Profil perusahaan

| M&G Ringkasan Ulasan | |

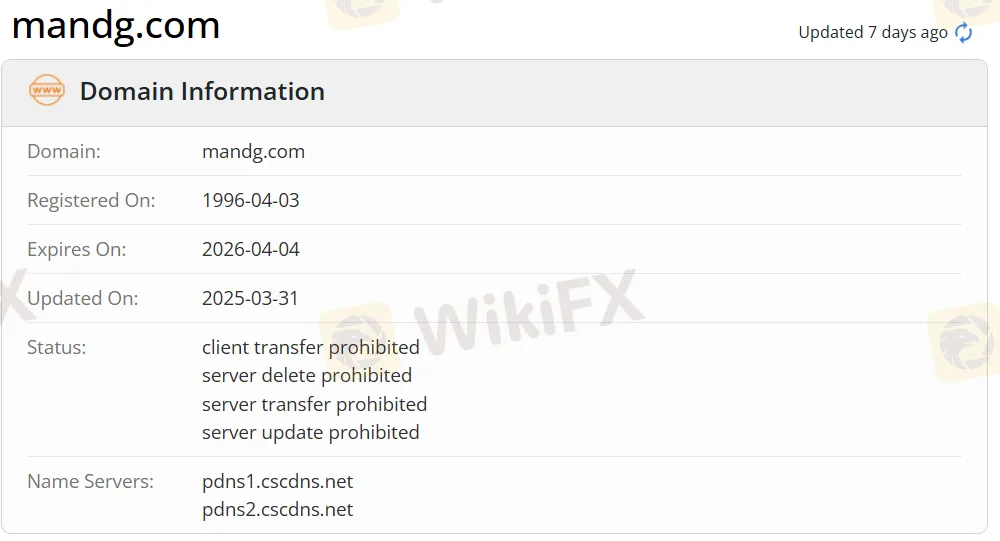

| Dibentuk | 1996 |

| Negara/Daerah Terdaftar | Irlandia |

| Regulasi | FCA (Melebihi) |

| Layanan | Manajemen aset, investasi, dan tabungan jangka panjang |

| Platform Perdagangan | myM&G web |

| Deposit Minimum | £1 |

| Dukungan Pelanggan | Tel: +44 (0)207 626 4588 |

| Email: info@mandg.co.uk | |

| Alamat: 10 Fenchurch Avenue LondonEC3M 5AG Inggris Raya | |

| Instagram, LinkedIn | |

| Pembatasan Regional | Pasar dengan AUM kurang dari £50 juta, dan wilayah seberang laut Inggris, dependensi mahkota, dan mikronegara Eropa (kecuali Malta) telah dikecualikan |

Informasi M&G

M&G adalah penyedia layanan pialang dan layanan keuangan unggulan, yang didirikan di Irlandia pada tahun 1996. Perusahaan ini menawarkan produk dan layanan untuk manajemen aset, investasi, dan tabungan jangka panjang. Selain itu, pasar dengan AUM kurang dari £50 juta, dan wilayah seberang laut Inggris, dependensi mahkota, dan mikronegara Eropa (kecuali Malta) tidak diizinkan. Lebih lanjut, perlu dicatat bahwa lisensi FCA M&G telah melebihi, yang berarti risiko potensial mungkin ada.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Waktu operasi yang panjang | Melebihi lisensi FCA |

| Berbagai saluran kontak | Pembatasan regional |

| Deposit minimum rendah | Biaya komisi dibebankan |

| Berbagai opsi pembayaran |

Apakah M&G Legal?

M&G diizinkan oleh Otoritas Perilaku Keuangan untuk menawarkan layanan tetapi status saat ini telah melebihi batas. Nomor lisensinya adalah 119328. Otoritas Perilaku Keuangan (FCA) adalah badan pengatur keuangan di Britania Raya, namun beroperasi secara independen dari Pemerintah Inggris, dan didanai dengan cara membebankan biaya kepada anggota industri jasa keuangan.

| Negara yang Diatur | Pengatur | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | No. Lisensi |

| Otoritas Perilaku Keuangan (FCA) | Melebihi Batas | M&G Investment Management Limited | Lisensi Penasihat Investasi | 119328 |

