Buod ng kumpanya

| Swiss CapitalBuod ng Pagsusuri | |

| Itinatag | 2020 |

| Rehistradong Bansa/Rehiyon | United Kingdom |

| Regulasyon | FCA (Nalampasan) |

| Mga Kasangkapan sa Merkado | Forex, ETFs, equities, indices, commodities |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Platform ng Paggawa ng Kalakalan | Swiss Capital |

| Minimum na Deposit | / |

| Suporta sa Customer | Form ng Pakikipag-ugnayan |

Impormasyon Tungkol sa Swiss Capital

Ang Swiss Capital ay isang broker na rehistrado sa United Kingdom. Kasama sa mga maaaring i-trade na kasangkapan ang forex, ETFs, equities, financial indices, at commodities. Ang Swiss Capital ay patuloy pa ring may panganib dahil sa kanyang Nalampasang katayuan at limitadong impormasyon sa transparency.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang mga kasangkapan na maaaring i-trade | Nalampasang lisensya |

| Iba't ibang paraan ng pagdedeposito | Hindi available ang MT4/MT5 |

| Demo account hindi available | |

| Hindi tiyak ang impormasyon sa oras at bayad ng paglilipat | |

| Suporta lamang sa form ng pakikipag-ugnayan |

Tunay ba ang Swiss Capital?

| Regulated na Bansa | Otoridad sa Regulasyon | Kasalukuyang Katayuan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| Financial Conduct Authority (FCA) | Nalampasan | SWISS CAPITAL LIMITED | Pangkaraniwang Paghahandog ng Negosyo | 11638236 |

