Company Summary

| KOSEI SECURITIES Review Summary | |

| Founded | 1997 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading Products | Stocks, Bonds, Investment Trusts, ETFs/REITs, Futures, Options, and Insurance/iDeco |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Tel: 0120-06-8617 |

| Address: 2-1-10 Kitahama, Chuo-ku, Osaka | |

KOSEI SECURITIES Information

The headquarters of Kosei Securities is located in Kitahama, Chuo-ku, Osaka City. Its business covers securities trading, investment trusts, futures and options, life insurance agency, etc., while also providing special services such as specific accounts (simplified tax filing) and NISA accounts (tax exemption for small-scale investments).

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Complex commission structure |

| Fund safety guarantee | Insufficient English support (primarily in Japanese) |

| Combination of online and offline | |

| Long operational history | |

| Various trading products | |

| Transparent fee info |

Is KOSEI SECURITIES Legit?

Kosei Securities is listed on the Tokyo Stock Exchange and regulatedby the Financial Services Agency (FSA) of Japan. With a license number of 近畿財務局長(金商)第14号, it is a legally registered securities company.

| Regulated Authority | Current Status | Regulated Country | Licensed Entity | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | Japan | 光世証券株式会社 | Retail Forex License | 近畿財務局長(金商)第14号 |

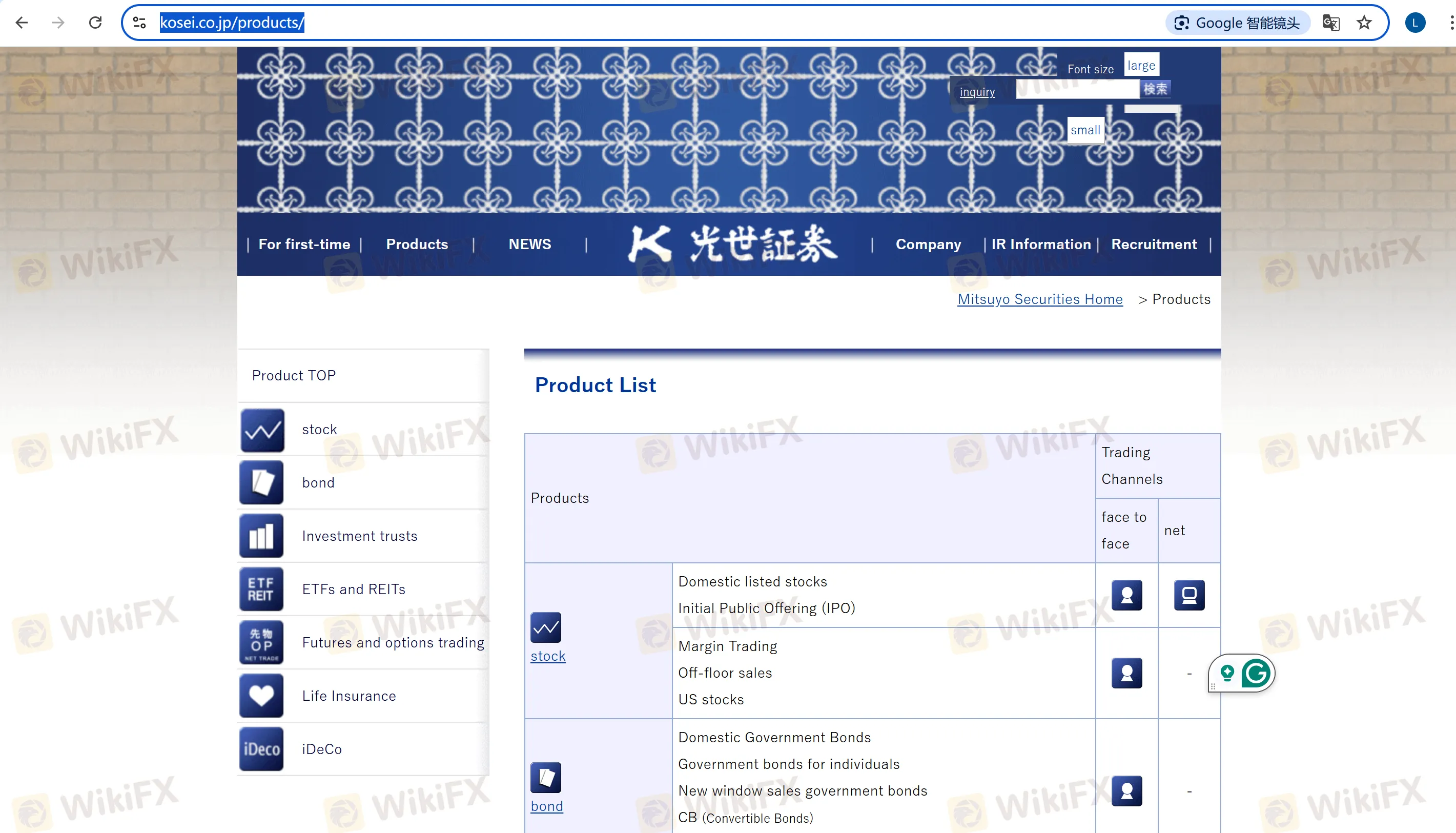

What Can I Trade on KOSEI SECURITIES?

