Buod ng kumpanya

| NOMURA Buod ng Pagsusuri | |

| Itinatag | 1994 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

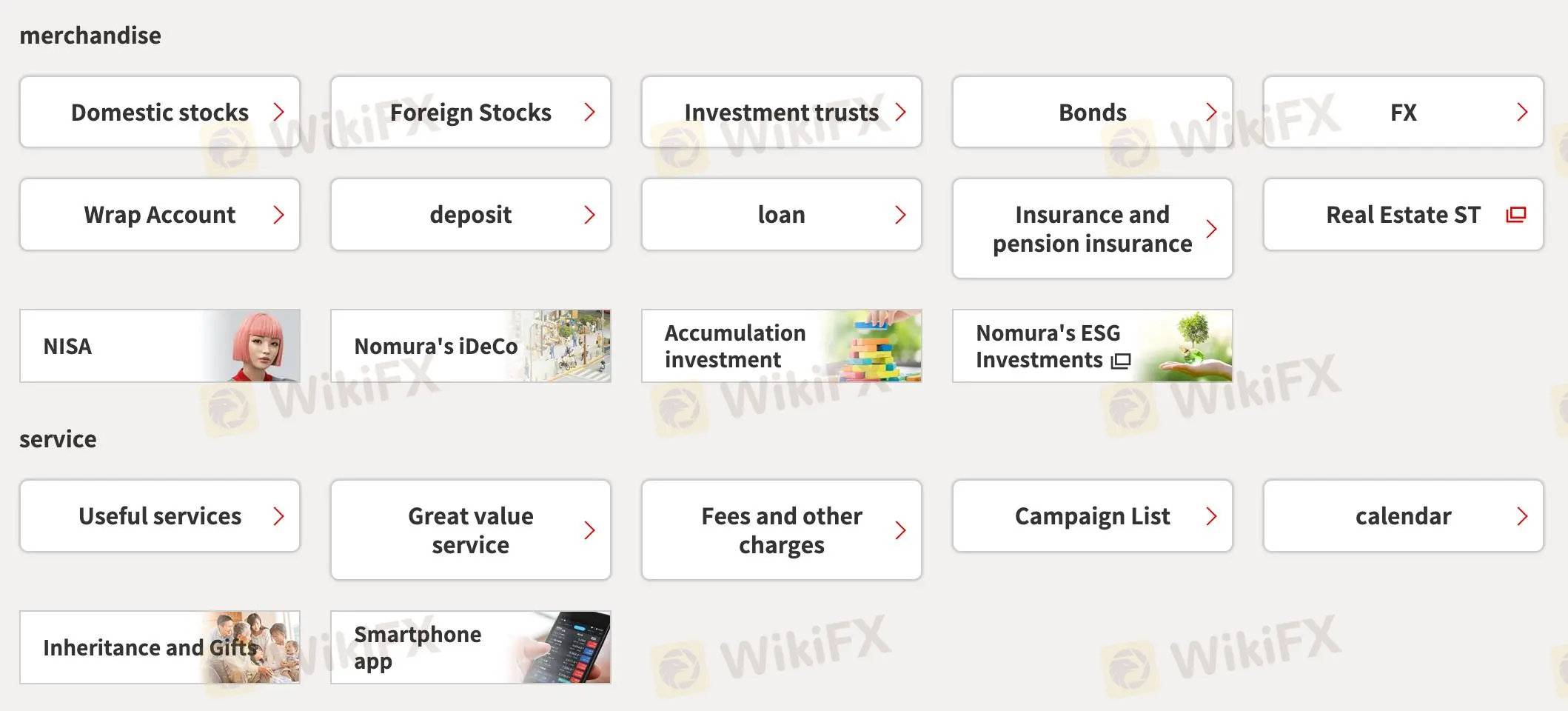

| Mga Instrumento sa Merkado | Domestic Stocks, Foreign Stocks, Investment Trusts, Bonds, FX, Real Estate ST |

