Présentation de l'entreprise

| GFFM Résumé de l'examen | |

| Fondé | 1976 |

| Pays/Région d'enregistrement | Royaume-Uni |

| Régulation | FCA |

| Instruments de marché | Métaux, Énergie, Produits doux et Agriculture |

| Compte de démonstration | ❌ |

| Effet de levier | / |

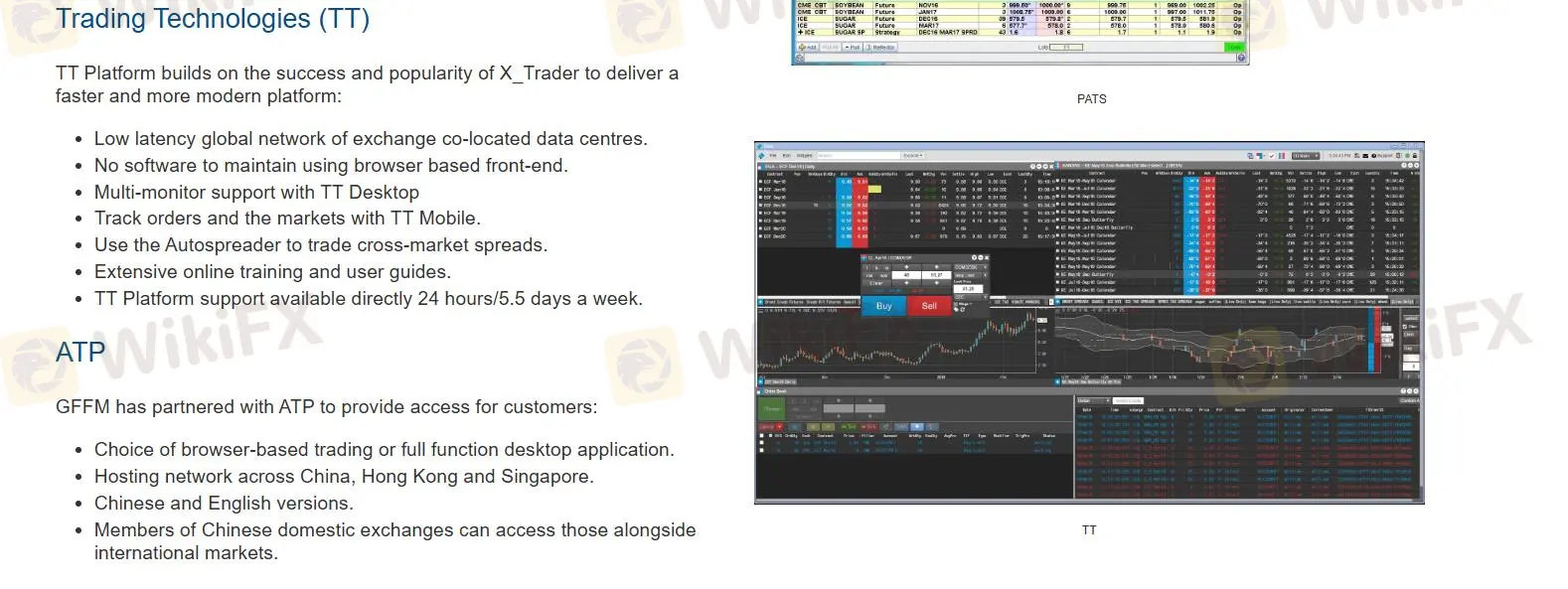

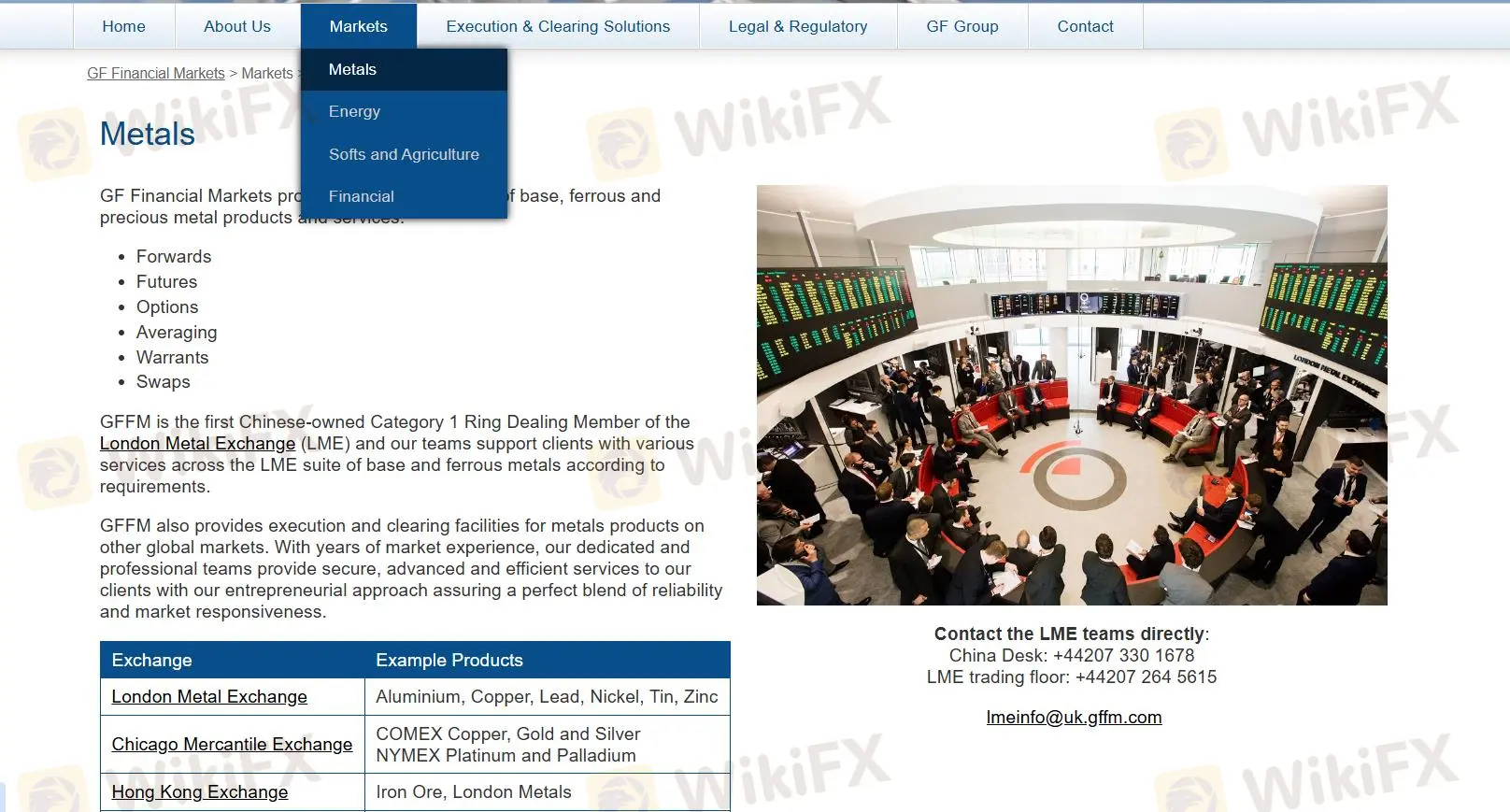

| Plateforme de trading | Patsystems (PATS), Trading Technologies (TT), ATP |

| Dépôt minimum | / |

| Assistance clientèle | Formulaire de contact |

| Tél : +44 (0) 20 7330 1688 | |

| Email : enquiries@uk.gffm.com | |

| Facebook : https://www.facebook.com/ftmarketsglobal | |

| Instagram : https://www.instagram.com/ftmarketsglobal/ | |

| Adresse physique : 1 Finsbury Square London EC2A 1AE ROYAUME-UNI | |

Fondée en 1976, GF Financial Markets (UK) Limited (GFFM) est un courtier en contrats à terme et en options qui propose des services de trading de métaux, d'énergie, de produits doux, de produits agricoles et d'instruments financiers. Il est réglementé par la Financial Conduct Authority (FCA) et offre l'accès à trois plateformes de trading : Patsystems (PATS), Trading Technologies (TT) et ATP.

Avantages et inconvénients

| Avantages | Inconvénients |

| Longue histoire d'activité | Pas de compte de démonstration |

| Réglementé par la FCA | Informations limitées sur les conditions de trading |

