Company Summary

| Pi Securities Review Summary | |

| Founded | 1966 |

| Registered Country/Region | Thailand |

| Regulation | No regulation |

| Trading Products | Equities, derivatives, mutual funds, bonds |

| Demo Account | ❌ |

| Trading Platform | Pi Financial APP, MT4, MT5, Streaming, eFinTradePlus, iFisE, iFisD |

| Minimum Deposit | / |

| Customer Support | Live chat via Pi Financial APP |

| LINE: @pisecurities | |

| Email: support@pi.financial | |

| Facebook Messenger: m.me/pisecurities | |

Pi Securities Information

Founded in 1966 and based in Thailand, Pi Securities is not governed by the Thai SEC or any other significant international body. Among its many financial offerings for consumers and institutional clients are stocks, funds, derivatives, and structured products.

Pros and Cons

| Pros | Cons |

| Wide product range for both personal and institutional investors | No regulation |

| Supports MT4, MT5, Pi App, and other multi-platform trading | No demo account or Islamic account |

| Strong presence in the Thai equities and derivatives markets | Fees for premium services are not publicly disclosed |

| No info on deposit and withdrawal |

Is Pi Securities Legit?

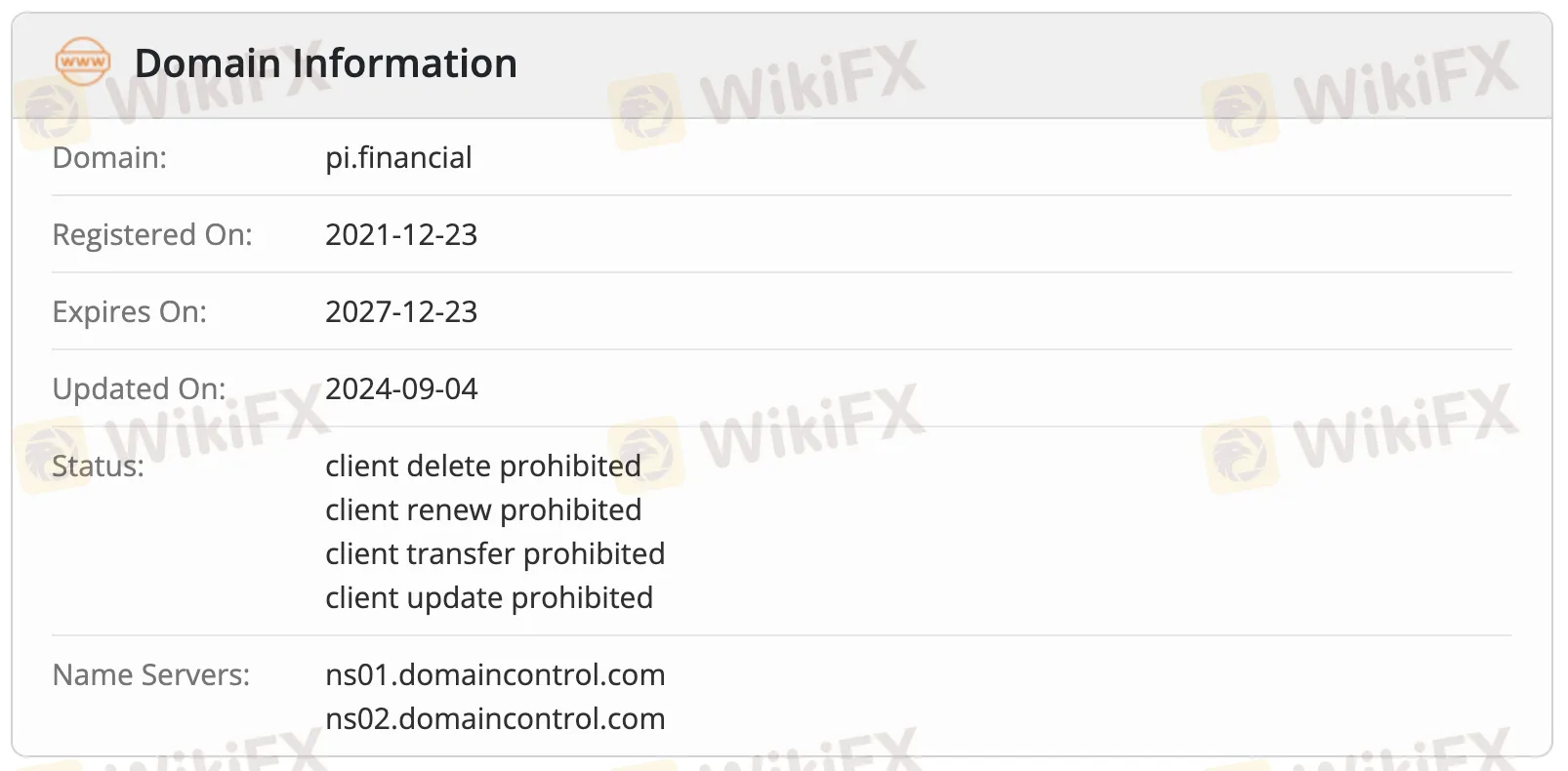

Pi Securities is unregulated. Despite being registered in Thailand, the Securities and Exchange Commission (SEC) does not regulate it. Please be aware of the risk!

WHOIS records show the domain pi.financial was registered on December 23, 2021, is now live, and will expire on December 23, 2027. The domain status comprises “client delete prohibited,” “client transfer prohibited,” and “client update prohibited”.

What Can I Trade on Pi Securities?

Among the many investing products and services Pi Securities provides are Thai and worldwide shares, derivatives, mutual funds, bonds, and more. Covering everything from personal portfolio management to corporate financial solutions, it serves both individual and institutional investors.

| Trading Products | Supported |

| Equities | ✔ |

| Derivatives | ✔ |

| Mutual Funds | ✔ |

| Bonds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

Pi Securities offers three live account types: Pre-paid Cash Balance (for beginners), Cash & Credit Balance (for active traders), and SBL Account (for advanced users). It does not provide a demo account or Islamic account.

| Account Type | Available | Suitable for |

| Pre-paid Cash Balance Account | ✔ | Beginners, casual investors |

| Cash & Credit Balance Account | ✔ | Active, experienced traders |

| SBL Account | ✔ | Advanced/professional traders |

| Demo Account | ❌ | – |

| Islamic Account | ❌ | – |

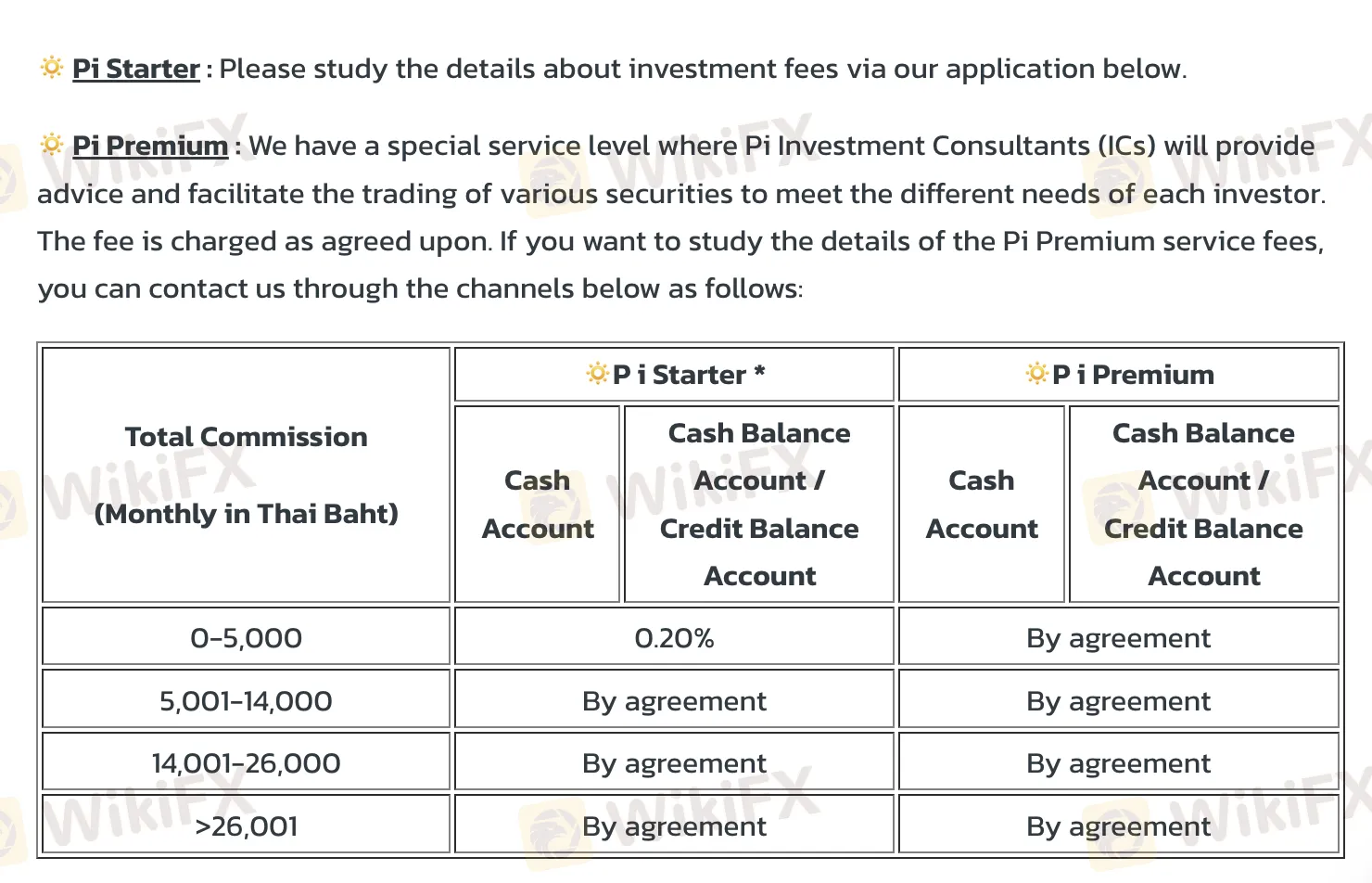

Pi Securities Fees

Starting at 0.20% commission for lower monthly trading volumes, Pi Securities' stock trading fees are usually consistent with industry standards for entry-level retail investors. Most pricing levels, notably for higher-volume and Pi Premium services, are not publicly stated and are subject to custom agreements, hence limiting fee openness.

| Monthly Trading Volume (THB) | Pi Starter (Cash Account) | Pi Starter (Cash/Credit Balance) | Pi Premium (All Accounts) |

| 0 – 5,000 | 0.20% | By agreement | |

| 5,001 – 14,000 | By agreement | ||

| 14,001 – 26,000 | |||

| > 26,000 | |||

Trading Platform

Pi Securities backs several trading systems, including its own Pi Financial App and third-party ones like MT4, MT5, Streaming, and others. Accessible across online, desktop, and mobile, these systems serve both novice and experienced traders.

| Trading Platform | Supported | Available Devices | Suitable for |

| Pi Financial APP | ✔ | iOS, Android | General investors trading Thai and global assets |

| MT4 | ✔ | Windows, macOS, iOS, Android | Beginners |

| MT5 | ✔ | Windows, macOS, iOS, Android | Experienced traders |

| Streaming | ✔ | Web, Desktop, Mobile | Local stock traders in Thailand |

| eFinTradePlus | ✔ | Desktop | Technical traders using advanced charting tools |

| iFisE | ✔ | Web | Institutional or professional clients |

| iFisD | ✔ | Desktop | Institutional or professional clients |