Resumo da empresa

| DORMAN TRADING Resumo da Revisão | |

| Fundação | 2000 |

| País/Região Registrada | Estados Unidos |

| Regulação | NFA (Não verificado) |

| Produto de Negociação | futuros |

| Negociação de Demonstração | ✅ |

| Plataforma de Negociação | Dorman Direct, ATAS, Barchart Trader, etc. |

| Suporte ao Cliente | Formulário de Contato |

| Tel: +1 800-552-7007 | |

| Fax: 312-341-7898 | |

| Endereço: 141 W. Jackson Blvd., Suite 1900 Chicago, IL 60604 | |

Informações sobre DORMAN TRADING

DORMAN TRADING é um corretor regulamentado, oferecendo negociação de futuros na Dorman Direct, ATAS, Barchart Trader, etc.

Prós e Contras

| Prós | Contras |

| / | Riscos de regulação não verificados |

| Produtos de negociação limitados | |

| Estrutura de taxas pouco clara | |

| Métodos de pagamento limitados |

DORMAN TRADING é Legítimo?

Sim. DORMAN TRADING é licenciado pela NFA com o número de licença 0264358 para oferecer serviços.

| País Regulamentado | Regulador | Status Atual | Entidade Regulamentada | Tipo de Licença | Número da Licença |

| Estados Unidos | NFA (National Futures Association) | Não verificado | DORMAN TRADING COMPANY 1 INC | Licença Comum de Serviços Financeiros | 0264358 |

O Que Posso Negociar na DORMAN TRADING?

DORMAN TRADING especializa-se em negociação de futuros.

| Produtos de Negociação | Suportado |

| Futuros | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

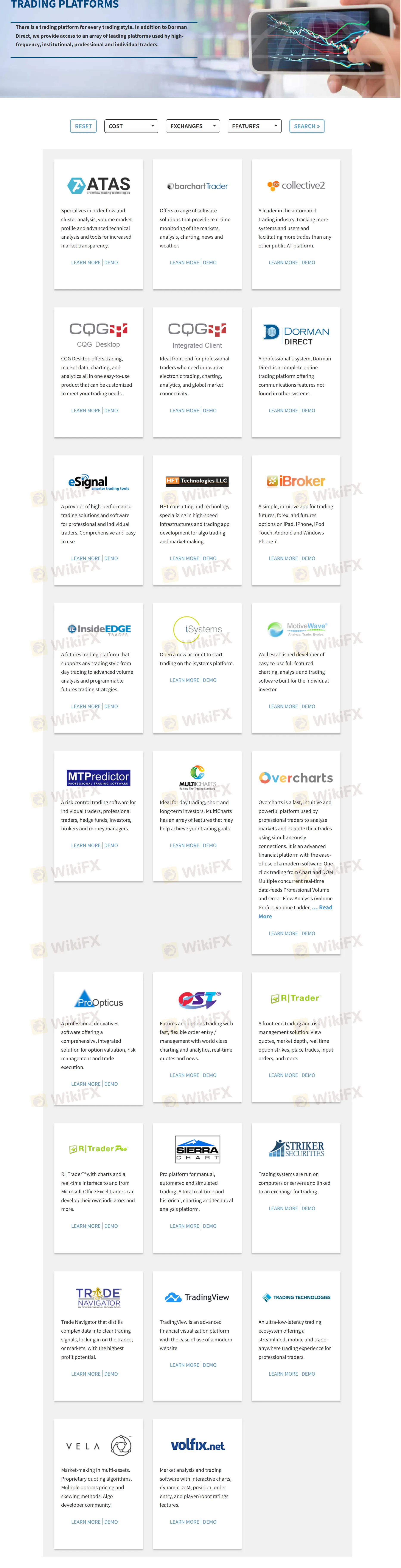

Plataforma de Negociação

| Plataforma de Negociação | Suportado |

| Dorman Direct | ✔ |

| ATAS | ✔ |

| Barchart Trader | ✔ |

| Collective2 | ✔ |

| CQG Desktop | ✔ |

| CQG Integrated Client | ✔ |

| eSignal | ✔ |

| HFT | ✔ |

| iBroker | ✔ |

| InsideEDGE Trader | ✔ |

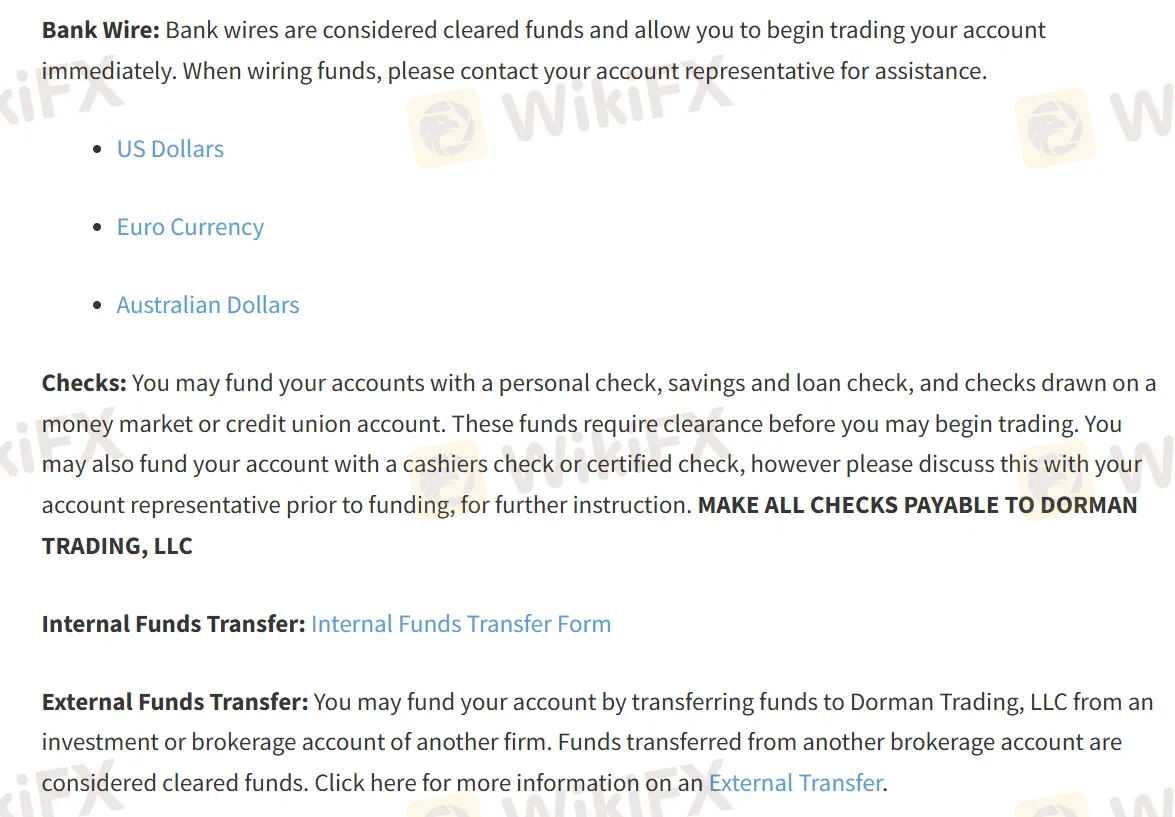

Depósito e Retirada

DORMAN TRADING aceita pagamentos via transferência bancária e cheques. No entanto, informações específicas como tempo de processamento de depósitos e retiradas e taxas associadas não são reveladas.