Profil perusahaan

| Pi Securities Ringkasan Ulasan | |

| Dibentuk | 1966 |

| Negara/Daerah Terdaftar | Thailand |

| Regulasi | Tidak diatur |

| Produk Perdagangan | Saham, derivatif, reksadana, obligasi |

| Akun Demo | ❌ |

| Platform Perdagangan | Aplikasi Keuangan Pi, MT4, MT5, Streaming, eFinTradePlus, iFisE, iFisD |

| Deposit Minimum | / |

| Dukungan Pelanggan | Obrolan langsung melalui Aplikasi Keuangan Pi |

| LINE: @pisecurities | |

| Email: support@pi.financial | |

| Facebook Messenger: m.me/pisecurities | |

Informasi Pi Securities

Didirikan pada tahun 1966 dan berbasis di Thailand, Pi Securities tidak diatur oleh SEC Thailand atau badan internasional lain yang signifikan. Di antara banyak penawaran keuangan untuk konsumen dan klien institusi adalah saham, dana, derivatif, dan produk struktural.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Rentang produk yang luas untuk investor personal dan institusi | Tidak diatur |

| Mendukung MT4, MT5, Aplikasi Pi, dan perdagangan multi-platform lainnya | Tidak ada akun demo atau akun Islami |

| Kehadiran kuat di pasar saham dan derivatif Thailand | Biaya untuk layanan premium tidak diungkapkan secara publik |

| Tidak ada informasi tentang deposit dan penarikan |

Apakah Pi Securities Legal?

Pi Securities tidak diatur. Meskipun terdaftar di Thailand, Komisi Sekuritas dan Bursa (SEC) tidak mengaturnya. Harap waspada terhadap risiko!

