Informasi Dasar

Kanada

Kanada

Skor

Kanada

|

5-10 tahun

|

Kanada

|

5-10 tahun

| https://www.mtfxgroup.com/

Website

Peringkat indeks

Pengaruh

B

Indeks pengaruh NO.1

Amerika Serikat 3.88

Amerika Serikat 3.88 Lisensi

LisensiTidak ada informasi regulasi yang valid, harap waspada!

Kanada

Kanada mtfxgroup.com

mtfxgroup.com Kanada

Kanada| MTFX Ringkasan Ulasan | |

| Teregistrasi Pada | 2016-03-04 |

| Negara/Daerah Terdaftar | Kanada |

| Regulasi | Tidak Diatur |

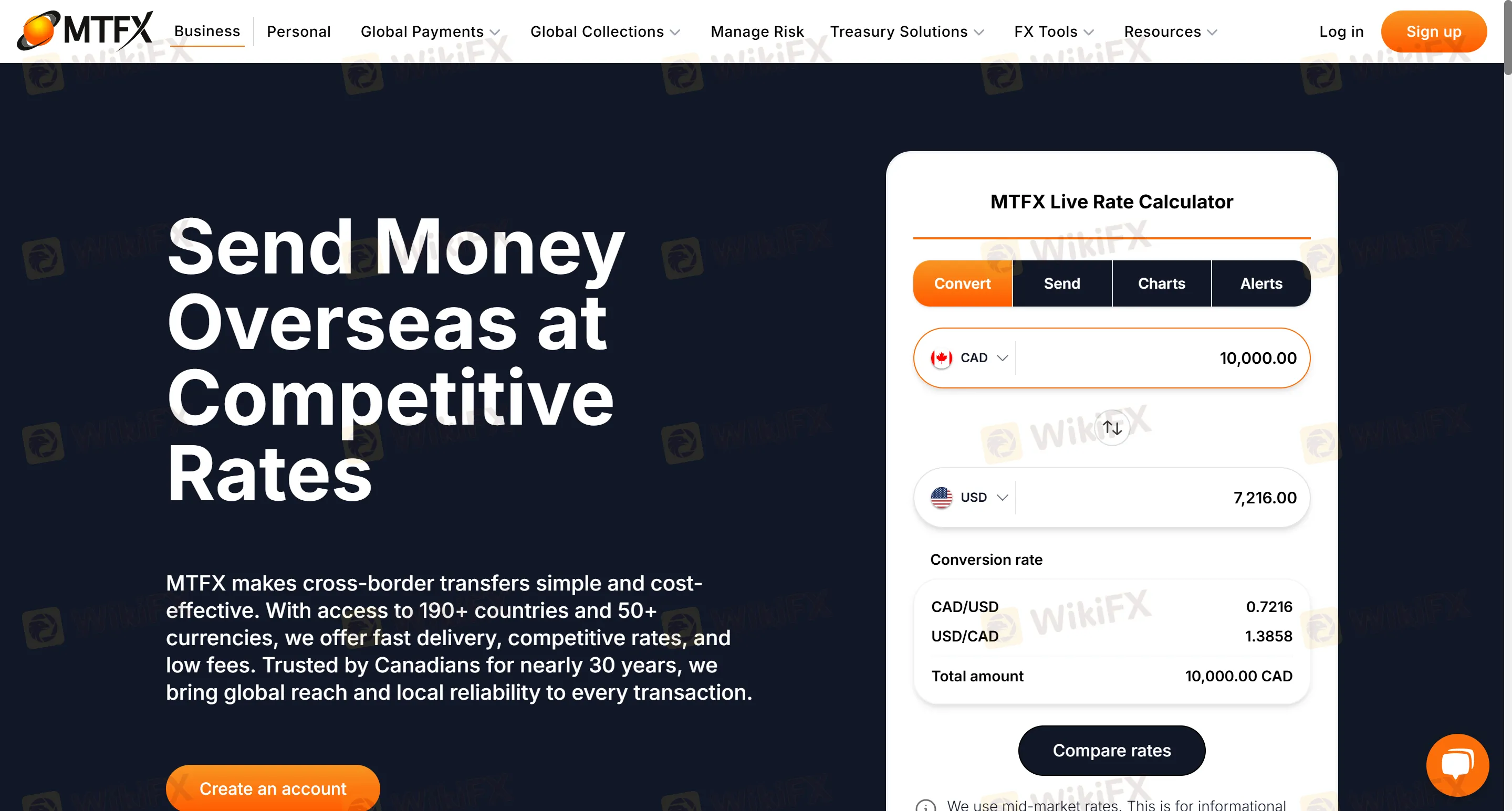

| Layanan | Penukaran Mata Uang, Pembayaran lintas Batas, Lindung Nilai Risiko |

| Platform Perdagangan | MTFX (aplikasi iOS dan Android) |

| Dukungan Pelanggan | Facebook, Twitter, Instagram |

MTFX adalah platform yang sudah mapan yang mengkhususkan diri dalam pembayaran lintas batas, mendukung transfer lebih dari 50 mata uang ke lebih dari 190 negara. Ini menawarkan transfer lintas batas pribadi dan korporat, pengumpulan dana e-commerce, transfer dana bernilai tinggi (seperti pembelian properti luar negeri dan akuisisi barang mewah), manajemen akun multi-mata uang, dan lindung nilai risiko mata uang. Cocok untuk pengguna yang membutuhkan transfer lintas batas yang sering dan mengutamakan biaya kurs dan keamanan dana, terutama dalam pembayaran bernilai tinggi dan skenario korporat.

| Pro | Kontra |

| Kurs pertukaran 4% | Tidak Diatur |

| Akses 24/7 ke portal online | Pembatasan pada pasangan mata uang (berfokus pada mata uang utama) |

| Cakupan multi-skenario | Informasi biaya yang tidak jelas |

MTFX tidak diatur, meskipun MTFX mengklaim diatur oleh FINTRAC (Pusat Analisis Transaksi Keuangan dan Laporan Kanada). Broker ini memiliki isu regulasi, dan disarankan agar para trader memprioritaskan memilih broker yang diatur.

MTFX terutama menyediakan transfer dana lintas batas dan layanan pertukaran mata uang, bukan platform perdagangan derivatif keuangan tradisional. Layanan termasuk:

Penukaran Mata Uang: Konversi real-time dari lebih dari 50 mata uang, seperti pasangan mata uang utama seperti CAD/USD dan EUR/GBP.

Pembayaran Lintas Batas: Pengiriman uang pribadi (biaya sekolah, biaya hidup, dana pembelian rumah) dan pembayaran korporat (penyelesaian pemasok, gaji, pengumpulan e-commerce).