| Demo Account | / |

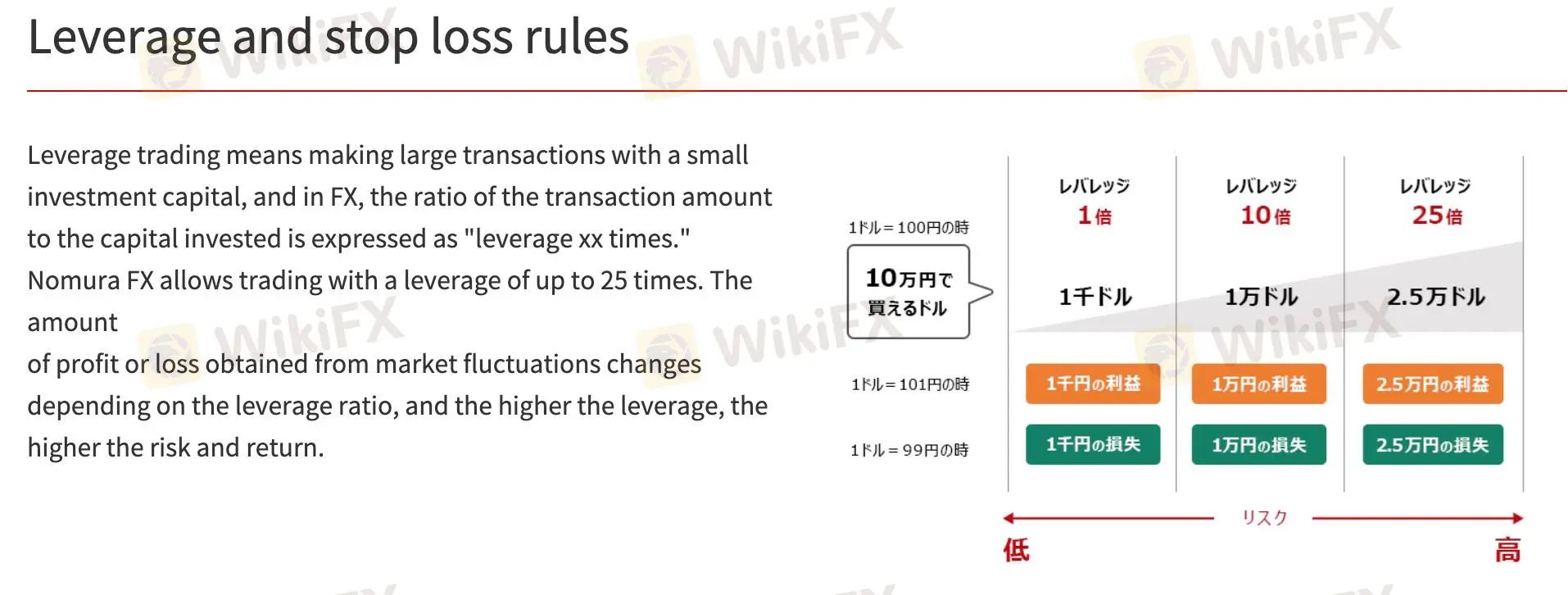

| Leverage | 1:25 |

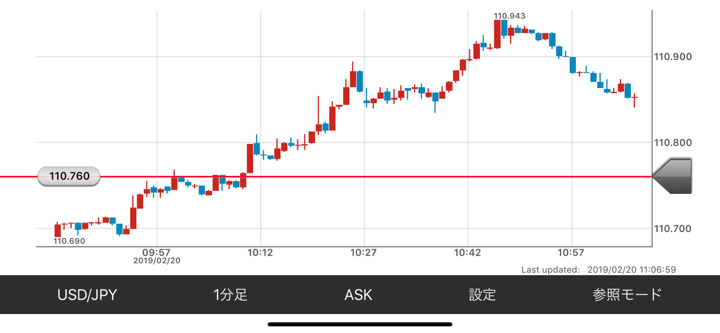

| Spread | USD/JPY: 2.8pips |

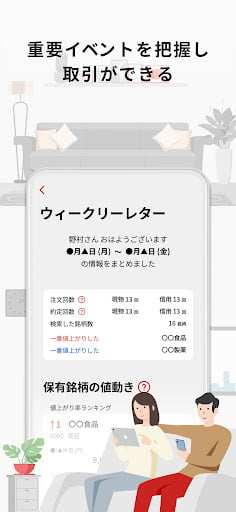

| Plataporma ng Pagkalakalan | Nomura Asset Management App (“NOMURA”), Asset Management App (“OneStock”), Nomura FX App |

| Min Deposit | / |

| Suporta sa Customer | - Pangkalahatan na Dial: 0570-077-000 |

| - Alternatibo: 042-303-8100 | |

NOMURA Impormasyon

Ang Nomura Securities ay nag-aalok ng mga equity, investment trust, FX trading, at structured real estate. Ang kanilang sopistikadong mga sistema ng pagkalakalan at mahigpit na kontrol sa regulasyon ay naglilingkod sa mga retail at institutional na kliyente. Ang istraktura ng gastos ng kumpanya ay nag-iiba depende sa channel ng serbisyo, kung saan ang mga rate sa mga sangay ay mas mataas kaysa sa online.

Mga Kalamangan at Disadvantage

| Mga Kalamangan | Mga Disadvantage |

| Regulasyon ng FSA | Mas mataas na bayad para sa mga transaksyon sa sangay |

| All-inclusive na mga app at plataporma ng pagkalakalan | Limitadong leverage kumpara sa mga katunggali |

| Maraming mga tradable na instrumento | Walang available na demo account |

Tunay ba ang NOMURA?

Oo, ang Nomura ay regulado. Sinusubaybayan ito ng FSA ng Hapon sa ilalim ng Retail Forex License. Ang numero ng lisensya ay 関東財務局長(金商)第142号, na may petsang epektibo noong 2007-09-30.

