Profil perusahaan

| DORMAN TRADING Ringkasan Ulasan | |

| Dibentuk | 2000 |

| Negara/Daerah Terdaftar | Amerika Serikat |

| Regulasi | NFA (Tidak Terverifikasi) |

| Produk Perdagangan | futures |

| Demo Trading | ✅ |

| Platform Perdagangan | Dorman Direct, ATAS, Barchart Trader, dll. |

| Dukungan Pelanggan | Formulir Kontak |

| Tel: +1 800-552-7007 | |

| Fax: 312-341-7898 | |

| Alamat: 141 W. Jackson Blvd., Suite 1900 Chicago, IL 60604 | |

Informasi DORMAN TRADING

DORMAN TRADING adalah broker yang teregulasi, menawarkan perdagangan futures di Dorman Direct, ATAS, Barchart Trader, dll.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| / | Risiko regulasi yang tidak terverifikasi |

| Produk perdagangan terbatas | |

| Struktur biaya yang tidak jelas | |

| Metode pembayaran terbatas |

Apakah DORMAN TRADING Legal?

Ya. DORMAN TRADING memiliki lisensi dari NFA dengan nomor lisensi 0264358 untuk menawarkan layanan.

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Tipe Lisensi | No. Lisensi |

| Amerika Serikat | NFA (National Futures Association) | Tidak Terverifikasi | DORMAN TRADING COMPANY 1 INC | Lisensi Layanan Keuangan Umum | 0264358 |

Apa yang Bisa Saya Perdagangkan di DORMAN TRADING?

DORMAN TRADING mengkhususkan diri dalam perdagangan futures.

| Produk Perdagangan | Dukungan |

| Futures | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

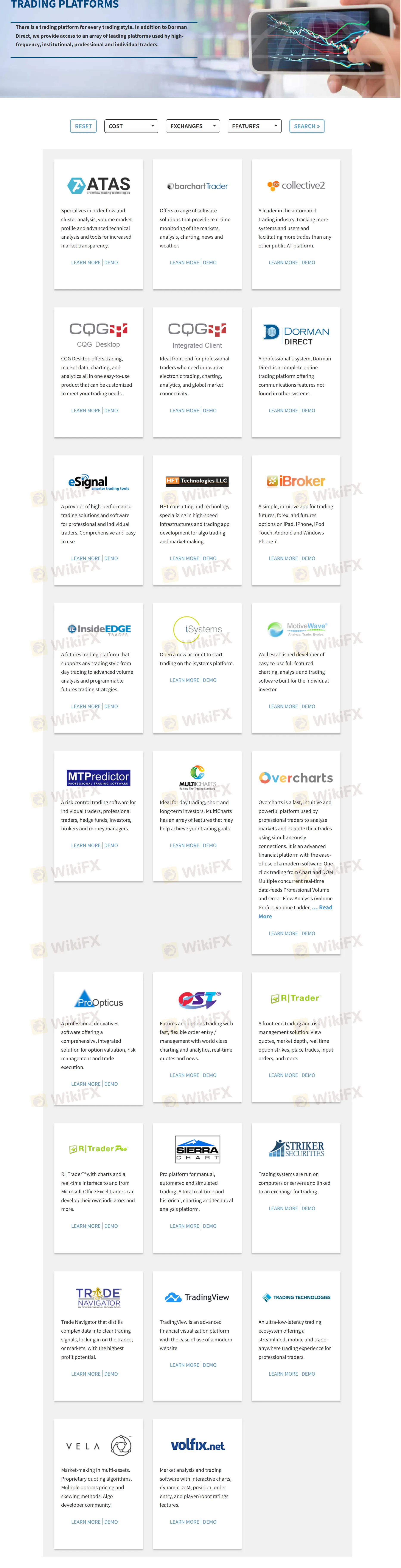

Platform Perdagangan

| Platform Perdagangan | Dukungan |

| Dorman Direct | ✔ |

| ATAS | ✔ |

| Pedagang Barchart | ✔ |

| Collective2 | ✔ |

| CQG Desktop | ✔ |

| Klien Terintegrasi CQG | ✔ |

| eSignal | ✔ |

| HFT | ✔ |

| iBroker | ✔ |

| Pedagang InsideEDGE | ✔ |

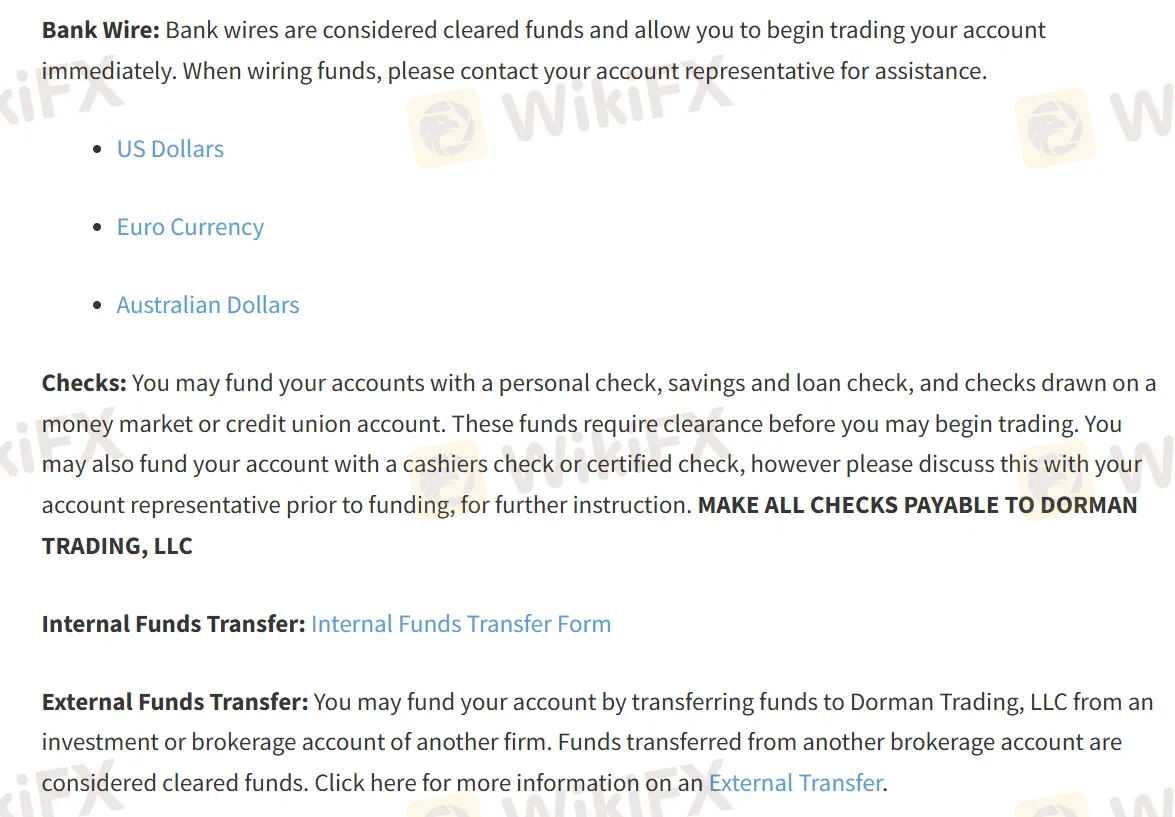

Deposit dan Penarikan

DORMAN TRADING menerima pembayaran melalui transfer kawat bank dan cek. Namun, informasi spesifik seperti waktu pemrosesan deposit dan penarikan serta biaya terkait tidak diungkapkan.