Buod ng kumpanya

| I-Access Buod ng Pagsusuri | |

| Itinatag | 1999 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | Walang regulasyon |

| Mga Kasangkapan sa Merkado | Securities, Shares, Futures, Options |

| Demo Account | ✅ |

| Platform ng Paggawa ng Kalakalan | ISSNet |

| Suporta sa Customer | |

| Tel: 2890 8019 | |

| Fax: 2850 5786 | |

| Email: info@i-access.com | |

| Address: Tsim Sha Tsui Suite 801-3, 8th Floor, Ocean Centre, Harbour City | |

Impormasyon Tungkol sa I-Access

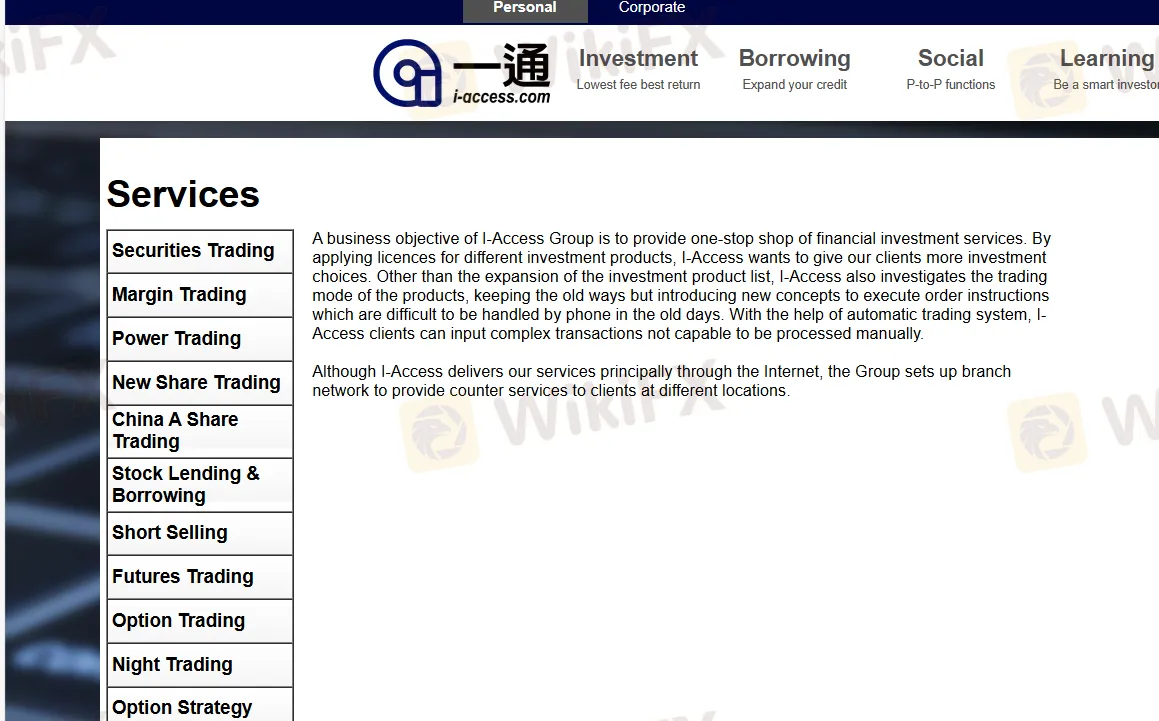

Ang I-Access ay isang hindi nairehistrong tagapagbigay ng pangunahing brokerage at serbisyong pinansyal, na itinatag sa Hong Kong noong 1999. Nag-aalok ito ng mga produkto at serbisyo para sa Securities Trading, Margin Trading, Power Trading, New Share Trading, China A Share Trading, Stock Lending & Borrowing, Short Selling, Futures Trading, Option Trading, Night Trading, Option Strategy, High Yield, Rollover, Bullion, Odd Lot Trading, Monthly Plan, eIPO, Online Bond Subscription, Realtime Quotation, Counter Services, Fund In/Out, at Borrowing.

Mga Kalamangan at Disadvantages

| Kalamangan | Kahinaan |

| Mahabang oras ng operasyon | Kawalan ng regulasyon |

| Iba't ibang mga produkto sa kalakalan | Singil sa komisyon |

| Mga demo account na magagamit |

Tunay ba ang I-Access?

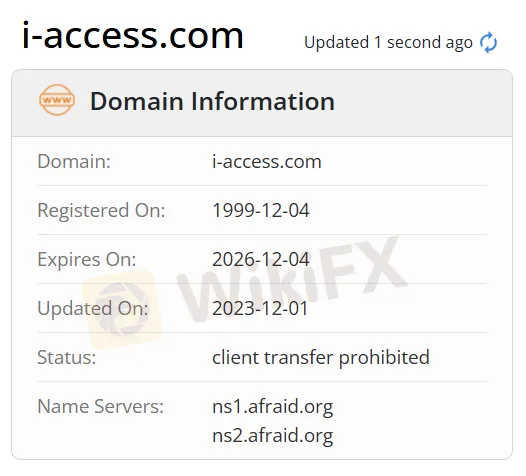

Hindi. Sa kasalukuyan, ang I-Access ay walang mga wastong regulasyon. Mangyaring maging maingat sa panganib! Bukod dito, ipinapakita ng status ng domain nito na ipinagbabawal ang paglipat ng kliyente.

Ano ang Maaari Kong Kalakalan sa I-Access?

| Mga Kasangkapan sa Kalakalan | Supported |

| Securities | ✔ |

| Shares | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

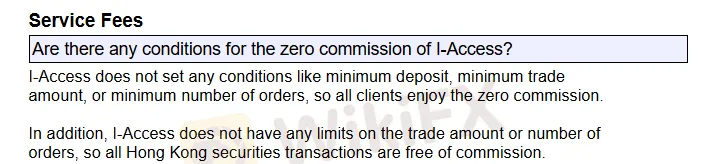

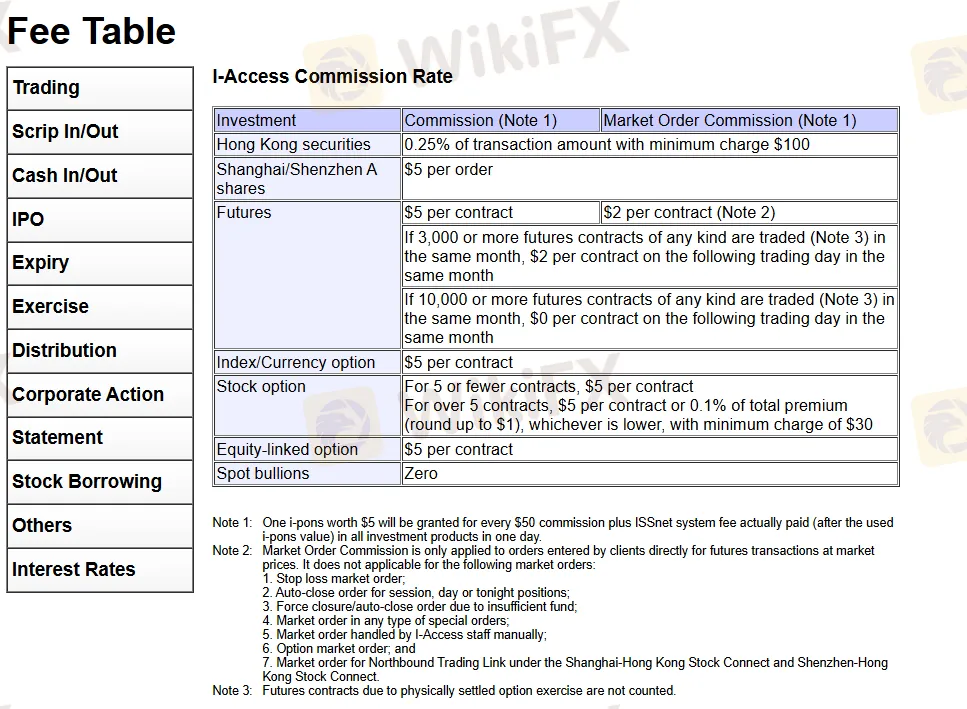

I-Access Fees

| Investment | Komisyon | Komisyon sa Market Order |

| Mga Securities sa Hong Kong | 0.25% ng halaga ng transaksyon na may minimum na singil na $100 | |

| Mga Ashares sa Shanghai/Shenzhen | $5 bawat order | |

| Mga Futures | $5 bawat kontrata | $2 bawat kontrata |

| Kung 3,000 o higit pang mga kontrata ng anumang uri ay na-trade sa parehong buwan, $2 bawat kontrata sa sumunod na araw ng kalakalan sa parehong buwan | ||

| Kung 10,000 o higit pang mga kontrata ng anumang uri ay na-trade sa parehong buwan, $0 bawat kontrata sa sumunod na araw ng kalakalan sa parehong buwan | ||

| Index/Currency option | $5 bawat kontrata | |

| Stock option | Para sa 5 o mas kaunting kontrata, $5 bawat kontrata. Para sa higit sa 5 kontrata, $5 bawat kontrata o 0.1% ng kabuuang premium (itataas sa $1), alinman ang mas mababa, na may minimum na singil na $30 | |

| Equity-linked option | $5 bawat kontrata | |

| Spot bullions | ❌ | |

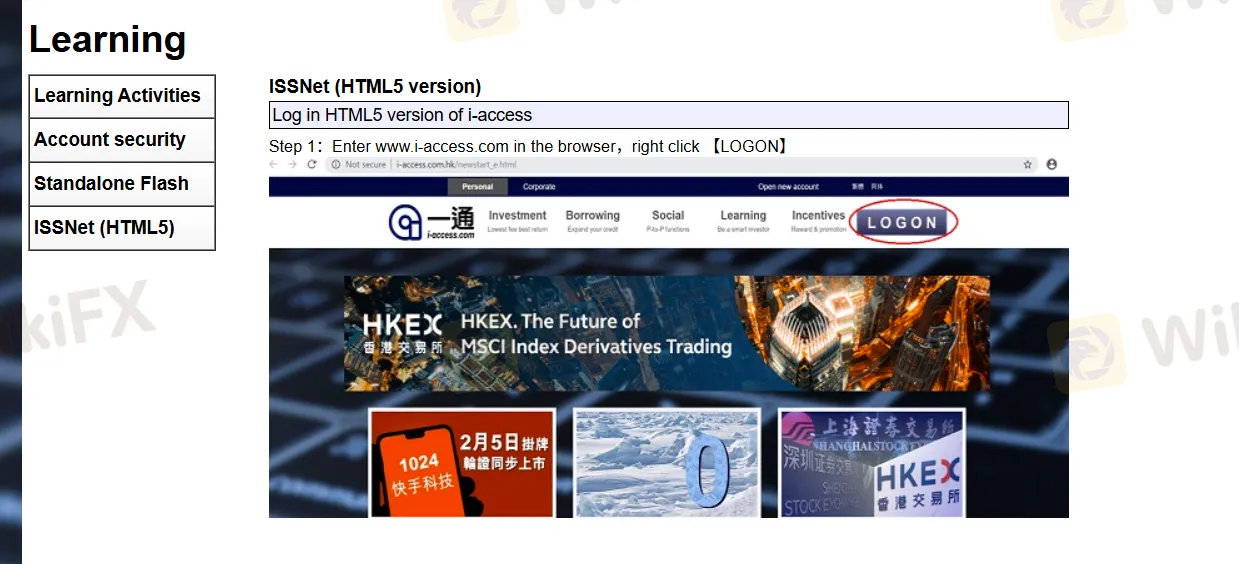

Plataforma ng Kalakalan

| Plataforma ng Kalakalan | Supported | Available Devices |

| ISSNet APP | ✔ | Mobile |

| ISSNet web | ✔ | PC, laptop, tablet |

Deposito at Pag-withdraw

Tungkol sa minimum na deposito, hindi nagtatakda ng anumang kondisyon si I-Access. Bukod dito, ang iba pang mga detalye tulad ng oras ng pagproseso, mga pagpipilian sa pagbabayad, at tinatanggap na mga currency, ay hindi malinaw.