Buod ng kumpanya

| Pi Securities Buod ng Pagsusuri | |

| Itinatag | 1966 |

| Nakarehistrong Bansa/Rehiyon | Thailand |

| Regulasyon | Walang regulasyon |

| Mga Produkto sa Paghahalal | Mga Ekswelto, derivatives, mutual funds, bonds |

| Demo Account | ❌ |

| Platform ng Paghahalal | Pi Financial APP, MT4, MT5, Streaming, eFinTradePlus, iFisE, iFisD |

| Minimum na Deposit | / |

| Suporta sa Customer | Live chat via Pi Financial APP |

| LINE: @pisecurities | |

| Email: support@pi.financial | |

| Facebook Messenger: m.me/pisecurities | |

Impormasyon Tungkol sa Pi Securities

Itinatag noong 1966 at nakabase sa Thailand, hindi pinamamahalaan ng Thai SEC o anumang iba pang pangunahing pandaigdigang ahensya ang Pi Securities. Kasama sa maraming alok nito para sa mga mamimili at institusyonal na kliyente ay mga stocks, pondo, derivatives, at structured products.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Malawak na hanay ng produkto para sa personal at institusyonal na mga mamumuhunan | Walang regulasyon |

| Suporta sa MT4, MT5, Pi App, at iba pang multi-platform na pagtetrading | Walang demo account o Islamic account |

| Matatag na presensya sa Thai equities at derivatives markets | Ang mga bayad para sa premium na mga serbisyo ay hindi pampublikong ipinapahayag |

| Walang impormasyon sa deposito at pag-withdraw |

Tunay ba ang Pi Securities?

Ang Pi Securities ay hindi regulado. Bagaman nakarehistro sa Thailand, hindi ito nireregula ng Securities and Exchange Commission (SEC). Mangyaring maging maingat sa panganib!

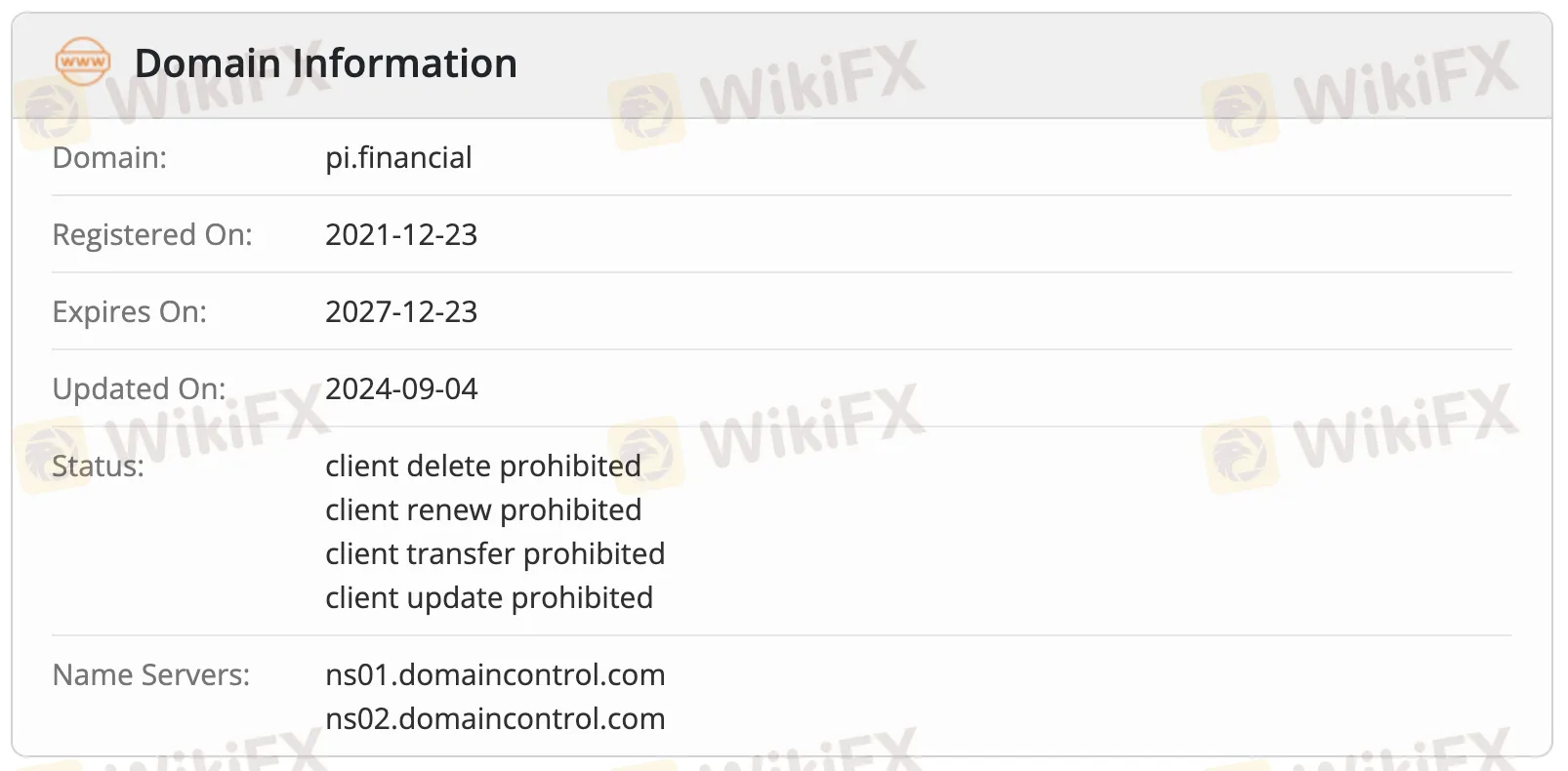

Ipakita ng mga rekord ng WHOIS na ang domain na pi.financial ay narehistro noong Disyembre 23, 2021, ngayon ay live, at mag-eexpire sa Disyembre 23, 2027. Ang kalagayan ng domain ay kinabibilangan ng "client delete prohibited," "client transfer prohibited," at "client update prohibited".

Ano ang Maaari Kong I-trade sa Pi Securities?

Sa mga maraming produkto at serbisyo sa pamumuhunan na ibinibigay ng Pi Securities ay kasama ang mga Thai at pandaigdigang mga shares, derivatives, mutual funds, bonds, at iba pa. Nagbibigay ito ng lahat mula sa personal portfolio management hanggang sa mga solusyon sa korporasyon sa pinansyal, at naglilingkod sa parehong indibidwal at institusyonal na mga mamumuhunan.

| Mga Produkto sa Paghahalal | Supported |

| Equities | ✔ |

| Derivatives | ✔ |

| Mutual Funds | ✔ |

| Bonds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Uri ng Account

Nag-aalok ang Pi Securities ng tatlong uri ng live account: Pre-paid Cash Balance (para sa mga nagsisimula), Cash & Credit Balance (para sa mga aktibong mangangalakal), at SBL Account (para sa mga advanced na gumagamit). Hindi ito nagbibigay ng demo account o Islamic account.

| Uri ng Account | Available | Angkop para sa |

| Pre-paid Cash Balance Account | ✔ | Mga nagsisimula, casual investors |

| Cash & Credit Balance Account | ✔ | Aktibo, may karanasan na mga mangangalakal |