Layanan M&G

| Layanan | Didukung |

| Manajemen aset | ✔ |

| Investasi | ✔ |

| Tabungan jangka panjang | ✔ |

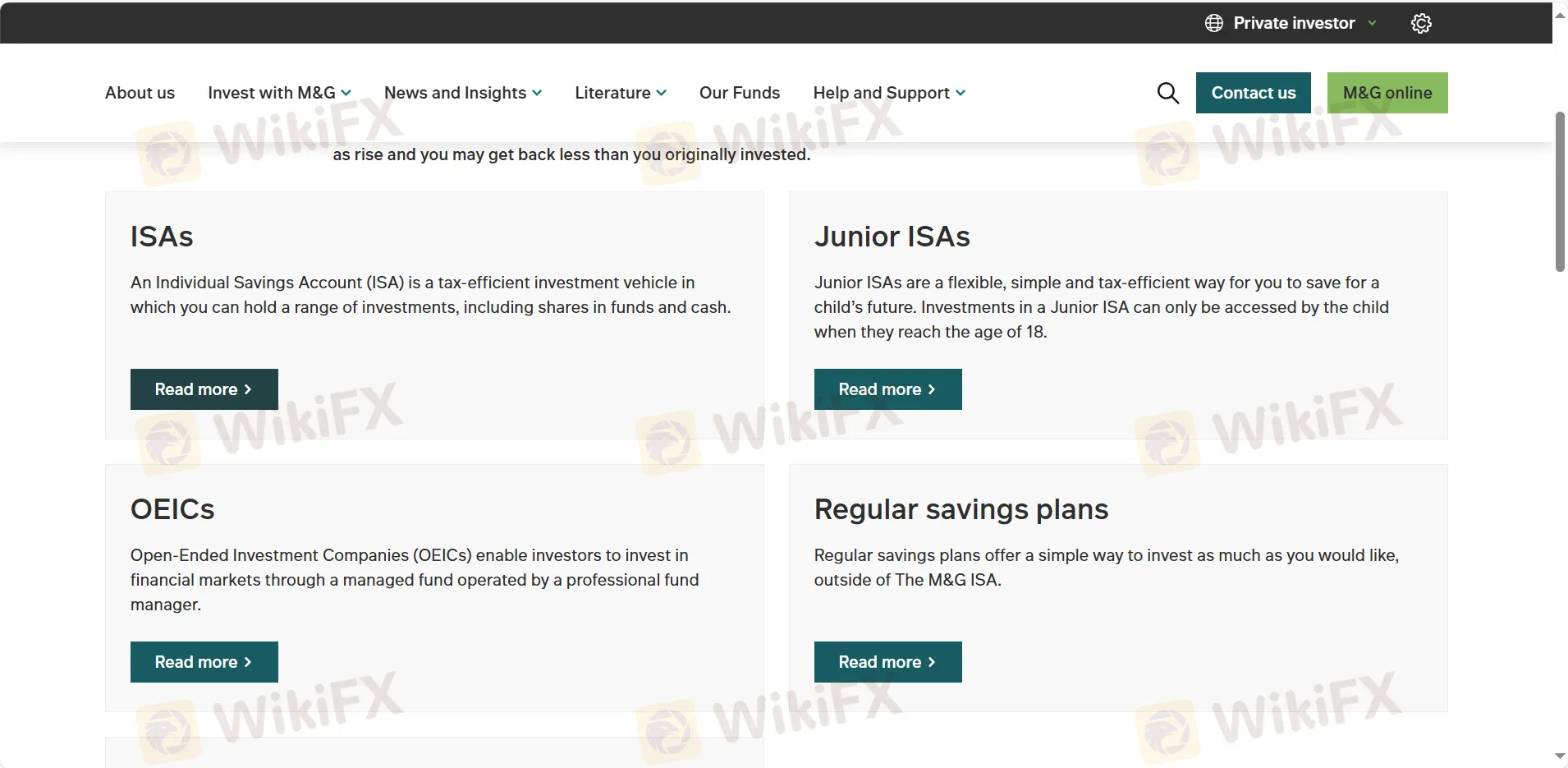

Jenis Akun

| Jenis Akun | Deposit Minimum |

| ISAs | £1 |

| Junior ISAs | £1 |

| OEIC | £1 |

Biaya M&G

Biaya terkait dengan nilai investasi dan akan bergantung pada kinerja dana. Biaya dihitung secara tahunan dan dibebankan setiap hari. Detail tidak disebutkan.

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| myM&G web | ✔ | PC, laptop, tablet | / |

Deposit dan Penarikan

Broker menerima pembayaran melalui Kartu Debit Maestro, MasterCard, Visa Debit & Visa Delta. Deposit minimum adalah £1. Tidak ada jumlah penarikan minimum yang ditentukan dan tidak ada biaya atau biaya yang spesifik.

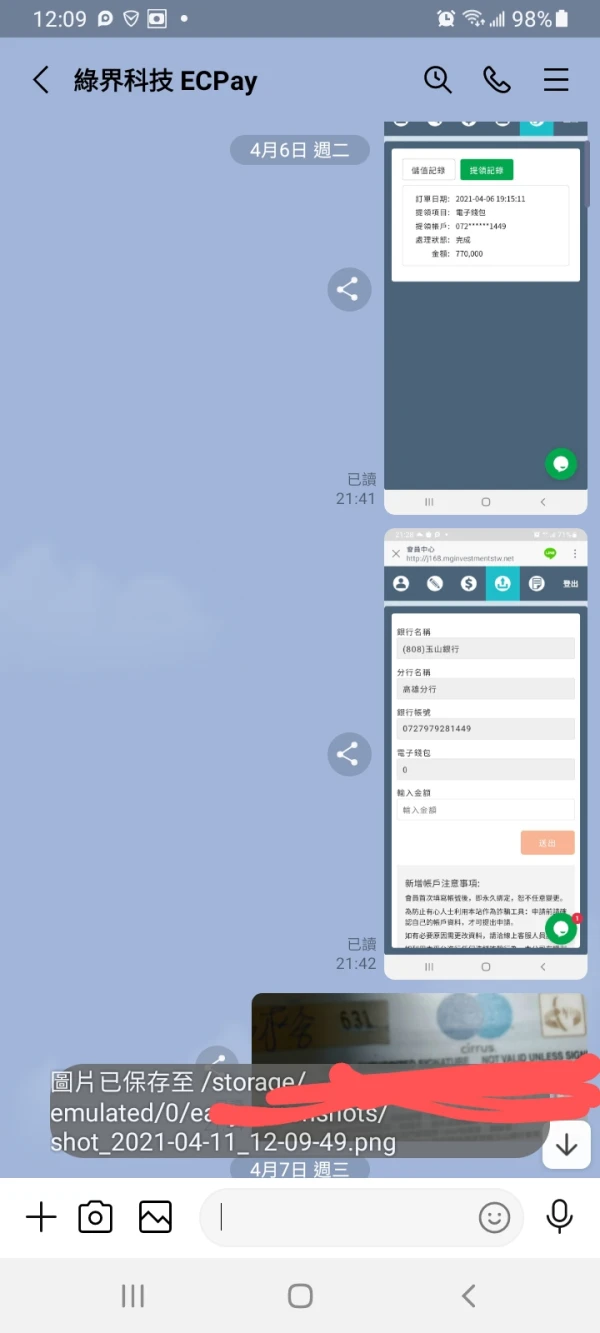

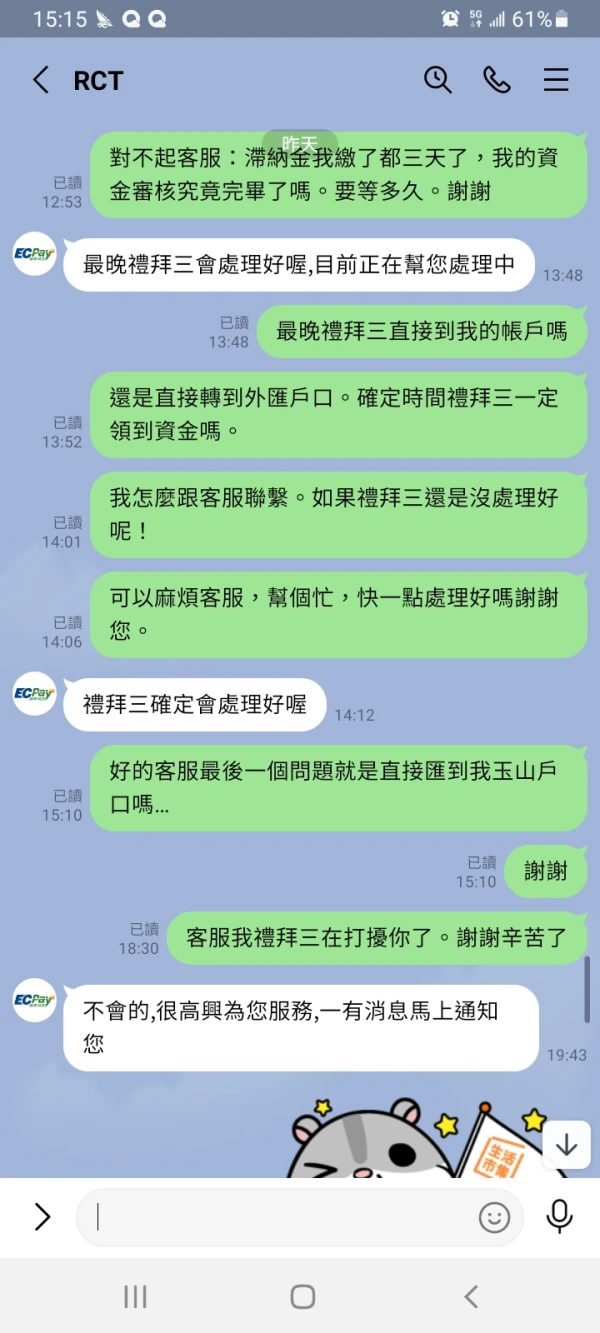

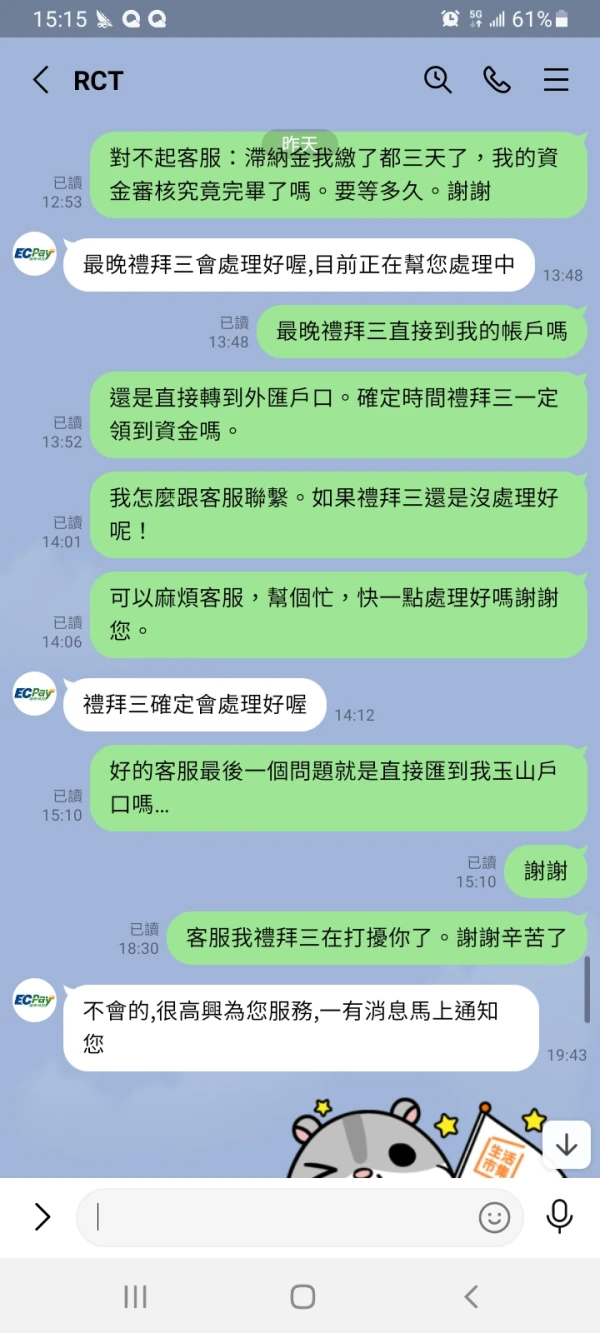

FX7068259962

Taiwan

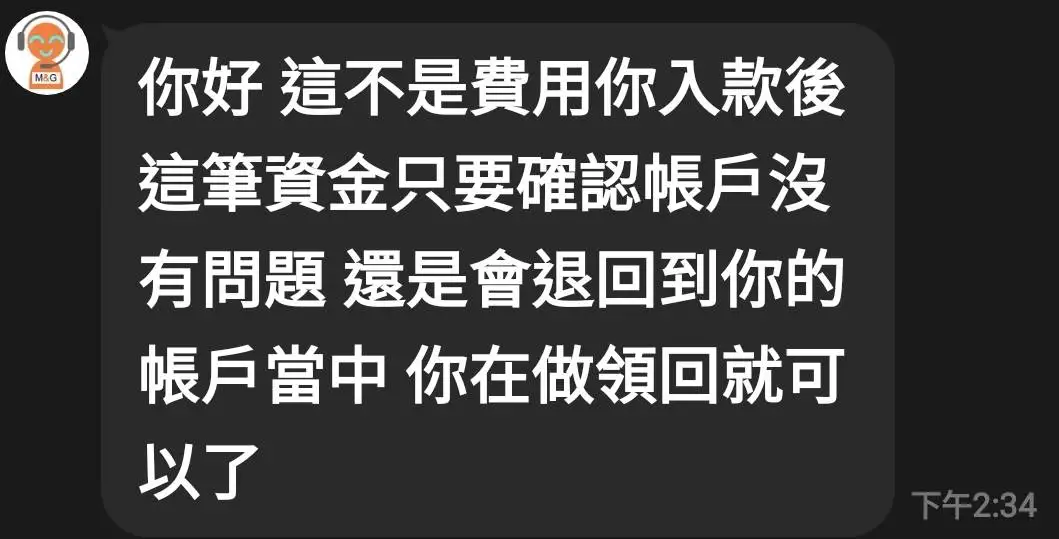

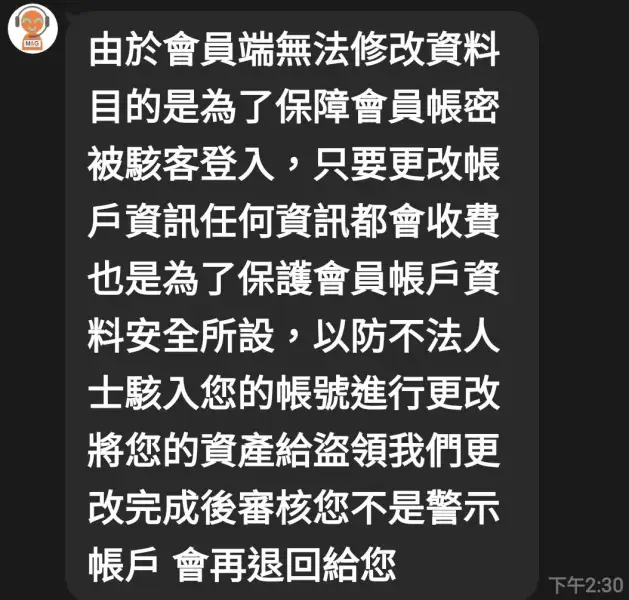