Mga Serbisyo at Produkto

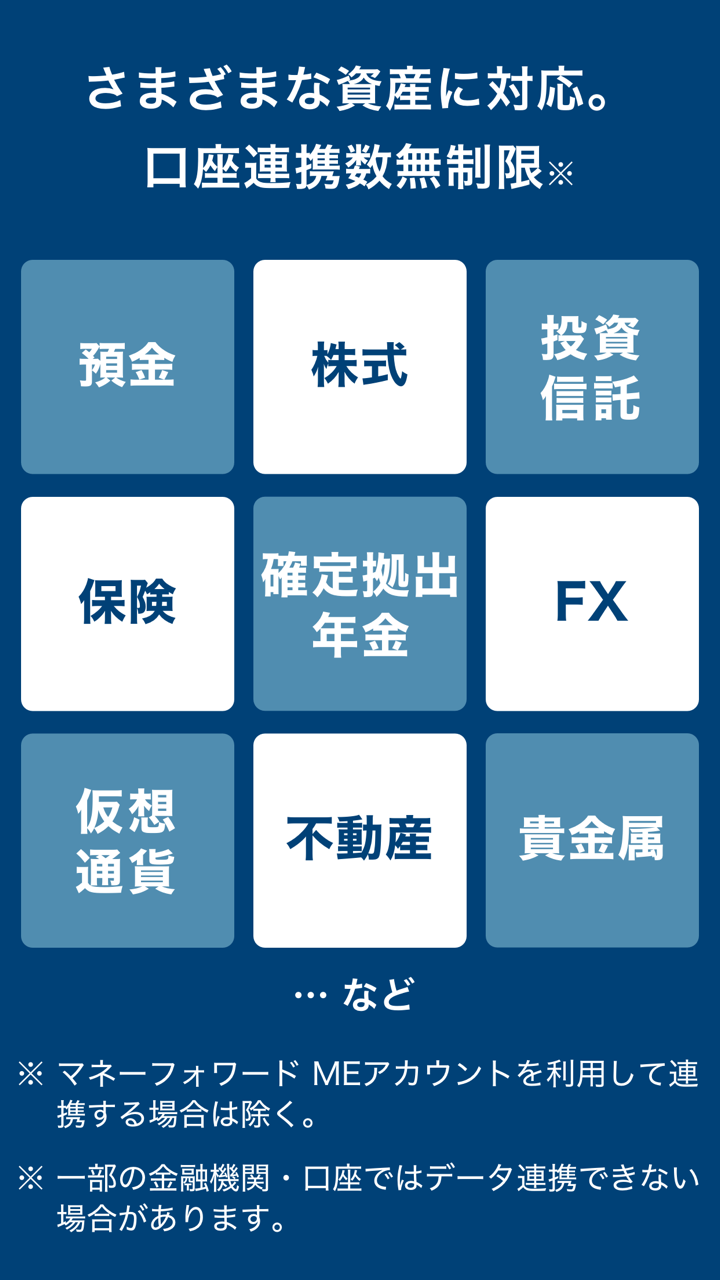

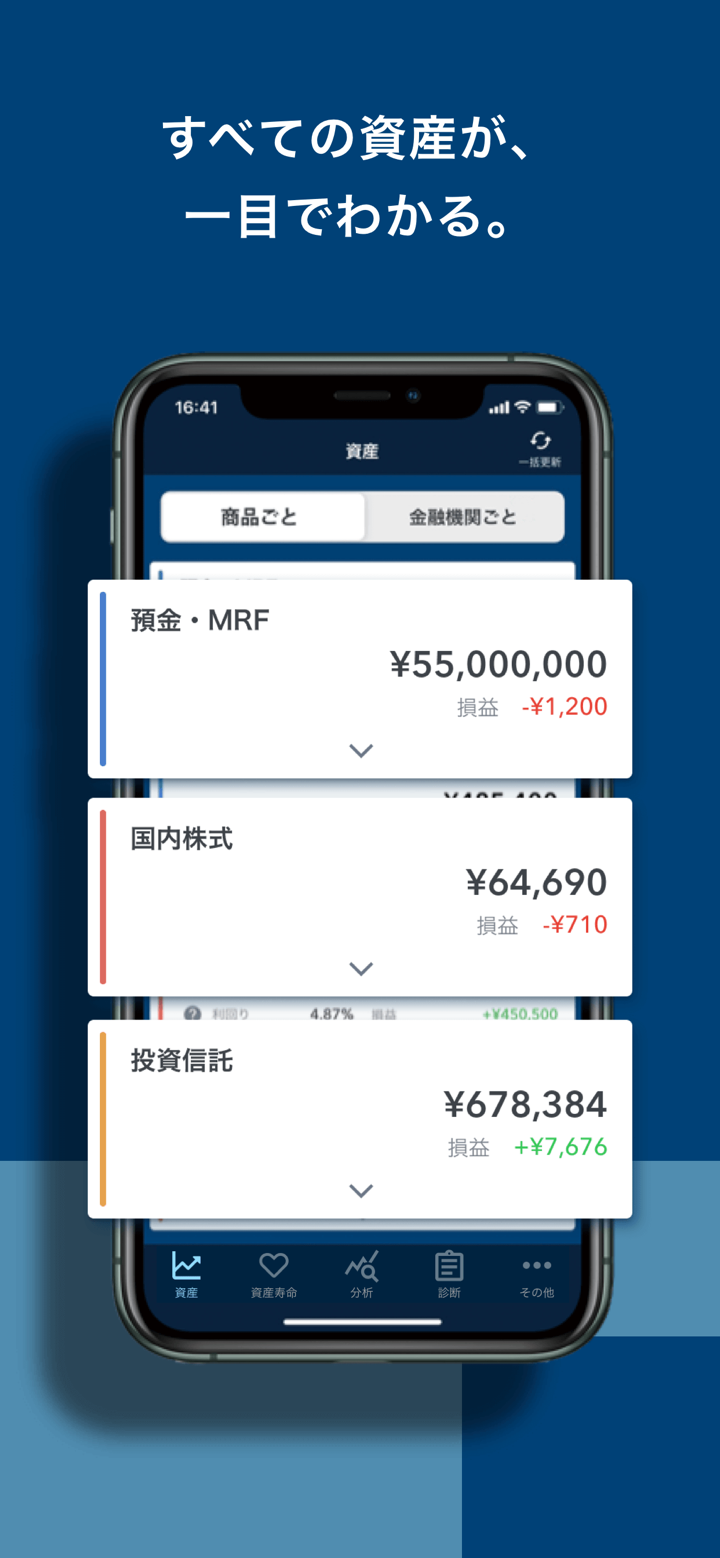

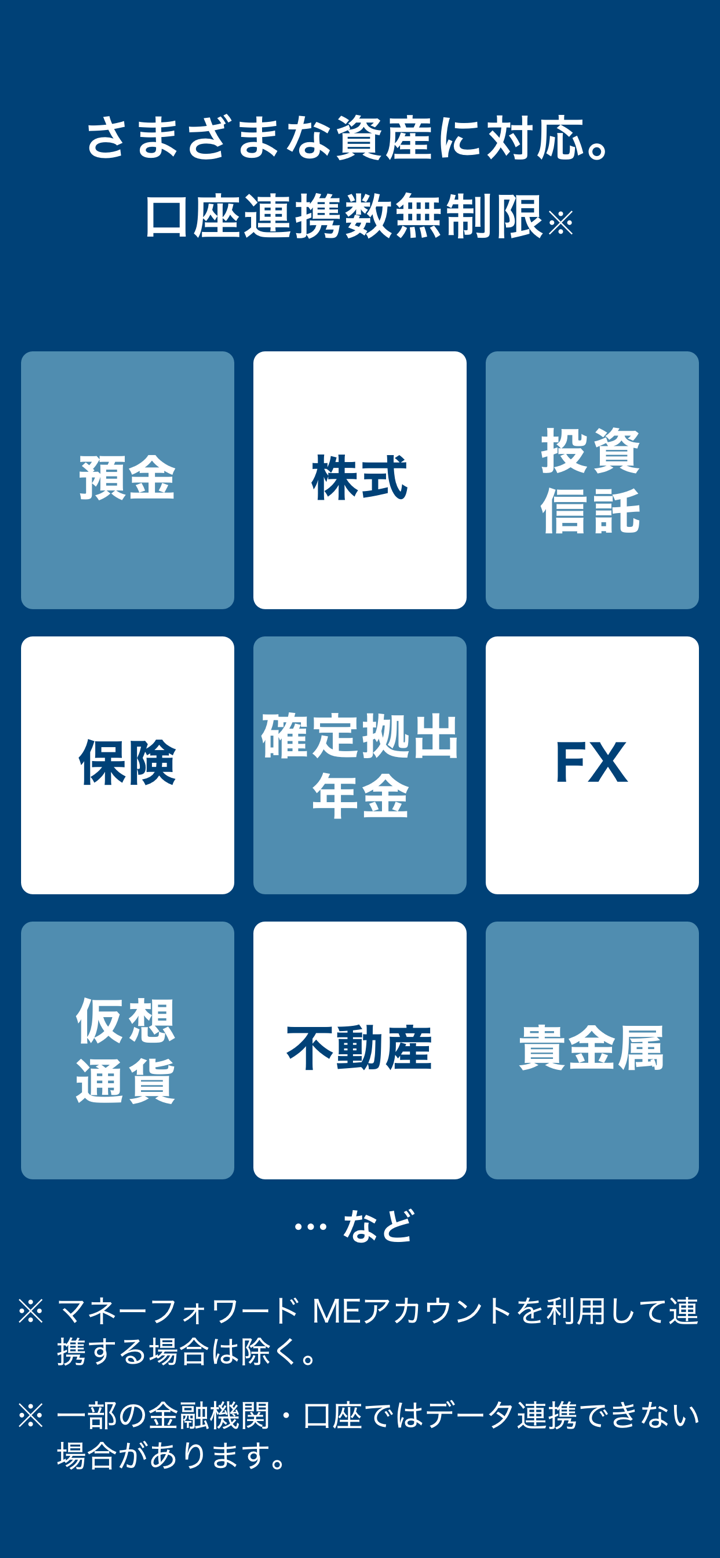

Ang broker ay nagbibigay ng lokal at dayuhang mga stocks, investment trusts, bonds, FX trading, at mga produkto ng seguro sa loob ng malawak na hanay ng mga produkto at serbisyo sa pananalapi. Nagbibigay sila ng mga serbisyong suporta kabilang ang mga kampanyang promosyon, paghahanda sa pamamana, at isang smartphone app.

| Mga Tradable na Instrumento | Supported |

| Domestic Stocks | ✔ |

| Foreign Stocks | ✔ |

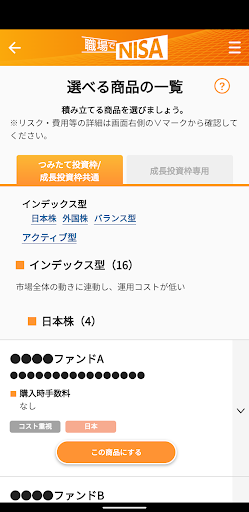

| Investment Trusts | ✔ |

| Bonds | ✔ |

| FX | ✔ |

| Real Estate Structured Products (ST) | ✔ |

| Commodities | ❌ |

| Crypto | ❌ |

| ETFs | ❌ |

Leverage

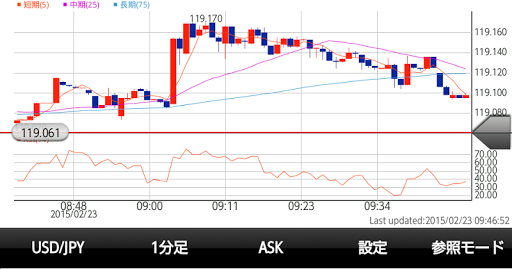

Ang Nomura FX ay nagbibigay-daan sa mga mangangalakal na magkaroon ng mas malalaking kalakalan gamit ang mas kaunting pera sa pamamagitan ng 25x leverage. Ang mataas na leverage ay nagpapataas ng kita ngunit nagpapataas din ng mga pagkalugi. Ang "loss cut rule," na awtomatikong nagsasara ng mga posisyon kapag ang "margin maintenance rate" ay bumaba sa 100%, ay nagpapababa ng panganib sa Nomura FX. Dapat mag-ingat ang mga mangangalakal dahil ang biglaang pagbabago sa merkado ay maaaring magdulot ng mga pagkalugi na mas malaki kaysa sa inilagak na pera, kahit na may mga stop-losses.

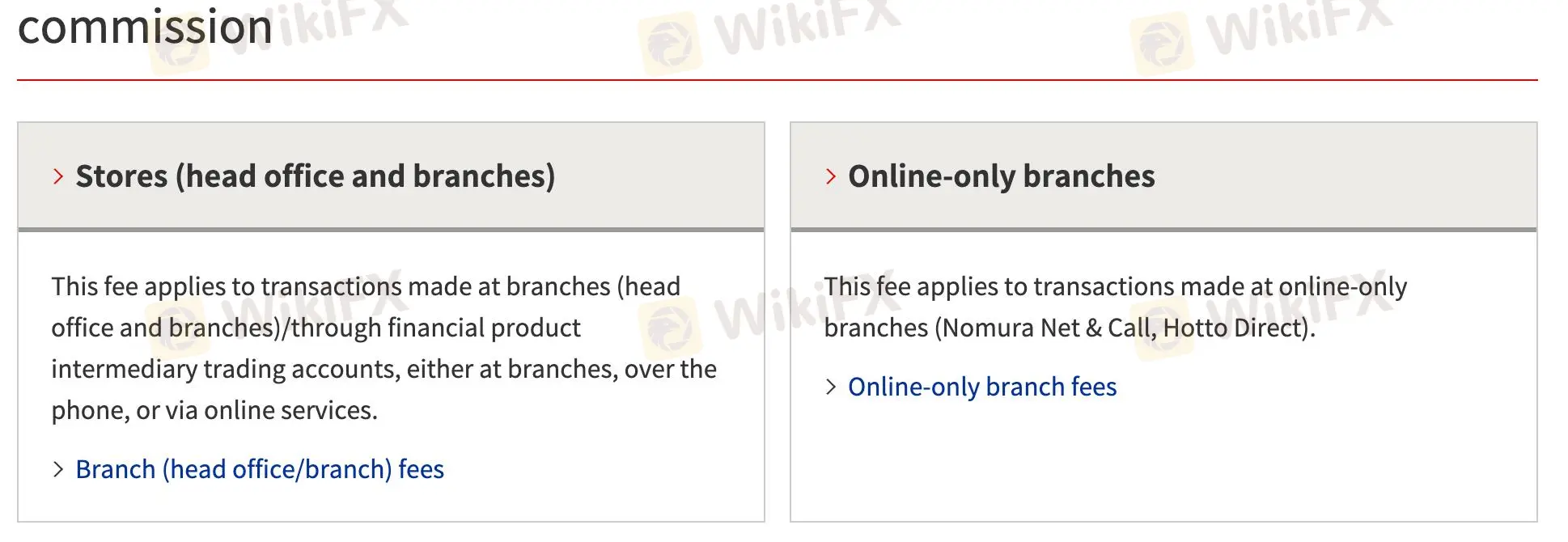

NOMURA Mga Bayad

Ang mga rate ng Nomura ay nag-iiba depende sa serbisyo, na may iba't ibang bayad para sa mga transaksyon sa sangay at online. Ang mga pisikal na sangay ay mas mahal ang bayad para sa pambansang stock trading kaysa sa mga online na account.

| Uri ng Bayad | Bayad |

| Paglipat ng mga shares sa ibang kumpanya (<20 units) | Batayang bayad: 550 yen + 550 yen/unit (minimum na 1,100 yen). |

| Paglipat ng mga shares sa ibang kumpanya (>20 units) | Uniform na bayad: 11,000 yen. |

| Karagdagang pagbili ng mga shares | 330 yen bawat stock. |

| Balanseng sertipiko o transaksyon | Libre para sa indibidwal na transaksyon; 1,000 yen para sa maramihang transaksyon bawat account. |

