مقدمة عن الشركة

| DORMAN TRADING ملخص المراجعة | |

| تأسست | 2000 |

| الدولة/المنطقة المسجلة | الولايات المتحدة |

| التنظيم | NFA (غير مُصدّق) |

| منتجات التداول | العقود الآجلة |

| تداول تجريبي | ✅ |

| منصة التداول | Dorman Direct، ATAS، Barchart Trader، وغيرها |

| دعم العملاء | نموذج الاتصال |

| هاتف: +1 800-552-7007 | |

| فاكس: 312-341-7898 | |

| العنوان: 141 W. Jackson Blvd.، Suite 1900 Chicago، IL 60604 | |

معلومات DORMAN TRADING

DORMAN TRADING هو وسيط مرخص، يقدم تداول العقود الآجلة على Dorman Direct، ATAS، Barchart Trader، وغيرها.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| / | مخاطر تنظيم غير مُصدّقة |

| تشكيلة محدودة من منتجات التداول | |

| هيكل رسوم غير واضح | |

| طرق دفع محدودة |

هل DORMAN TRADING شرعية؟

نعم. DORMAN TRADING مرخصة من قبل NFA برقم ترخيص 0264358 لتقديم الخدمات.

| الدولة المنظمة | الهيئة التنظيمية | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| الولايات المتحدة | NFA (الجمعية الوطنية للعقود الآجلة) | غير مُصدّق | DORMAN TRADING شركة 1 ذ.م.م | رخصة الخدمات المالية الشائعة | 0264358 |

ما الذي يمكنني التداول به على DORMAN TRADING؟

DORMAN TRADING متخصص في تداول العقود الآجلة.

| منتجات التداول | مدعومة |

| العقود الآجلة | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

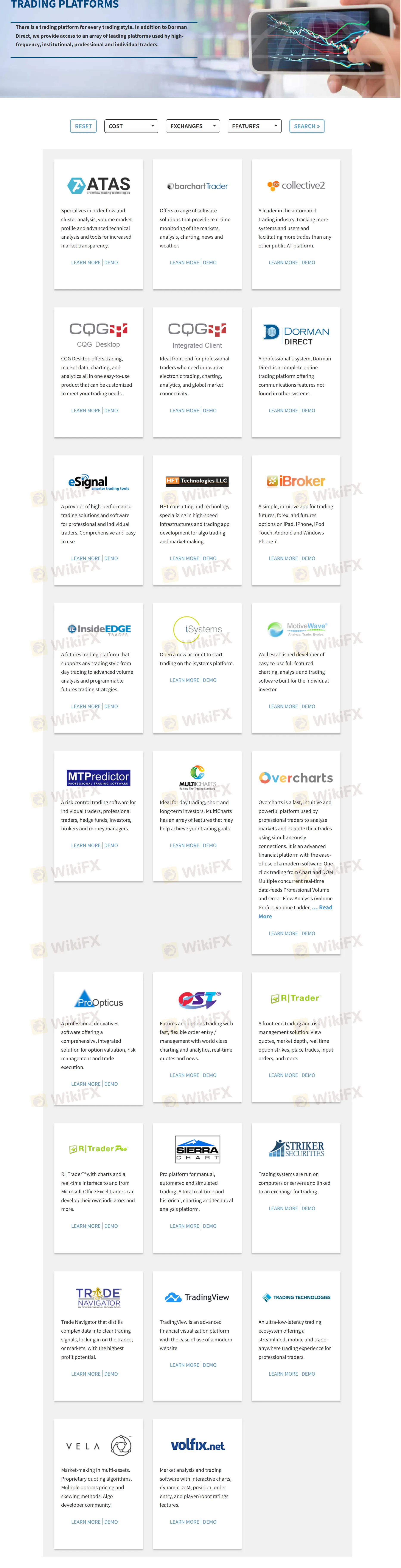

منصة التداول

| منصة التداول | مدعومة |

| Dorman Direct | ✔ |

| ATAS | ✔ |

| تاجر Barchart | ✔ |

| Collective2 | ✔ |

| مكتب CQG | ✔ |

| عميل CQG المتكامل | ✔ |

| eSignal | ✔ |

| HFT | ✔ |

| iBroker | ✔ |

| تاجر InsideEDGE | ✔ |

الإيداع والسحب

DORMAN TRADING يقبل المدفوعات عبر تحويل الأموال البنكي والشيكات. ومع ذلك، لم يتم الكشف عن معلومات محددة مثل وقت معالجة الإيداع والسحب والرسوم المرتبطة.