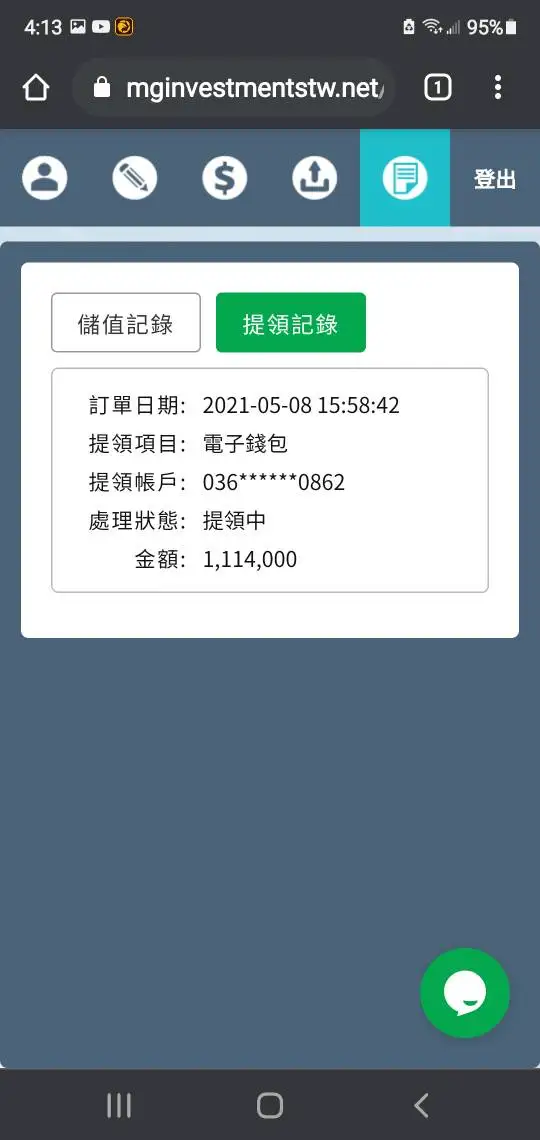

Saya telah membayar lebih dari 100.000 dari semua biaya

Paparan

Hsuan天天

Taiwan

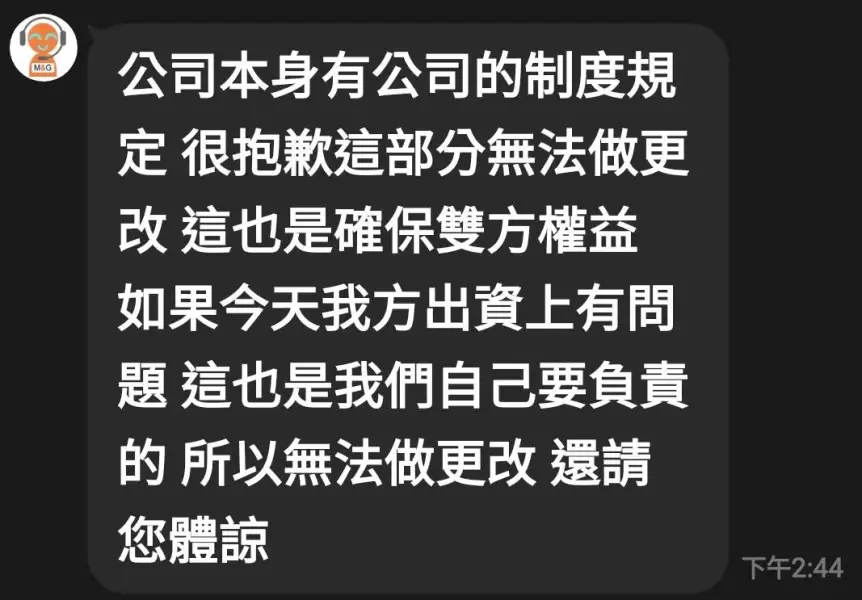

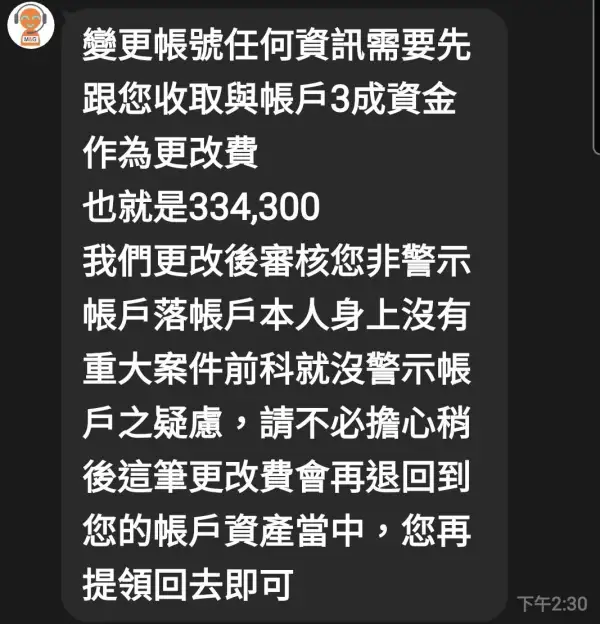

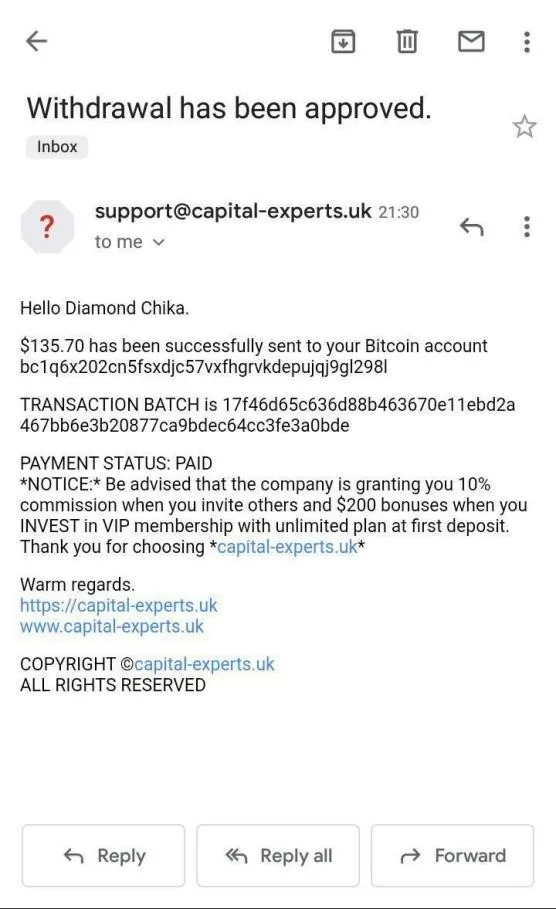

mginvestmentstw.net/. Jika Anda memasukkan rekening bank yang benar, itu akan menunjukkan kepada Anda bahwa itu salah. Jika Anda ingin mengubah infonya, Anda harus membayar 30% dari aset Anda. Jika Anda melihat situs webnya, jangan berinvestasi

Paparan

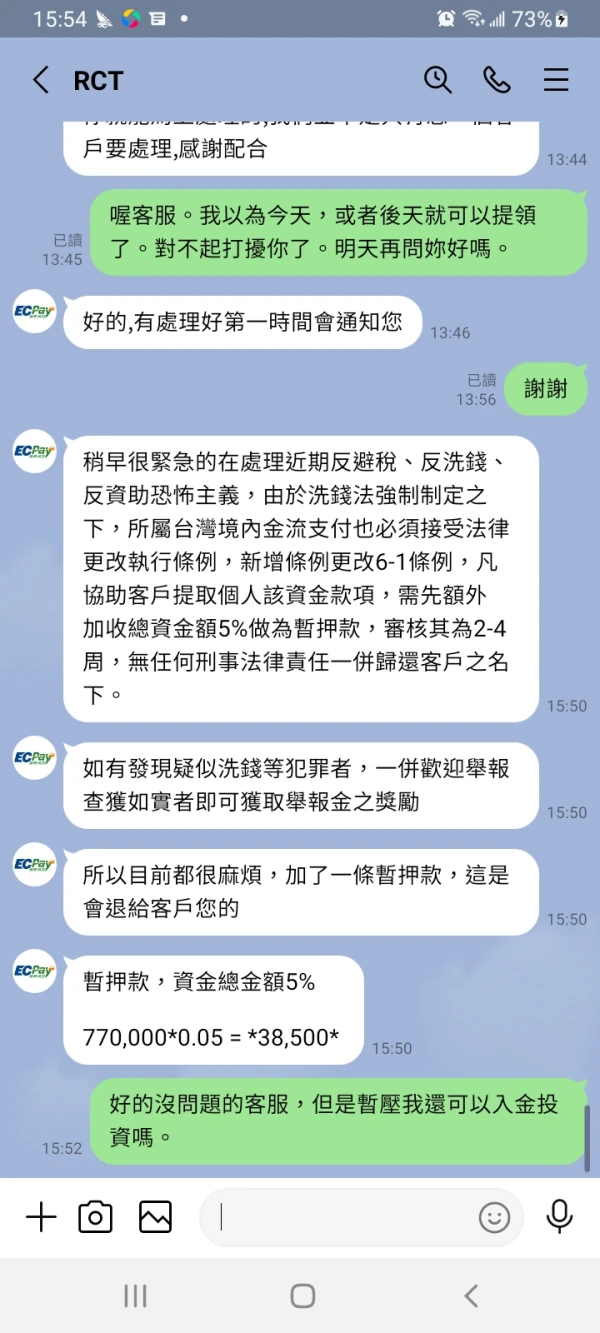

FX4102010959

Argentina

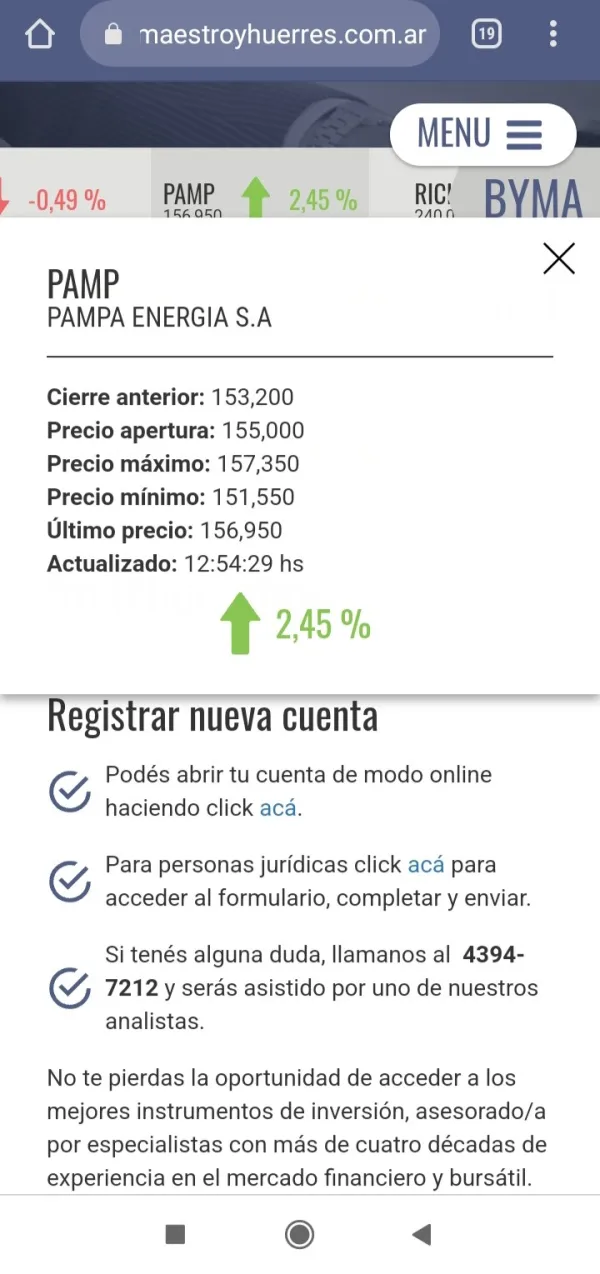

Mereka mengubah informasi pasar. Saya menyetor 66.215 peso dan kehilangan semua investasi.

Paparan

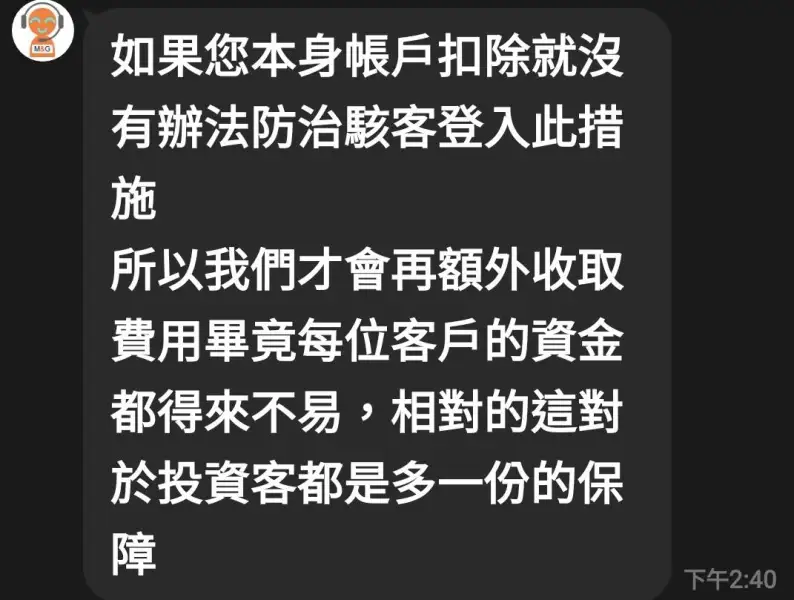

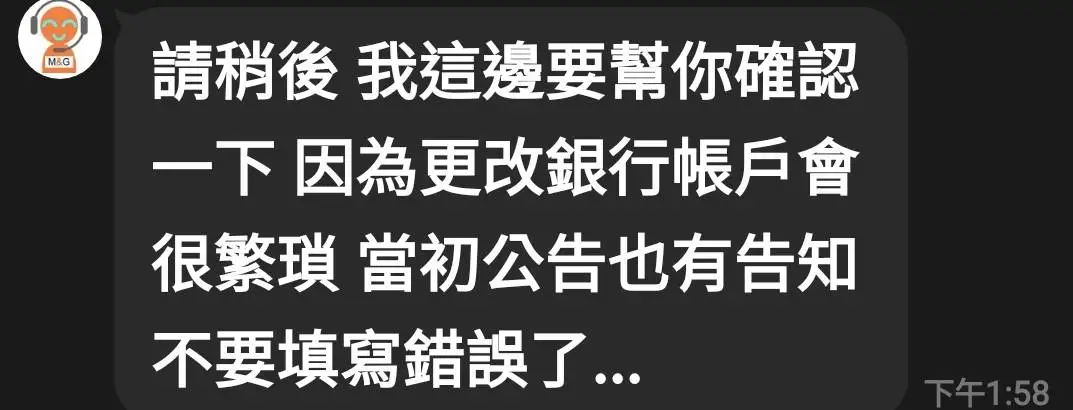

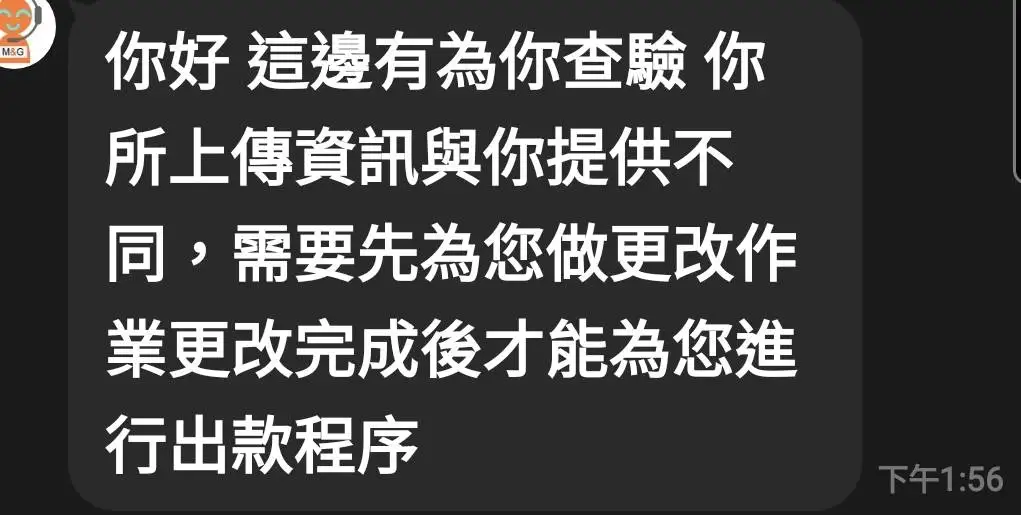

FX3308363627

Taiwan

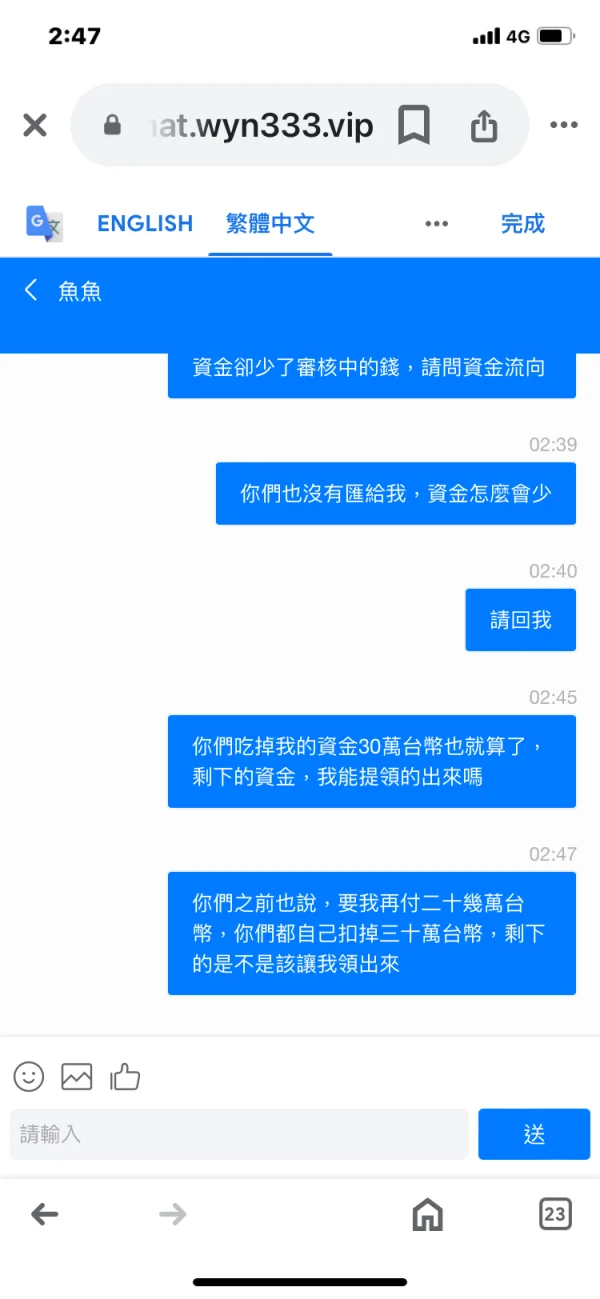

Saya mengunduh aplikasi ini ketika saya melihatnya di internet yang bisa menghasilkan uang. Layanan pelanggan juga menyediakan pengiriman uang secara online. Saya mengirimkan uang. Ketika saya ingin menarik uang, masih dalam proses peninjauan. Saya menarik uang sebanyak tiga kali, setiap kali menarik 100.000 Dolar Taiwan Baru, tetapi saya tidak menerimanya. Saya sudah banyak kali menghubungi layanan pelanggan, tetapi mereka tidak merespons. Ketika saya masuk ke platform ini lagi, saya menemukan bahwa uang yang saya tarik sudah hilang. Awalnya, jumlahnya lebih dari 1,9 juta, tetapi sekarang hanya menjadi sedikit lebih dari 1,5 juta. Ini jelas merupakan penipuan untuk mengambil uang saya.

Paparan

วิทยา ประธานทรง

St. Barthelemy

Halo, Witthaya Prathantrong atau pengusaha M.

Baik

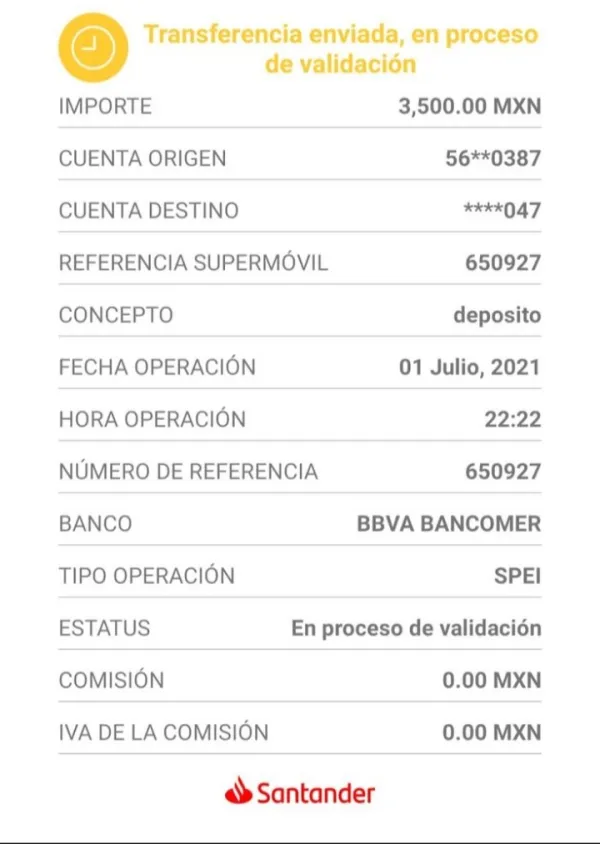

FX1828697794

Meksiko

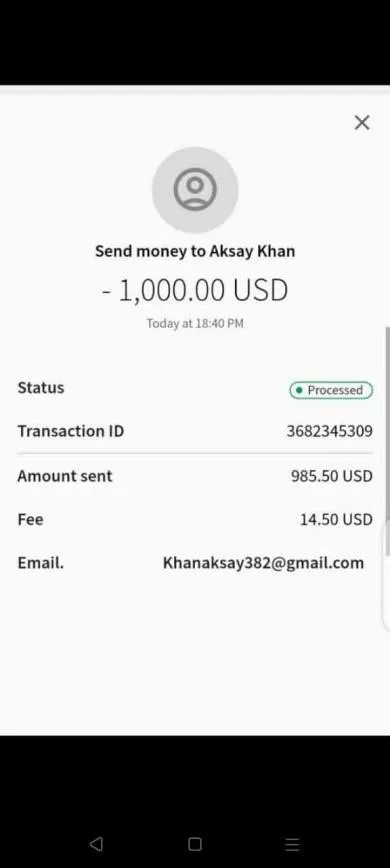

Saya menyetor $3500 dan menarik $2300. Papan saya menunjukkan gambar dan mereka mengatakan ada yang tidak beres. Uang itu bukan milik saya. Itu adalah kebenaran terburuk.

Paparan

FX2046354843

Filipina

Hindari Investasi M&V mereka. Mengambil pinjaman £ 5000 karena saya cukup gila untuk mempercayai ROI yang mereka janjikan. Saya bahkan tidak dapat mengingat ROI yang Diiklankan, tetapi berada di kisaran 5-7% per bulan. (Yang tentu saja bagus.) Selama dua minggu pertama itu sangat positif (saya telah bersama mereka sejak Agustus 2021) kemudian semuanya menurun dari sana. Jika Anda merumuskan grafik saldo akun saya, itu akan terlihat seperti rangkaian tangga yang menurun. Saya sekarang menetapkan sekitar £2900 (dari £5000) dengan keuntungan mengambang dalam perdagangan terbuka -£600. Jadi untuk menarik sisa saldo saya harus menutup semua perdagangan terbuka dan kehilangan £600 itu juga. Namun mereka memiliki dukungan pelanggan yang membantu dan umumnya responsif. Mereka juga tampaknya benar-benar berusaha keras.

Paparan