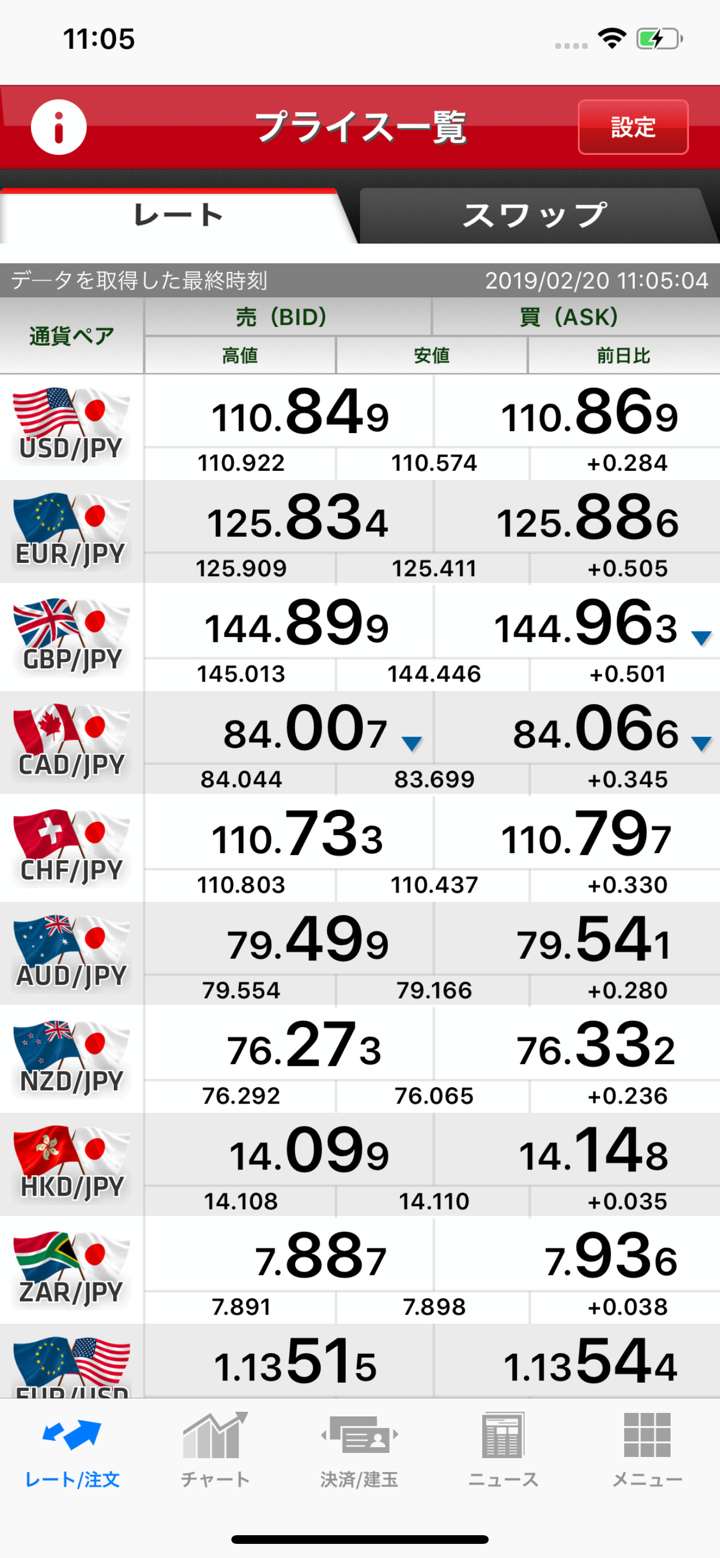

Walang Bayad sa Transaksyon: Ang Nomura FX ay hindi nagpapataw ng tuwirang bayad sa transaksyon ngunit kumikita mula sa mga spread.

Swap Rates: Maaaring kumita o magbayad ng mga swap points ang mga mangangalakal depende sa pagkakaiba ng interes rate sa pagitan ng mga pinagpapalitang currencies. Ang mga swap points ay nagbabago batay sa mga kondisyon ng merkado.

Currency Conversion: Para sa mga kalakalan ng hindi yen currency, maaaring magkaroon ng karagdagang spread para sa yen conversion.

| Pares ng Currency | Spread (pips) |

| USD/JPY | 2.8 |

| EUR/JPY | 5.3 |

| GBP/JPY | 6.9 |

| AUD/JPY | 4.9 |

| EUR/USD | 2.9 |

Plataporma ng Kalakalan

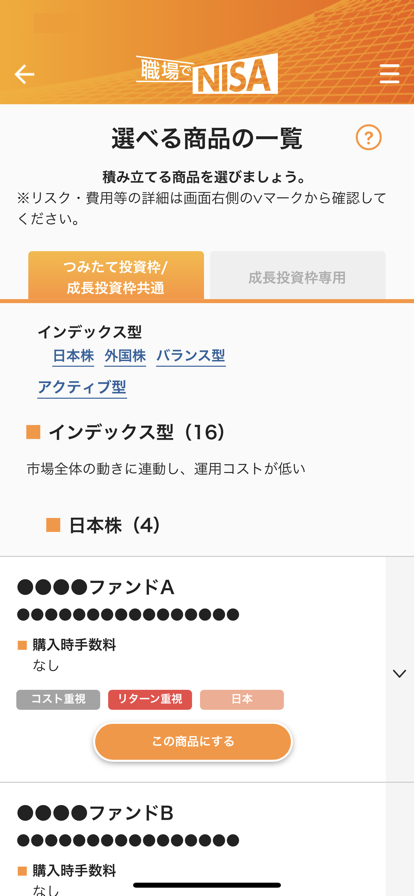

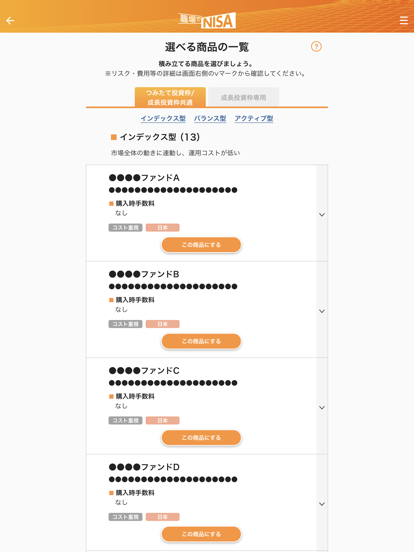

| Plataporma ng Kalakalan | Supported | Available Devices | Suitable for What Kind of Traders |

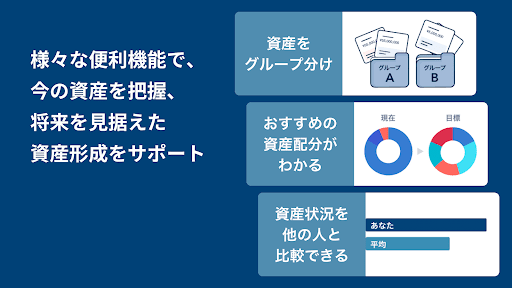

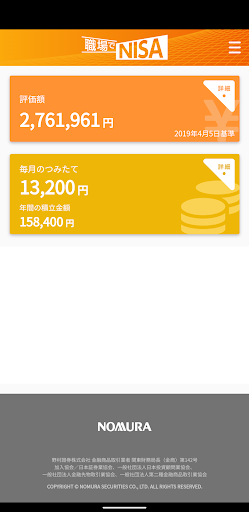

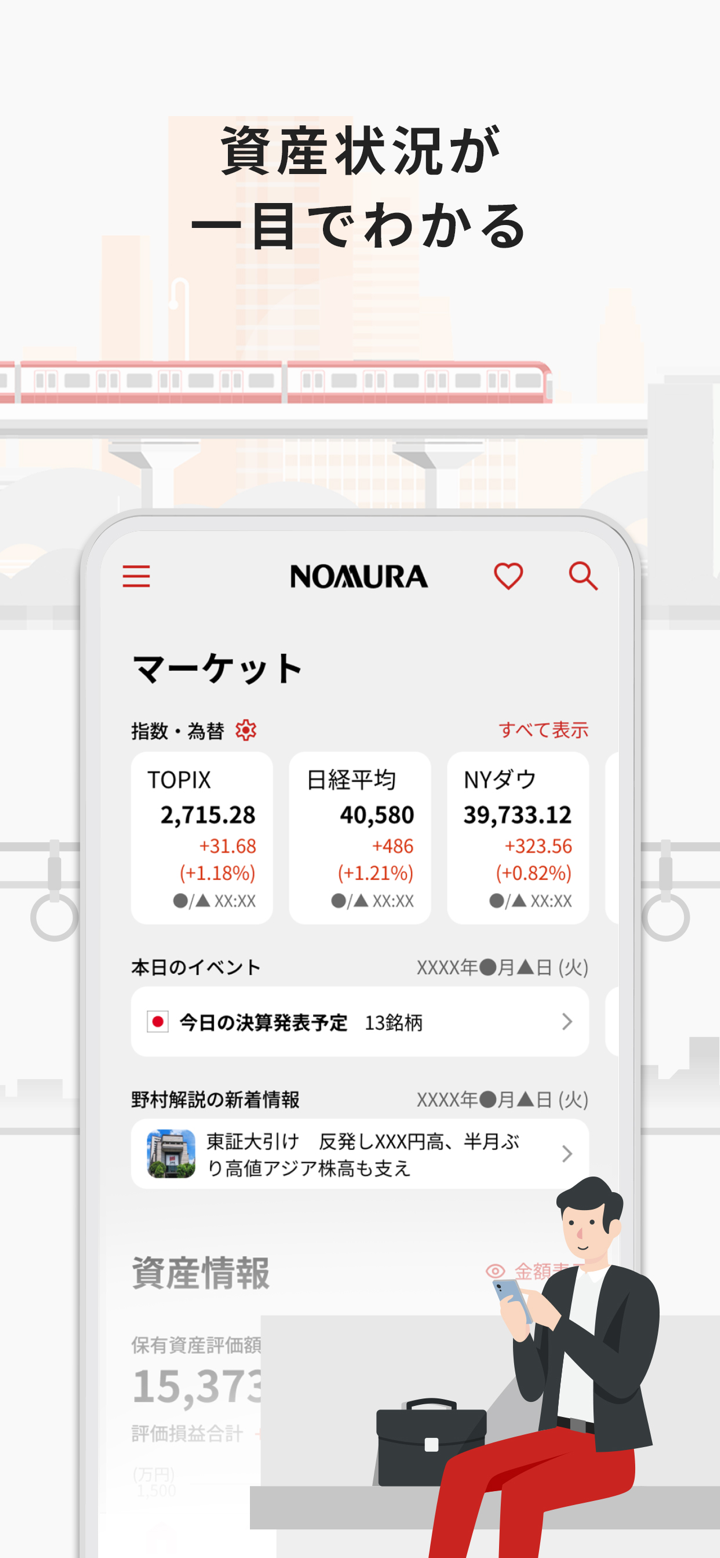

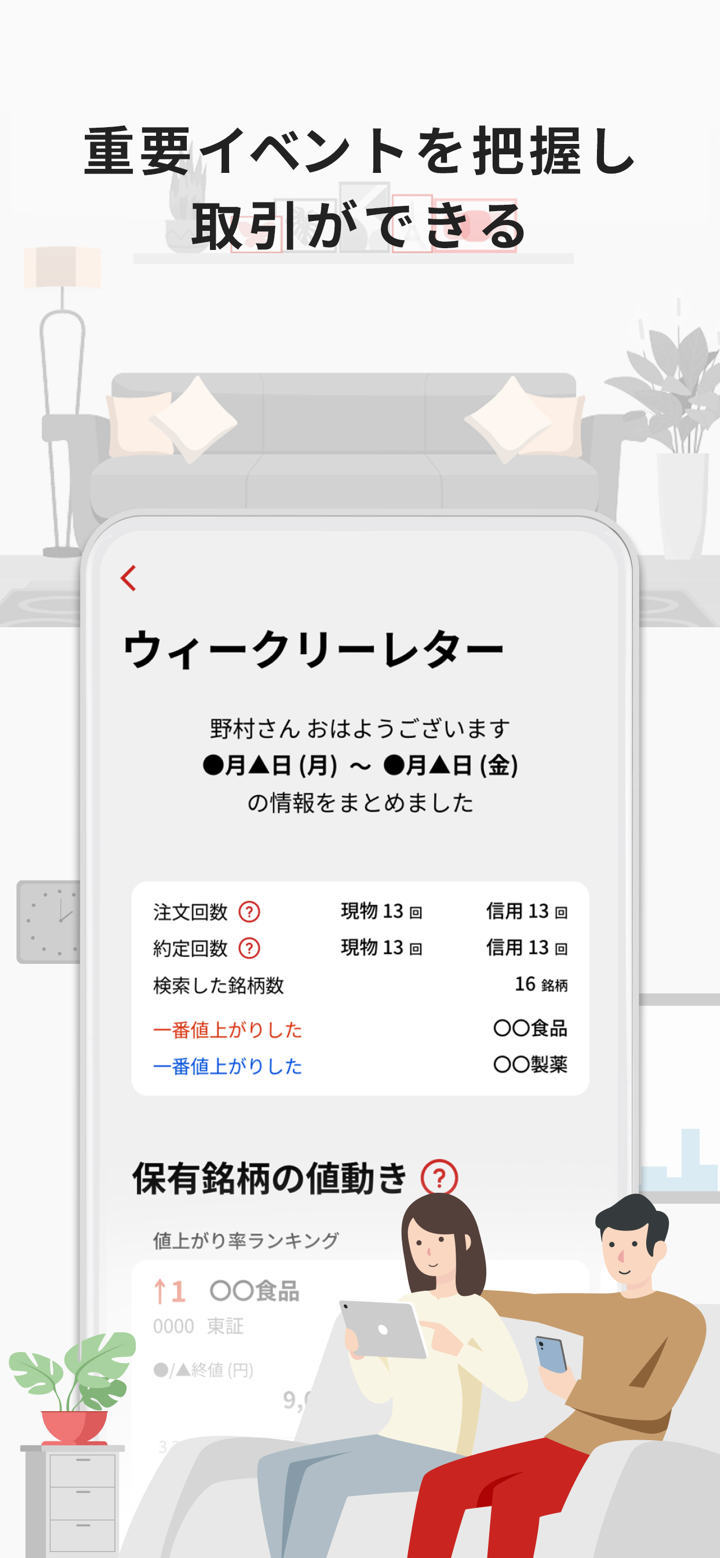

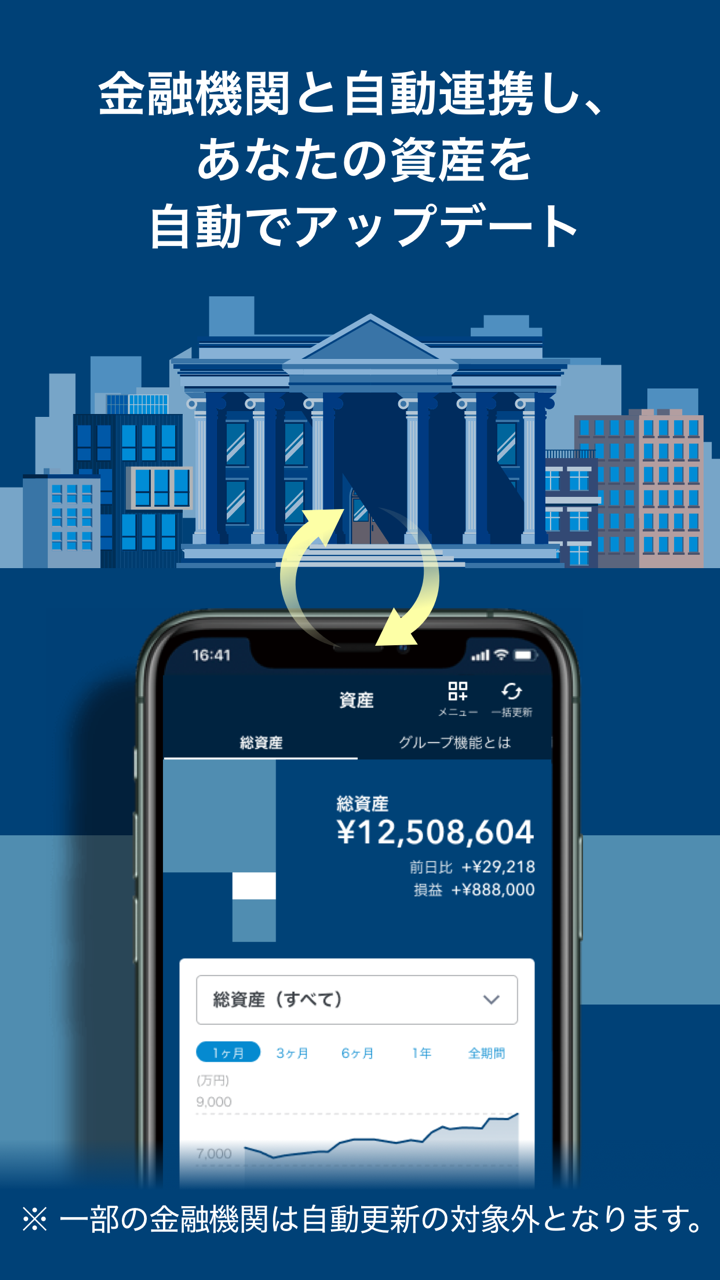

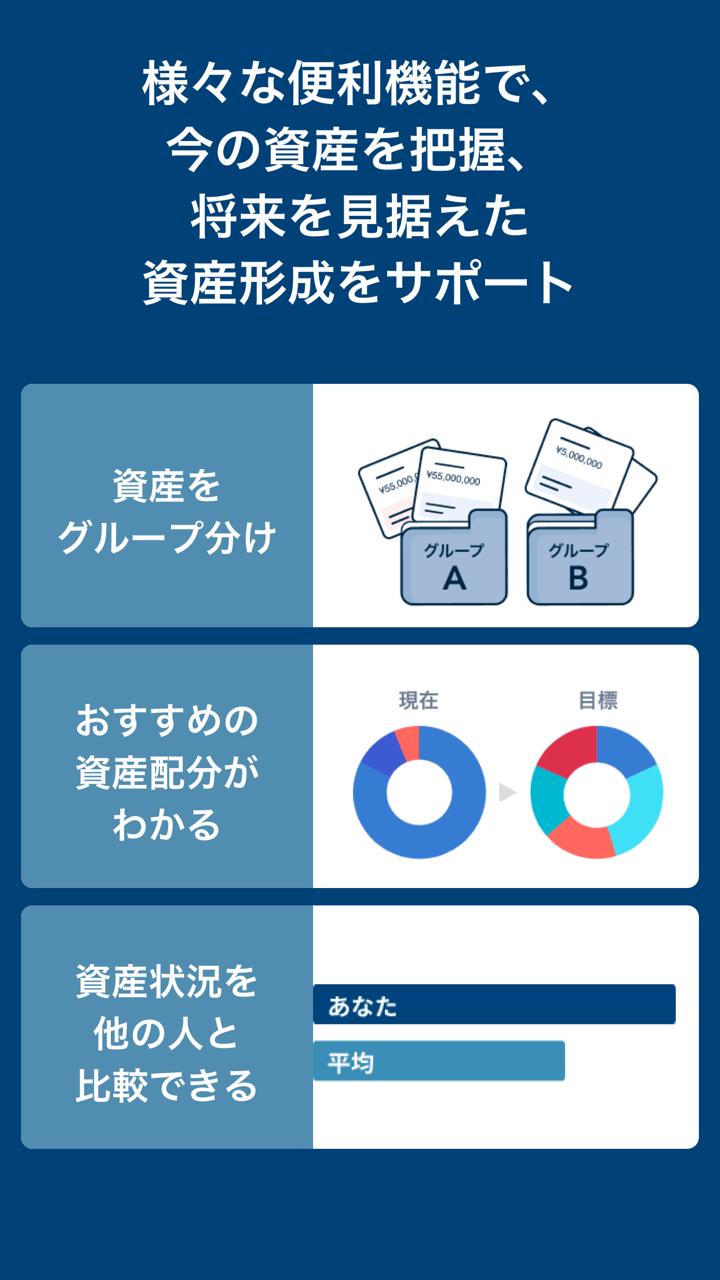