| SBL Account | ✔ | Advanced/professional traders |

| Demo Account | ❌ | – |

| Islamic Account | ❌ | – |

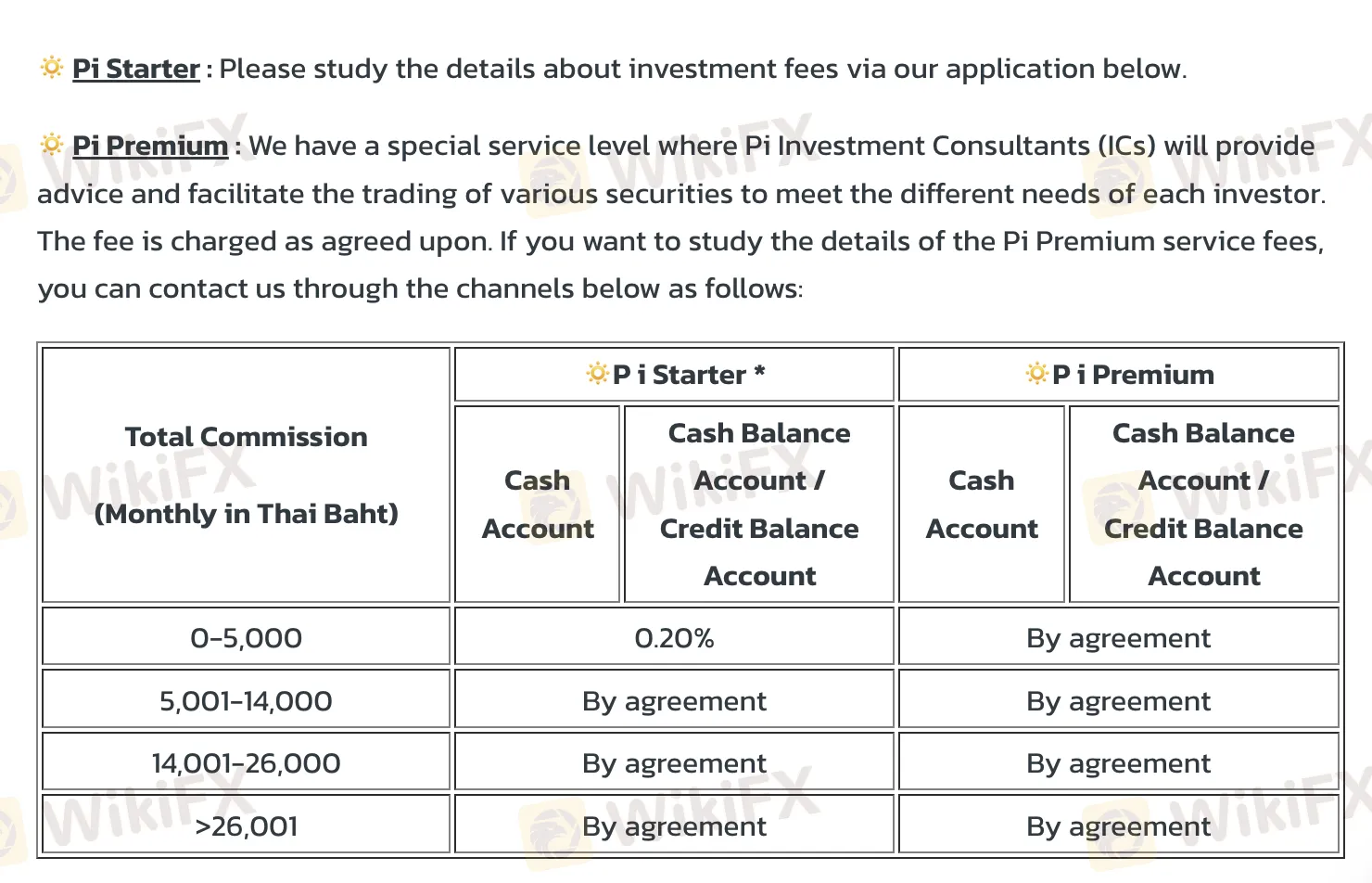

Mga Bayad ng Pi Securities

Nagsisimula sa 0.20% komisyon para sa mas mababang buwanang trading volumes, karaniwan ang mga bayad sa stock trading ng Pi Securities ay kasama sa mga industry standards para sa mga entry-level retail investors. Ang karamihan sa mga antas ng presyo, lalo na para sa mas mataas na volume at Pi Premium services, ay hindi pampubliko at saklaw ng custom agreements, kaya't limitado ang pagiging bukas ng bayad.

| Buwanang Trading Volume (THB) | Pi Starter (Cash Account) | Pi Starter (Cash/Credit Balance) | Pi Premium (Lahat ng Accounts) |

| 0 – 5,000 | 0.20% | By agreement | |

| 5,001 – 14,000 | By agreement | ||

| 14,001 – 26,000 | |||

| > 26,000 | |||

Platform ng Paghahalal

Pi Securities suporta ang ilang mga sistema ng kalakalan, kabilang ang kanilang sariling Pi Financial App at ang mga third-party tulad ng MT4, MT5, Streaming, at iba pa. Accessible sa online, desktop, at mobile, ang mga sistemang ito ay naglilingkod sa parehong mga baguhan at mga may karanasan na mangangalakal.

| Plataforma ng Kalakalan | Supported | Available Devices | Angkop para sa |

| Pi Financial APP | ✔ | iOS, Android | Pangkalahatang mga mamumuhunan na nagtetrading ng mga Thai at global na assets |

| MT4 | ✔ | Windows, macOS, iOS, Android | Mga nagsisimula |

| MT5 | ✔ | Windows, macOS, iOS, Android | Mga may karanasan na mangangalakal |

| Streaming | ✔ | Web, Desktop, Mobile | Mga lokal na mangangalakal ng stock sa Thailand |

| eFinTradePlus | ✔ | Desktop | Mga teknikal na mangangalakal na gumagamit ng advanced charting tools |

| iFisE | ✔ | Web | Institutional o propesyonal na mga kliyente |

| iFisD | ✔ | Desktop | Institutional o propesyonal na mga kliyente |