Présentation de l'entreprise

| ZLK Résumé de l'examen | |

| Fondé | 2013 |

| Pays/Région Enregistré | Pakistan |

| Régulation | Pas de régulation |

| Instruments de Marché | Actions, matières premières |

| Compte de Démo | ❌ |

| Plateforme de Trading | Trader Web, application mobile |

| Dépôt Minimum | / |

| Support Client | Formulaire de contact, Whatsapp |

| Portable : +92-321-5111288 | |

| Tél : +92 (51) 2894401-05 | |

| Email : info@zlksec.com | |

| Réseaux sociaux : Facebook, X, YouTube, LinkedIn | |

| Adresse : 412, Bourse de Islamabad, Islamabad | |

Informations sur ZLK

ZLK est un fournisseur de services non réglementé de premier plan en courtage et services financiers à la Bourse du Pakistan. Il propose des produits et services en courtage d'actions, compte digital Roshan, courtage de matières premières, recherche, trading en ligne, ouverture de compte digital en ligne.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Divers produits & services | Pas de comptes de démonstration |

| Divers canaux de contact | Pas de plateforme MT4/MT5 |

| Longue durée d'opération | Frais de commission facturés |

| Manque de transparence | |

| Manque de régulation |

ZLK est-il Légitime?

Le numéro ZLK n'a actuellement aucune réglementation valide. Veuillez être conscient du risque !

Que puis-je trader sur ZLK ?

| Actifs de trading | Pris en charge |

| Actions | ✔ |

| Matières premières | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

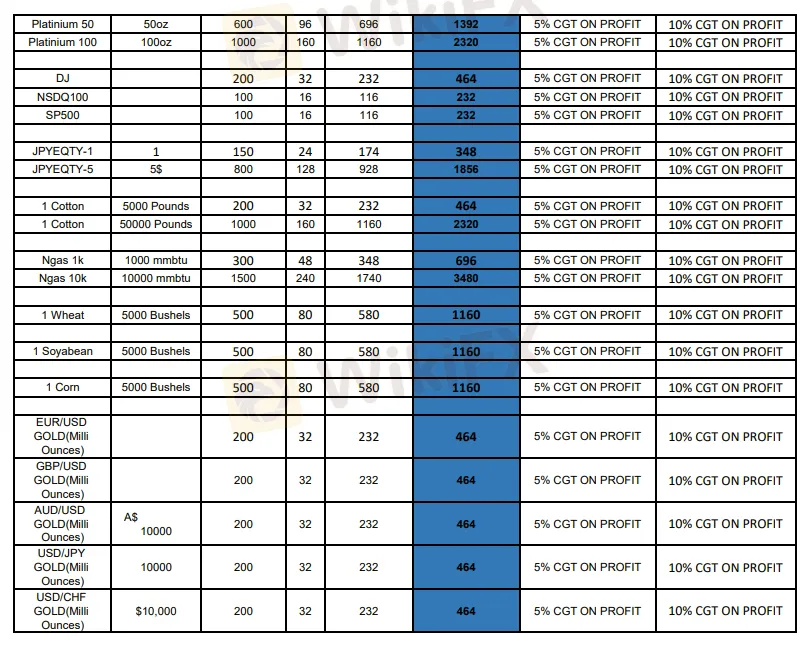

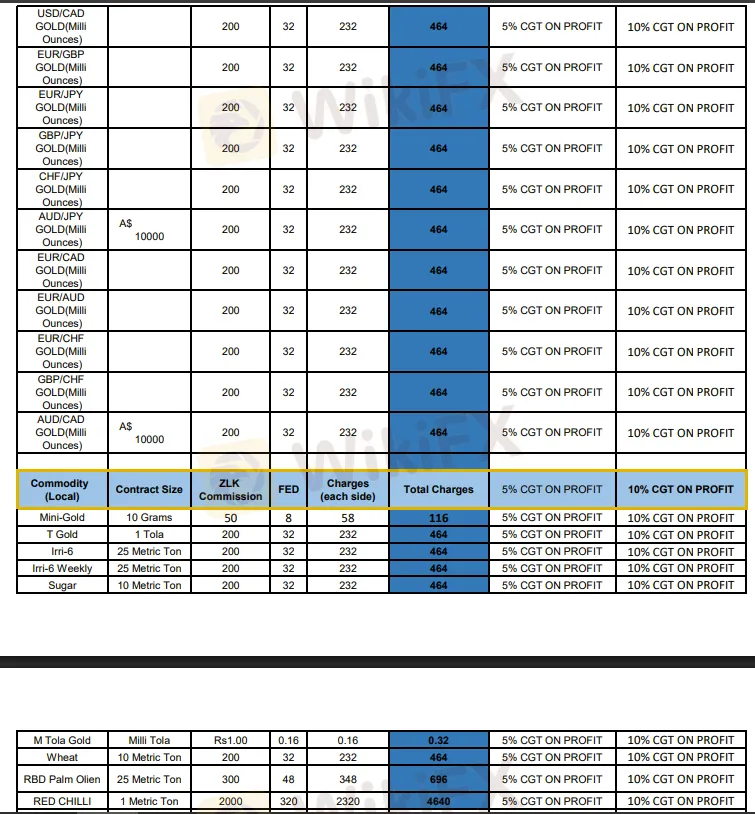

Frais ZLK

ZLK propose des options de commission flexibles, variant en fonction du type d'instruments de trading. Vous trouverez plus de détails dans les captures d'écran ci-dessous :

Plateforme de trading

ZLK utilise ses propres plateformes de trading disponibles sur le web, PC et appareils mobiles, et ne prend pas en charge les MT4 ou MT5 couramment utilisés.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Trader Web | ✔ | Bureau, web | / |

| Application mobile | ✔ | Mobile | / |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |