Resumo da empresa

| MTFX Resumo da Revisão | |

| Registrado Em | 2016-03-04 |

| País/Região Registrada | Canadá |

| Regulação | Não Regulamentado |

| Serviços | Câmbio de Moedas, Pagamentos Transfronteiriços, Hedge de Risco |

| Plataforma de Negociação | MTFX (aplicativos iOS e Android) |

| Suporte ao Cliente | Facebook, Twitter, Instagram |

MTFX Informações

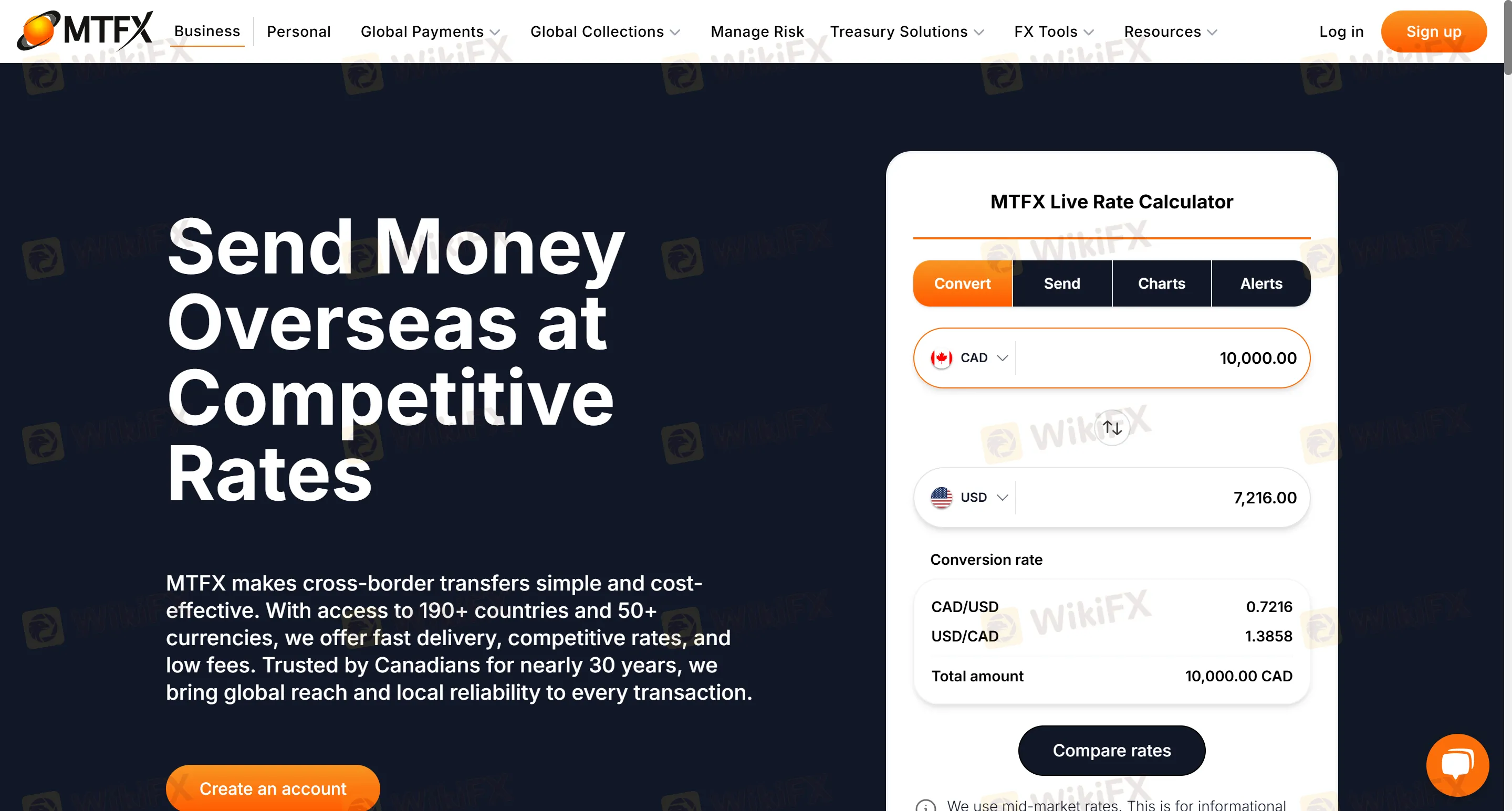

MTFX é uma plataforma estabelecida especializada em pagamentos transfronteiriços, suportando a transferência de 50+ moedas para mais de 190 países. Oferece transferências transfronteiriças pessoais e corporativas, coleta de fundos de comércio eletrônico, transferências de fundos de alto valor (como compras de imóveis no exterior e aquisições de itens de luxo), gerenciamento de contas multi-moeda e hedge de risco cambial. É adequado para usuários que necessitam de transferências transfronteiriças frequentes e dão importância aos custos de taxa de câmbio e segurança de fundos, especialmente em pagamentos de alto valor e cenários corporativos.

Prós e Contras

| Prós | Contras |

| Taxa de câmbio de 4% | Não Regulamentado |

| Acesso 24/7 ao portal online | Limitações em pares de moedas (foco em moedas principais) |

| Cobertura multi-cenário | Informações de taxas pouco claras |

É MTFX Legítimo?

MTFX não é regulamentado, mesmo que MTFX afirme ser regulamentado pela FINTRAC (Centro de Análise de Transações Financeiras e Relatórios do Canadá). Este corretor possui problemas regulatórios e é recomendado que os traders priorizem a escolha de corretores regulamentados.

Quais Serviços MTFX Oferece?

MTFX fornece principalmente transferências de fundos transfronteiriços e serviços de câmbio, não plataformas tradicionais de negociação de derivativos financeiros. Os serviços incluem:

Câmbio de Moedas: Conversão em tempo real de 50+ moedas, como pares de moedas principais como CAD/USD e EUR/GBP.

Pagamentos Transfronteiriços: Remessas pessoais (taxas de matrícula, despesas de vida, fundos para compra de imóveis) e pagamentos corporativos (liquidações de fornecedores, folha de pagamento, cobranças de comércio eletrônico).

Hedge de Risco: Fixação de taxas de câmbio e estratégias de hedge personalizadas, adequadas para cenários de comércio e investimento internacionais.

Tipo de Conta

MTFX oferece dois tipos de contas. Contas pessoais são adequadas para transferências individuais transfronteiriças, pagamentos de mensalidades internacionais e remessas regulares (como aluguel e pensão), enquanto contas empresariais são projetadas para pagamentos corporativos transfronteiriços, liquidações de cadeias de suprimentos, gerenciamento de fundos multi-moeda e integração com plataformas de comércio eletrônico (como Amazon e eBay).

Plataforma de Negociação

O portal online suporta aplicativos móveis 24/7, incluindo aplicativos iOS e Android.

Depósito e Saque

Os fundos são depositados diretamente na conta bancária do beneficiário. Para transferências corporativas, os fundos chegarão dentro de 24-48 horas (transferências bancárias no mesmo dia têm prioridade). A maioria das transferências pessoais é concluída no mesmo dia ou no próximo dia útil.