회사 소개

| GFFM 리뷰 요약 | |

| 설립 | 1976 |

| 등록 국가/지역 | 영국 |

| 규제 | FCA |

| 시장 상품 | 금속, 에너지, 소프트 상품 및 농산물 |

| 데모 계정 | ❌ |

| 레버리지 | / |

| 거래 플랫폼 | Patsystems (PATS), Trading Technologies (TT), ATP |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: +44 (0) 20 7330 1688 | |

| 이메일: enquiries@uk.gffm.com | |

| 페이스북: https://www.facebook.com/ftmarketsglobal | |

| 인스타그램: https://www.instagram.com/ftmarketsglobal/ | |

| 주소: 1 Finsbury Square London EC2A 1AE UNITED KINGDOM | |

1976년에 설립된 GF Financial Markets (UK) Limited (GFFM)은 금속, 에너지, 소프트 상품, 농산물 및 금융 상품 거래 서비스를 제공하는 선물 및 옵션 브로커입니다. 영국 금융감독청(FCA)의 규제를 받으며 Patsystems (PATS), Trading Technologies (TT), ATP 세 가지 거래 플랫폼에 접속할 수 있습니다.

장단점

| 장점 | 단점 |

| 긴 운영 역사 | 데모 계정 없음 |

| FCA 규제 | 거래 조건에 대한 제한된 정보 |

| 다양한 거래 플랫폼 | 알려지지 않은 결제 방법 |

GFFM이 신뢰할 만한가요?

GFFM은 영국 금융감독청(FCA)에서 발급한 기관 외환 라이선스(라이선스 번호: 114237)를 보유한 합법적인 브로커입니다.

| 규제 국가 | 규제 기관 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 영국 금융감독청(FCA) | GF Financial Markets (UK) Limited | 기관 외환 라이선스 | 114237 |

GFFM에서 무엇을 거래할 수 있나요?

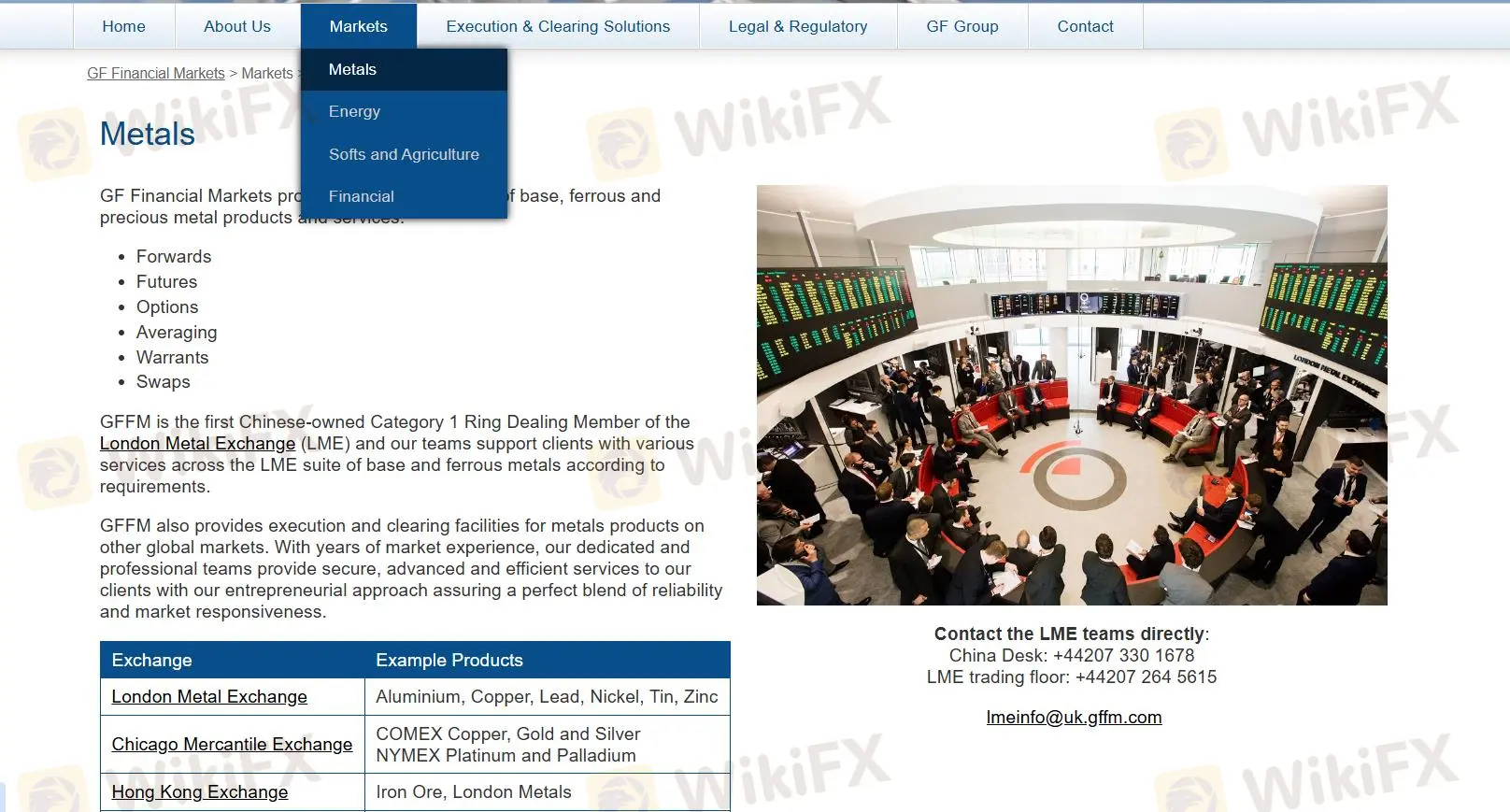

GFFM은 상품 거래에 초점을 맞추고 있습니다.

- 금속: 금, 은, 백금과 같은 귀금속 및 기초 금속.

- 에너지: 원유 및 천연가스와 같은 인기 있는 에너지.

- 소프트 및 농업: 커피, 설탕, 밀과 같은 소프트 상품 및 농산물.

| 거래 가능한 상품 | 지원 여부 |

| 금속 | ✔ |

| 에너지 | ✔ |

| 소프트 및 농업 | ✔ |

| 외환 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETF | ❌ |

거래 플랫폼

GFFM은 다양하고 고급스러운 플랫폼을 제공하기 위해 노력하고 있습니다. 이에는 Patsystems (PATS), Trading Technologies (TT), ATP 등이 포함됩니다.

| 거래 플랫폼 | 지원 여부 | 사용 가능한 장치 | 적합 대상 |

| Patsystems (PATS) | ✔ | 웹 | / |

| Trading Technologies (TT) | ✔ | 웹 | / |

| ATP | ✔ | 웹 | / |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |