Buod ng kumpanya

| Capital Trader Buod ng Pagsusuri | |

| Itinatag | 2024-07-10 |

| Rehistradong Bansa/Rehiyon | Cyprus |

| Regulasyon | Hindi Regulado |

| Mga Kasangkapan sa Merkado | Forex, CFDs, Stocks |

| Demo Account | ❌ |

| Leverage | Hanggang sa 1:500 |

| Spread | Mula sa 0.2 pips (EUR/USD, Average) |

| Platform ng Paggagalaw | Capital Trader WebTrader (Web) |

| Min Deposit | $250 |

| Suporta sa Customer | info@capitalltraders.com |

| +442038973562 | |

| 256 Archiepiskopou Makariou III Avenue, Eftapaton Court 3105 Limassol, Cyprus | |

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Maraming mga instrumento sa pagtitingi | Hindi Regulado |

| Mga flexible na uri ng account | Ambiguous na impormasyon (hal. CFDs leverage ratio) |

| Matataas na leverage hanggang sa 1:500 | Mataas na minimum deposit para sa premium accounts (nagsisimula sa $100,000) |

| Multilingual 24/5 suporta sa customer | Mataas na komisyon na $30 bawat lot para sa XAU/USD sa MICRO accounts |

| MT4/MT5 hindi available |

Totoo ba ang Capital Trader?

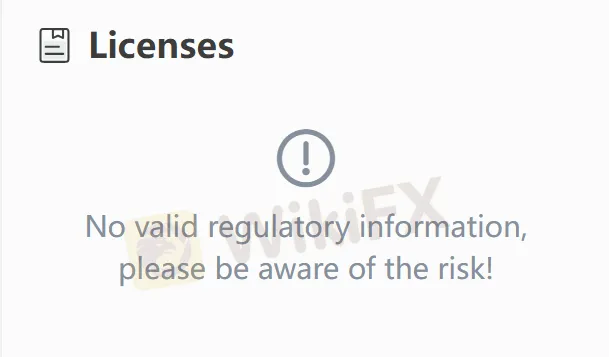

Ang Capital Trader ay hindi regulado. Bagaman ito ay nagmamay-ari ng pangunahing lisensiyang regulasyon tulad ng FCA at CySEC, pinapayuhan ang mga mangangalakal na suriin at patunayan sa opisyal na mga website ng mga kaukulang awtoridad sa regulasyon at bigyang prayoridad ang pamumuhunan sa mga reguladong mga broker.

Ano ang Maaari Kong I-trade sa Capital Trader?

Capital Trader nagbibigay ng mga serbisyo sa forex, stock, at CFD trading.

| Mga Tradable na Kasangkapan | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Stocks | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Uri ng Account

| Uri ng Account | STANDARD | PROFESSIONAL | BUSINESS | BUSINESS PLUS |

| Minimum na Deposit | Mula $250 | Mula $10000 | Mula $30000 | Mula $100000 |

| Min Lot Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Plataforma ng Paggawa ng Kalakalan | Capital Trader webtrader | Capital Trader webtrader | Capital Trader webtrader | Capital Trader webtrader |

| Minimum na Deposit | $250 | $10000 | $30000 | $100000 |

| Mobile Trading | Mobile Trading | Mobile Trading | Mobile Trading | Tailored conditions |

| 24-oras na Paggawa ng Kalakalan | ✔ | ✔ | ✔ | ✔ |

| Deposit Bonus | 30% | 50% | 100% | |

| Islamic Account | ✔ | ✔ | ✔ |

Leverage

Ang maximum na leverage sa forex ay 1:500 (na naaangkop sa major currency pairs tulad ng EUR/USD). Ang mataas na leverage ay angkop para sa short-term speculation ngunit may kasamang napakataas na panganib.

Plataforma ng Paggawa ng Kalakalan

Capital Trader WebTrader ay sumusuporta sa mga operasyon sa web. Ang mga basic account ay sumusuporta sa karaniwang mobile trading, habang ang BUSINESS PLUS accounts ay nagbibigay ng mga custom na kondisyon sa trading.

| Plataforma ng Trading | Sumusuporta | Available Devices | Angkop para sa |

| Capital Trader WebTrader | ✔ | Web | / |

Bonus

Ang deposit bonuses ay nagtataas depende sa account tiers: 30% para sa mga PROFESSIONAL accounts, 50% para sa mga BUSINESS accounts, at 100% para sa mga BUSINESS PLUS accounts.