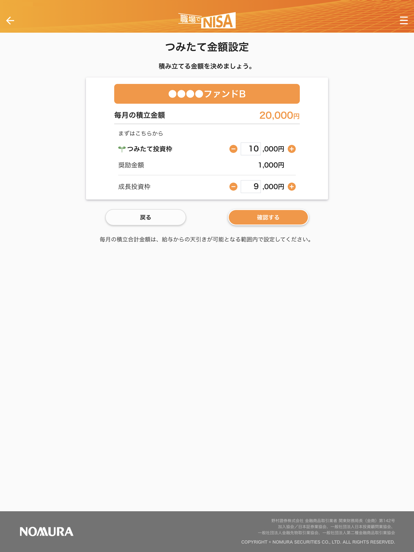

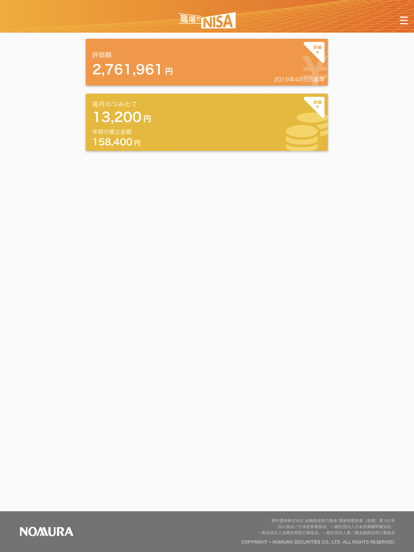

| Nomura Asset Management App "NOMURA" | ✔ | iPhone, Android | Mga mangangalakal at mga mamumuhunan na namamahala ng maraming financial assets at naghahanap ng mga personalisadong kagamitan sa kalakalan. |