Lindung Nilai Risiko: Mengunci kurs dan strategi lindung nilai yang disesuaikan, cocok untuk skenario perdagangan dan investasi internasional.

MTFX menawarkan dua jenis akun. Akun personal cocok untuk transfer lintas batas individu, pembayaran uang sekolah internasional, dan pengiriman reguler (seperti sewa dan pensiun), sementara akun bisnis dirancang untuk pembayaran lintas batas korporat, penyelesaian rantai pasokan, manajemen dana multi-mata uang, dan integrasi platform e-commerce (seperti Amazon dan eBay).

Portal online mendukung aplikasi seluler 24/7, termasuk aplikasi iOS dan Android.

Dana langsung ditransfer ke rekening bank penerima. Untuk transfer korporat, dana akan tiba dalam 24-48 jam (transfer kawat pada hari yang sama diprioritaskan). Sebagian besar transfer personal diselesaikan pada hari yang sama atau hari kerja berikutnya.

As an experienced trader, I always weigh regulatory status very carefully before deciding where to move or hold any significant funds. For MTFX, the reality is clear: according to the most recent background checks, this platform operates without recognized, valid regulatory oversight. While there are user claims that MTFX is licensed by FINTRAC in Canada, the broader consensus from regulatory reviews is that there is currently no valid regulatory information, which is a substantial cause for concern. In my professional view, the absence of robust, transparent regulation means that there are no external authorities actively monitoring MTFX’s client fund segregation, risk management practices, or dispute resolution procedures. This creates extra risk in safeguarding my funds. Even though MTFX has been in business for over 5 years and positions itself as a significant player in cross-border payments, longevity alone does not offset the risks that come from a lack of regulatory oversight. In highly regulated environments, I see protections such as insurance on client deposits, enforceable segregation of funds, and structured avenues for complaint resolution. With MTFX's unregulated status, I cannot rely on these protections, so in my risk assessment, my funds do not have the same safeguards here as they would with a properly licensed broker. For me, this is a serious consideration, and I would only ever allocate capital to such a service with an abundance of caution—and never with money I couldn’t afford to lose.