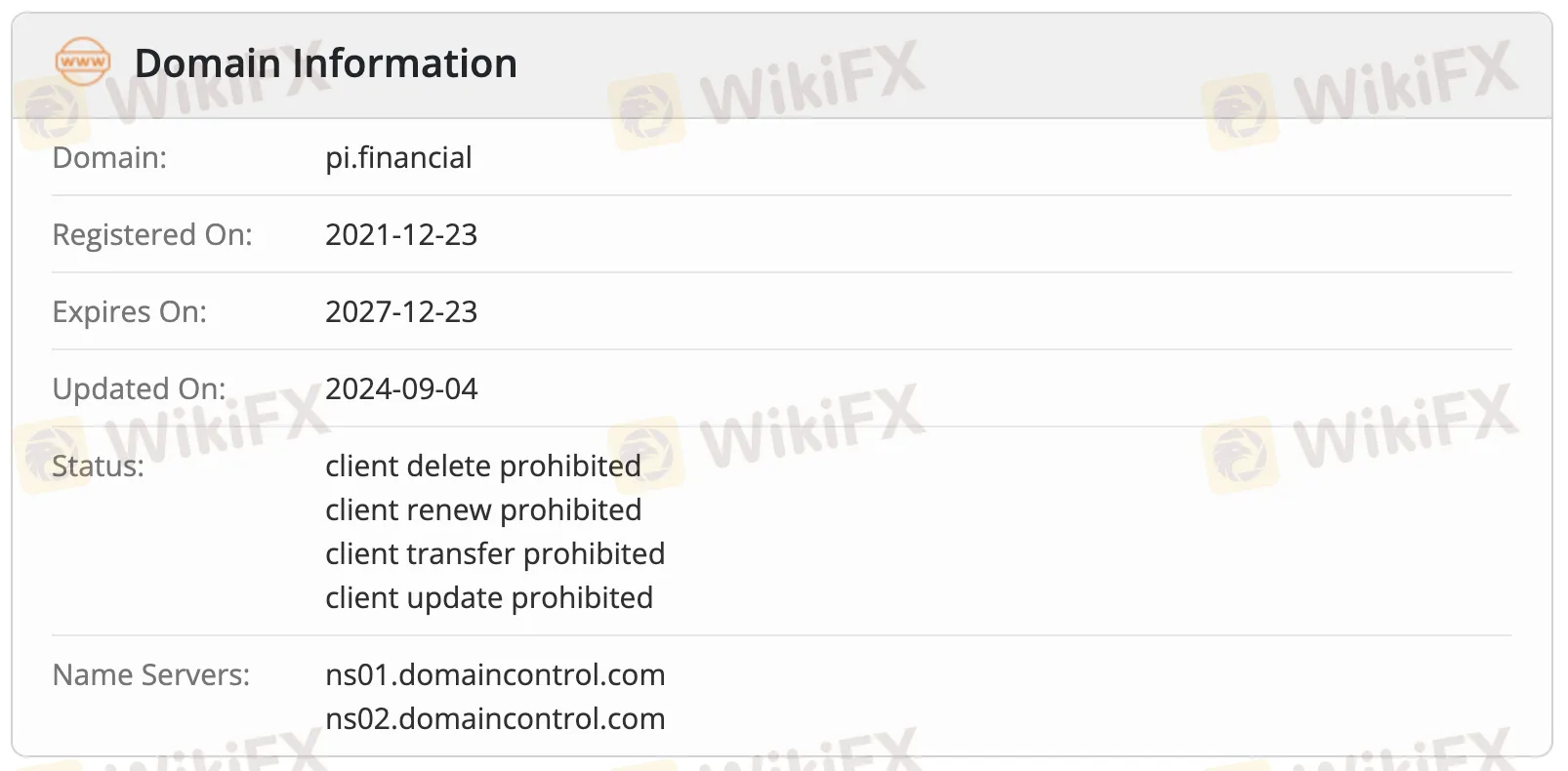

Catatan WHOIS menunjukkan domain pi.financial didaftarkan pada 23 Desember 2021, sekarang aktif, dan akan kedaluwarsa pada 23 Desember 2027. Status domain mencakup "klien hapus dilarang," "klien transfer dilarang," dan "klien update dilarang".

Apa yang Bisa Saya Perdagangkan di Pi Securities?

Di antara banyak produk dan layanan investasi yang diberikan oleh Pi Securities adalah saham Thailand dan saham global, derivatif, reksa dana, obligasi, dan lainnya. Mulai dari manajemen portofolio pribadi hingga solusi keuangan perusahaan, layanan ini melayani baik investor perorangan maupun institusi.

| Produk Perdagangan | Didukung |

| Saham | ✔ |

| Derivatif | ✔ |

| Reksa Dana | ✔ |

| Obligasi | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kripto | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

Jenis Akun

Pi Securities menawarkan tiga jenis akun live: Pre-paid Cash Balance (untuk pemula), Cash & Credit Balance (untuk trader aktif), dan SBL Account (untuk pengguna lanjutan). Tidak menyediakan akun demo atau akun Islami.

