회사 소개

| LINE FX리뷰 요약 | |

| 설립일 | 2019-04-23 |

| 등록 국가/지역 | 일본 |

| 규제 | 규제되지 않음 |

| 상품 | 23개 통화쌍 |

| 레버리지 | 최대 1:25 |

| 스프레드 | 0.3 픽셀 이상 |

| 거래 플랫폼 | LINE FX(스마트폰)/LINE FX Pro(PC)/TradingView |

| X, Line, Facebook | |

LINE FX 정보

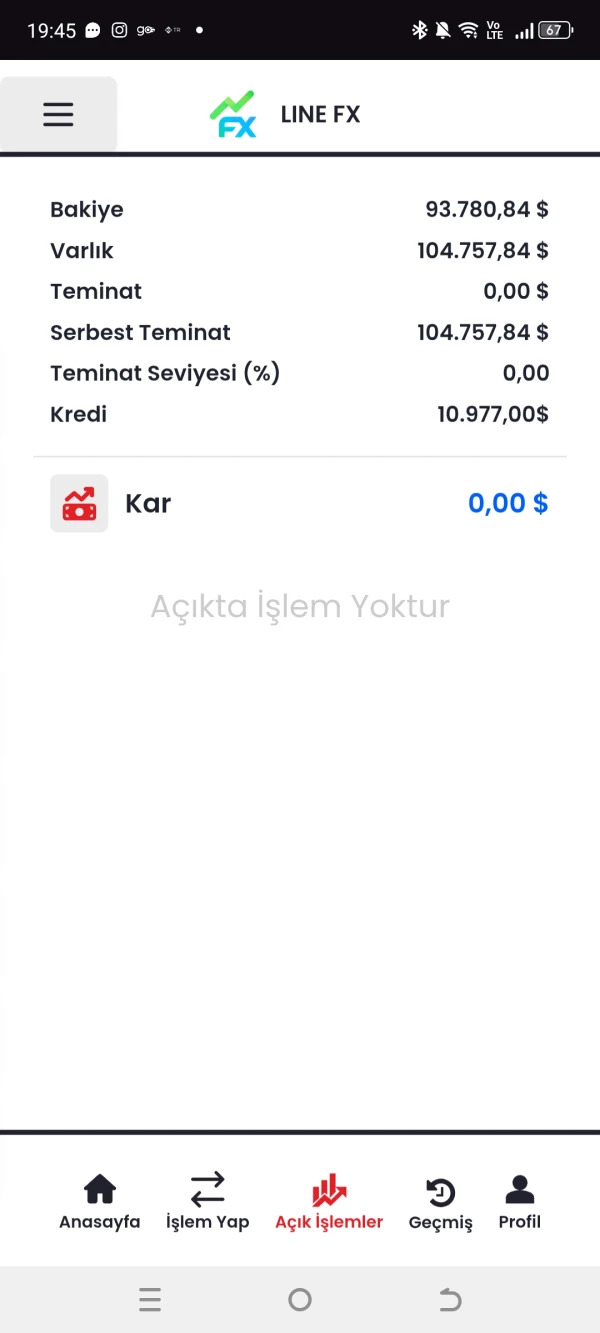

LINE FX은 일본에 등록된 증권 회사로, 수수료 없이 23개 통화쌍에 접근할 수 있습니다. EUR/USD 핵심 시간(원칙적으로 고정)은 오전 9시부터 다음 날 오전 5시까지 0.3 픽셀이며, 다른 시간은 0.4-9.0 픽셀입니다. 스프레드가 낮을수록 유동성이 더 좋습니다.

거래 수수료는 0 엔입니다. 그러나 LINE FX가 제공하는 통화의 매수 및 매도 가격 사이에는 차이(스프레드)가 있습니다. 주문을 할 때마다 각 통화쌍에 대해 4% 이상의 마진(레버리지 25배)이 필요합니다.

LINE FX이 신뢰할 만한가요?

금융 서비스 기관(FSA)은 라이선스 번호 関東財務局長(金商)第3144号 및 라이선스 유형 Retail Forex License로 LINE FX을 규제하므로 규제되지 않은 것보다 안전합니다.

