Описание компании

| Axis Bank Обзор | |

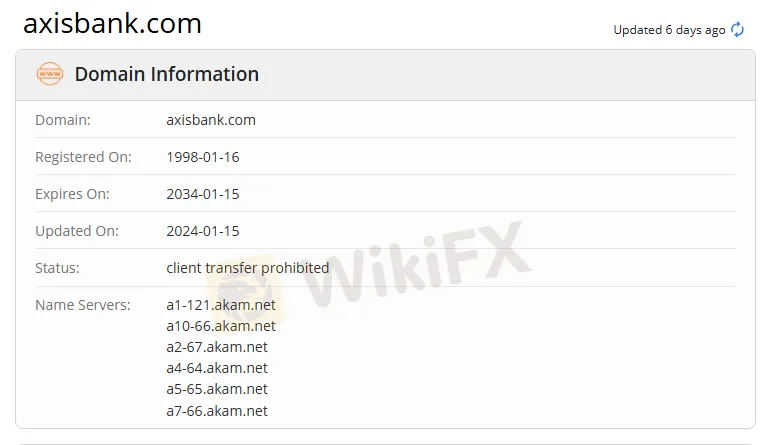

| Основана | 1998 |

| Страна/Регион регистрации | Индия |

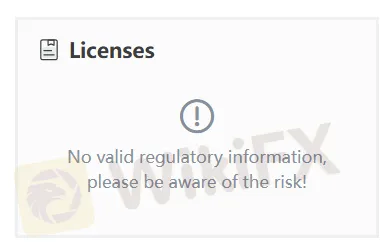

| Регулирование | Отсутствует регулирование |

| Продукты и услуги | Кредит, валютный обмен, страхование, управление взаимными фондами, цифровое золото и т. д. |

| Платформа/Приложение | Приложение Axis Bank |

| Поддержка клиентов | Телефон: +91-79-66306161 |

| Эл. почта: PNO@axisbank.com | |

| Социальные сети: Facebook, LinkedIn, Twitter, YouTube, Instagram | |

| Адрес: Axis Bank Limited, Trishul 3rd Floor, Opp. Samartheshwar Temple, Near Law Garden, Ellisbridge. Ahmedabad-380 006 | |

Информация о Axis Bank

Axis Bank была основана в 1998 году и зарегистрирована в Индии. Компания предлагает разнообразные финансовые продукты и услуги, включая кредит, валютный обмен, страхование, управление взаимными фондами, цифровое золото и т. д.

Однако в настоящее время компания не имеет регулирования. Инвесторам следует проявлять осторожность в отношении безопасности своих средств.

Плюсы и минусы

| Плюсы | Минусы |

| Разнообразие продуктов и услуг | Отсутствие регулирования |

| Несколько типов счетов |

Axis Bank Легальность

У Axis Bank в настоящее время нет действующего регулирования. Пожалуйста, будьте внимательны к риску!

Продукты и услуги

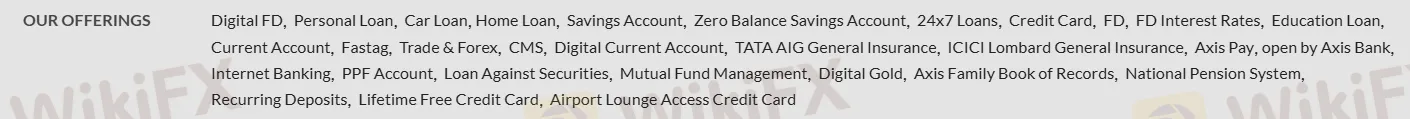

Axis Bank предлагает широкий спектр продуктов и услуг, включая кредит, валютный обмен, страхование, управление взаимными фондами, цифровое золото и т. д.

Типы счетов

Axis Bank поддерживает транзакции через свое собственное приложение Axis Bank.

| Платформа/ПРИЛОЖЕНИЕ | Поддерживается | Доступные устройства |

| Axis Bank App | ✔ | Настольный компьютер, Мобильный, Веб |