Profil perusahaan

| GUOSEN FUTURES Ringkasan Ulasan | |

| Didirikan | 2008 |

| Negara/Daerah Terdaftar | China |

| Regulasi | CFFEX (Teregulasi) |

| Instrumen Pasar | Emas, Baja, Produk Pertanian, Logam Dasar, Produk Energi |

| Akun Demo | ❌ |

| Platform Perdagangan | Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 dan lain-lain |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: 400-86-95536 / 0755-22941888 |

Guosen Futures Limited adalah anak perusahaan sepenuhnya dari Guoxin Securities Company Limited. Berkantor pusat di Shanghai, mereka menawarkan aset yang dapat diperdagangkan di berbagai platform perdagangan mereka. Menikmati posisi di antara sepuluh besar industri, Guosen Futures mendapatkan manfaat dari jaringan luasnya yang mencakup kota-kota besar, difasilitasi oleh lebih dari 100 departemen bisnis Guoxin Securities. Statusnya diatur dengan baik oleh CFFEX.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh CFFEX | Prosedur pembukaan akun yang memakan waktu |

| Berbagai platform perdagangan di berbagai perangkat | Saluran kontak terbatas |

| Tidak ada akun demo |

Apakah GUOSEN FUTURES Legal?

GUOSEN FUTURES diatur oleh China Financial Futures Exchange Co. Ltd. (CFFEX). Mereka memegang lisensi Futures dengan nomor lisensi No.0113.

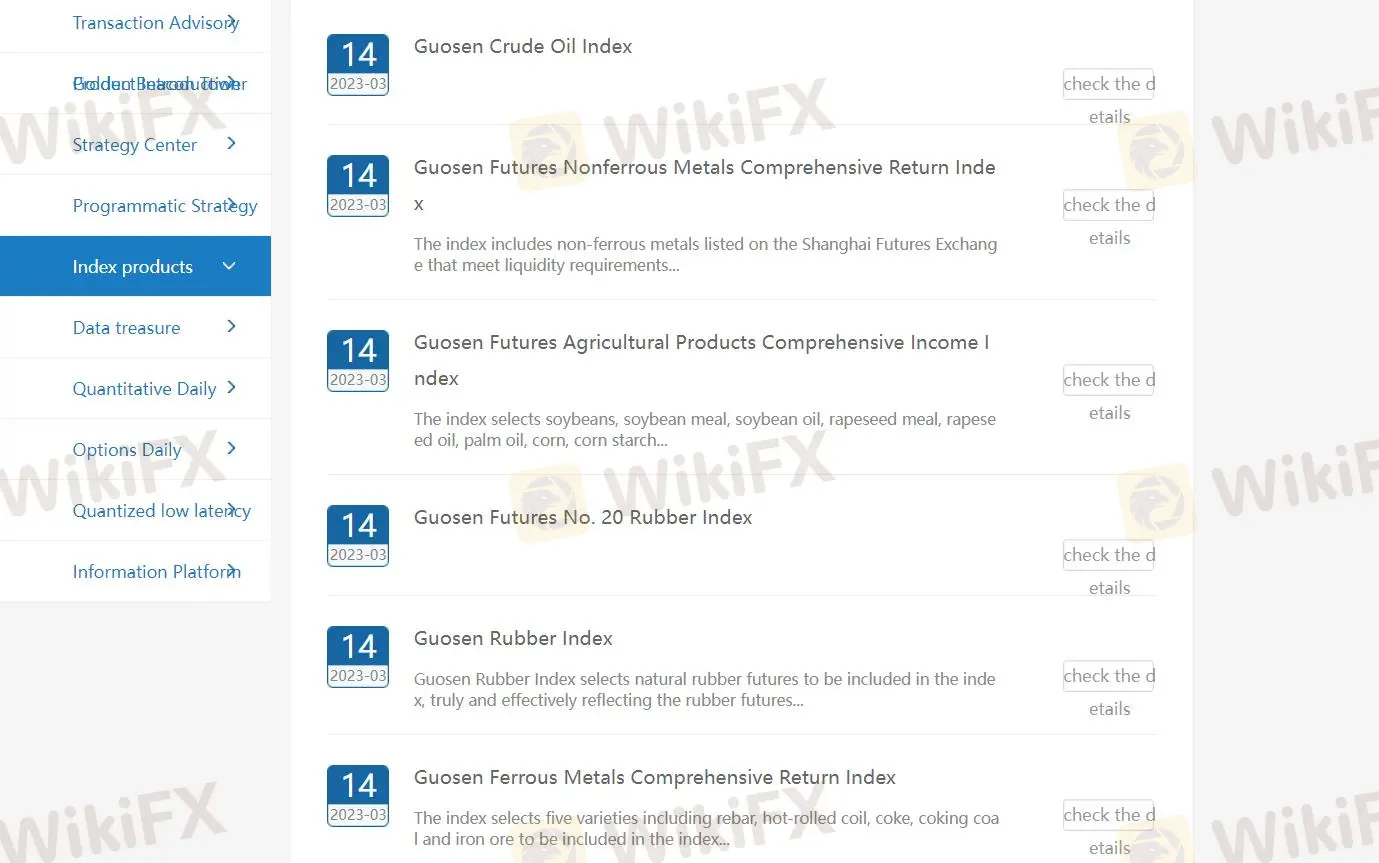

Apa yang Dapat Saya Perdagangkan di GUOSEN FUTURES?

GUOSEN FUTURES menawarkan futures, emas, baja, produk pertanian, logam dasar, dan produk energi.

Jenis Akun

Untuk membuka akun GUOSEN FUTURES, Anda dapat mendaftar dan masuk ke sistem awan pembukaan akun internet berjangka melalui ponsel atau komputer, mengisi informasi pribadi Anda, dan memilih jenis akun yang ingin Anda buka. Selain itu, Anda juga perlu mengikuti penilaian, mengajukan pertukaran yang sesuai, dan menandatangani dokumen-dokumen terkait dan sebagainya. Oleh karena itu, prosedurnya kompleks dan memakan waktu.

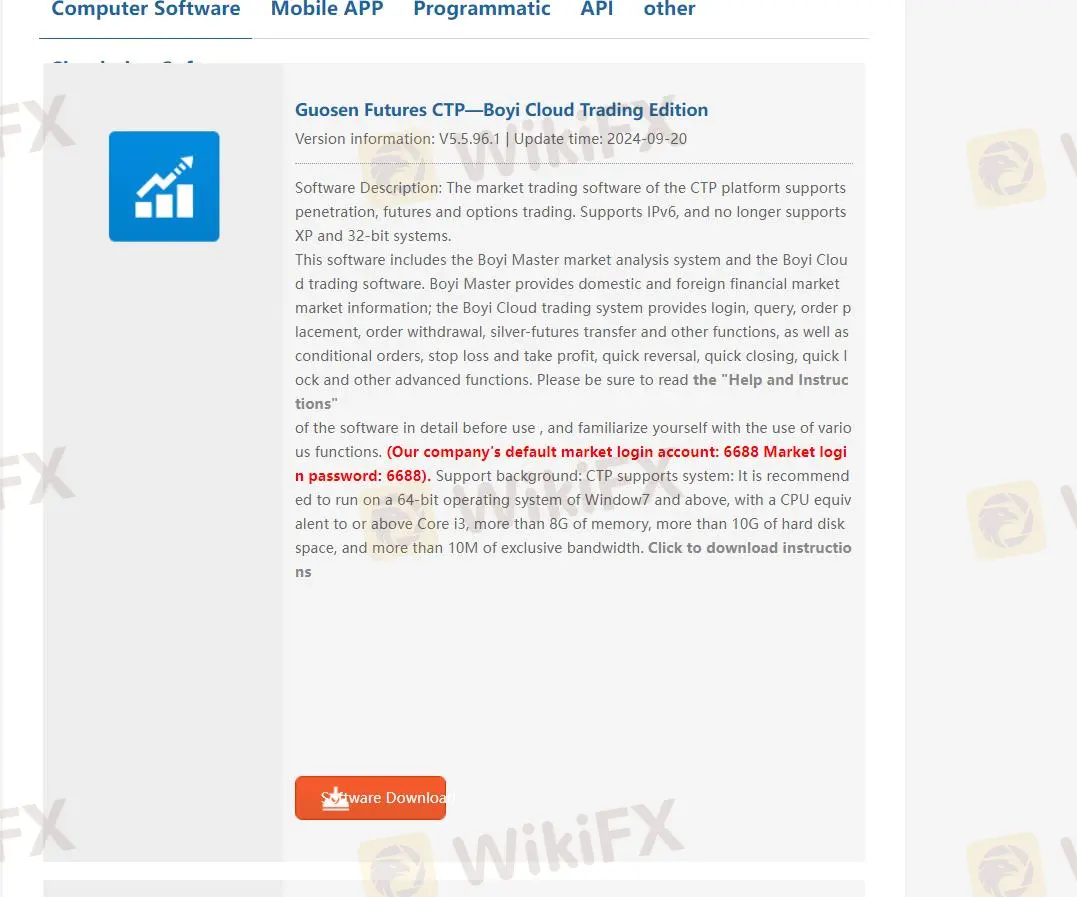

Platform Perdagangan

GUOSEN FUTURES menawarkan berbagai platform perdagangan termasuk perangkat lunak desktop, Aplikasi seluler, Programmatic, API, dan lain-lain. Perangkat lunak komputer termasukGuosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 dan lain-lain.

Selain itu, aplikasi mereka adalah Guosen Futures dan Guosen Futures Premium Edition. Anda dapat memilih platform yang berbeda sesuai dengan kondisi perdagangan Anda. Informasi lebih lanjut tentang platform perdagangan dapat dipelajari melalui: https://www.guosenqh.com.cn/main/kfzx/xjzq/dnrj/index.shtml

Deposit dan Penarikan

GUOSEN FUTURES mendukung transfer bank-futures, transfer perbankan online, dan transfer over-the-counter. Transfer bank-futures dibuka untuk ICBC, ABC, BOC, CCB, BOC, SPDB, Minsheng, CMB, CITIC, Everbright, Ping An, Industrial Bank, dan Postal Savings Bank.

Jumlah maksimum yang dapat Anda tarik setiap hari adalah RMB 10 juta, dan batas maksimum untuk transfer tunggal juga RMB 10 juta. Dana jaminan RMB 100 tidak dapat ditarik (jika tidak ada transaksi atau posisi pada hari itu, Anda dapat mengajukan penarikan dana jaminan melalui telepon).