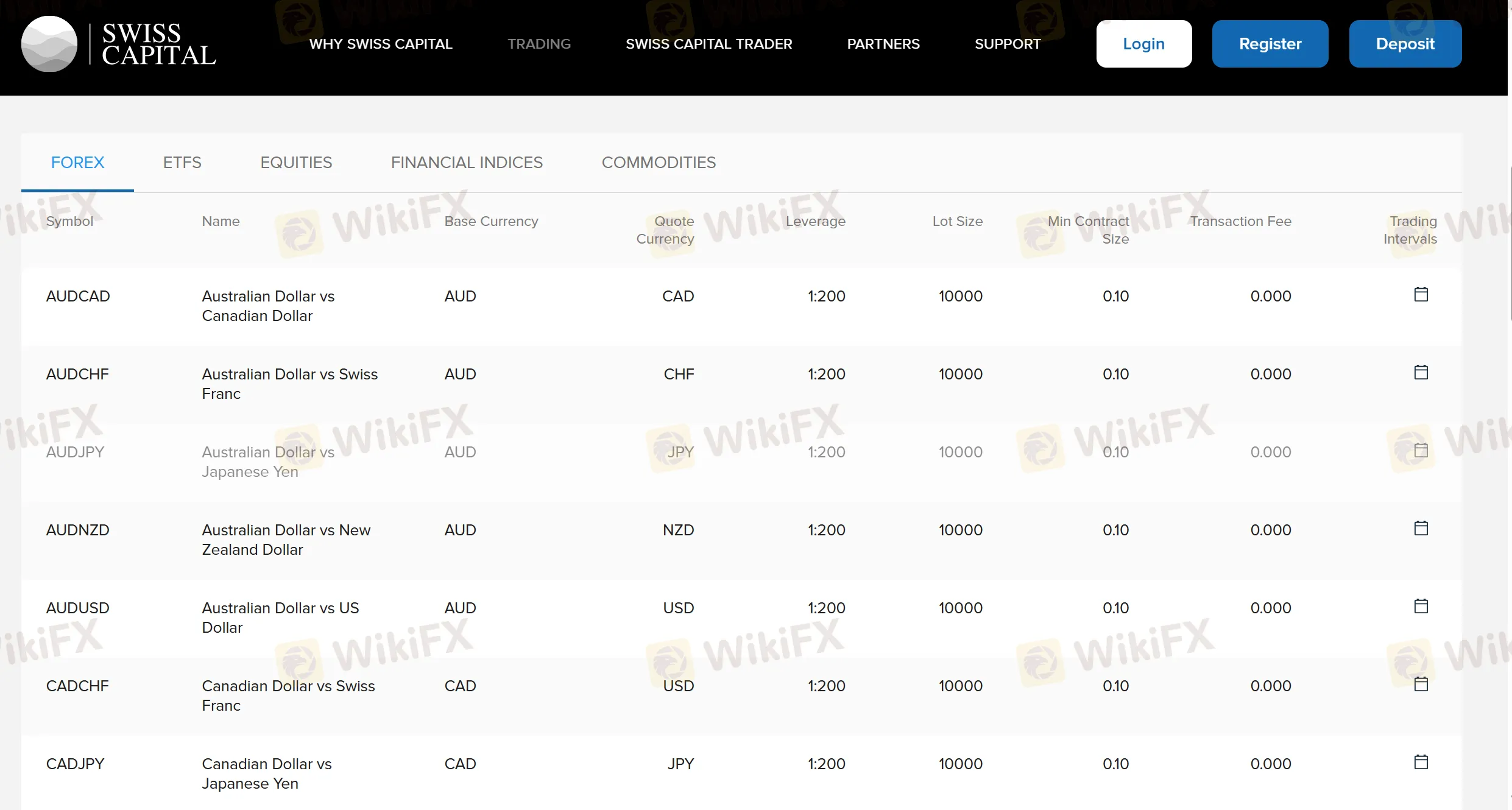

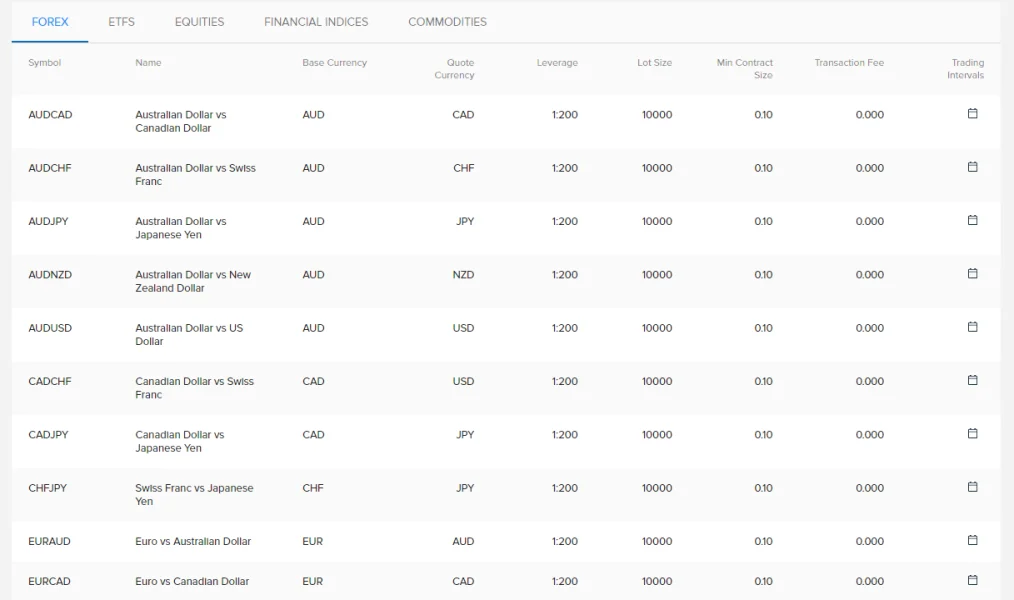

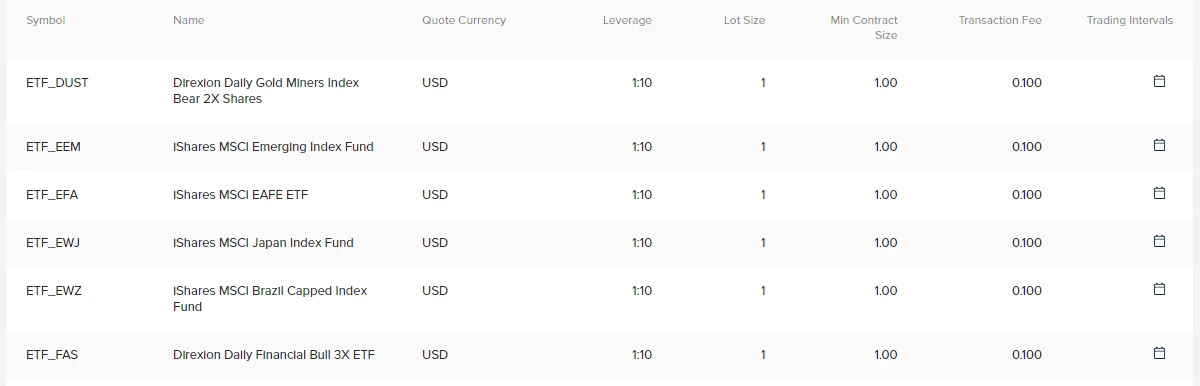

Ano ang Maaari Kong I-trade sa Swiss Capital?