| Trading Products | Supported | Details |

| Stocks | ✔ | Domestic listed stocks, U.S. stocks, initial public offerings (IPOs), and margin trading |

| Bonds | ✔ | Individual government bonds, corporate bonds, foreign currency-denominated bonds, and convertible bonds |

| Investment Trusts | ✔ | Equity investment trusts, corporate bond investment trusts, and hedge fund-type funds |

| ETFs/REITs | ✔ | Listed investment trusts, real estate investment trusts (e.g., TOPIX REIT Index) |

| Futures and Options | ✔ | Nikkei 225 futures, TOPIX options, precious metal futures (gold standard), and commodity index futures (CME crude oil) |

| Insurance/iDeco | ✔ | Life insurance agency services, Nomura iDeco (pension accounts) |

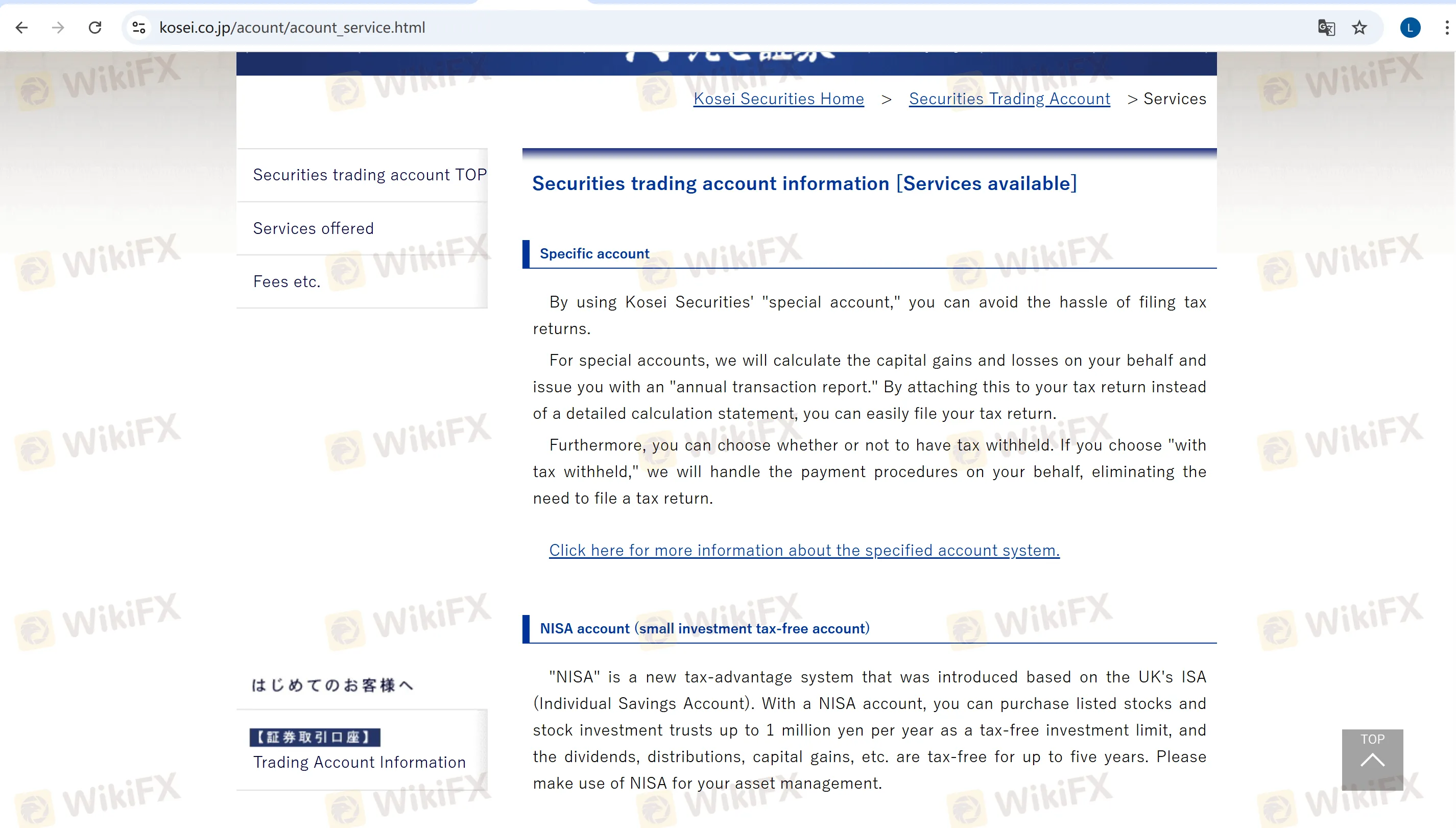

Account Type

Specific Account: Calculates profits and losses on behalf of clients, handles tax payments, and simplifies annual tax filings.

