회사 소개

| Axis Bank 리뷰 요약 | |

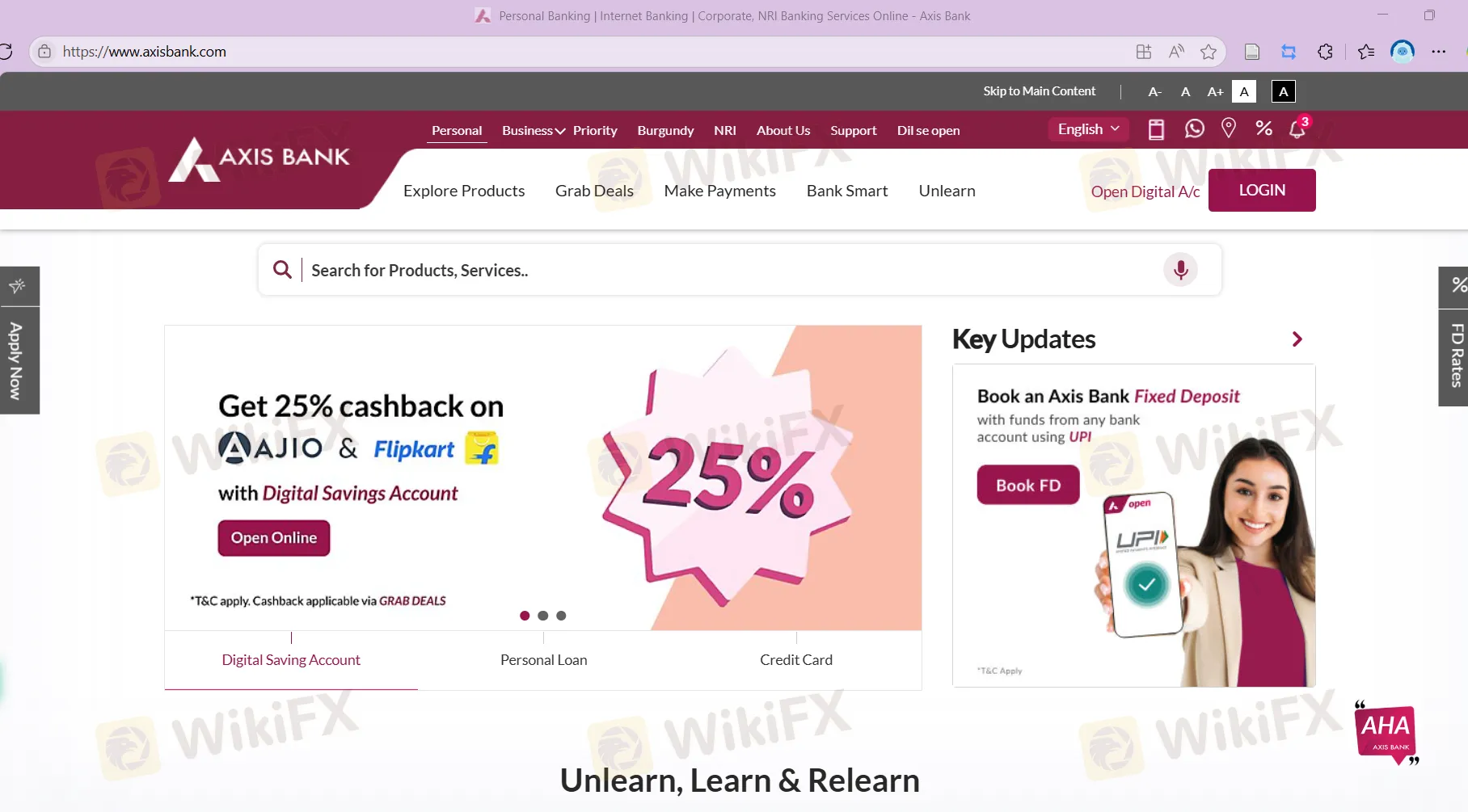

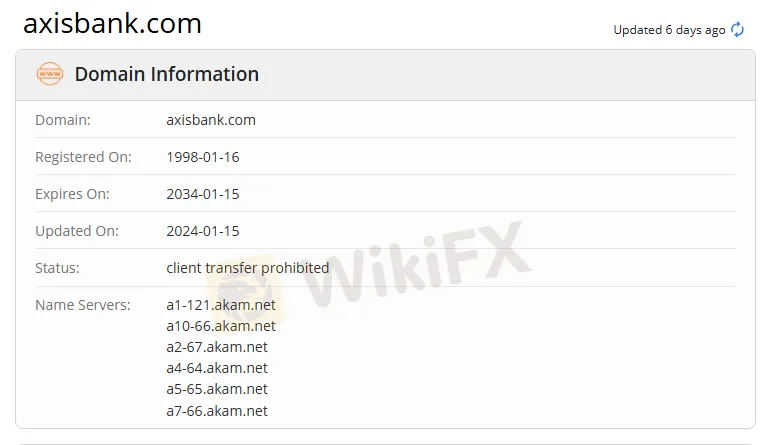

| 설립 연도 | 1998 |

| 등록 국가/지역 | 인도 |

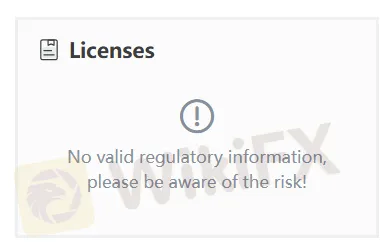

| 규제 | 규제 없음 |

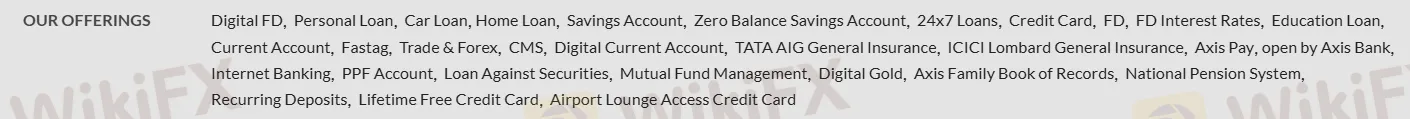

| 제품 및 서비스 | 대출, 외환, 보험, 펀드 관리, 디지털 골드 등 |

| 플랫폼/앱 | Axis Bank 앱 |

| 고객 지원 | 전화: +91-79-66306161 |

| 이메일: PNO@axisbank.com | |

| 소셜 미디어: Facebook, LinkedIn, Twitter, YouTube, Instagram | |

| 주소: Axis Bank 리미티드, Trishul 3층, 오포. Samartheshwar Temple, Near Law Garden, Ellisbridge. Ahmedabad-380 006 | |

Axis Bank 정보

Axis Bank는 1998년에 설립되었으며 인도에 등록되어 있습니다. 대출, 외환, 보험, 펀드 관리, 디지털 골드 등 다양한 금융 제품 및 서비스를 제공합니다.

그러나 현재 회사는 규제를 받고 있지 않습니다. 투자자들은 자금의 안전에 대해 주의를 기울여야 합니다.

장단점

| 장점 | 단점 |

| 다양한 제품 및 서비스 | 규제 없음 |

| 다양한 계정 유형 |

Axis Bank 합법성

Axis Bank는 현재 유효한 규제가 없습니다. 리스크에 주의하시기 바랍니다!

제품 및 서비스

Axis Bank은 대출, 외환, 보험, 펀드 관리, 디지털 골드 등 다양한 제품과 서비스를 제공합니다.

계정 유형

Axis Bank은 독점적인 Axis Bank 앱을 통해 거래를 지원합니다.

| 플랫폼/앱 | 지원 | 사용 가능한 장치 |

| Axis Bank 앱 | ✔ | 데스크톱, 모바일, 웹 |