거래 도구

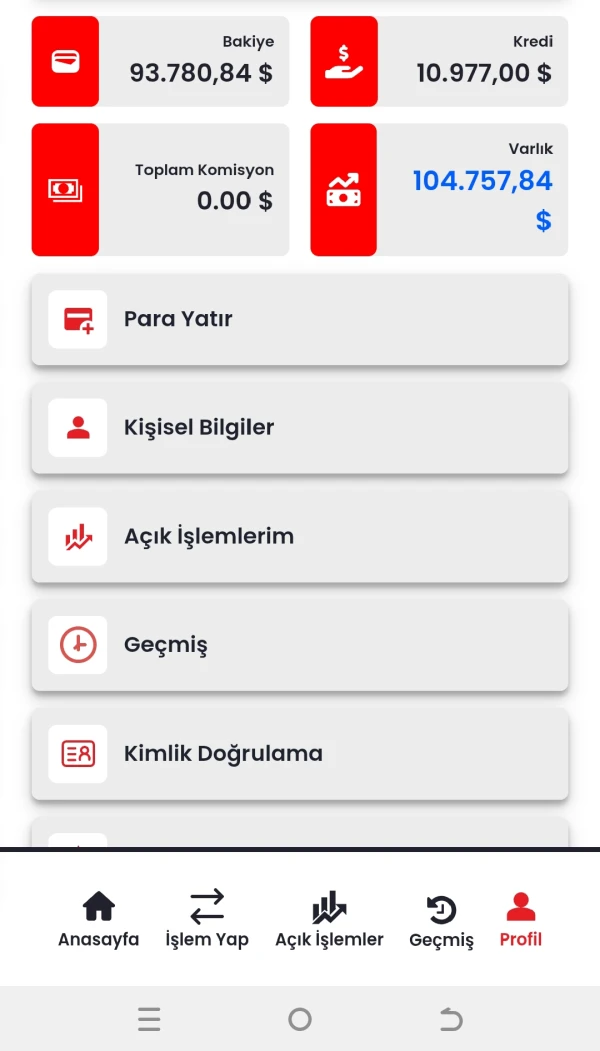

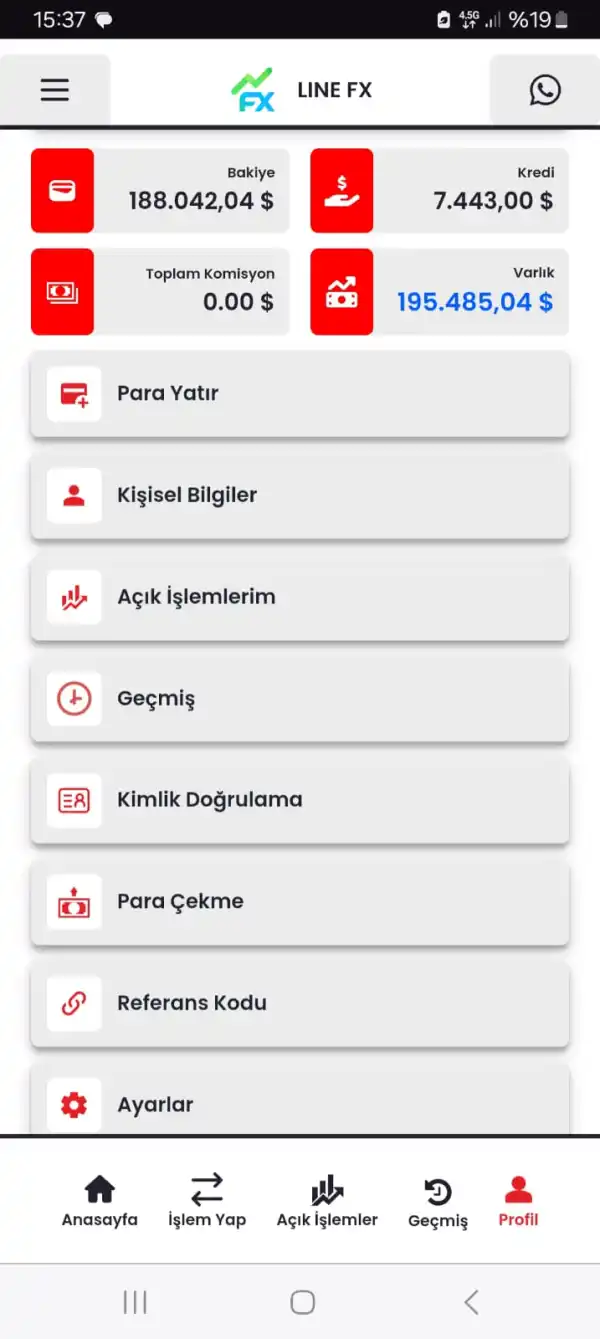

초보자와 전문가를 위한 거래 도구인 TradingView는 차트 기능을 갖추고 있으며, 스마트폰에서 사용할 수 있는 LINE FX와 PC에 적합한 LINE FX Pro가 있습니다

| 거래 도구 | 지원 | 사용 가능한 기기 |

| LINE FX | ✔ | 스마트폰 |

| LINE FX Pro | ✔ | PC |

| TradingView | ✔ | - |

입출금

LINE FX은(는) 결제를 위해 은행 송금 및 QuickCash를 받아들이고, 인출을 위해 은행 송금을 받아들입니다. 은행 송금 결제는 수수료가 필요합니다. 금융 기관을 지정하는 QuickCash 결제를 제외한 다른 결제는 모든 은행에 적용되며, 처리 시간은 일반적으로 24시간 이내입니다.

| 절차 | 결제 방법 | 수수료 | 사용 가능한 금융 기관 | 영업 시간 |

| 결제 | 은행 송금 | 고객 부담 | 모든 은행 | 일반적으로 24시간 |

| QuickCash | 무료 | Mitsubishi UFJ BankSumitomo Mitsui Banking CorporationMizuho BankSumishin SBI Net BankRakuten Bank JapanPost BankPayPay Bank | ||

| 인출 | 은행 송금 | 무료 | 모든 은행 |