| Multiples plateformes de trading | Méthodes de paiement inconnues |

Est-ce que GFFM est légitime ?

GFFM est un courtier légal, détenteur d'une licence Institution Forex délivrée par la Financial Conduct Authority (FCA) avec le numéro de licence 114237.

| Pays réglementé | Autorité réglementée | Entité réglementée | Type de licence | Numéro de licence |

| Financial Conduct Authority (FCA) | GF Financial Markets (UK) Limited | Licence Institution Forex | 114237 |

Que puis-je trader sur GFFM ?

GFFM se concentre sur le trading de matières premières.

- Métaux : Métaux précieux et de base tels que l'or, l'argent et le platine.

- Énergie : Énergies populaires, comme le pétrole brut et le gaz naturel.

- Softs et Agriculture : Matières premières douces et produits agricoles, comme le café, le sucre et le blé.

| Instruments négociables | Pris en charge |

| Métaux | ✔ |

| Énergie | ✔ |

| Softs & Agriculture | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETF | ❌ |

Plateforme de trading

GFFM s'efforce de fournir à ses clients des plateformes polyvalentes et avancées. Celles-ci incluent Patsystems (PATS), Trading Technologies (TT) et ATP.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Patsystems (PATS) | ✔ | Web | / |

| Trading Technologies (TT) | ✔ | Web | / |

| ATP | ✔ | Web | / |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |