Resumo da empresa

| ZLK Resumo da Revisão | |

| Fundação | 2013 |

| País/Região Registrada | Paquistão |

| Regulação | Sem regulação |

| Instrumentos de Mercado | Ações, commodities |

| Conta Demo | ❌ |

| Plataforma de Negociação | Trader web, aplicativo móvel |

| Depósito Mínimo | / |

| Suporte ao Cliente | Formulário de contato, Whatsapp |

| Celular: +92-321-5111288 | |

| Tel: +92 (51) 2894401-05 | |

| Email: info@zlksec.com | |

| Redes sociais: Facebook, X, YouTube, LinkedIn | |

| Endereço: 412, Bolsa de Valores de Islamabad, Islamabad | |

Informações sobre ZLK

ZLK é um provedor de serviços não regulamentado de corretagem e serviços financeiros de primeira linha na Bolsa de Valores do Paquistão. Oferece produtos e serviços de corretagem de ações, conta digital Roshan, corretagem de commodities, pesquisa, negociação online, abertura de conta digital online.

Prós e Contras

| Prós | Contras |

| Vários produtos e serviços | Sem contas de demonstração |

| Vários canais de contato | Sem plataforma MT4/MT5 |

| Tempo de operação longo | Taxas de comissão cobradas |

| Falta de transparência | |

| Falta de regulação |

ZLK é Legítimo?

No. ZLK atualmente não possui regulamentações válidas. Por favor, esteja ciente do risco!

O que posso negociar na ZLK?

| Ativos de Negociação | Suportado |

| Ações | ✔ |

| Commodities | ✔ |

| Forex | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

Taxas da ZLK

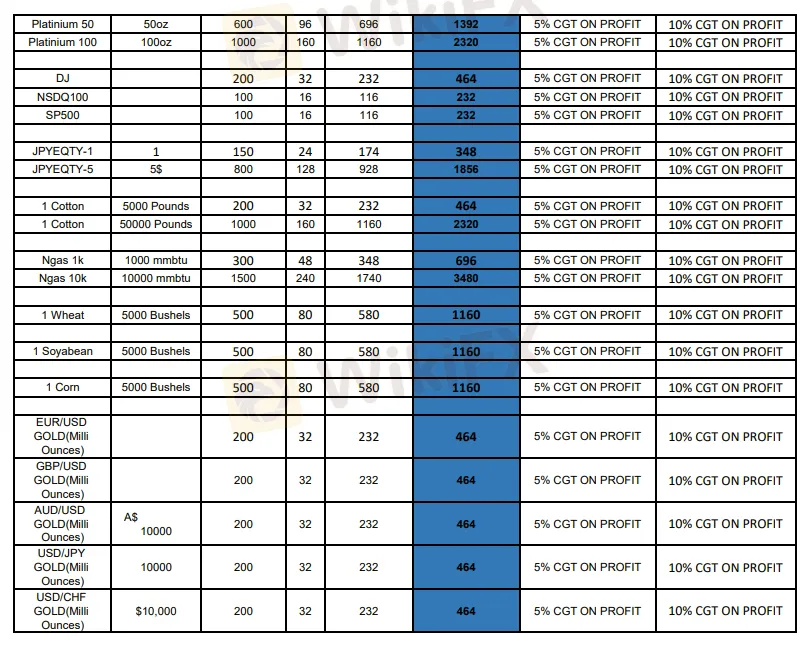

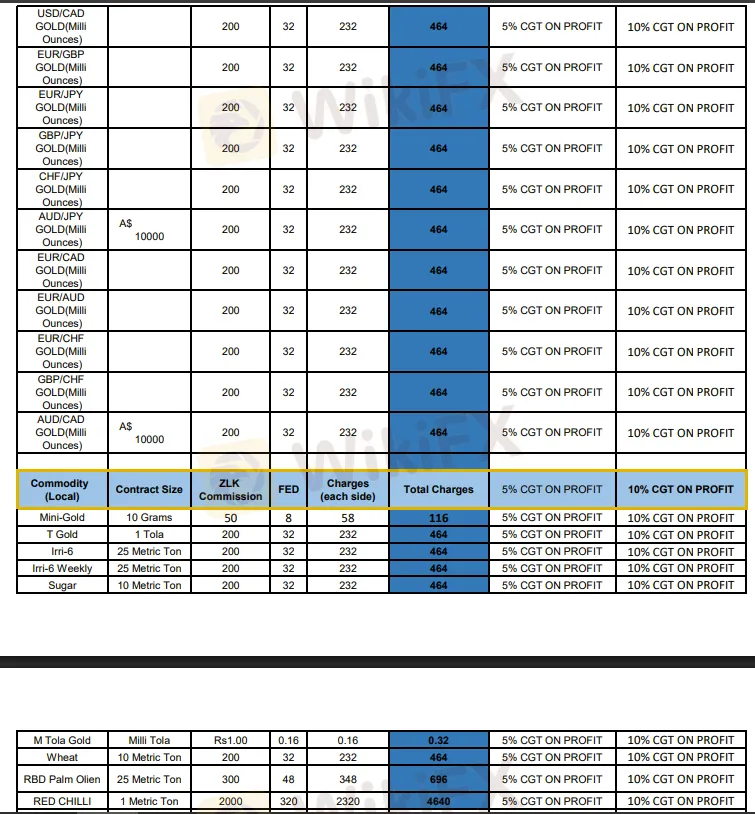

ZLK oferece opções de comissão flexíveis, variando de acordo com o tipo de instrumento de negociação. Mais detalhes podem ser encontrados nas capturas de tela abaixo:

Plataforma de Negociação

ZLK utiliza suas próprias plataformas de negociação que estão disponíveis na web, PC e dispositivos móveis, e não suporta o MT4 ou MT5 comumente utilizados.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Web Trader | ✔ | Desktop, web | / |

| Aplicativo Móvel | ✔ | Móvel | / |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |