公司简介

| KOSEI SECURITIES评论摘要 | |

| 成立时间 | 1997 |

| 注册国家/地区 | 日本 |

| 监管 | FSA |

| 交易产品 | 股票、债券、投资信托、ETF/REIT、期货、期权和保险/iDeco |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 电话:0120-06-8617 |

| 地址:大阪市中央区北浜2-1-10 | |

KOSEI SECURITIES信息

Kosei Securities的总部位于大阪市中央区北浜。其业务涵盖证券交易、投资信托、期货和期权、人寿保险代理等,同时还提供特殊服务,如特定账户(简化报税)和NISA账户(小额投资免税)。

优缺点

| 优点 | 缺点 |

| 受FSA监管 | 复杂的佣金结构 |

| 资金安全保障 | 英文支持不足(主要以日语为主) |

| 线上线下结合 | |

| 悠久的运营历史 | |

| 多样的交易产品 | |

| 透明的费用信息 |

KOSEI SECURITIES是否合法?

Kosei Securities在东京证券交易所上市,并受日本金融厅(FSA)监管。持有近畿财务局长(金商)第14号许可证,是一家合法注册的证券公司。

| 监管机构 | 当前状态 | 监管国家 | 持牌实体 | 许可证类型 | 许可证号码 |

| 日本金融厅(FSA) | 受监管 | 日本 | KOSEI SECURITIES株式会社 | 零售外汇牌照 | 近畿财务局长(金商)第14号 |

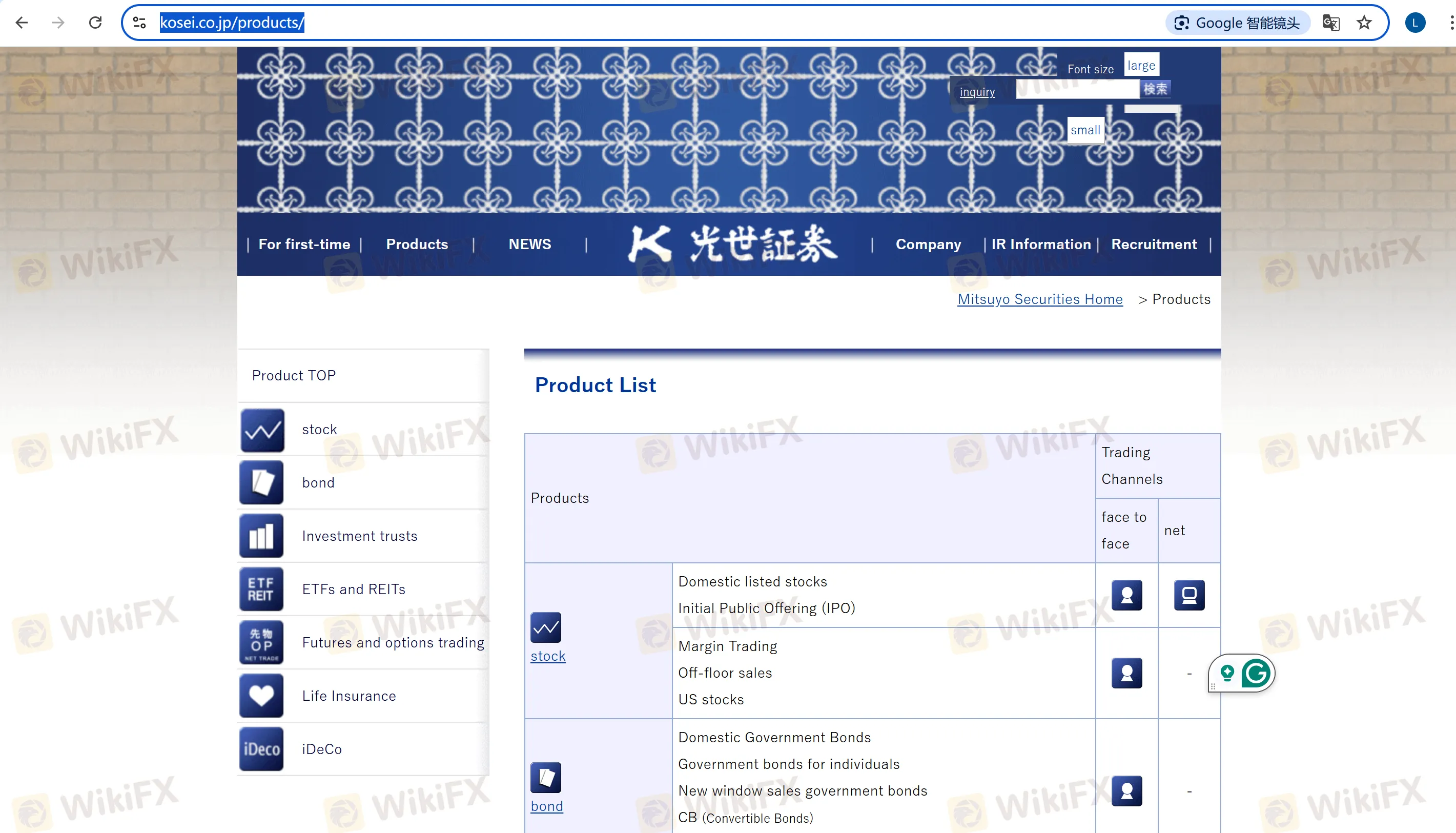

我可以在KOSEI SECURITIES上交易什么?

