitter | |

Información de Fortune Wealth

Fortune Wealth es un bróker no regulado que ofrece trading en acciones y derivados en la aplicación móvil NSE y la plataforma de trading NOW de NSE.

Pros y Contras

| Pros | Contras |

| Tiempo de operación prolongado | Sin regulación |

| Varios canales de contacto | Sin cuentas demo |

| Tipos limitados de opciones de pago |

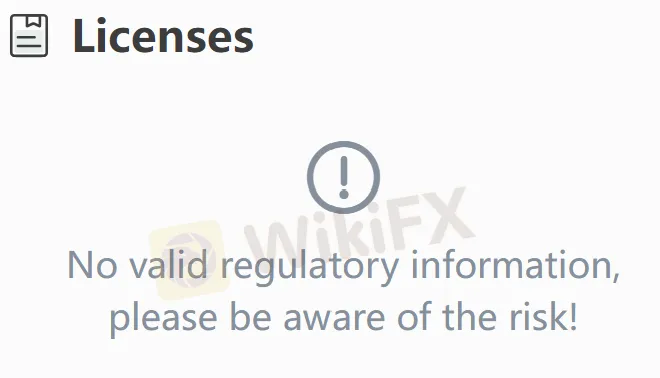

¿Es Legítimo Fortune Wealth?

No. Fortune Wealth actualmente no tiene regulaciones válidas. ¡Por favor, tenga en cuenta el riesgo!

¿Qué Puedo Operar en Fortune Wealth?

Fortune Wealth ofrece trading en acciones y derivados.

| Instrumentos de Trading | Soportado |

| Acciones | ✔ |

| Derivados | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

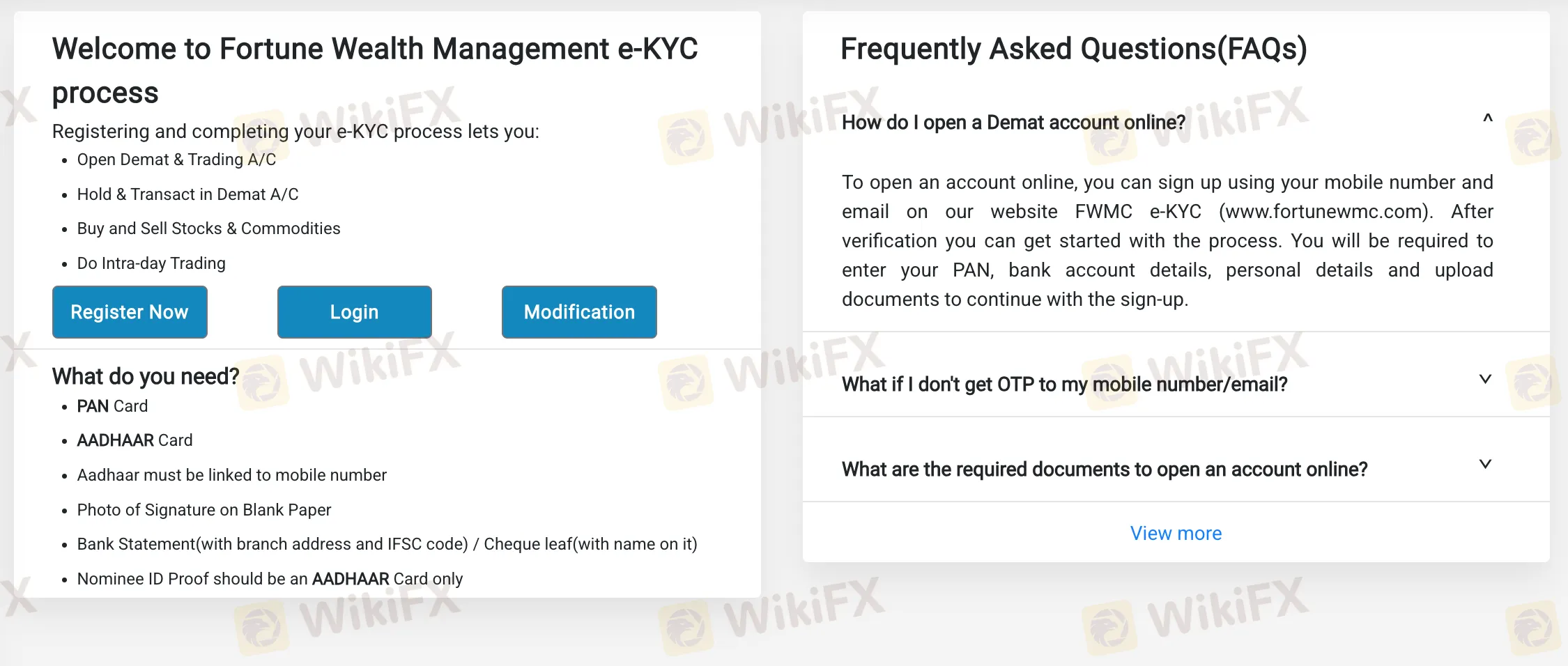

Tipo de Cuenta

El bróker ofrece cuentas Demat. Sin embargo, no proporciona detalles sobre las cuentas.

Tarifas de Fortune Wealth

Los clientes deben pagar un 20% de margen inicial del valor de la transacción para operar en el segmento del mercado de efectivo.

Al abrir una cuenta de trading con el bróker, hay una tarifa única de Rs 116.

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles |

| Aplicación Móvil NSE | ✔ | Móvil |

| NOW (Plataforma de trading en línea de NSE) | ✔ | Web |

Depósito y Retiro

El bróker acepta pagos realizados a través de transferencia bancaria. No se define un monto mínimo de depósito o retiro y no se especifican tarifas o cargos.