Unternehmensprofil

| GFFM Überprüfungszusammenfassung | |

| Gegründet | 1976 |

| Registriertes Land/Region | Vereinigtes Königreich |

| Regulierung | FCA |

| Handelsinstrumente | Metalle, Energie, Softs und Landwirtschaft |

| Demokonto | ❌ |

| Hebelwirkung | / |

| Handelsplattform | Patsystems (PATS), Trading Technologies (TT), ATP |

| Mindesteinzahlung | / |

| Kundensupport | Kontaktformular |

| Tel: +44 (0) 20 7330 1688 | |

| E-Mail: enquiries@uk.gffm.com | |

| Facebook: https://www.facebook.com/ftmarketsglobal | |

| Instagram: https://www.instagram.com/ftmarketsglobal/ | |

| Physische Adresse: 1 Finsbury Square London EC2A 1AE VEREINIGTES KÖNIGREICH | |

GF Financial Markets (UK) Limited (GFFM) wurde 1976 gegründet und ist ein Futures- und Optionsbroker, der Dienstleistungen im Handel mit Metallen, Energie, Soft Commodities, landwirtschaftlichen Produkten und Finanzinstrumenten anbietet. Es wird von der Financial Conduct Authority (FCA) reguliert und bietet Zugang zu drei Handelsplattformen: Patsystems (PATS), Trading Technologies (TT) und ATP.

Vor- und Nachteile

| Vorteile | Nachteile |

| Langjährige Betriebserfahrung | Keine Demokonten |

| Reguliert durch die FCA | Begrenzte Informationen zu Handelsbedingungen |

| Mehrere Handelsplattformen | Unbekannte Zahlungsmethoden |

Ist GFFM seriös?

GFFM ist ein legaler Broker und besitzt eine Institution Forex-Lizenz, die von der Financial Conduct Authority (FCA) mit der Lizenznummer 114237 ausgestellt wurde.

| Reguliertes Land | Regulierungsbehörde | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| Financial Conduct Authority (FCA) | GF Financial Markets (UK) Limited | Institution Forex-Lizenz | 114237 |

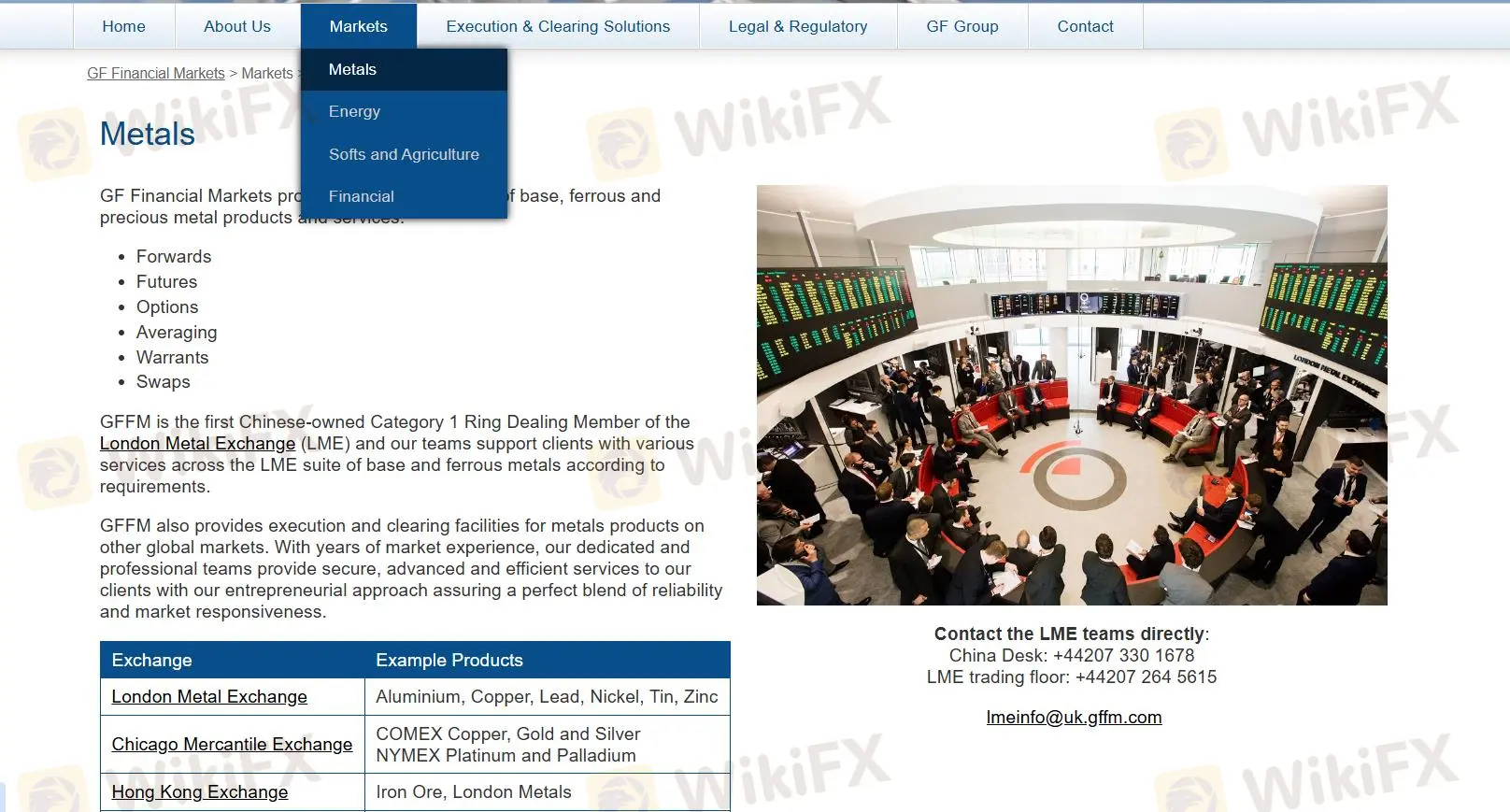

Was kann ich bei GFFM handeln?

GFFM konzentriert sich auf den Handel mit Rohstoffen.

- Metalle: Edelmetalle und Basismetalle wie Gold, Silber und Platin.

- Energie: Beliebte Energien wie Rohöl und Erdgas.

- Softs und Landwirtschaft: Soft Commodities und landwirtschaftliche Produkte wie Kaffee, Zucker und Weizen.

| Handelsinstrumente | Unterstützt |

| Metalle | ✔ |

| Energie | ✔ |

| Softs & Landwirtschaft | ✔ |

| Forex | ❌ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

Handelsplattform

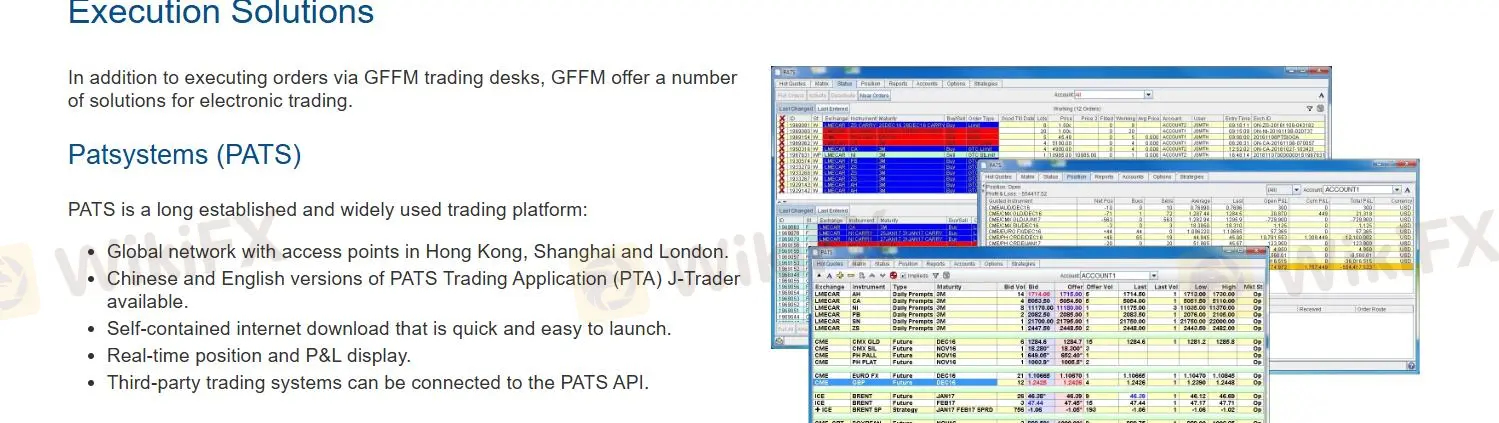

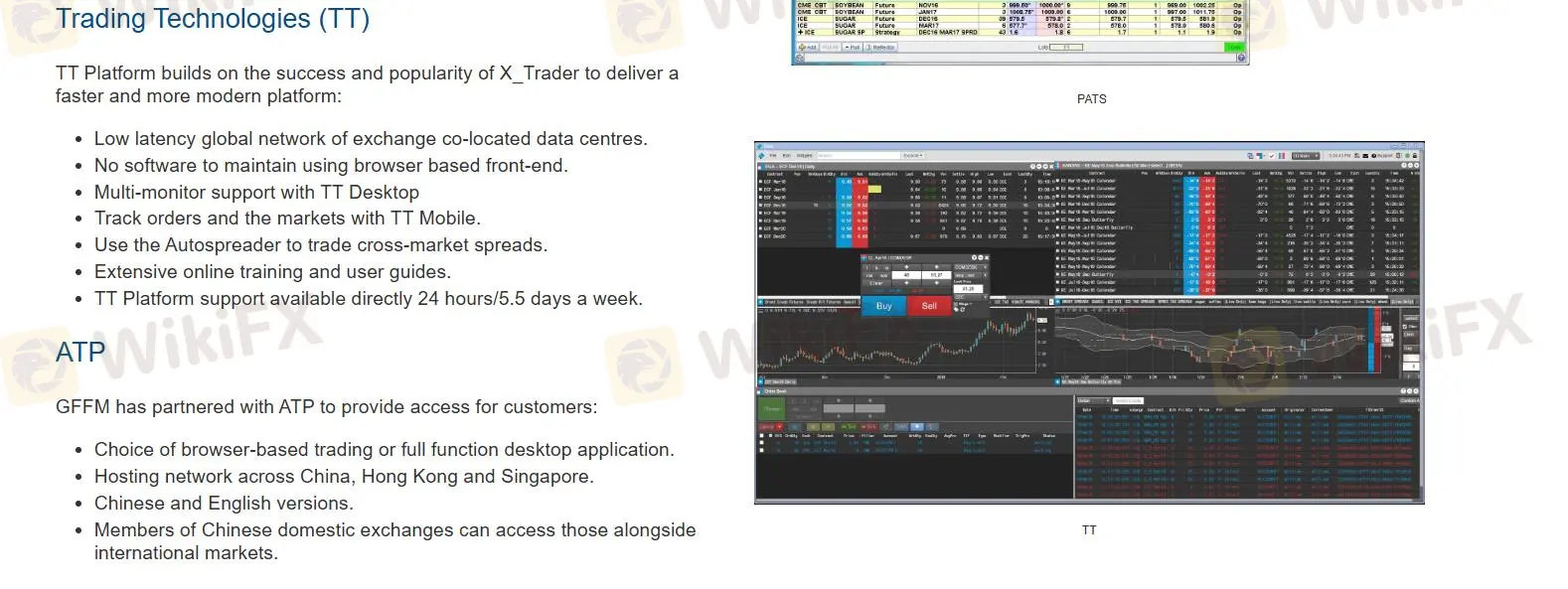

GFFM bemüht sich, seinen Kunden vielseitige und fortschrittliche Plattformen anzubieten. Dazu gehören Patsystems (PATS), Trading Technologies (TT) und ATP.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Patsystems (PATS) | ✔ | Web | / |

| Trading Technologies (TT) | ✔ | Web | / |

| ATP | ✔ | Web | / |

| MT4 | ❌ | / | Anfänger |

| MT5 | ❌ | / | Erfahrene Trader |