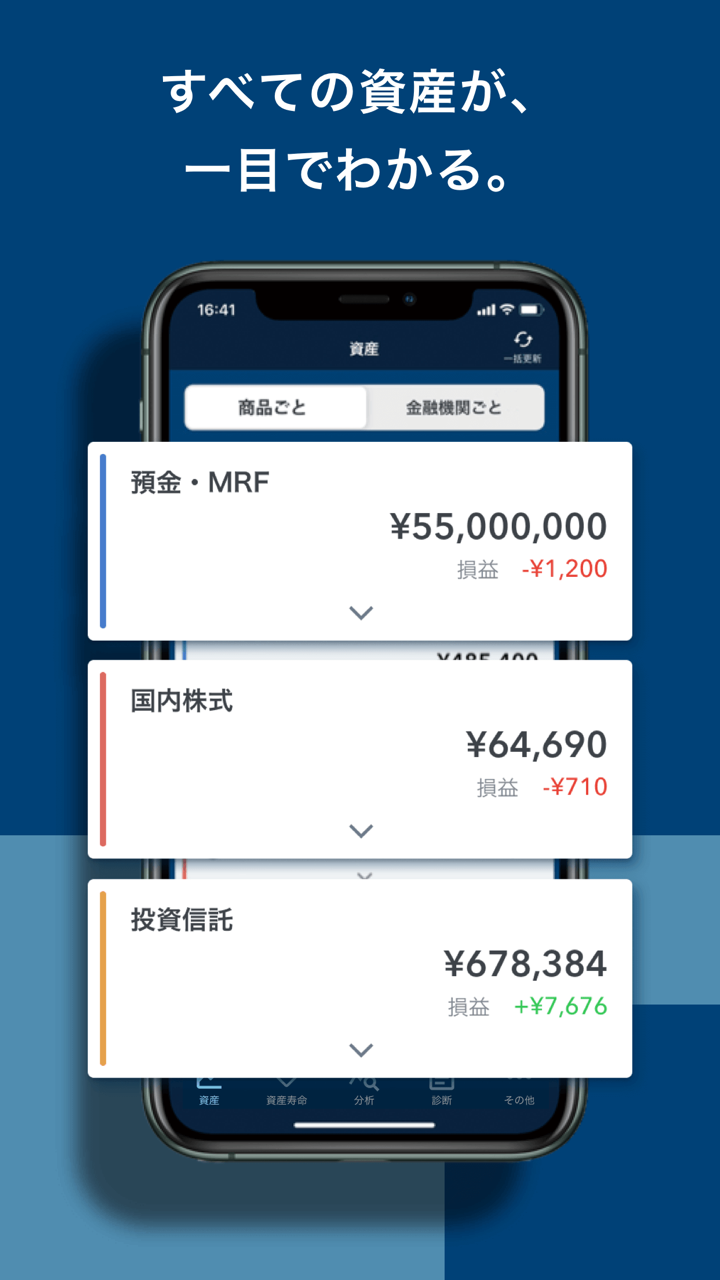

| Asset Management App "OneStock" | ✔ | iPhone, Android | Mga mamumuhunan na nais ng pangkalahatang-ideya ng kanilang mga assets, na may karagdagang mga tampok tulad ng asset diagnosis. |

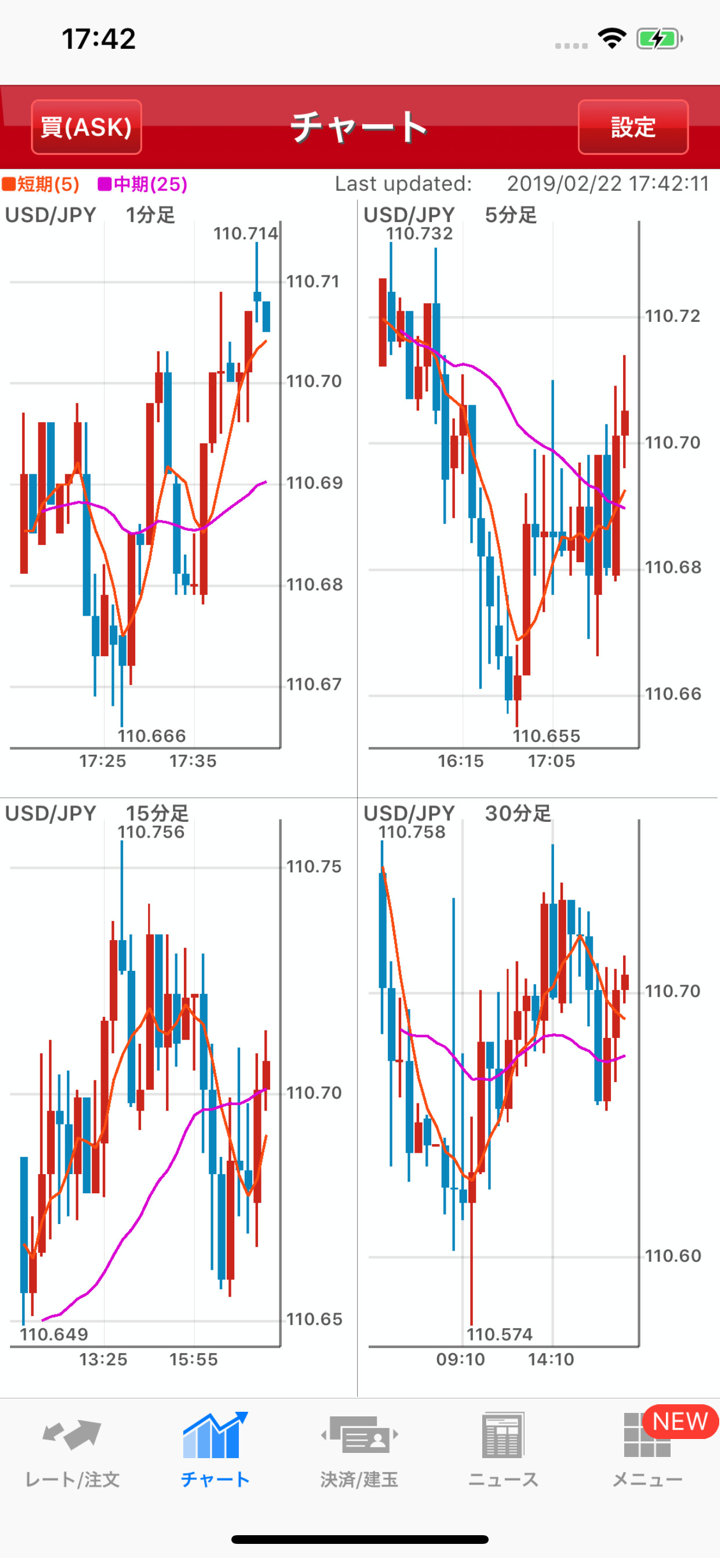

| Nomura FX App | ✔ | iPhone, Android | Mga mangangalakal ng FX na mas gusto ang kalakalan sa mobile devices na may intuitibo at nakatuon na mga operasyon. |