| Jenis Akun | Tersedia | Cocok untuk |

| Akun Pre-paid Cash Balance | ✔ | Pemula, investor casual |

| Akun Cash & Credit Balance | ✔ | Trader aktif, berpengalaman |

| Akun SBL | ✔ | Trader lanjutan/profesional |

| Akun Demo | ❌ | – |

| Akun Islami | ❌ | – |

Biaya Pi Securities

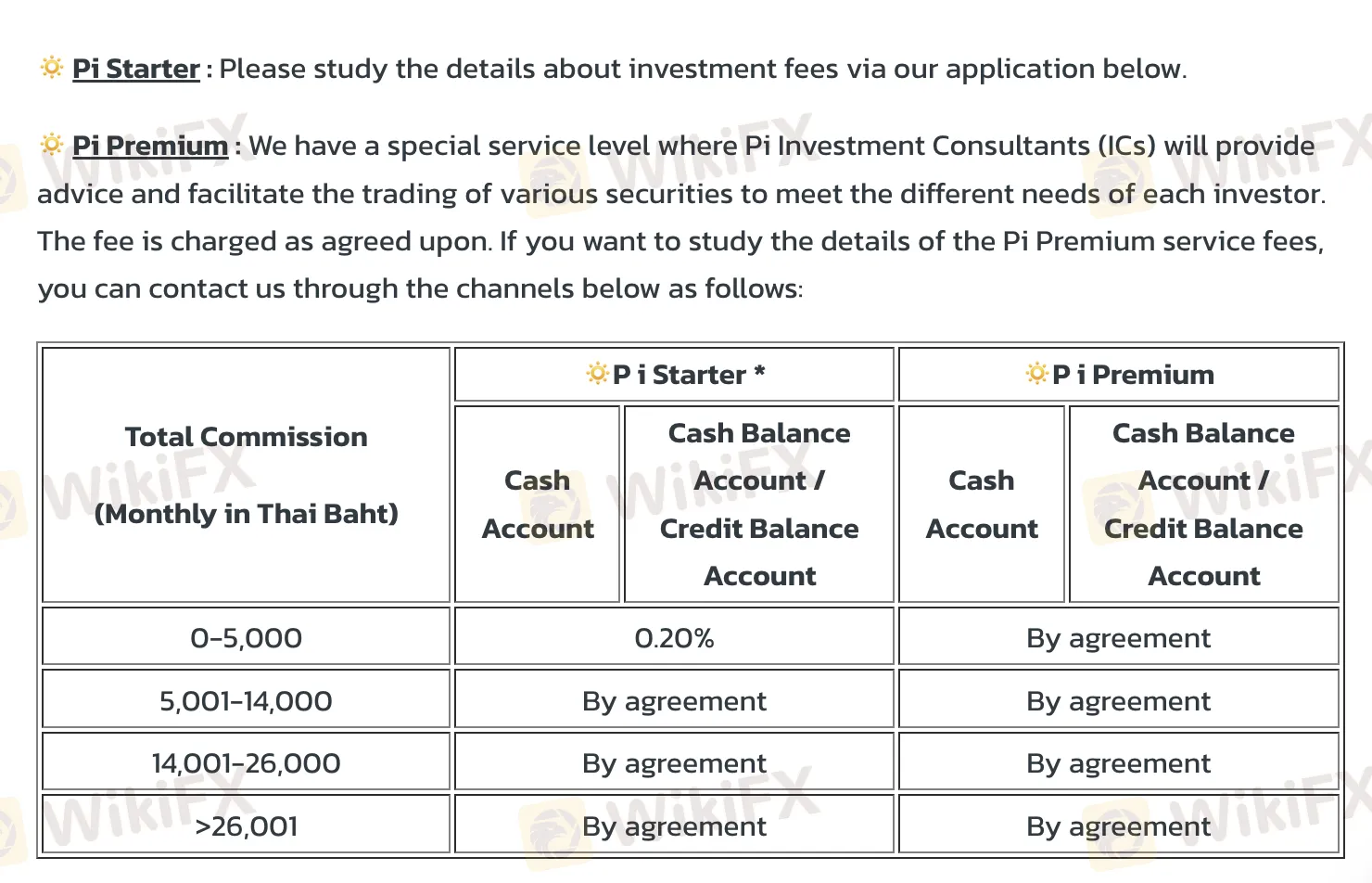

Dimulai dari komisi 0.20% untuk volume perdagangan bulanan yang lebih rendah, biaya perdagangan saham Pi Securities biasanya konsisten dengan standar industri untuk investor ritel tingkat pemula. Sebagian besar tingkat harga, terutama untuk layanan volume tinggi dan Pi Premium, tidak diumumkan secara publik dan tunduk pada kesepakatan khusus, sehingga membatasi keterbukaan biaya.

| Volume Perdagangan Bulanan (THB) | Pi Starter (Akun Tunai) | Pi Starter (Akun Tunai/Kredit) | Pi Premium (Semua Akun) |

| 0 – 5,000 | 0.20% | Menurut kesepakatan | |

| 5,001 – 14,000 | Menurut kesepakatan | ||

| 14,001 – 26,000 | |||

| > 26,000 | |||

Platform Perdagangan

Pi Securities mendukung beberapa sistem perdagangan, termasuk Aplikasi Keuangan Pi miliknya sendiri dan pihak ketiga seperti MT4, MT5, Streaming, dan lainnya. Dapat diakses secara online, desktop, dan mobile, sistem-sistem ini melayani baik trader pemula maupun berpengalaman.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Pi Financial APP | ✔ | iOS, Android | Investor umum yang melakukan perdagangan aset Thailand dan global |

| MT4 | ✔ | Windows, macOS, iOS, Android | Pemula |

| MT5 | ✔ | Windows, macOS, iOS, Android | Trader berpengalaman |

| Streaming | ✔ | Web, Desktop, Mobile | Trader saham lokal di Thailand |

| eFinTradePlus | ✔ | Desktop | Trader teknis yang menggunakan alat charting canggih |

| iFisE | ✔ | Web | Klien institusional atau profesional |

| iFisD | ✔ | Desktop | Klien institusional atau profesional |