Swiss Capital ay nag-aalok ng malawak na hanay ng mga instrumento sa merkado, kabilang ang forex, ETFs, equities, financial indices, at commodities.

| Mga Tradable na Instrumento | Supported |

| Forex | ✔ |

| ETFs | ✔ |

| Equities | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Precious Metals | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Plataforma ng Paghahalal

Swiss Capital ay nagbibigay ng isang proprietary trading platform na available sa mobile para sa kalakalan, sa halip na ang awtoritatibong MT4/MT5 na may matatandang kagamitan sa pagsusuri at EA intelligent systems.

| Plataforma ng Paghahalal | Supported | Available Devices | Angkop para sa |

| Swiss Capital | ✔ | Mobile | / |

| MT4 | ❌ | / | Mga Baguhan |

| MT5 | ❌ | / | Mga Karanasan na mangangalakal |

Deposito at Pag-Atas

Swiss Capital ay tumatanggap ng Visa, Mastercard, Apple Pay, Samsung Pay, Union Pay, Alipay, at iba pa para sa mga deposito at pag-atras. Gayunpaman, ang mga oras ng proseso ng paglipat at ang kaugnay na bayad ay hindi tiyak.

TysonM

Albania

Nagpasok ako na alam na walang crypto, at okey lang ako doon. Kailangan ko lang ng isang lugar para sa forex at stock trades. Lahat ay gumagana nang maayos, at wala akong naging problema sa pagpopondo o pagwiwithdraw. Mukhang matatag sila.

Positibo

Willi Kohler

Italya

Nagtetrade sa aking telepono 90% ng oras. Ang mobile na bersyon ng platform ay medyo magulo pero gumagana naman.

Katamtamang mga komento

Johann

Alemanya

Ang Swiss Capital ay gumagana nang maayos para sa standard na pag-trade sa FX, ETFs, at mga stocks. Ang web platform ay simple, marahil masyadong simple para sa mga advanced chart lovers. Hindi ako fan ng credit card hold, ngunit ang pagbabayad na sumusunod na 1-2 araw ay consistent. Sa pangkalahatan, kung okey sa iyo ang mas mabagal na support channel at walang mga alok na crypto, ito ay isang magandang pagpipilian.

Katamtamang mga komento

Gilbert Heb

Alemanya

Maganda sana kung may mga pagpipilian para sa cryptocurrency na deposito, pero hindi nila inaalok iyon.

Katamtamang mga komento

Kailash2

Alemanya

Ang mga kalakalan ay agad na isinasagawa. Hindi pa naranasan ang malaking pagkakabutas.

Positibo

Andree770

Italya

Gusto ko ang pagtetrade ng ETFs at mga indeks, at nag-aalok sila ng magandang pagpipilian.

Positibo

Moritz Lange

Alemanya

Ang platform ay madaling gamitin, at madali rin ang pag-set up ng isang account. Ako ay naniniwala na ang Swiss Capital ay isang matibay na pagpipilian para sa mga nagsisimula sa trading.

Positibo

Holdenkemmer

Slovenia

Ang MT4 ay isang pamilyar na plataporma para sa akin, at ang implementasyon ng Swiss Capital ay matatag at epektibo.

Positibo

Blaise

Espanya

Sana meron silang live chat. Ang suporta sa email ay okay pero hindi mabilis kapag kailangan mo ng mabilis na mga sagot.

Katamtamang mga komento

RosarioD

United Kingdom

Mabuting broker para sa mga nagsisimula. Madali ang pag-navigate sa platform, at mabilis ang tugon ng customer support sa aking mga email. Sana meron silang live chat, bagaman.

Positibo

Klemens884

United Kingdom

Ang mga pag-withdraw ay mabilis na naiproseso. Gayunpaman, mas gusto ko sana na magkaroon ng mas maraming pagpipilian sa pag-trade, lalo na ang mga cryptocurrencies.

Positibo

Juri

Norway

Rekomendado. Mabilis na bilis ng pagpapatupad.

Positibo

Jayde

Espanya

mt4 suportado, mapagkakatiwalaang broker.

Positibo

Sandence

Taiwan

Ang software ng pagtitinda ay madaling gamitin, ngunit ang saklaw ng mga paraan ng pagbabayad ay limitado. Gusto ko sanang makakita ng mas maraming pagpipilian.

Katamtamang mga komento

gerlinde

United Kingdom

Magandang platform, madaling gamitin, at mabilis na pagbabayad. Napakaganda.

Positibo

Liesel Doring

Espanya

Lahat ay maayos sa aking unang pag-withdraw.

Positibo

Samuel Harris

South Africa

Ugh, ang pagtitinda dito ay hindi gaanong maganda kumpara sa IC Markets o eToro, alam mo ba? Sa ibang mga plataporma, lahat ay pakiramdam na napakaintuitive at madaling i-navigate. Dito, parang kinuha nila ang isang simpleng bagay at ginawang mas komplikado kaysa sa kailangan.

Katamtamang mga komento

ArturH

France

Mag-trade ng mga balita nang hindi masyadong nag-aalala sa slippage.

Positibo

Iacopo Parisi

Alemanya

Mababang komisyon para sa ECN trading. Walang kinakain sa aking kita.

Positibo

Hohmann

Italya

Gusto ko kung paano hindi masyadong hinihingi ng Swiss Capital ang malaking halaga ng pera sa simula. Mababa ang kanilang mga kinakailangang margin.

Positibo