NISA Account: A tax-exempt account for small-scale investments, with an annual investment limit of ¥1,000,000. Dividends and sales proceeds are tax-exempt for 5 years.

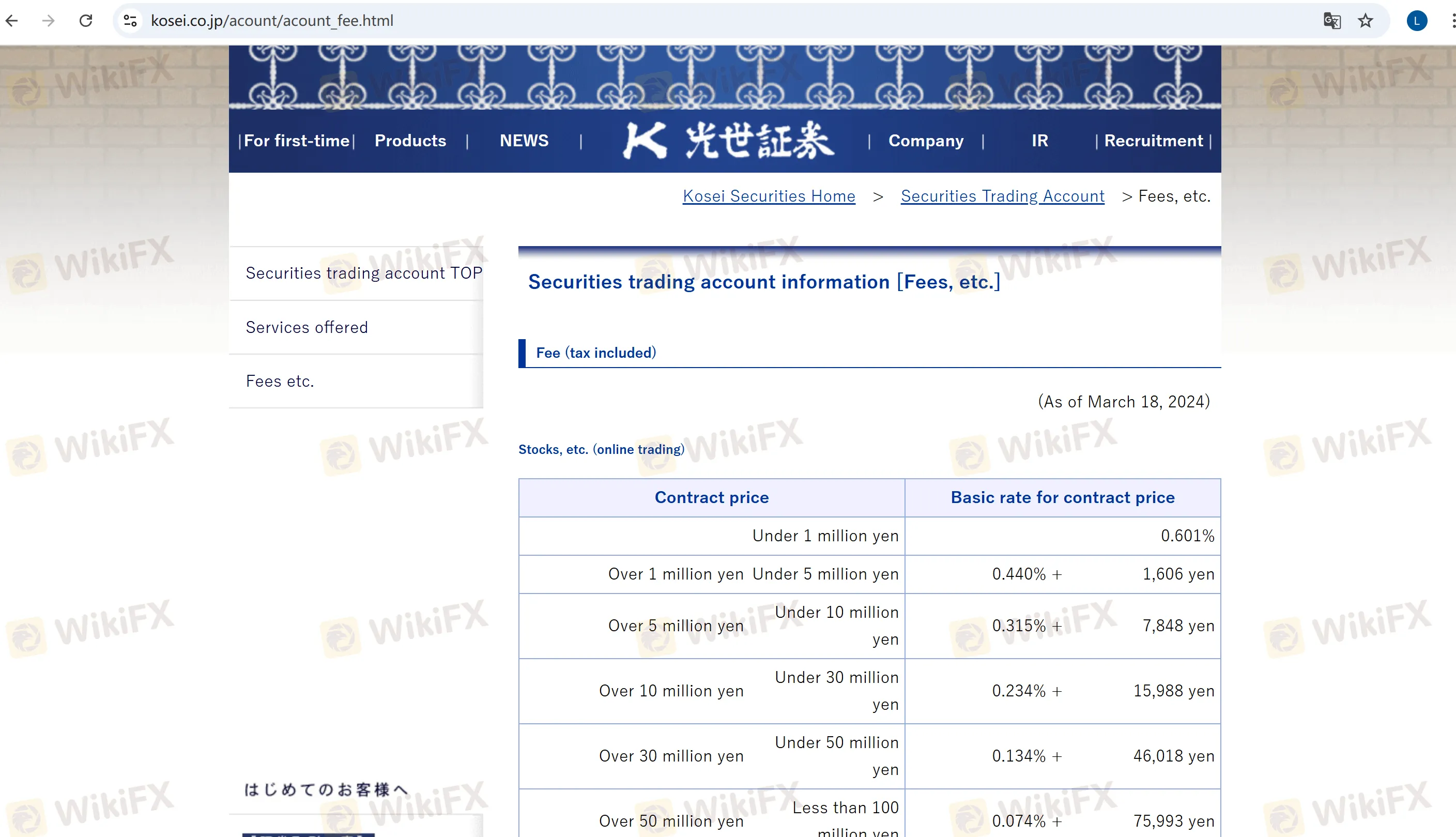

KOSEI SECURITIES Fees

Main Commission Fees:

Stocks (Online): 0.601% for transactions under ¥1,000,000 (minimum ¥1,100). For amounts over ¥1,000,000,000, fees are subject to individual negotiation.

U.S. Stocks: A flat 0.495% (minimum ¥550). SEC fees will be temporarily waived starting May 13, 2025.

Futures & Options (Online): 0.022% for index futures, 0.0044% for government bond futures, with a minimum fee of ¥440.

Account Maintenance Fee: ¥2,200 annually (waived for clients holding 100+ shares of the firms stock).

Other Fees:

Margin Loan Rates (Buy Side): Institutional margin: 1.64%–1.92% (annual interest); General margin: 2.14%–2.42%.

For more detailed account fee information, please visit the official website.