| 交易产品 | 支持 | 详情 |

| 股票 | ✔ | 国内上市股票、美国股票、首次公开发行(IPO)和保证金交易 |

| 债券 | ✔ | 个人政府债券、公司债券、外币计价债券和可转换债券 |

| 投资信托 | ✔ | 股权投资信托、公司债券投资信托和类对冲基金 |

| ETFs/REITs | ✔ | 上市投资信托、房地产投资信托(例如TOPIX房地产信托指数) |

| 期货和期权 | ✔ | 日经225期货、TOPIX期权、贵金属期货(黄金标准)和商品指数期货(芝加哥商品交易所原油) |

| 保险/iDeco | ✔ | 人寿保险代理服务、野村iDeco(养老金账户) |

账户类型

特定账户:代表客户计算利润和损失,处理税款,并简化年度税务申报。

NISA账户:适用于小规模投资的免税账户,年度投资限额为¥1,000,000。股息和销售收益在5年内免税。

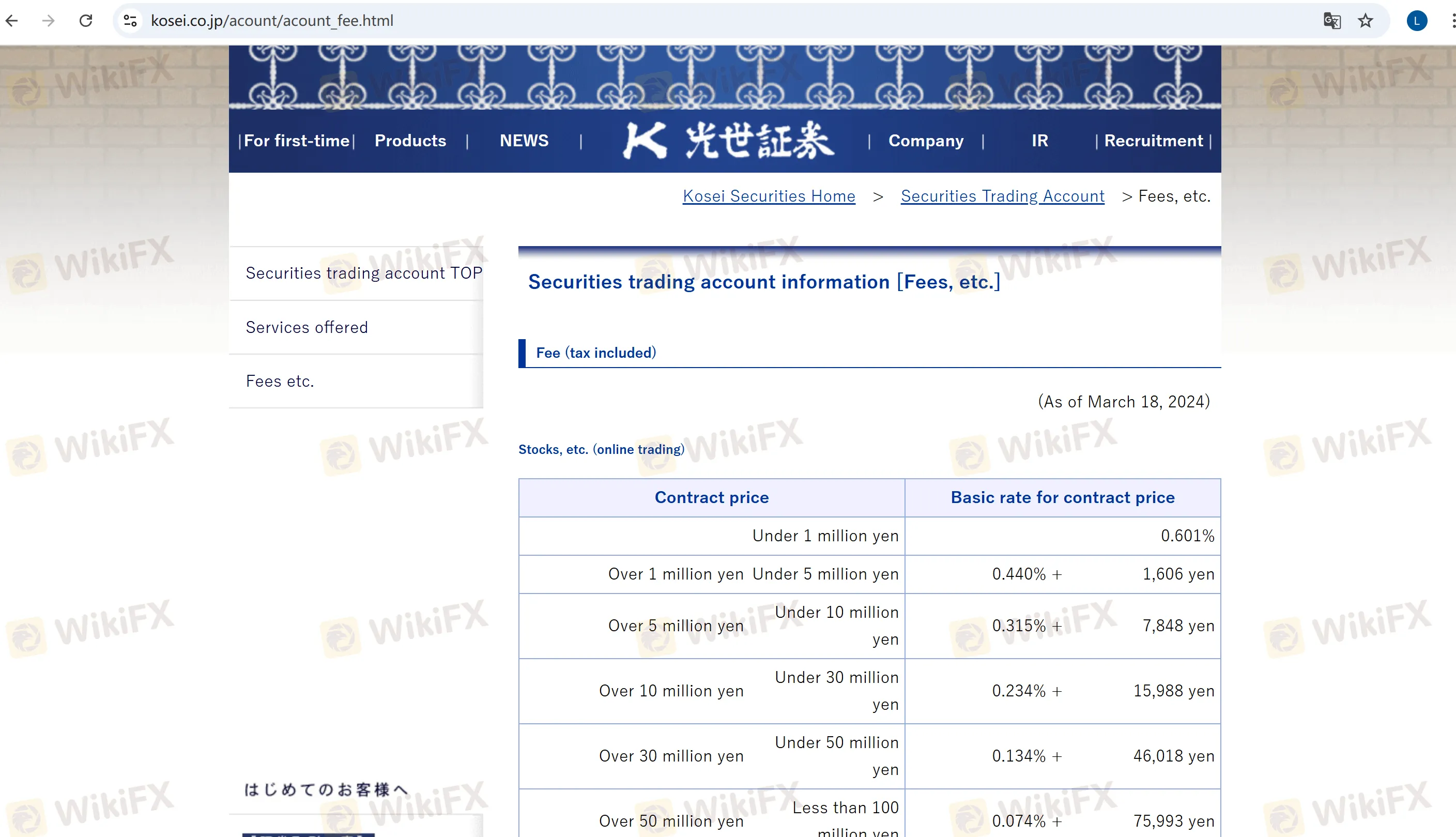

KOSEI SECURITIES费用

主要佣金费用:

股票(在线):交易额低于¥1,000,000的0.601%(最低¥1,100)。超过¥1,000,000,000的部分手续费需单独协商。

美国股票:固定0.495%(最低¥550)。SEC手续费将于2025年5月13日起暂时豁免。

期货和期权(在线):指数期货0.022%,政府债券期货0.0044%,最低费用¥440。

账户维护费:年度¥2,200(对持有公司股票100股以上的客户免费)。

其他费用:

保证金贷款利率(买方):机构保证金:1.64%–1.92%(年利率);一般保证金:2.14%–2.42%。

有关更详细的账户费用信息,请访问官方网站。