In my experience, when evaluating a service like MTFX, it's best to start with a conservative approach, especially given the unique context of this provider. Unlike typical forex trading brokers, MTFX primarily focuses on cross-border payments and currency exchange rather than offering leveraged trading or traditional forex spreads. From what I can gather, MTFX enables users to exchange over 50 currencies and facilitates international payments, including risk hedging strategies for businesses and individuals. However, it is not a classic forex broker with detailed, transparent information on spread types—fixed or variable—as one might expect from a broker specializing in margin trading or speculative forex. I have not found any specific disclosure on whether MTFX uses fixed or variable spreads. This lack of transparency is itself a concern, as reliable brokers usually state this information clearly. Moreover, MTFX’s unregulated status and the fact that fee and pricing data are described as “unclear” in the available information signal to me the need for heightened caution. In the absence of direct data, I would deduce that currency conversion costs could effectively function like variable spreads, potentially widening during volatile market periods or important news events, simply because most payments services dynamically adjust rates to mitigate their own risk exposure. For traders or businesses with sensitive or large transactions, I would personally avoid making assumptions about spreads or cost stability during volatile periods when using MTFX. Instead, I would reach out to their support team for written confirmation about their pricing model before initiating any significant transactions. Given the high potential risk highlighted and the ambiguous regulatory background, I advise anyone considering MTFX to clarify all rates and conditions upfront, particularly if market volatility could materially impact costs. For me, transparency and regulation are non-negotiable factors, especially with cross-border forex operations.

From my own experience and a careful review of what MTFX provides, it's clear that this platform is quite different from many of the traditional forex brokers out there. While I approached MTFX hoping for access to a broad set of trading instruments like forex pairs, stocks, indices, cryptocurrencies, or commodities, I found that their core services are focused strictly on currency exchange and cross-border payments rather than derivatives or margin trading. In practice, this means MTFX enables real-time conversion between over 50 major currencies—for example, standard pairs like CAD/USD or EUR/GBP—but does not offer an environment for speculating on their price movements through leveraged products. I could not find any access to stock markets, indices, commodities, or crypto instruments. This distinction is important: MTFX is structured for individuals and businesses needing efficient currency transfer and risk hedging solutions rather than for traders seeking exposure to multiple global asset classes. Their risk hedging functions do include some options for locking in exchange rates, but these are centered around international payments and not speculative trading contracts. For those specifically interested in trading across various instruments, I feel it's prudent to consider a regulated, multi-asset broker. As always, the lack of recognized regulatory oversight with MTFX raises additional concerns about overall fund safety when compared to established, supervised trading platforms.

From my perspective as a seasoned forex trader with a focus on capital protection and regulatory safeguards, I approach MTFX with significant caution. Based on my research, MTFX lacks valid, recognized regulatory oversight, despite some claims about FINTRAC affiliation. This absence of regulation presents a core risk for anyone seeking assurance on fund security or dispute resolution. In my experience, regulation is not just a formality—it means a third party regularly audits broker operations, mandates segregated client accounts, and enforces standards that ultimately help protect retail customers. While MTFX appears established, with a history dating back several years and a strong offering in cross-border payments and currency exchange, this does not equate to the security frameworks provided by regulated entities. I've noticed that, although they offer 24/7 online access and support a wide array of currency transactions, the business is more about international payments than classic forex trading, and fee structures are not fully transparent. Unclear costs and limited protection mechanisms are red flags for me. Ultimately, when my funds are involved, especially with large transfers or hedging needs, I'm unwilling to accept elevated risks from brokers lacking clear regulatory status. For those prioritizing security, my conservative advice remains to work only with brokers fully licensed by reputable authorities, where oversight and recourse are well defined.

Silakan masukan...

TOP

TOP

Chrome

Plugin Chrome

Pertanyaan Regulasi Pialang Forex Global

Jelajahi situs web broker forex dan kenali broker resmi dan penipu secara akurat

Pasang sekarang